Personal Profit and Loss Worksheet

A personal profit and loss worksheet is a helpful tool for individuals looking to gain a better understanding of their financial situation. By tracking income and expenses, this worksheet allows you to take control of your finances and make informed decisions. Whether you're a budget-conscious college student, a parent managing a household, or someone looking to grow their investments, a personal profit and loss worksheet can be a valuable asset in managing your money effectively.

Table of Images 👆

- Financial Statement Accounts

- Monthly Income Profit Loss Statement Worksheet

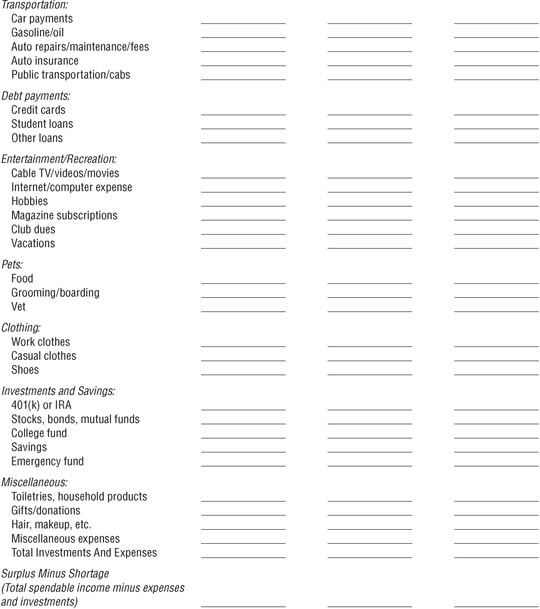

- Free Printable Profit Loss Forms

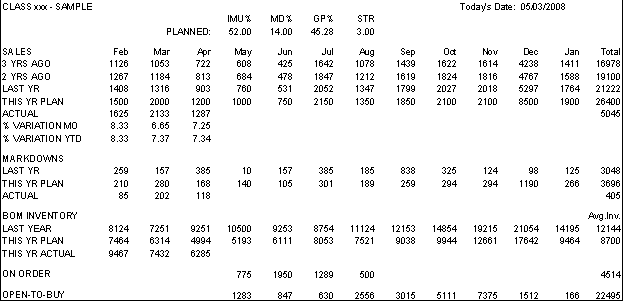

- Retail Open to Buy Spreadsheet

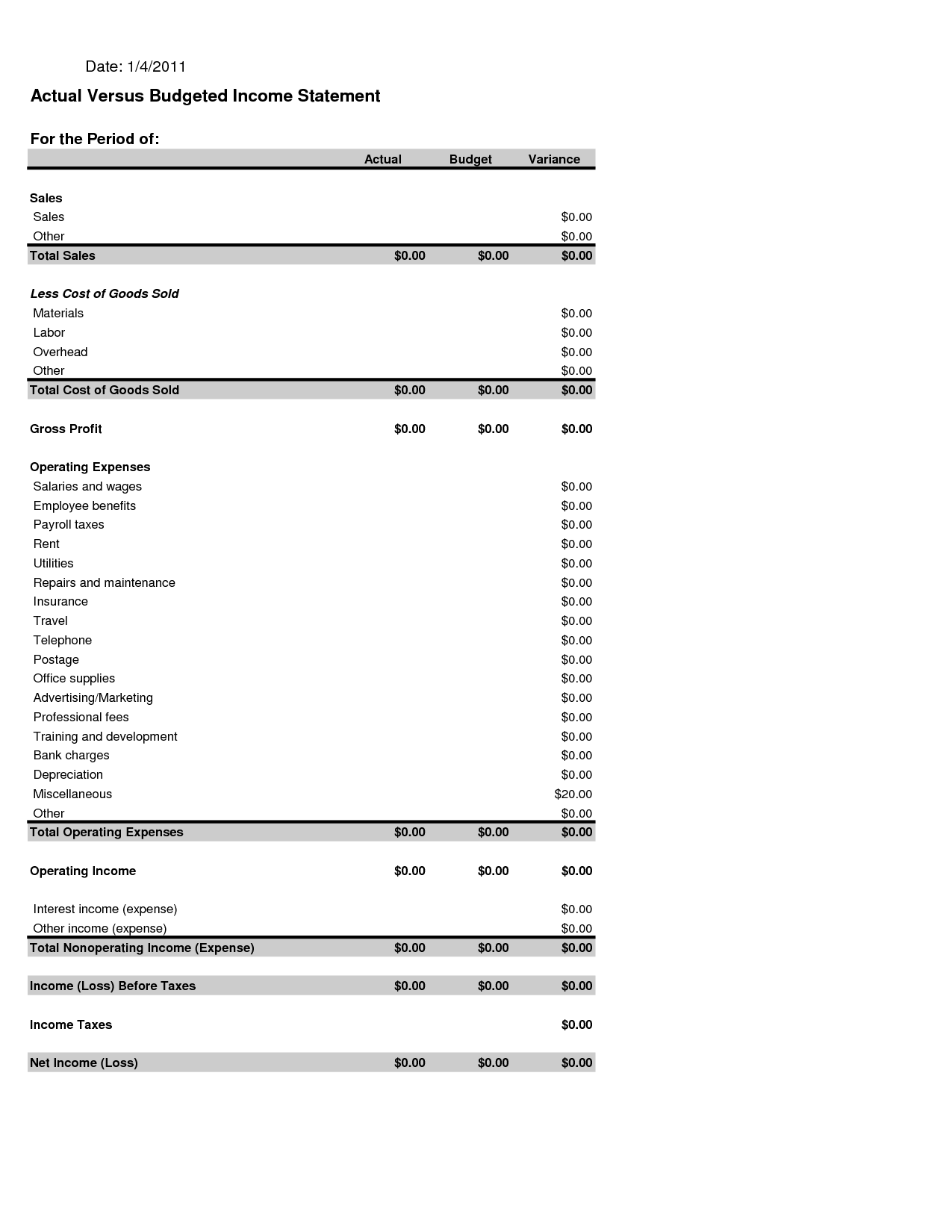

- Budgeted Income Statement Template

- Profit and Loss Statement Template

- College Student Budget Worksheet Printable

- Free Financial Statement Worksheet

- Sample Non-Profit Bylaws Template

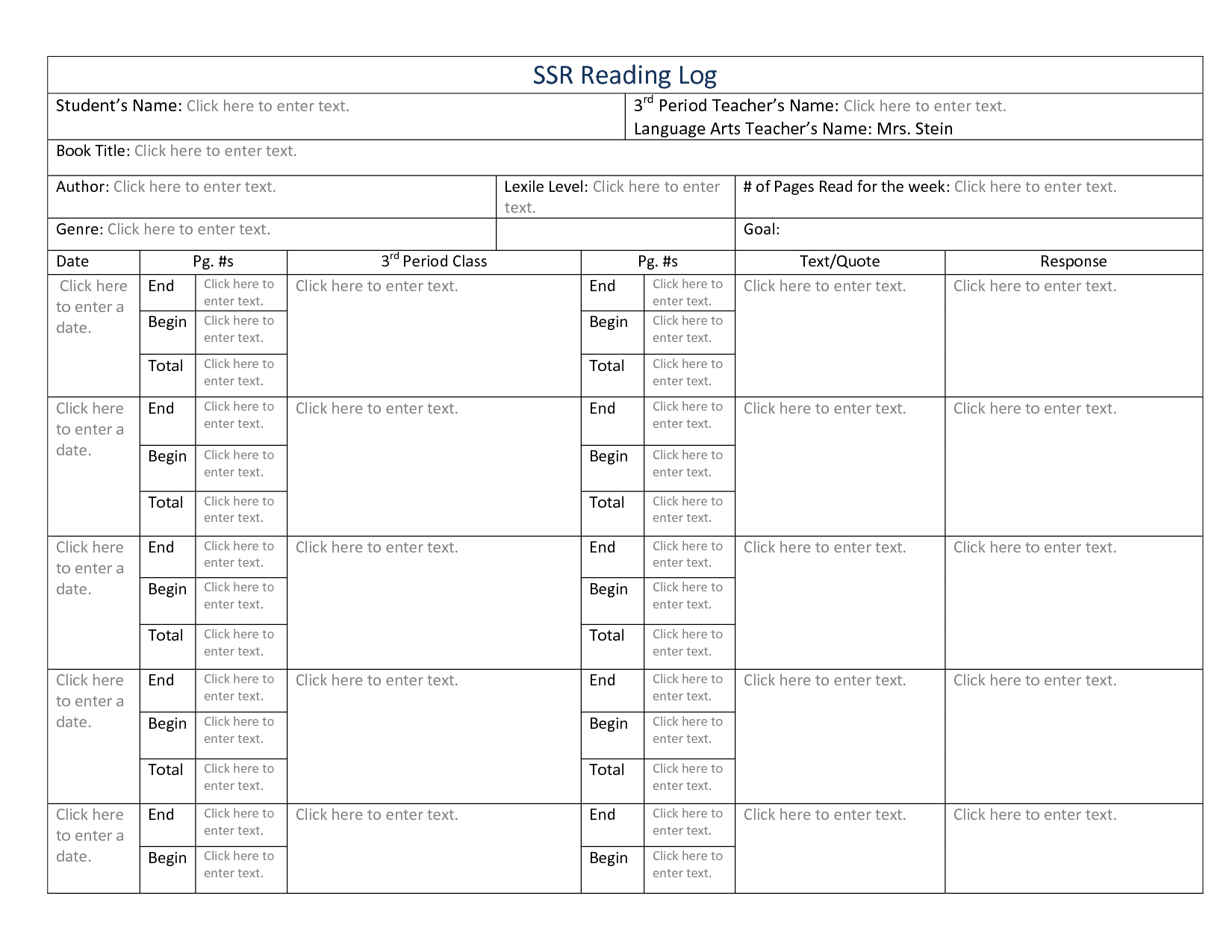

- SSR Reading Log Worksheet

- Personal Income and Expense Statement

- Ice Cream Shop Business

- Student Organization Constitution Sample

- Printable House Cleaning Schedule Checklists

- Business Plans Proposal Forms

- Business Plans Proposal Forms

- Business Plans Proposal Forms

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a Personal Profit and Loss Worksheet?

A Personal Profit and Loss Worksheet is a financial tool used to track and analyze an individual's income and expenses. It helps individuals understand their financial situation by calculating their net income (income minus expenses) over a specified period of time. This tool can assist in budgeting, identifying areas for potential cost-cutting, and making informed financial decisions.

Why is it important to track personal income and expenses?

It is important to track personal income and expenses because it helps in creating a clear picture of your financial situation, allowing you to make informed decisions about budgeting, saving, and investing. Monitoring your income and expenses helps you identify areas where you can cut costs, increase savings, or adjust spending habits to reach your financial goals. It also helps in avoiding debt and ensuring financial stability in the long run.

How often should a Personal Profit and Loss Worksheet be updated?

A Personal Profit and Loss Worksheet should ideally be updated on a monthly basis to provide an accurate and up-to-date reflection of your financial situation. Regularly reviewing and updating the worksheet allows you to track your income, expenses, and overall financial health effectively, enabling you to make informed decisions and adjustments as needed.

What information should be included in the income section of the worksheet?

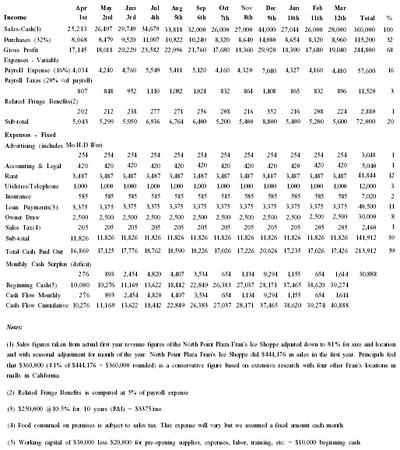

The income section of a worksheet should include all sources of income, such as wages, salaries, bonuses, dividends, interest, rental income, and any other sources of revenue received by an individual or organization during a specific period of time. It should also include any relevant details about each income source, such as the amount received, date received, and any deductions or taxes withheld. Additionally, it is important to accurately document and track all income to ensure proper financial planning and reporting.

What types of expenses should be included in the worksheet?

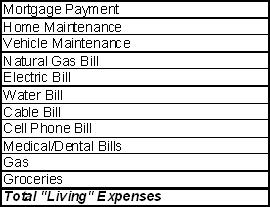

All types of expenses related to running the business or personal finances should be included in the worksheet. This may include rent or mortgage payments, utilities, insurance, transportation costs, office supplies, advertising and marketing expenses, employee salaries, taxes, loan payments, and any other expenses incurred in the course of business operations or personal financial management. Tracking and documenting all expenditures accurately will help in budgeting, financial planning, and decision-making.

How can the worksheet help with budgeting and financial planning?

Worksheets can help with budgeting and financial planning by providing a structured way to organize and track income, expenses, savings, and debts. By inputting this information into a worksheet, individuals can easily visualize their financial situation, identify areas of overspending or opportunities for saving, set clear financial goals, and track their progress over time. This tool can not only help with creating a realistic budget but also with making informed financial decisions to achieve long-term financial success.

Can a Personal Profit and Loss Worksheet be used to determine one's financial health?

Yes, a Personal Profit and Loss Worksheet can be a useful tool in determining one's financial health. By tracking income and expenses, individuals can assess their spending habits, identify areas where they can cut costs or increase income, and evaluate their overall financial situation. This worksheet can help individuals make informed decisions about budgeting, saving, and improving their financial well-being.

Are there any specific categories or subcategories that should be considered in the worksheet?

Yes, when creating a worksheet, it's important to consider categories that align with the learning objectives or goals. Some common categories include introduction or background information, examples or sample problems, guided practice exercises, independent practice questions, and a summary or reflection section. Depending on the subject or topic, other categories like vocabulary terms, key concepts, and supplementary resources can also be included to enhance the learning experience. Subcategories can further break down the content within each main category for better organization and clarity.

How can the worksheet be used to identify areas of potential savings or cutbacks?

The worksheet can be used to identify areas of potential savings or cutbacks by categorizing expenses, analyzing spending patterns, and comparing costs to budgeted amounts. By reviewing each category on the worksheet, you can pinpoint where money is being spent unnecessarily or where costs can be reduced. Identifying areas with high expenses relative to their importance or necessity can help prioritize where cuts or savings can be made, ultimately leading to a more streamlined budget.

Are there any other financial documents or tools that can complement the use of a Personal Profit and Loss Worksheet?

Yes, there are several financial documents and tools that can complement the use of a Personal Profit and Loss Worksheet. Some of these may include a personal budget template to track expenses and income, a cash flow statement to monitor the flow of money in and out of your accounts, a net worth statement to assess your overall financial health, and financial goal setting tools to help you plan and achieve your financial objectives. Additionally, using financial tracking apps or software can also be beneficial in managing your finances effectively.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments