Personal Financial Statement Worksheet

A personal financial statement worksheet is a helpful tool for individuals seeking to gain a comprehensive understanding of their financial situation. It provides a structured format to list and analyze all of your assets, liabilities, and net worth. Whether you're a college student trying to manage your budget or a professional aiming to track your financial progress, using a personal financial statement worksheet can provide clarity and organization to your financial planning efforts.

Table of Images 👆

- Printable Personal Financial Statement Form

- Personal Financial Statement Template for Excel Worksheet

- Free Personal Financial Statement Template

- Free Blank Spreadsheets

- Personal Financial Statement Template PDF

- SunTrust Bank Statement Sample

- Family Financial Planning Worksheet

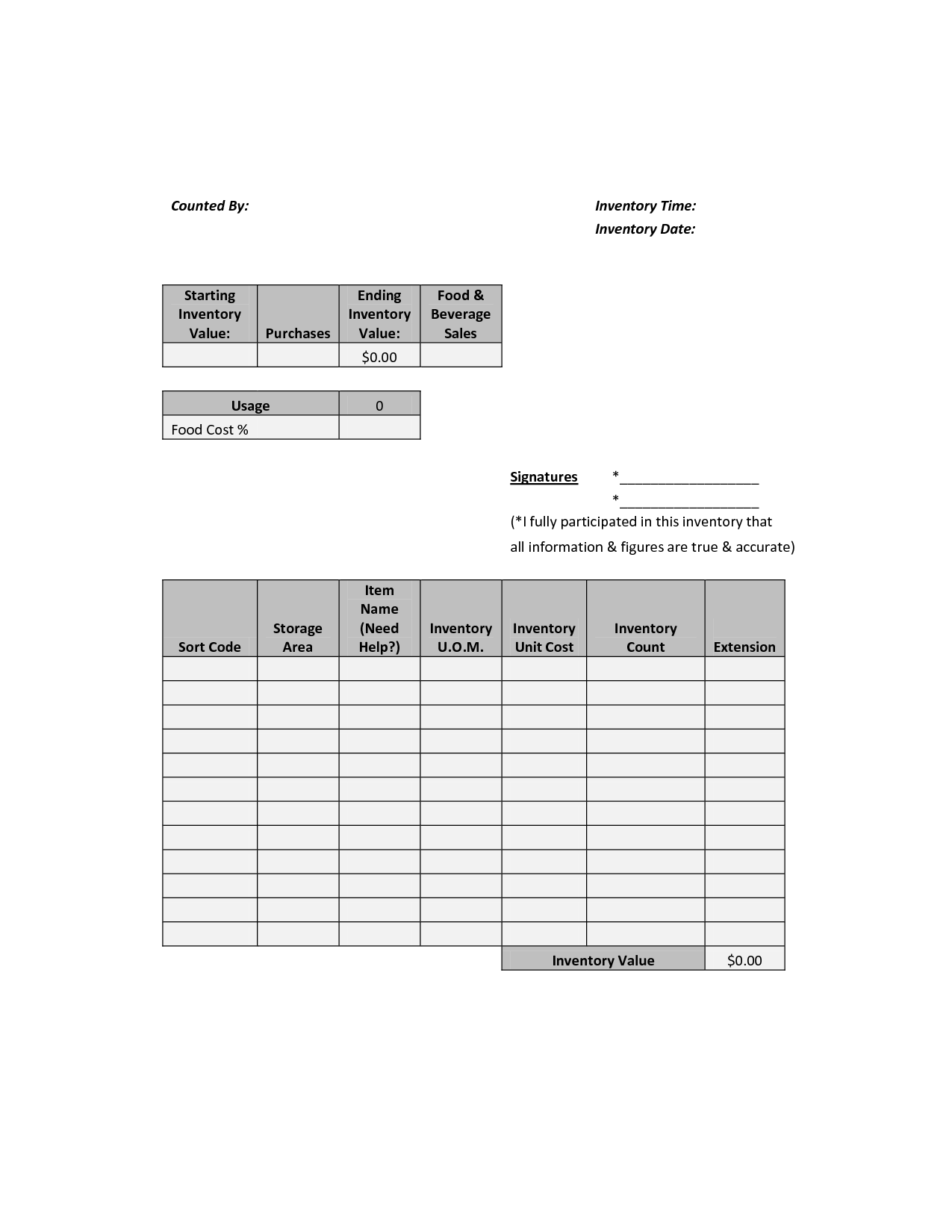

- Restaurant Food Inventory Template

- Business Balance Sheet Example

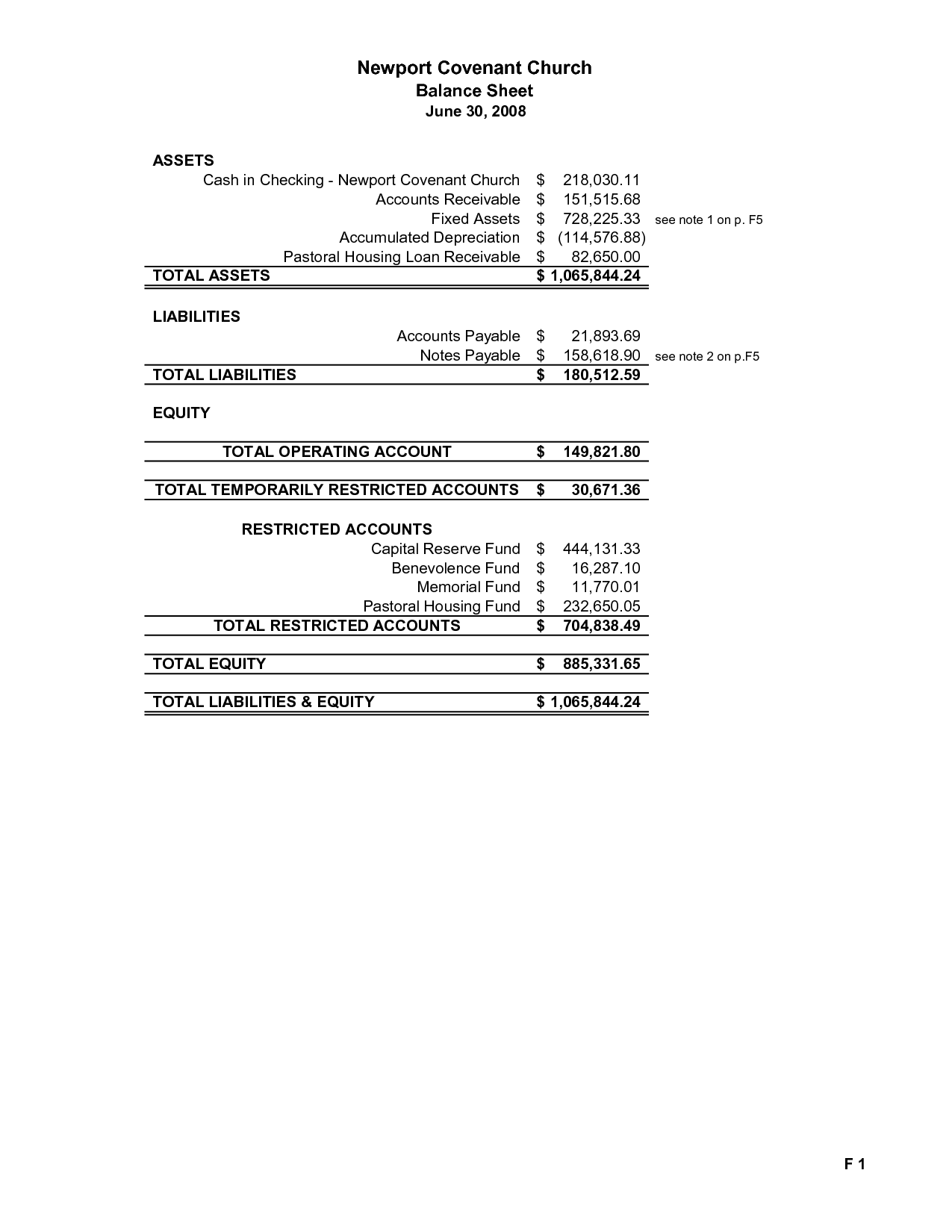

- Sample Church Balance Sheet Template

- Cash Flow Projection Worksheet

- 3 Year Pro Forma Income Statement

- Break-Even Analysis Template

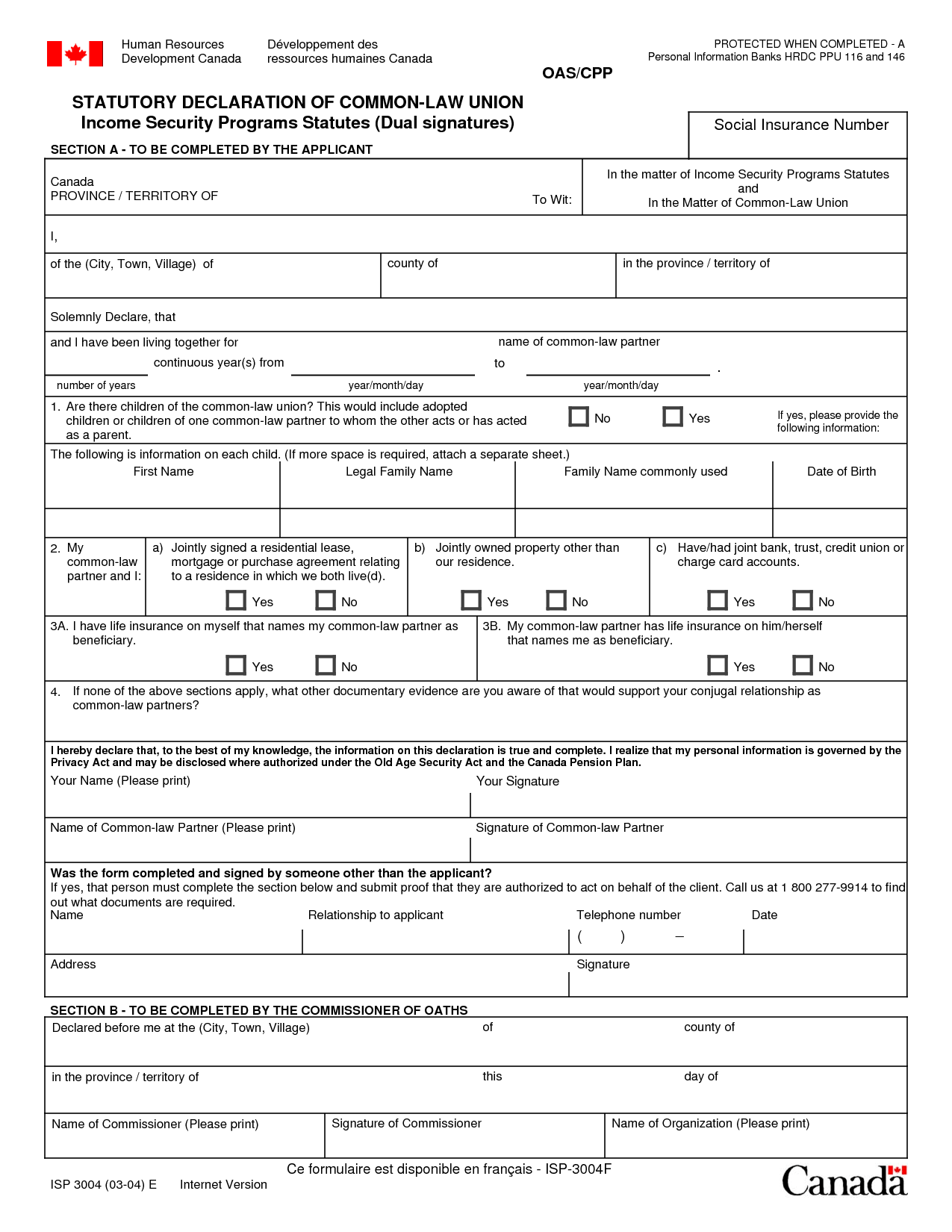

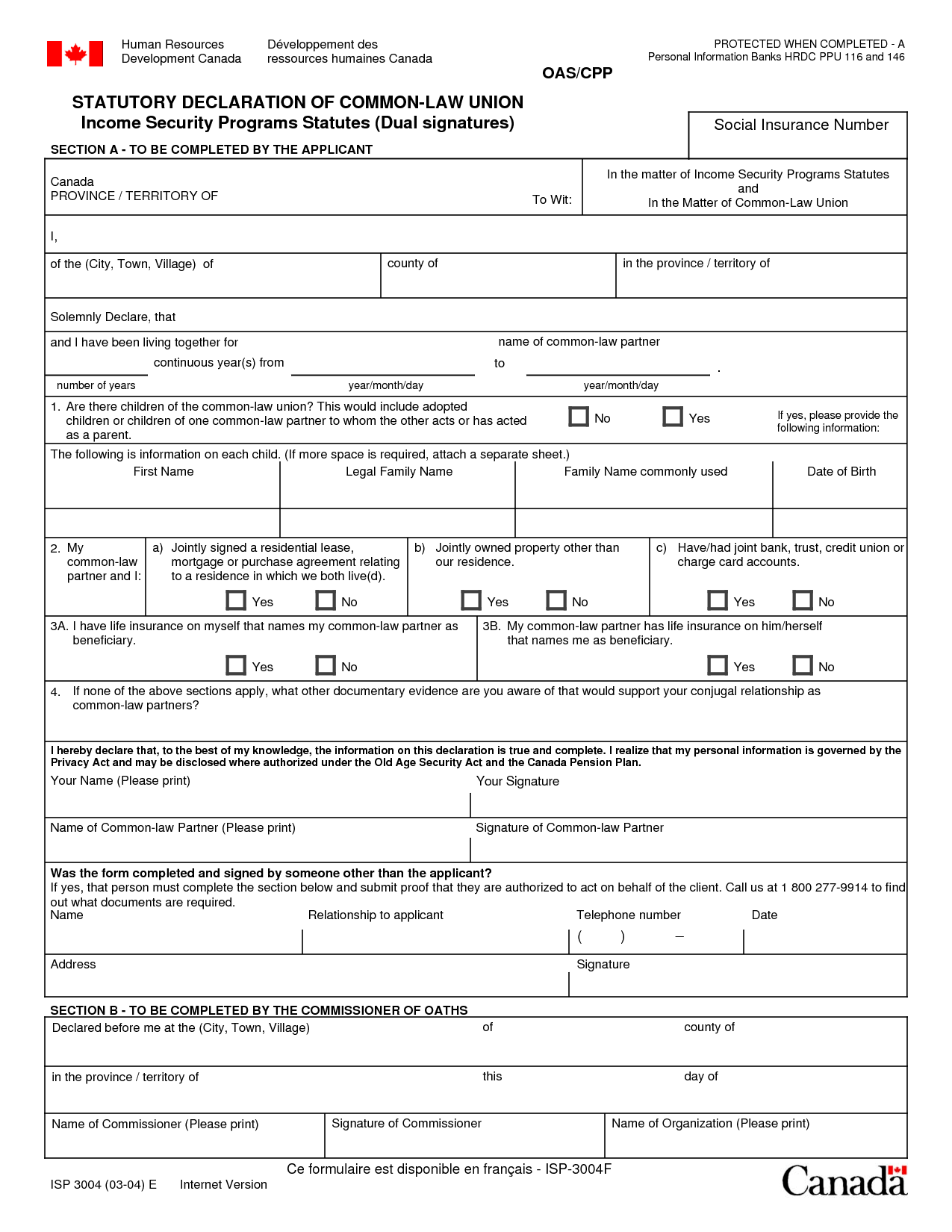

- Statutory Declaration Form Canada

- Statutory Declaration Form Canada

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a Personal Financial Statement Worksheet?

A Personal Financial Statement Worksheet is a document that helps individuals track their financial assets, liabilities, income, and expenses. It typically includes sections for listing assets such as savings accounts, investments, and real estate, as well as liabilities like debts and loans. By comparing the total assets to liabilities, individuals can determine their net worth. It also helps in analyzing income sources and expenses to create a budget and make informed financial decisions.

How can a Personal Financial Statement Worksheet help individuals manage their finances?

A Personal Financial Statement Worksheet can help individuals manage their finances by providing a comprehensive overview of their assets, liabilities, income, and expenses in one place. By listing all financial information in an organized manner, individuals can track their net worth, identify areas for improvement, set financial goals, and create a budget. This tool can also help individuals make informed decisions about saving, investing, and spending to achieve their financial objectives more effectively.

What types of information are typically included in a Personal Financial Statement Worksheet?

A Personal Financial Statement Worksheet typically includes information such as an individual's assets (cash, investments, real estate, vehicles), liabilities (debts, loans), income (salary, investments), expenses (housing, utilities, transportation), and net worth (assets minus liabilities). This document helps individuals assess their overall financial health by providing a snapshot of their financial situation at a specific point in time.

How often should individuals update their Personal Financial Statement Worksheet?

Individuals should update their Personal Financial Statement Worksheet regularly, at least once a year or whenever there is a significant change in their financial situation. This will ensure that the information is accurate and up-to-date, allowing for better financial planning and decision-making.

What is the purpose of calculating net worth on a Personal Financial Statement Worksheet?

The purpose of calculating net worth on a Personal Financial Statement Worksheet is to gather a comprehensive snapshot of an individual's financial situation by subtracting total liabilities from total assets. This calculation helps individuals assess their overall financial health, track progress towards financial goals, identify areas of improvement, and make informed decisions regarding budgeting, saving, investing, and debt management.

How can a Personal Financial Statement Worksheet help individuals track their expenses?

A Personal Financial Statement Worksheet can help individuals track their expenses by providing a structured format to list all income sources and expenses, allowing them to see a clear overview of their financial situation. By detailing their income and tracking expenses such as rent, utilities, groceries, entertainment, and other costs, individuals can track where their money is being spent and identify areas where they can potentially cut back or make necessary adjustments to their budget. This tool can help individuals gain a better understanding of their spending habits and make more informed financial decisions to reach their financial goals.

What are some common financial goals that individuals can track on a Personal Financial Statement Worksheet?

Common financial goals that individuals can track on a Personal Financial Statement Worksheet include saving for emergencies, retirement, major purchases like a home or car, paying off debt, investing for the future, creating a budget, monitoring income and expenses, setting aside funds for education or healthcare expenses, and building an emergency fund.

How can a Personal Financial Statement Worksheet assist individuals in budgeting their income?

A Personal Financial Statement Worksheet can assist individuals in budgeting their income by providing a clear and organized overview of their financial situation. It allows individuals to track their assets, liabilities, income, and expenses all in one place, helping them to see where their money is coming from and where it is going. By having this comprehensive picture, individuals can make informed decisions about their spending, identify areas where they can cut costs, set financial goals, and ultimately create a more effective budget that aligns with their financial priorities and objectives.

What are the benefits of using a Personal Financial Statement Worksheet for retirement planning?

A Personal Financial Statement Worksheet is beneficial for retirement planning as it helps individuals assess their current financial situation by organizing and summarizing assets, liabilities, income, and expenses in one place. It provides a clear overview of their financial health, allowing them to identify areas for improvement and set realistic retirement goals. By having a comprehensive understanding of their finances, individuals can make informed decisions, monitor their progress, and make necessary adjustments to achieve a secure retirement.

How can a Personal Financial Statement Worksheet help individuals identify areas where they need to cut back on spending?

A Personal Financial Statement Worksheet can help individuals identify areas where they need to cut back on spending by providing a detailed overview of their income and expenses. By categorizing and listing all sources of income and expenses, individuals can clearly see where their money is going each month. This visualization can help pinpoint areas of overspending or unnecessary expenditures, making it easier to identify where adjustments need to be made to reduce expenses and improve their overall financial health.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments