Personal Financial Planning Worksheet

Are you interested in taking control of your personal finances? Look no further than the Personal Financial Planning Worksheet! This handy tool is designed to help individuals effectively manage their money and create a solid financial plan. With a focus on entity and subject, this worksheet provides a comprehensive overview of income, expenses, savings, debt, and financial goals. Whether you're just starting out or trying to improve your current financial situation, this worksheet is perfect for anyone looking to take a proactive approach to their personal finances.

Table of Images 👆

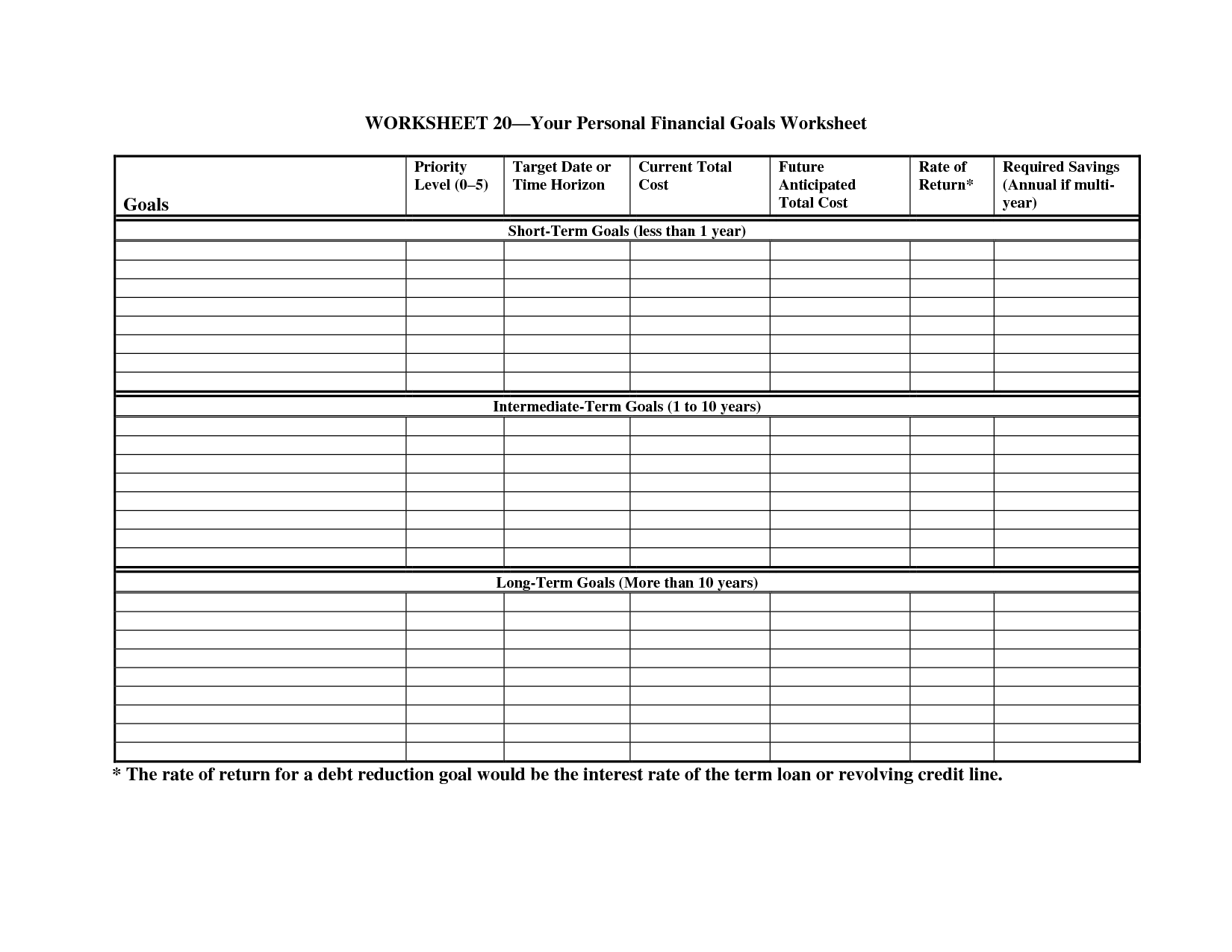

- Personal Financial Goals Worksheet

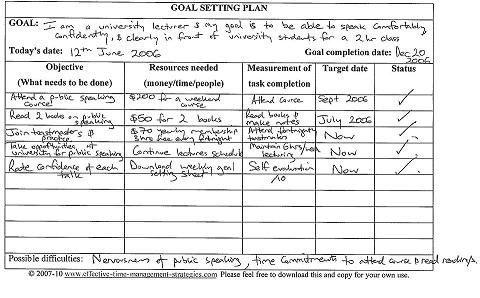

- Examples Smart Goal Setting Worksheet

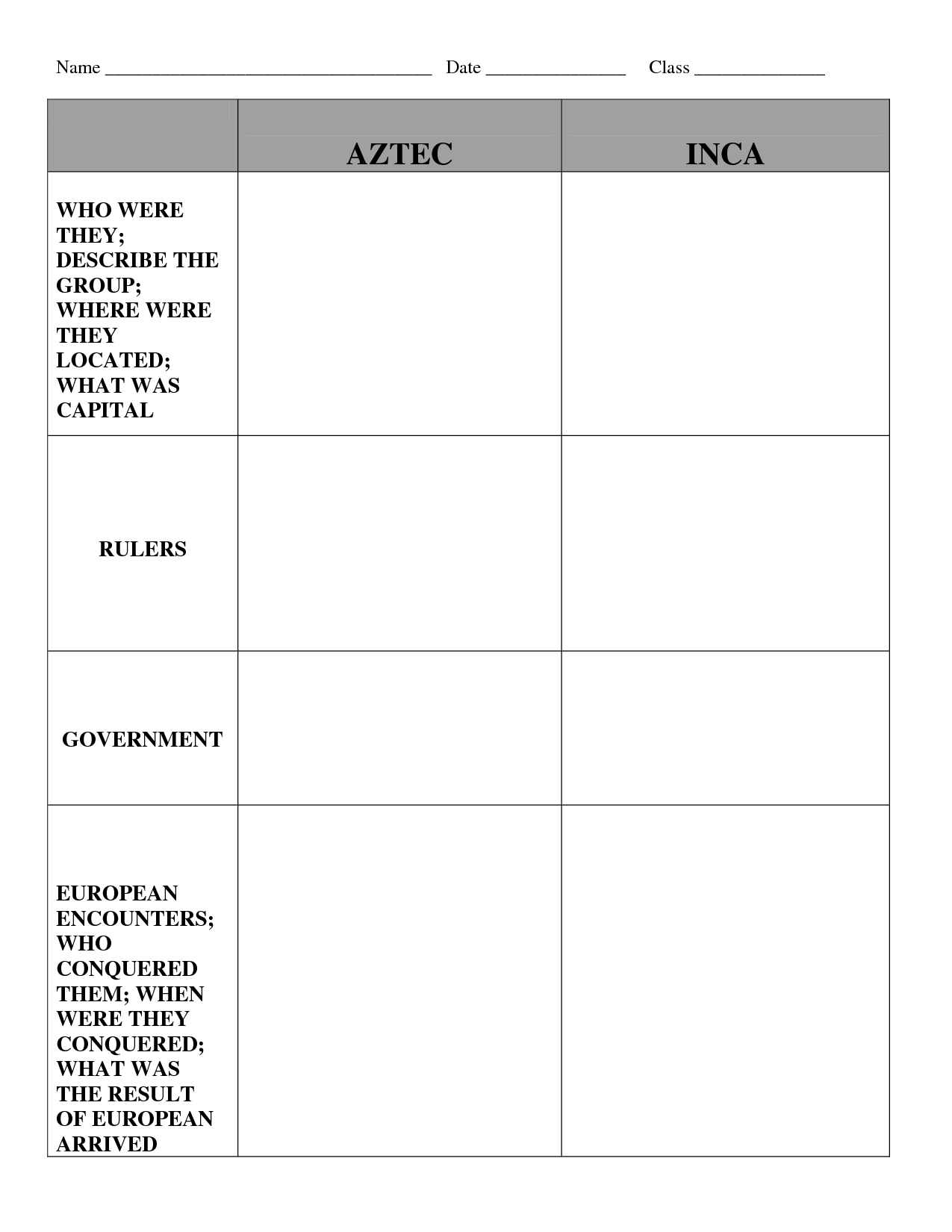

- Maya-Aztec Inca Graphic Organizer

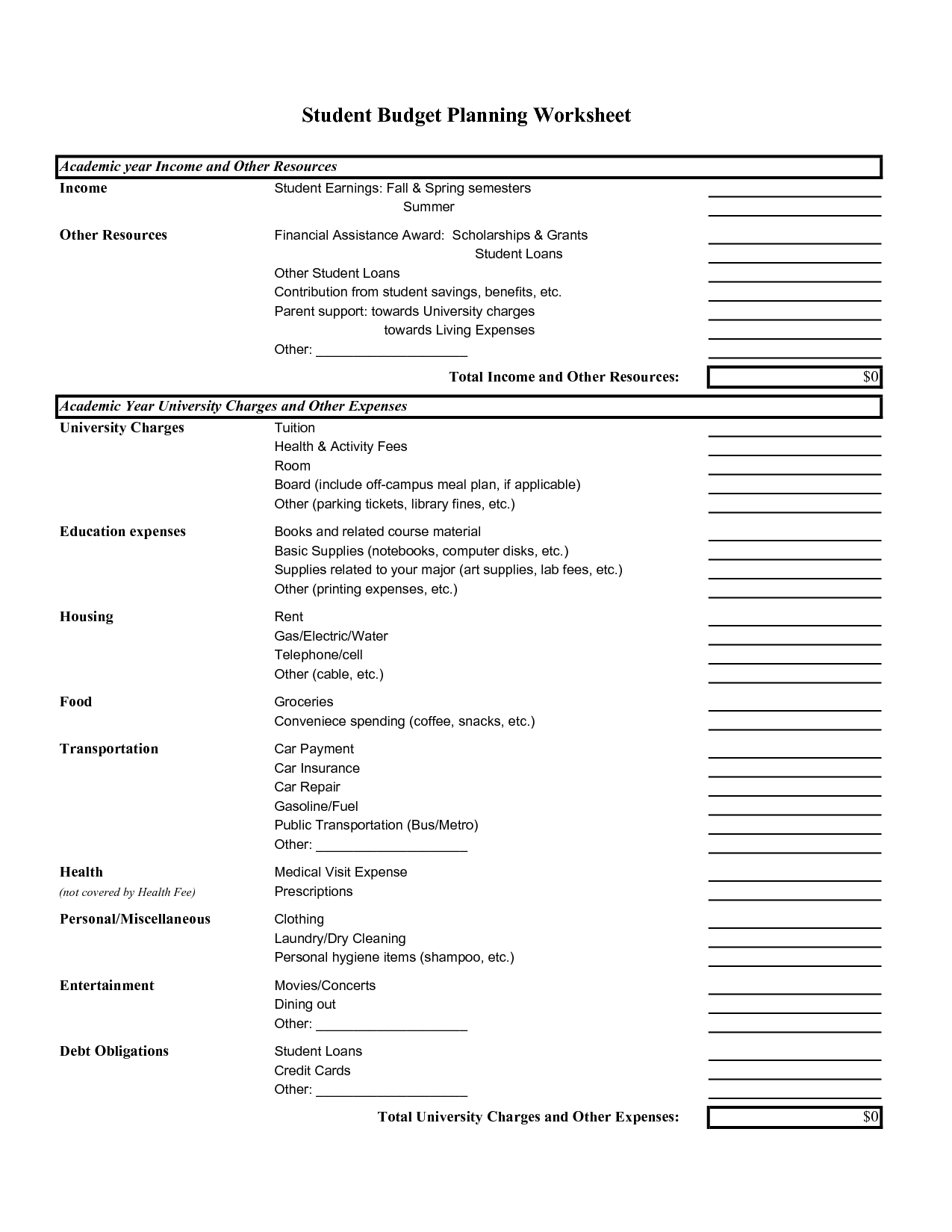

- Sample Student Budget Worksheet

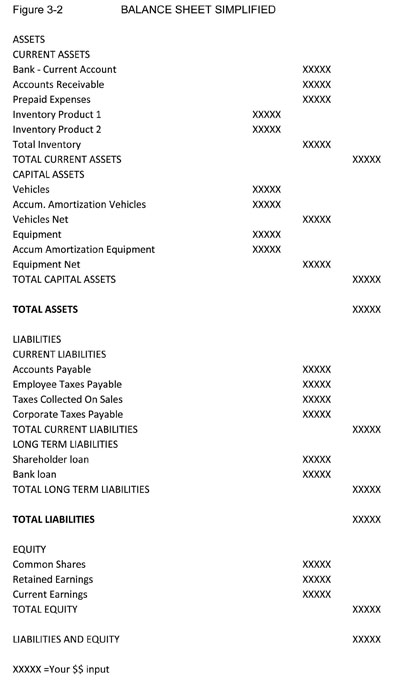

- Small Business Profit and Loss Statement

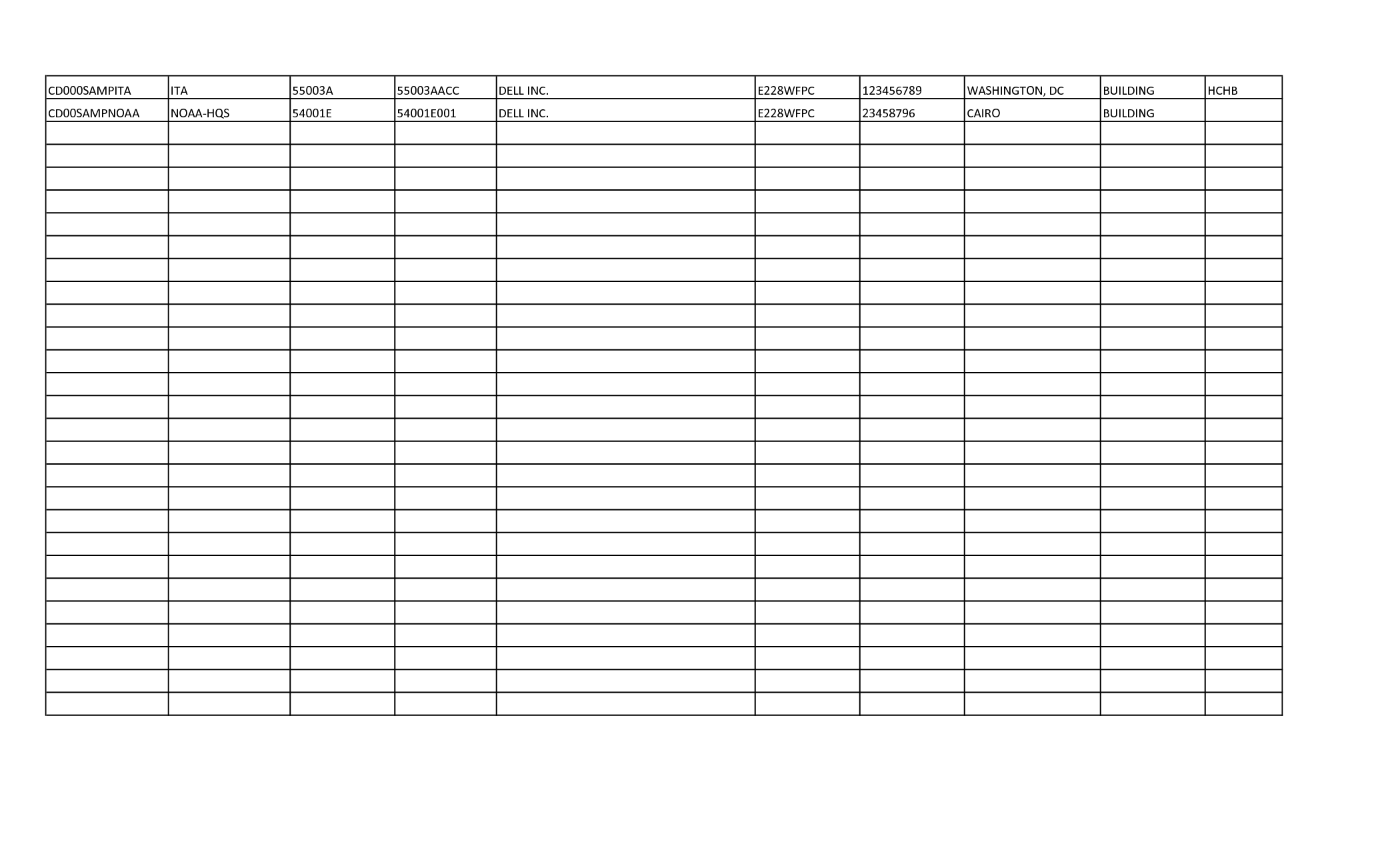

- Excel Worksheet

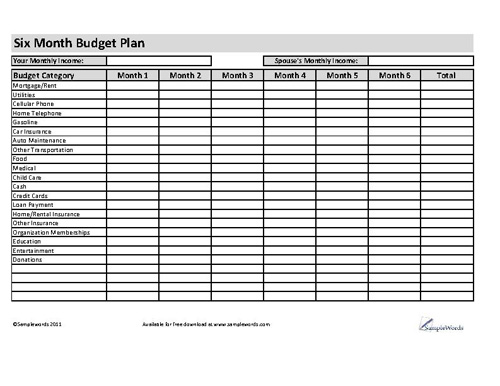

- 6 Month Budget Plan

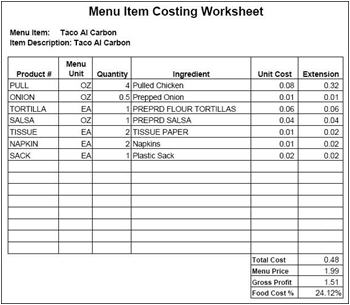

- Food Cost Sheet Template Excel

- IRS Tax Return Calendar 2016

- IRS Tax Return Calendar 2016

- IRS Tax Return Calendar 2016

- IRS Tax Return Calendar 2016

- IRS Tax Return Calendar 2016

- IRS Tax Return Calendar 2016

- IRS Tax Return Calendar 2016

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a personal financial planning worksheet?

A personal financial planning worksheet is a tool used to help individuals organize and track their financial situation. It typically includes sections for documenting income, expenses, assets, liabilities, savings goals, and other financial information. By using a financial planning worksheet, individuals can create a comprehensive overview of their finances to help them make informed decisions, set goals, and track progress towards achieving financial stability and security.

Why is it important to create a personal financial plan?

Creating a personal financial plan is important because it helps individuals set specific goals, track their progress, and make informed decisions about their finances. A financial plan can help manage income, expenses, savings, investments, and debt, ultimately leading to a more secure financial future and the ability to achieve long-term financial success. It also provides a roadmap for making financial decisions, preparing for emergencies, and reaching financial milestones.

What are the key components of a personal financial planning worksheet?

Key components of a personal financial planning worksheet usually include sections for income sources, expenses, assets, liabilities, budgeting, savings goals, investment accounts, retirement planning, insurance coverage, and other financial goals. The worksheet helps individuals organize and track their financial information, create a budget, set goals, and make informed decisions to manage their finances effectively.

How can a personal financial planning worksheet help track income and expenses?

A personal financial planning worksheet can help track income and expenses by providing a structured format for documenting all sources of income and categorizing various expenses. By listing income sources and recording expenses in different categories such as housing, transportation, utilities, groceries, etc., individuals can see where their money is going and identify areas where they may be overspending. This tracking enables them to create a budget, set financial goals, and make informed decisions about their spending habits to ultimately achieve financial stability and reach their financial objectives.

What role does goal setting play in a personal financial planning worksheet?

Goal setting is essential in a personal financial planning worksheet as it helps individuals define their financial objectives and create a roadmap towards achieving them. By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, individuals can better allocate their resources, track their progress, and make informed financial decisions. Goals provide motivation, focus, and a sense of direction in managing finances effectively, leading to improved financial security and overall well-being.

How does a personal financial planning worksheet help in managing debt and savings?

A personal financial planning worksheet helps in managing debt and savings by providing a clear overview of one's financial situation. By listing all debts, including amounts owed and interest rates, individuals can prioritize and create a repayment plan. Additionally, by outlining income sources, expenses, and savings goals, individuals can track progress towards financial goals and make informed decisions on how to allocate funds effectively. This tool can help individuals stay organized, stay accountable to their financial goals, and make adjustments as needed to improve their financial health in the long run.

How can a personal financial planning worksheet assist in budgeting and setting spending limits?

A personal financial planning worksheet can assist in budgeting and setting spending limits by providing a clear overview of one's income, expenses, savings goals, and debt obligations. By tracking and categorizing expenses, individuals can identify areas where they can cut back or adjust their spending to meet their financial goals. The worksheet can also help in setting realistic spending limits for different categories of expenses, ensuring that individuals stay within their budget and reach their financial objectives.

What are some common financial challenges that a personal financial planning worksheet can help address?

A personal financial planning worksheet can help address common financial challenges such as budgeting, tracking expenses, setting financial goals, creating a savings plan, managing debt, monitoring investments, assessing insurance needs, and planning for retirement. By outlining income, expenses, assets, and liabilities in an organized manner, individuals can gain a clearer understanding of their financial situation and make informed decisions to improve their financial health.

How does a personal financial planning worksheet contribute to long-term financial stability?

A personal financial planning worksheet helps individuals to organize their income, expenses, assets, and liabilities, providing a clear overview of their financial situation. By using this tool, individuals can set financial goals, create budgets, track their progress, and make informed decisions about saving, investing, and spending. This level of organization and planning ultimately leads to better financial habits, increased awareness of financial goals, and the ability to adapt to changes and challenges, all of which are crucial for achieving and maintaining long-term financial stability.

What are some resources or tools that can be used in conjunction with a personal financial planning worksheet?

Some resources and tools that can be used in conjunction with a personal financial planning worksheet include budgeting apps like Mint or You Need a Budget, investment calculators to plan for retirement or growth of savings, debt payoff calculators to create a repayment plan, financial goal trackers to monitor progress towards specific goals, and financial education resources such as books, podcasts, or online courses to improve financial literacy and decision-making.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments