Monthly Income Budget Worksheet

A Monthly Income Budget Worksheet is a helpful tool for individuals who want to effectively manage their finances and take control of their spending habits. By providing a detailed breakdown of income sources and expenses, this worksheet allows users to track their financial health and make informed decisions about their spending. Whether you are a college student trying to navigate your monthly expenses or a family looking to save for future goals, this worksheet can be a valuable resource in achieving your financial goals.

Table of Images 👆

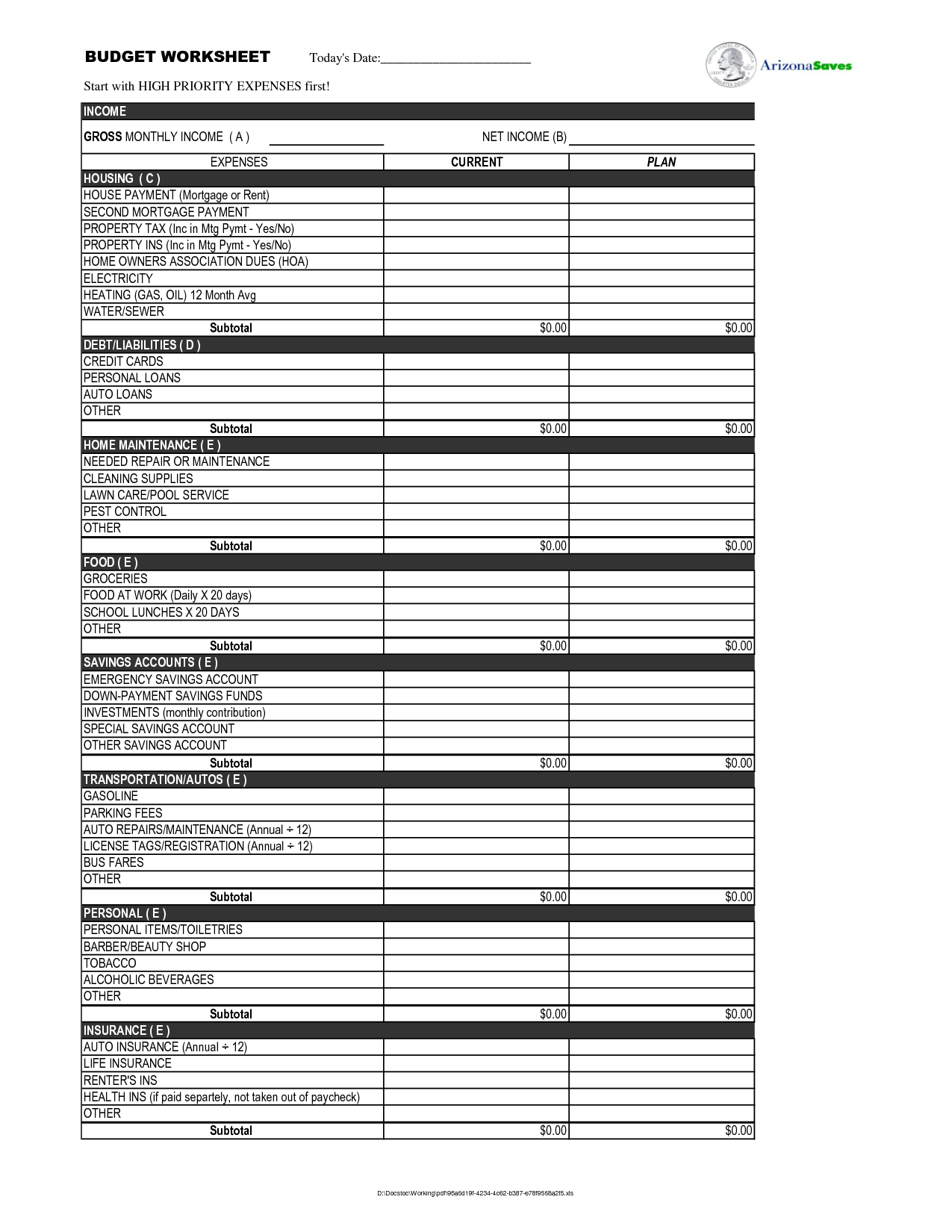

- Monthly Income Expense Worksheet

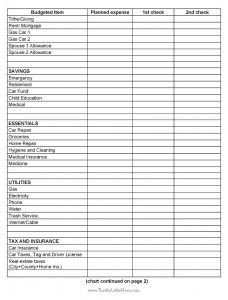

- Free Printable Budget Worksheets for Young Adults

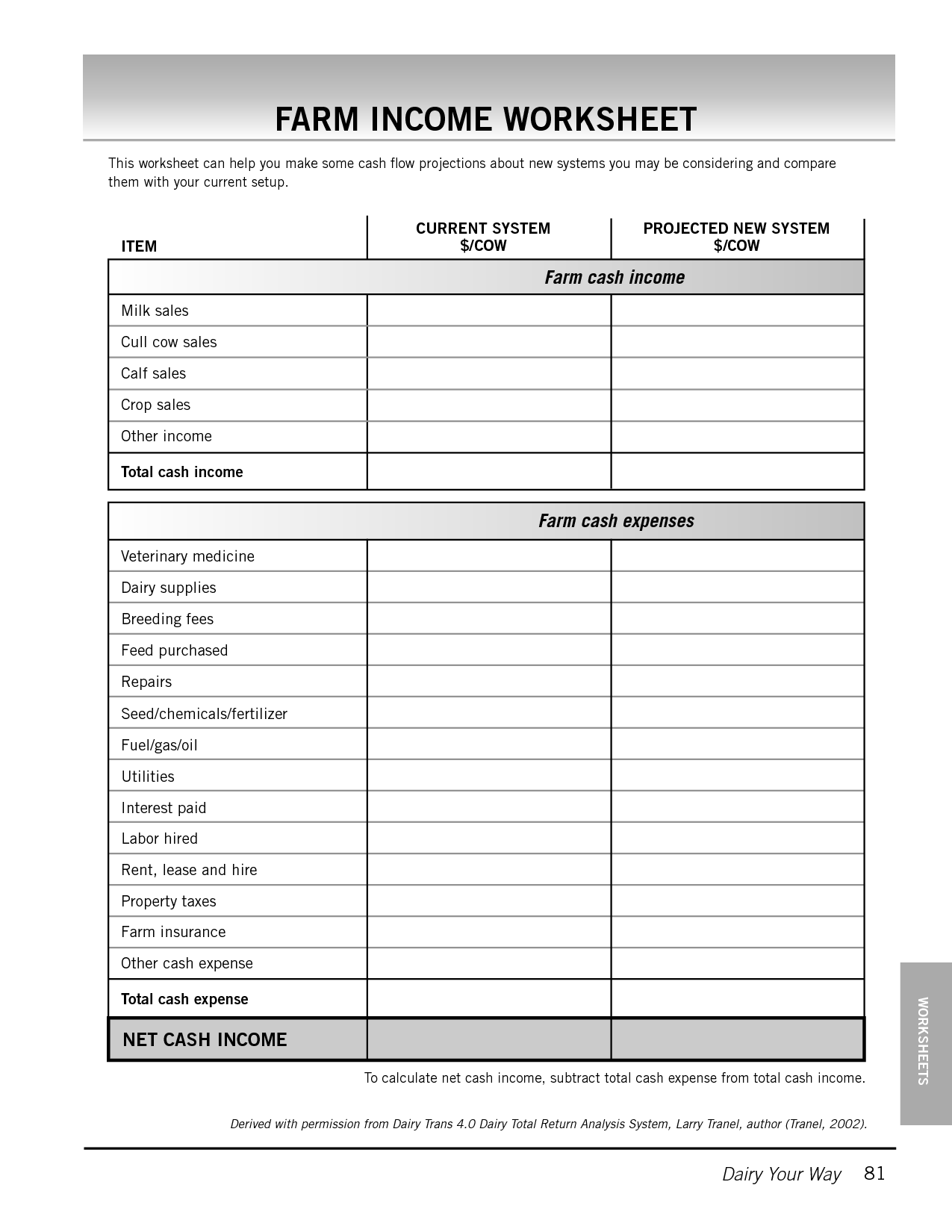

- Farm Income and Expense Worksheet

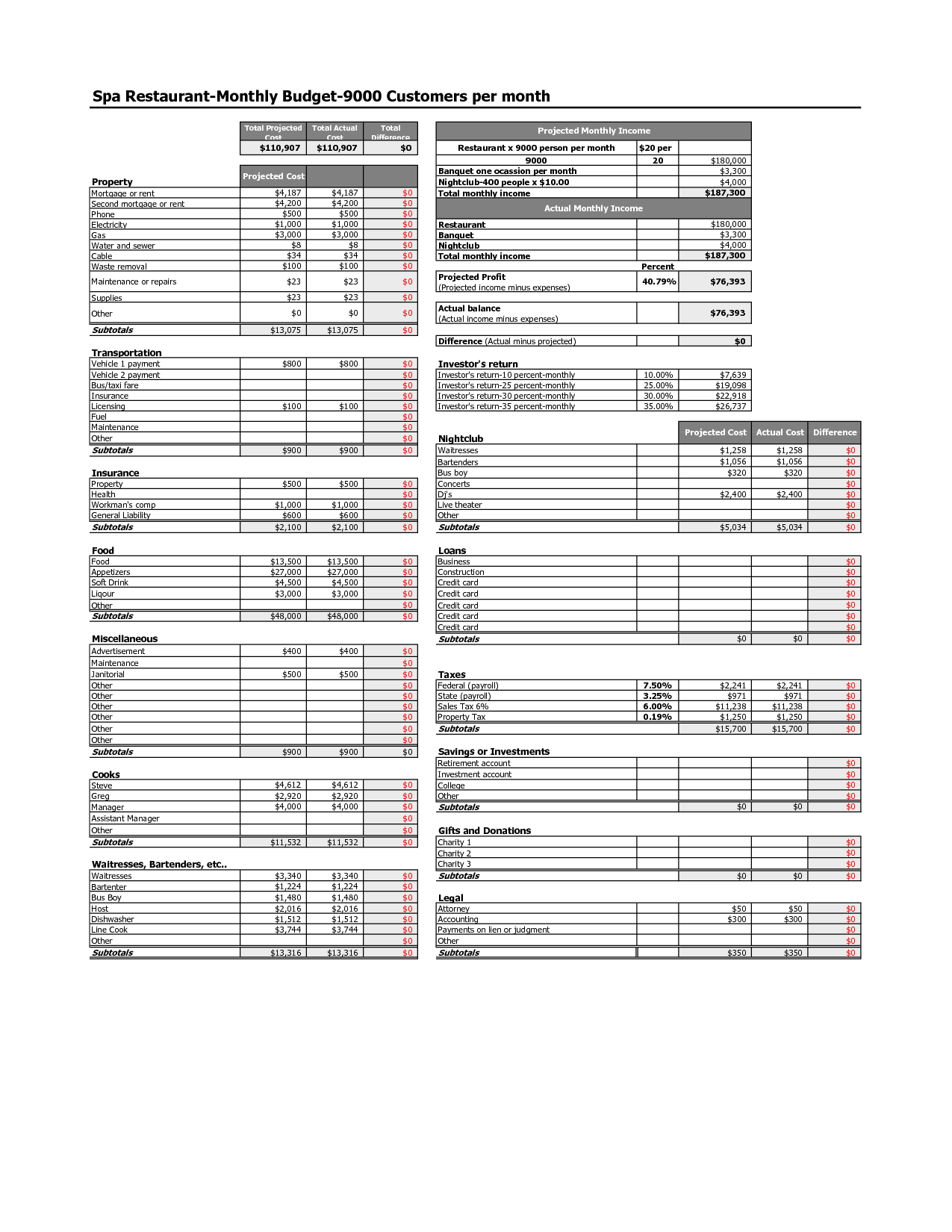

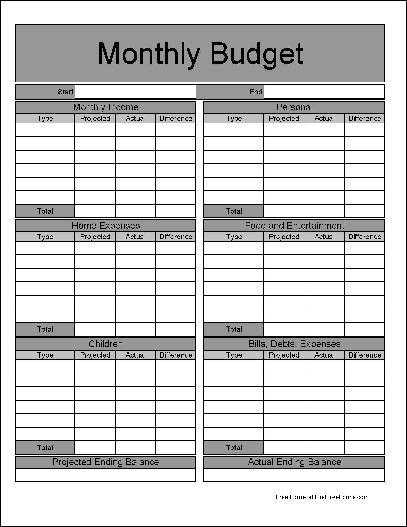

- Monthly Budget Worksheet

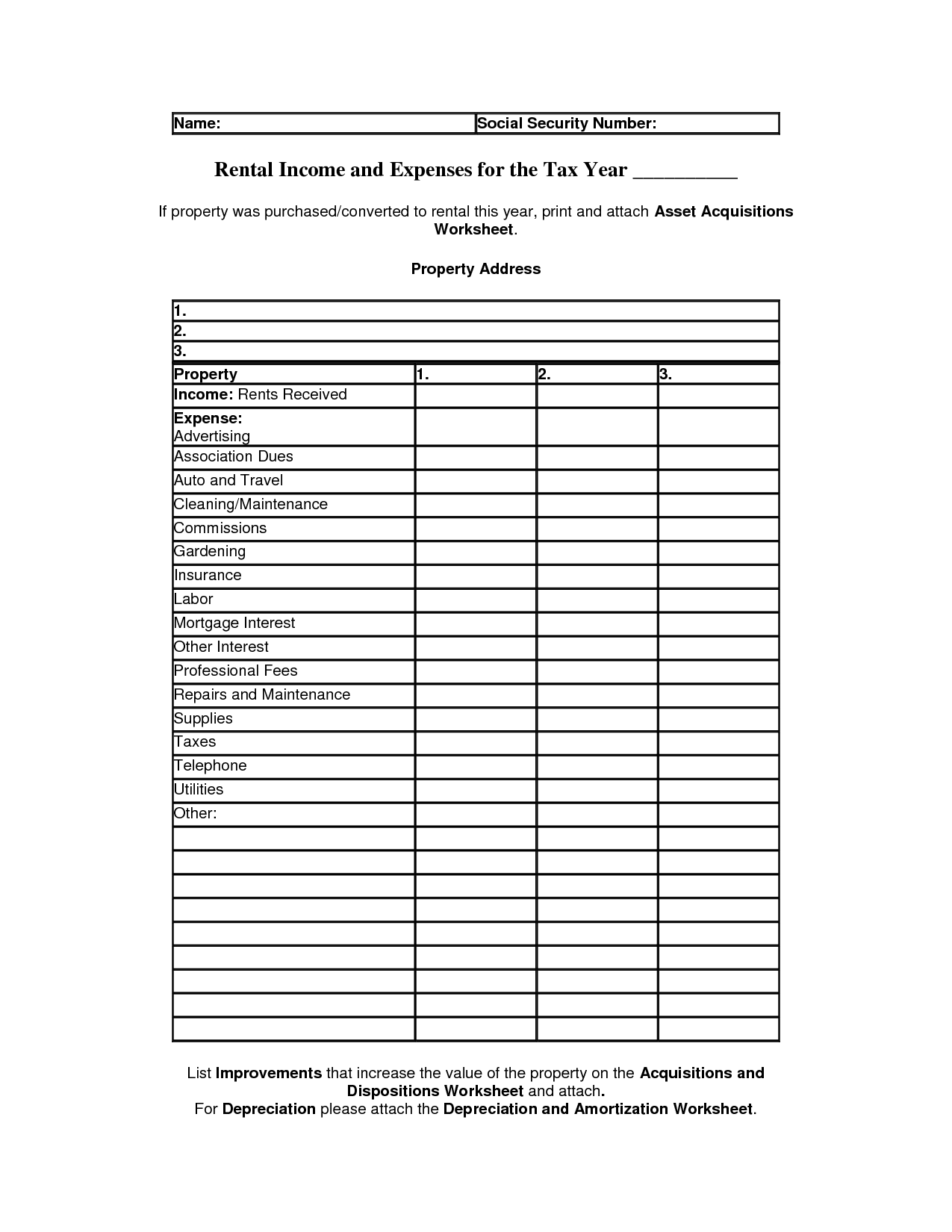

- Rental Property Income and Expense Worksheet

- Free Printable Monthly Budget Forms

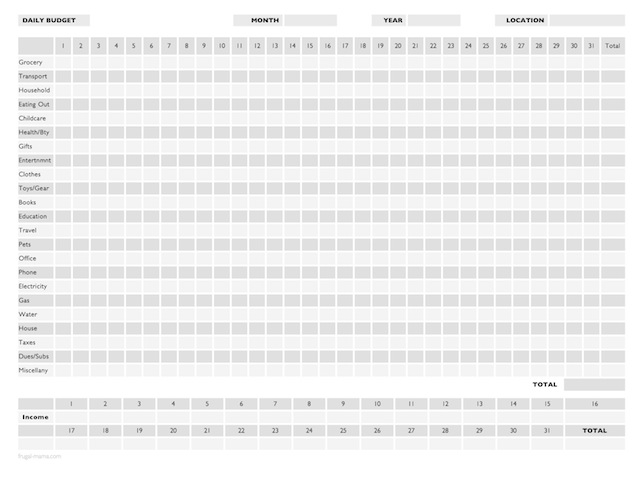

- Daily Budget Worksheet Printable

- Sample Household Budget Sheets

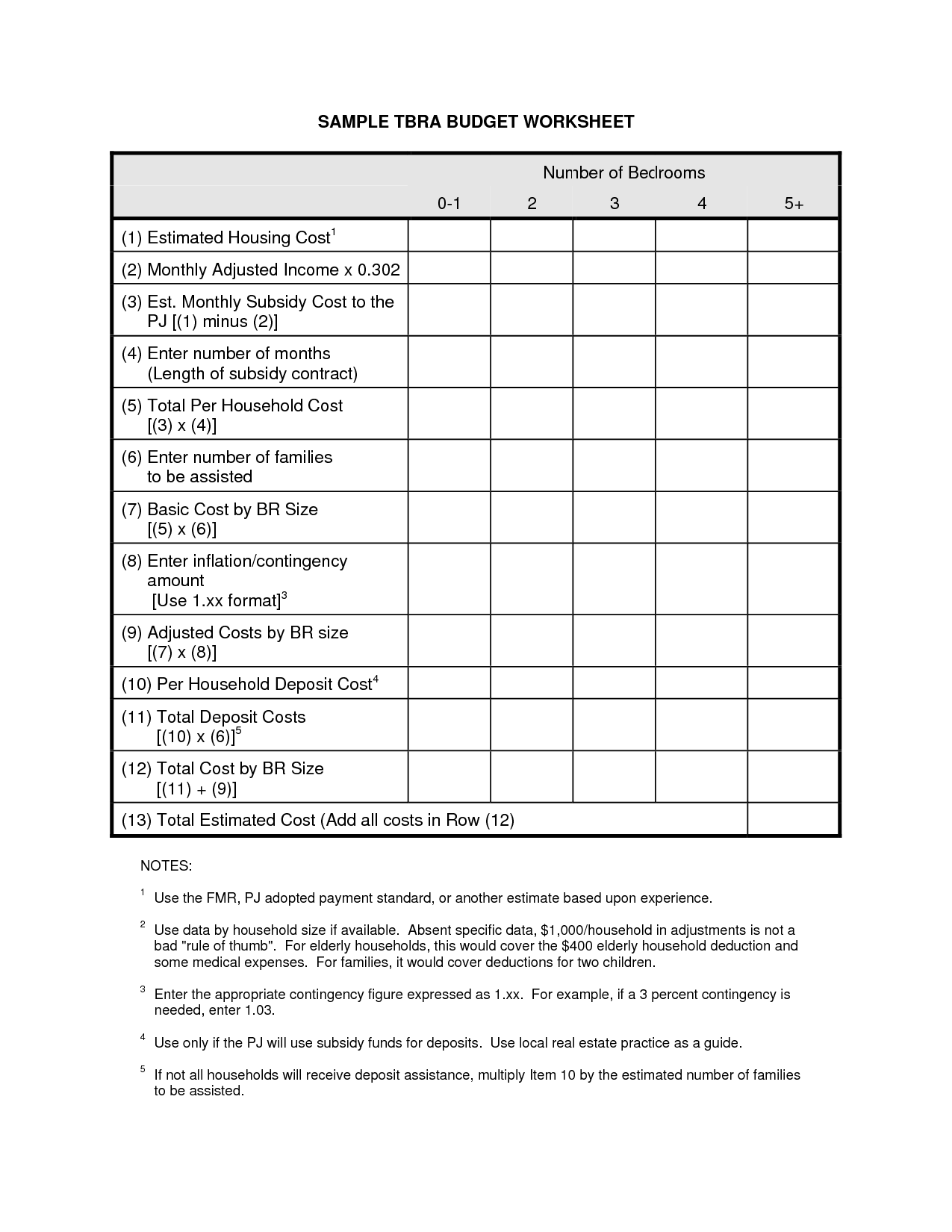

- Debt Budget Worksheet

- College Student Budget Worksheet

- Free Printable Accounting Ledger Sheets

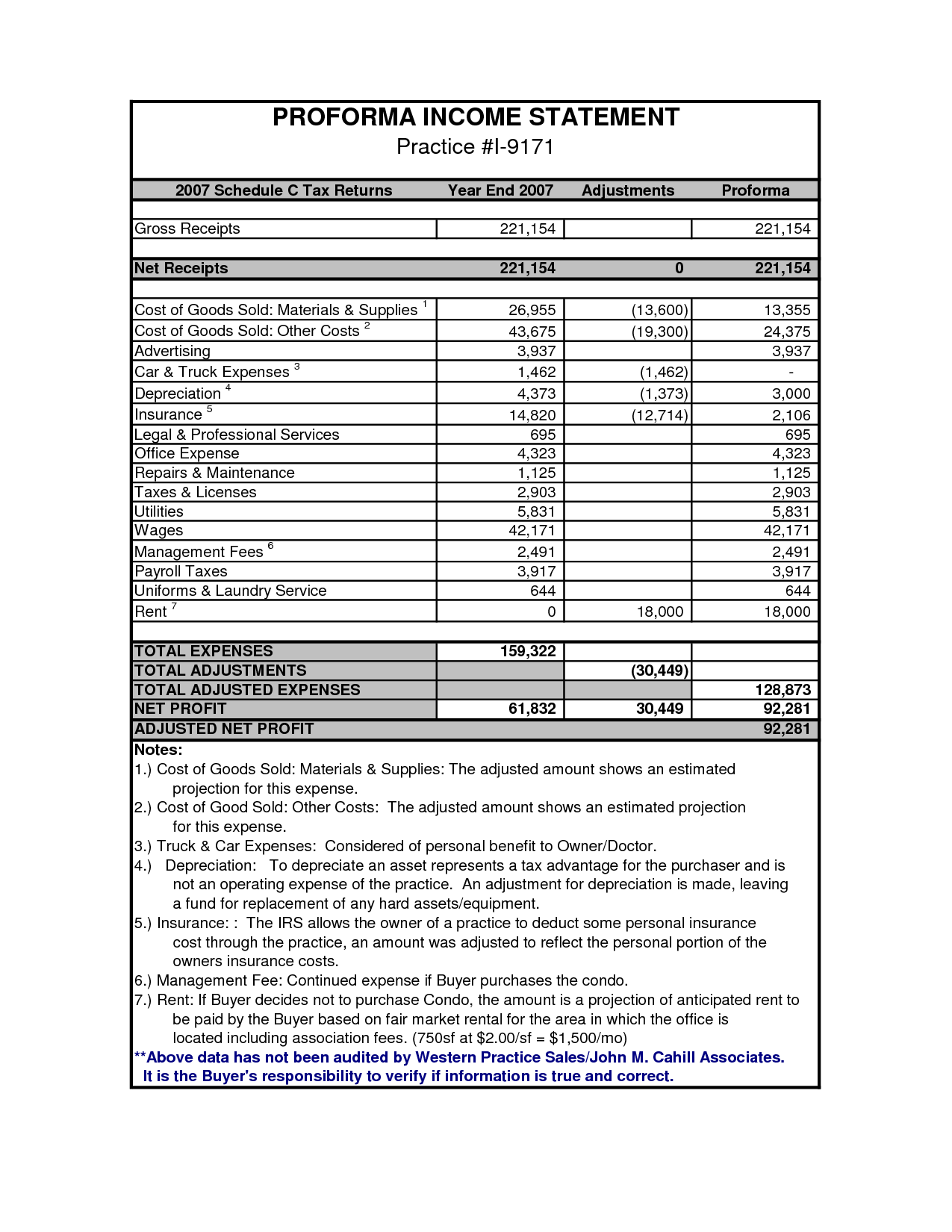

- Cost of Goods Income Statement

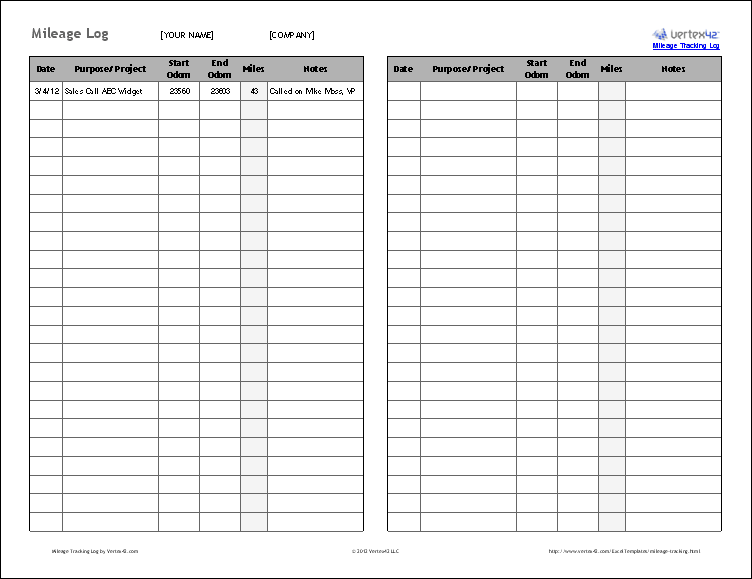

- Mileage Log Sheet Template

- Tracking Ticket Sales Sheet Templates

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a Monthly Income Budget Worksheet?

A Monthly Income Budget Worksheet is a tool used to track and manage an individual's or household's income and expenses for a specific month. It typically includes categories for different sources of income, such as salaries and investments, as well as expenses like rent, utilities, groceries, and savings. By detailing income and expenses in one place, the worksheet helps individuals understand where their money is going, identify areas for potential savings or cutbacks, and plan for future financial goals.

What is the purpose of using a Monthly Income Budget Worksheet?

The purpose of using a Monthly Income Budget Worksheet is to track and manage your income and expenses on a monthly basis. It helps you create a detailed breakdown of your income sources and where your money is being spent, allowing you to set financial goals, identify areas where you can reduce spending, and prioritize your spending based on your financial priorities. By using a budget worksheet, you can gain control over your finances, plan for any upcoming expenses, and work towards achieving financial stability.

What are the key components of a Monthly Income Budget Worksheet?

A Monthly Income Budget Worksheet typically includes key components such as a breakdown of all sources of income for the month, including salaries, bonuses, and any other forms of income, followed by a detailed list of all expenses categorized into fixed expenses (like rent, mortgage, utilities) and variable expenses (such as groceries, entertainment). It also includes sections for savings goals, debt payments, and emergency funds, as well as space to track actual spending and compare it to the budgeted amounts to ensure financial discipline and goal achievement.

How can a Monthly Income Budget Worksheet help in tracking and managing expenses?

A Monthly Income Budget Worksheet can help in tracking and managing expenses by providing a clear structure to list all sources of income and categorize different expenses such as utilities, groceries, rent, and entertainment. By comparing income to expenses, individuals can identify areas where they may be overspending or could potentially cut back, enabling them to make informed decisions about their finances and prioritize their spending to ensure they stay within their budget. Regularly updating the worksheet can help track progress towards financial goals and adjust spending habits as needed to maintain a healthy financial balance.

How do you calculate your total monthly income on a Monthly Income Budget Worksheet?

To calculate your total monthly income on a Monthly Income Budget Worksheet, start by listing all sources of income, such as salaries, wages, bonuses, rental income, etc., in the appropriate sections. Add up the amounts from each category for the month to determine your total monthly income. Make sure to review your pay stubs, bank statements, and any other financial documents to accurately track and include all sources of income for a comprehensive calculation that reflects your total monthly earnings.

How do you categorize and list your monthly expenses on a Monthly Income Budget Worksheet?

To categorize and list your monthly expenses on a Monthly Income Budget Worksheet, you can start by creating main categories such as housing, utilities, transportation, groceries, entertainment, savings, and miscellaneous expenses. Under each main category, list specific subcategories including rent/mortgage, electricity, gas, car payment, insurance, food, dining out, subscriptions, emergency fund, and other smaller expenses. Then, assign a budgeted amount to each subcategory based on your income and spending priorities to effectively track and manage your expenses.

What is the importance of setting realistic goals on a Monthly Income Budget Worksheet?

Setting realistic goals on a Monthly Income Budget Worksheet is important because it helps you track and manage your finances effectively. By setting achievable goals, you can monitor your progress, identify areas where you may be overspending or underspending, and make necessary adjustments to stay on track with your budget. Realistic goals also help you stay motivated and accountable for your financial decisions, ultimately leading to better financial health and stability in the long run.

How can a Monthly Income Budget Worksheet help in identifying areas of overspending?

A Monthly Income Budget Worksheet can help in identifying areas of overspending by providing a clear overview of your income and expenses in a structured format. By tracking all sources of income and categorizing expenses, you can easily compare your budgeted amounts with actual spending, highlighting any discrepancies. This visual representation can pinpoint areas where you are overspending and enable you to make adjustments to bring your finances back on track.

How can you use the information from a Monthly Income Budget Worksheet to make financial adjustments?

By analyzing the information from a Monthly Income Budget Worksheet, you can identify areas where you are overspending or not allocating enough funds. This data can help you make informed financial adjustments by reallocating expenses, cutting unnecessary costs, setting savings goals, and prioritizing essential expenditures. Tracking your income and expenses through the budget worksheet enables you to create a more effective budget, improve your financial planning, and work towards achieving your financial goals.

What are the benefits of regularly reviewing and updating a Monthly Income Budget Worksheet?

Regularly reviewing and updating a Monthly Income Budget Worksheet allows for better financial awareness and control. It helps in tracking expenses, identifying areas where spending can be reduced, and staying on top of financial goals. It also enables adjustments to be made to the budget based on changes in income or expenses, ultimately helping to improve financial stability and achieve long-term financial success.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments