Money ESL Worksheets

Worksheets are an effective tool for teaching English as a Second Language (ESL) learners about money-related topics. These resources provide structured exercises that allow students to practice and reinforce their understanding of the vocabulary, grammar, and concepts associated with money. From learning coin values to calculating expenses, ESL worksheets cater to a wide range of language proficiency levels and cater to students who want to improve their financial literacy skills.

Table of Images 👆

- Blank Writing Worksheet Templates

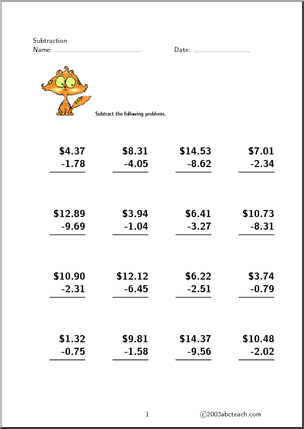

- Money Math Worksheets Subtraction

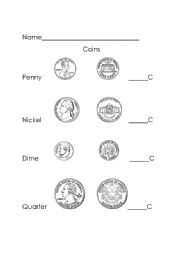

- Coin Value Worksheet

- Printable Money Worksheets

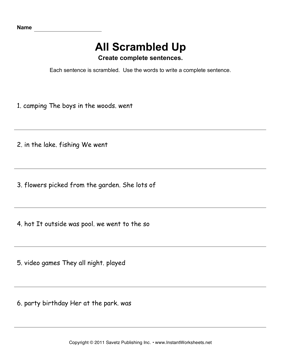

- Scrambled Sentences Worksheets

- Number Words Worksheet

- Valentines Day Writing Activity

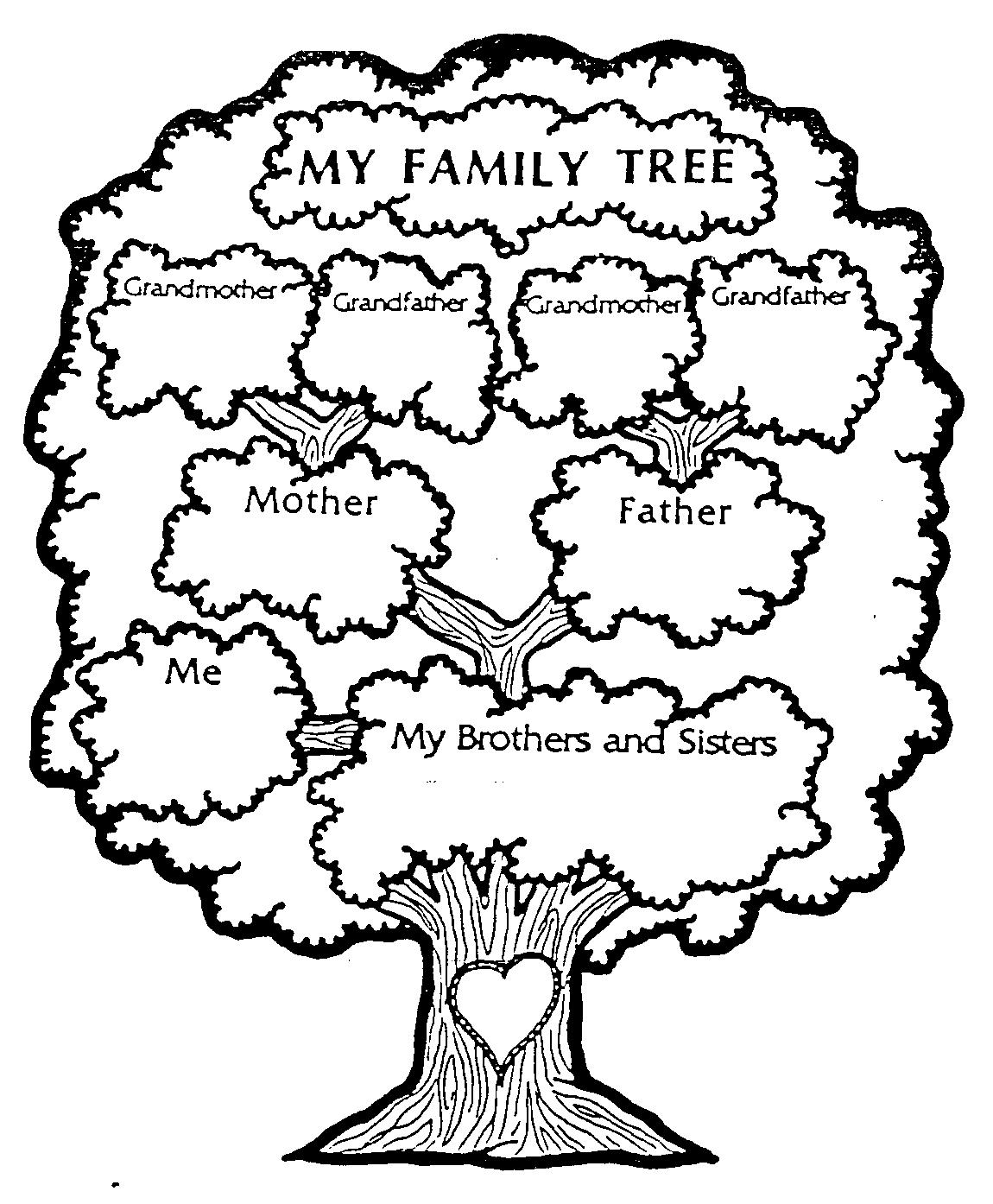

- Printable Kids Family Tree

- English language

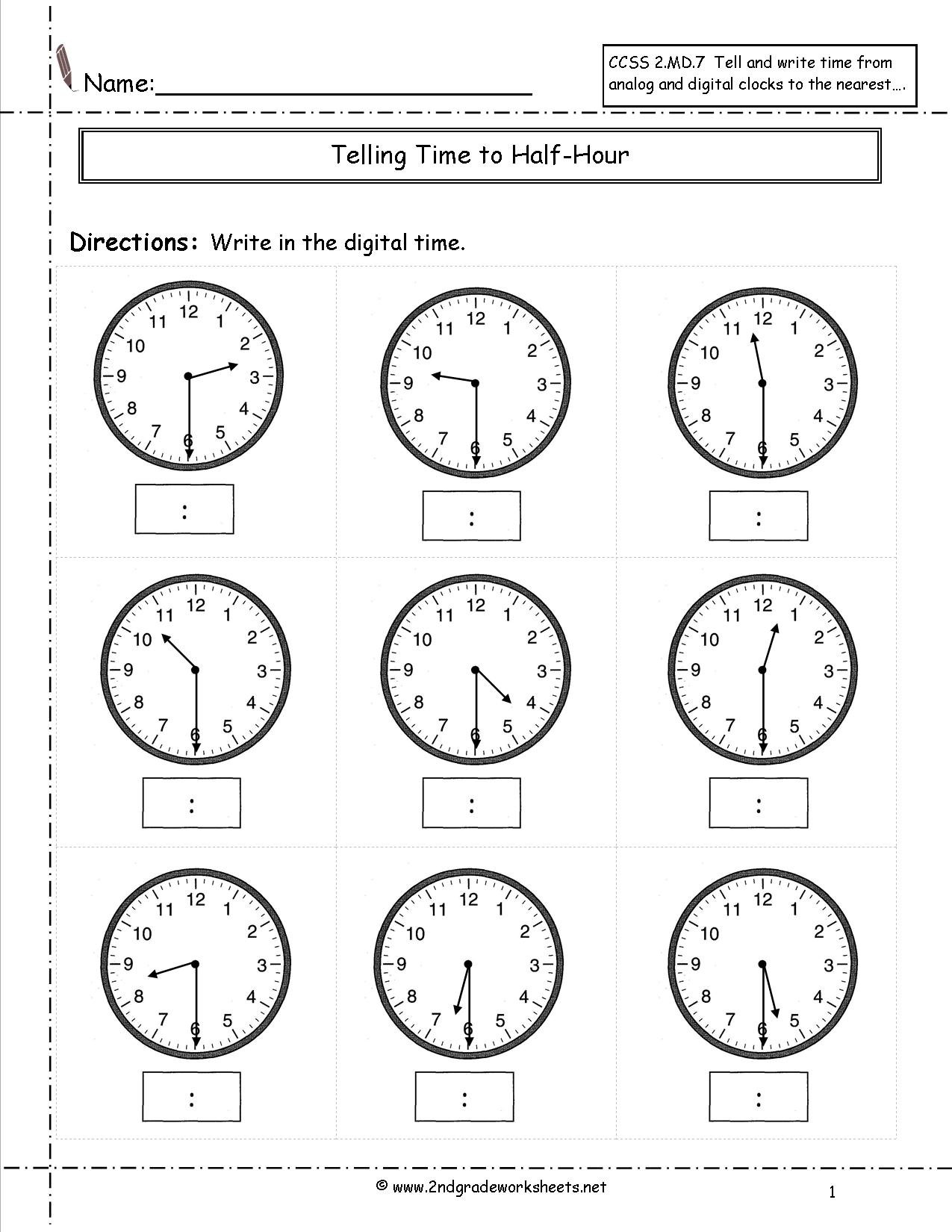

- Telling Time Worksheets Half Hour

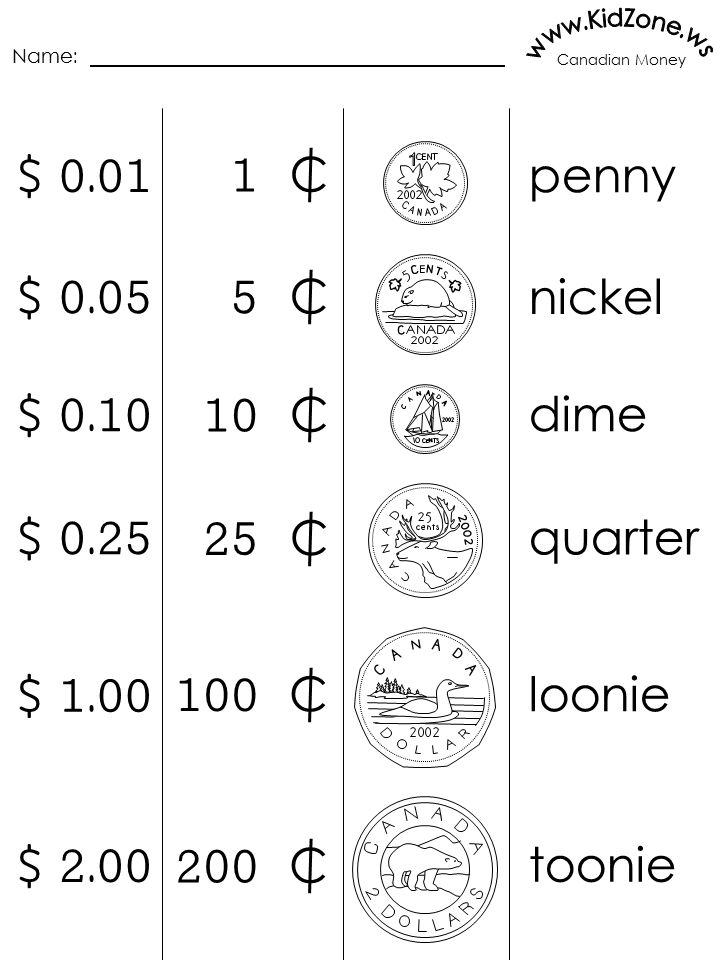

- Canadian Coin Templates for Teachers

- Number 20 Coloring Worksheets

- Number 20 Coloring Worksheets

- Number 20 Coloring Worksheets

- Number 20 Coloring Worksheets

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

What is the definition of money?

Money is a universal medium of exchange that is commonly accepted in transactions for goods and services, as well as for repayment of debts. It serves as a unit of account, a store of value, and a standard of deferred payment. Money can take various forms, including coins, banknotes, and digital currency, and plays a crucial role in enabling economic activities and facilitating trade.

Why do people need money?

People need money to meet their basic needs such as food, shelter, and clothing as well as to access goods and services that improve their quality of life. Money serves as a medium of exchange for goods and services, allowing individuals to trade what they have for what they need. Additionally, money provides individuals with financial security, enabling them to handle emergencies, invest in their future, and pursue opportunities for personal and professional growth.

What are the different forms of money?

The different forms of money include physical currency (coins and banknotes), digital money (electronic transfers and payments), checks, money orders, and cryptocurrencies like Bitcoin. Money can also exist in the form of assets such as stocks, bonds, and commodities. Additionally, there are various forms of money in different countries, including local currencies and foreign currencies used for international trade.

How do people earn money?

People earn money by offering their skills, knowledge, products, or services to others in exchange for a payment. This can be through traditional employment, freelance work, entrepreneurship, investments, or other means of generating income. The money earned can then be used to cover expenses, save for the future, or invest back into their business or assets to generate more wealth.

What are some ways to save money?

To save money, you can start by creating a budget to track your expenses and identify areas where you can cut back, such as dining out less, using public transportation instead of driving, shopping for deals, avoiding impulse purchases, and comparing prices before making big purchases. Additionally, consider setting up automatic transfers to a savings account each month, taking advantage of discounts and coupons, and finding free or low-cost entertainment options.

What are the advantages of having a budget?

Having a budget allows you to track and control your spending, prioritize your expenses, and save money for future goals. It helps you to stay organized, reduce financial stress, and make more informed decisions about your finances. Additionally, budgeting can help you identify areas where you can cut costs, avoid debt, and ultimately achieve greater financial stability and freedom.

What are the risks of borrowing money?

Borrowing money carries several risks, including the potential for accruing high interest rates, struggling with repayment obligations, damaging one's credit score if payments are missed, and facing legal action if the debt is not repaid. Additionally, borrowing could lead to a cycle of debt if it is not managed properly, causing financial stress and impacting one's overall financial well-being.

How can someone avoid overspending?

To avoid overspending, it is important to create a budget, track expenses, prioritize needs over wants, avoid impulse purchases, comparison shop before making a purchase, limit credit card usage, and set savings goals to help stay accountable and in control of finances.

What is the difference between needs and wants when it comes to money?

Needs refer to essential goods and services required for basic survival and well-being, such as food, shelter, and healthcare, while wants are non-essential items or services that enhance one's quality of life but are not strictly necessary for survival, like luxury items or entertainment. Managing money effectively involves prioritizing needs over wants to ensure financial stability and security.

How can people make their money grow through investments?

People can make their money grow through investments by diversifying their portfolio, carefully researching and selecting investments, monitoring and adjusting their portfolio regularly, and seeking professional advice if needed. It's important to understand one's risk tolerance and investment goals in order to make informed decisions that align with their financial objectives. Patience and a long-term perspective are key to successfully growing wealth through investments.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments