Mileage Expense Worksheets

If you are a business owner or self-employed individual looking for a simple and organized way to keep track of your mileage expenses, then mileage expense worksheets may be just what you need. These worksheets provide an entity where you can accurately record the distance traveled for business purposes, making it easier to calculate your deductible expenses at tax time.

Table of Images 👆

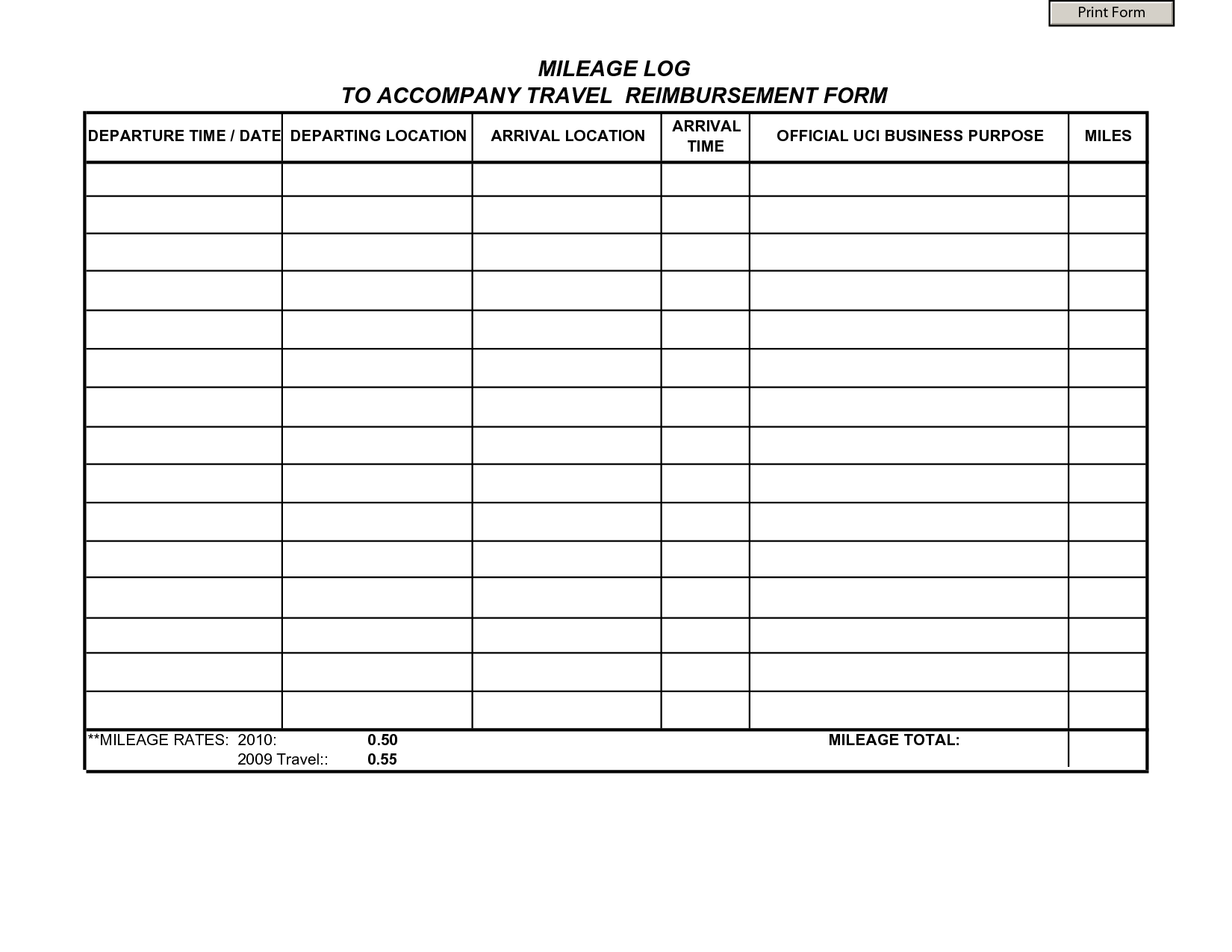

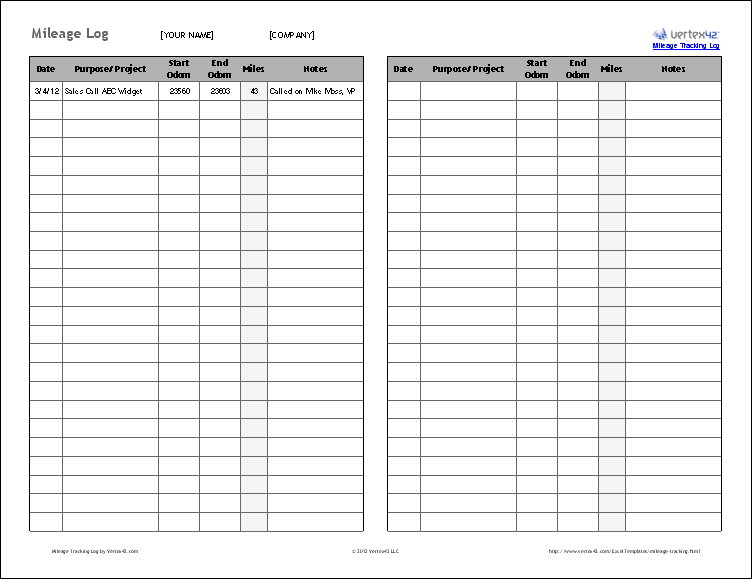

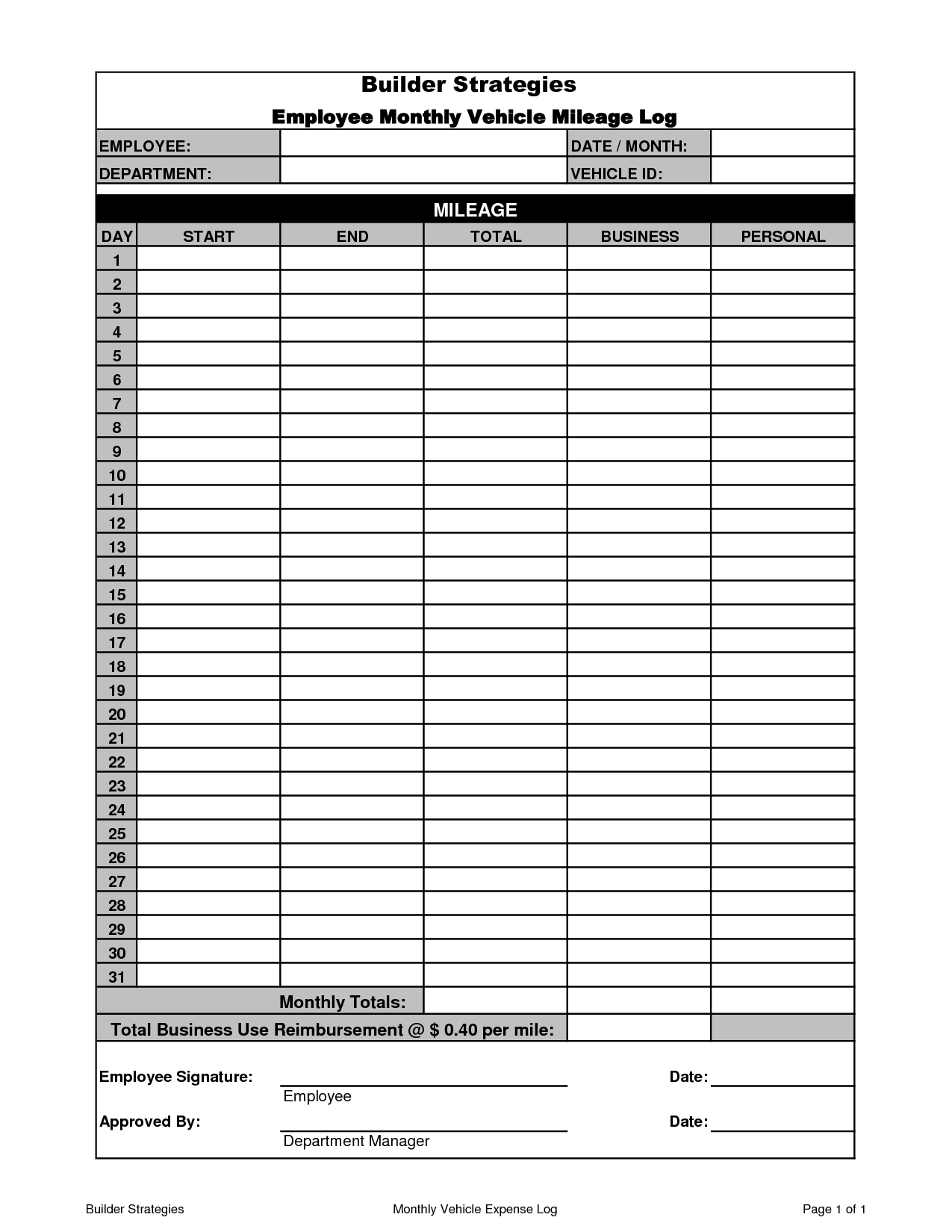

- Free Printable Mileage Log Form

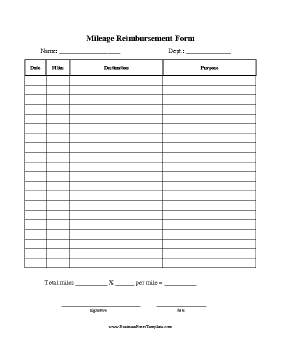

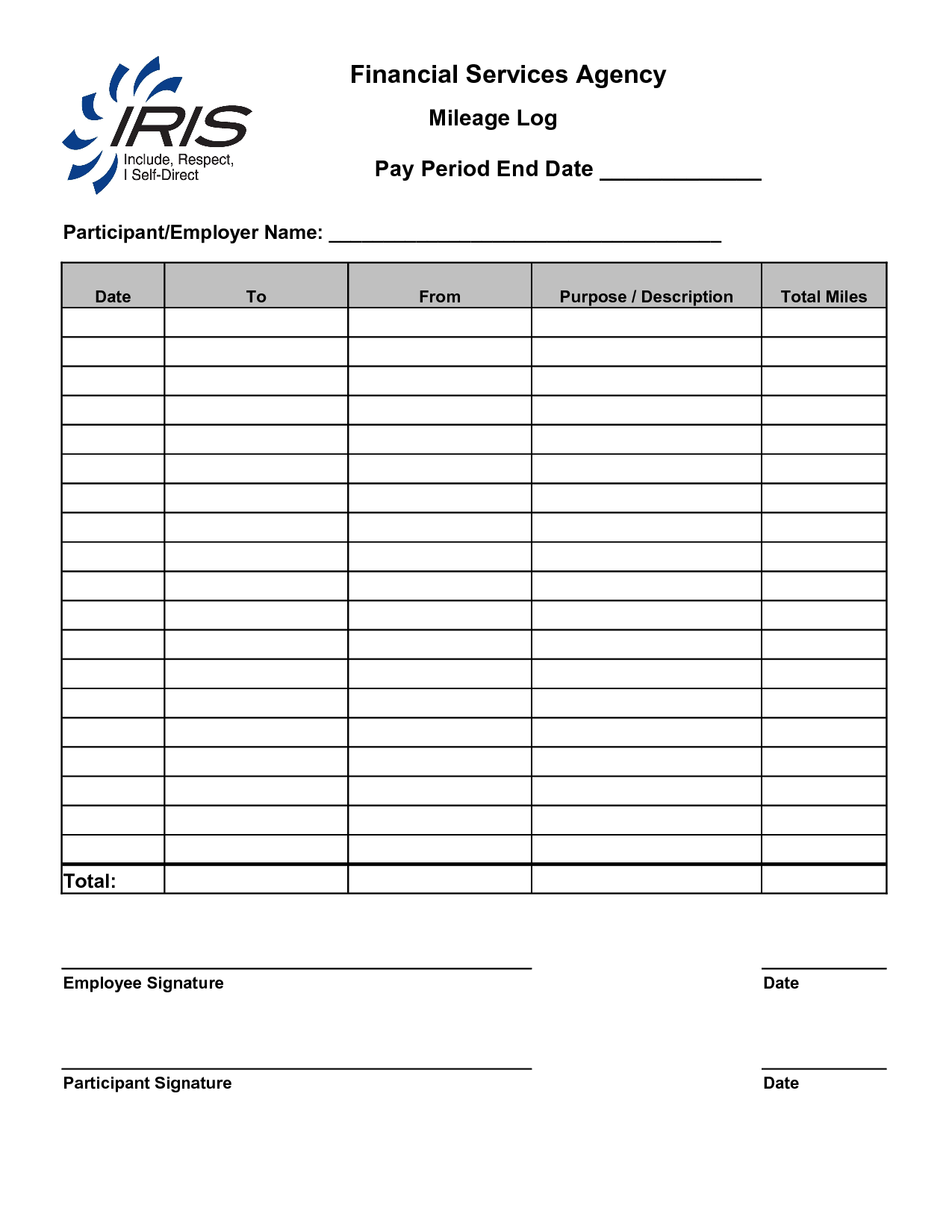

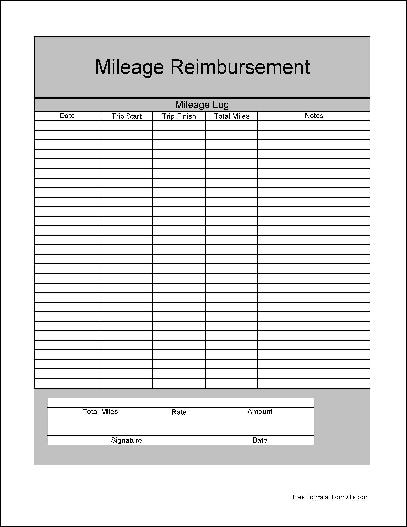

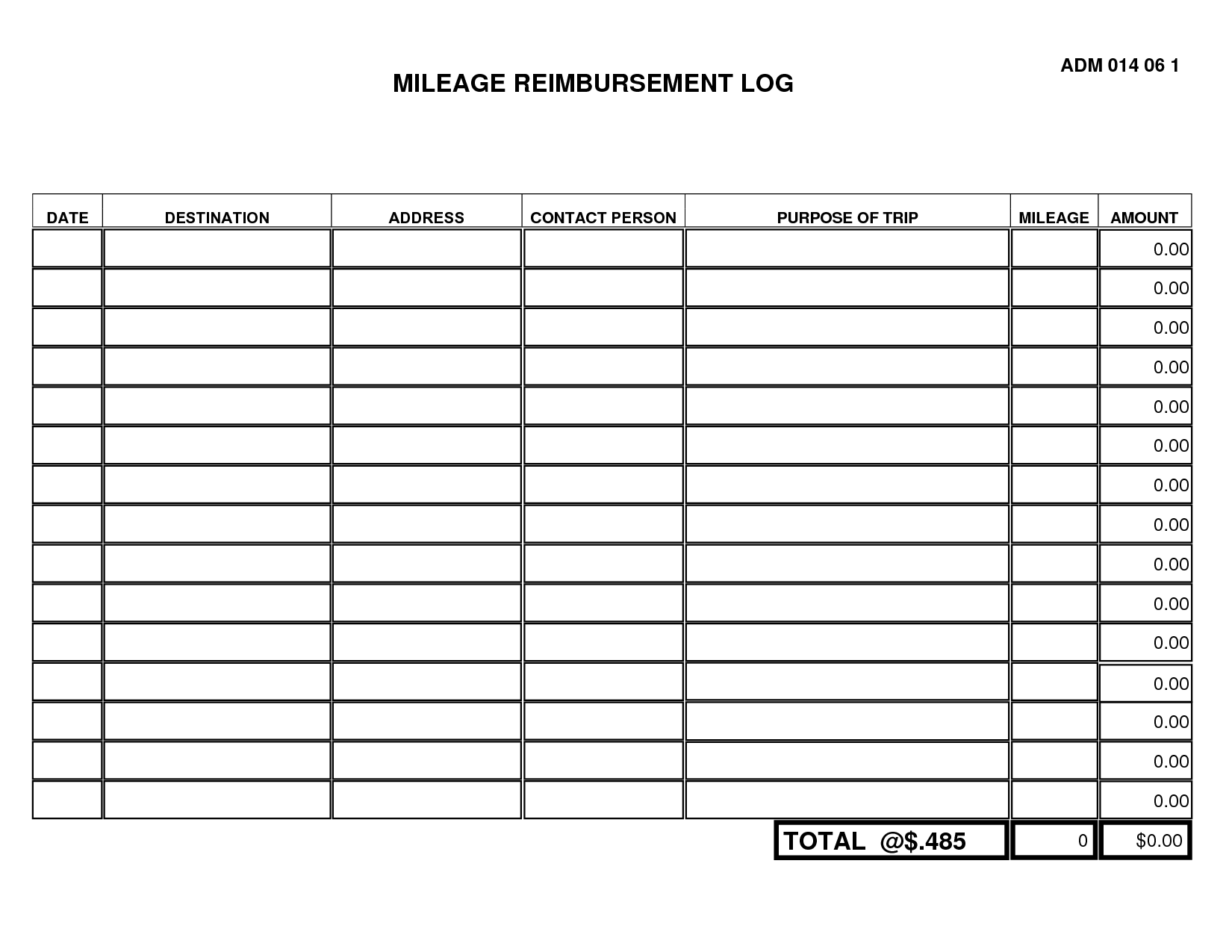

- Free Printable Mileage Reimbursement Form

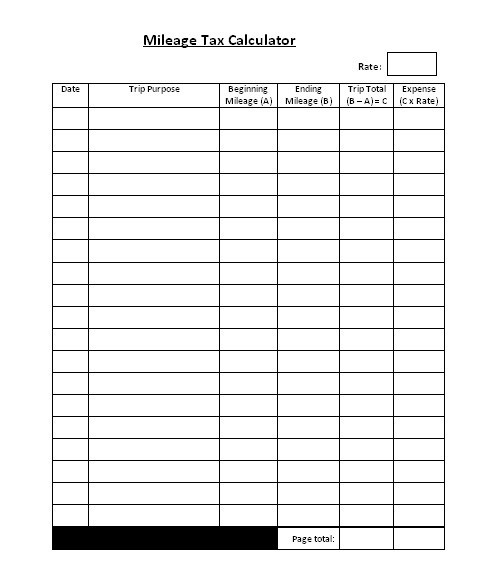

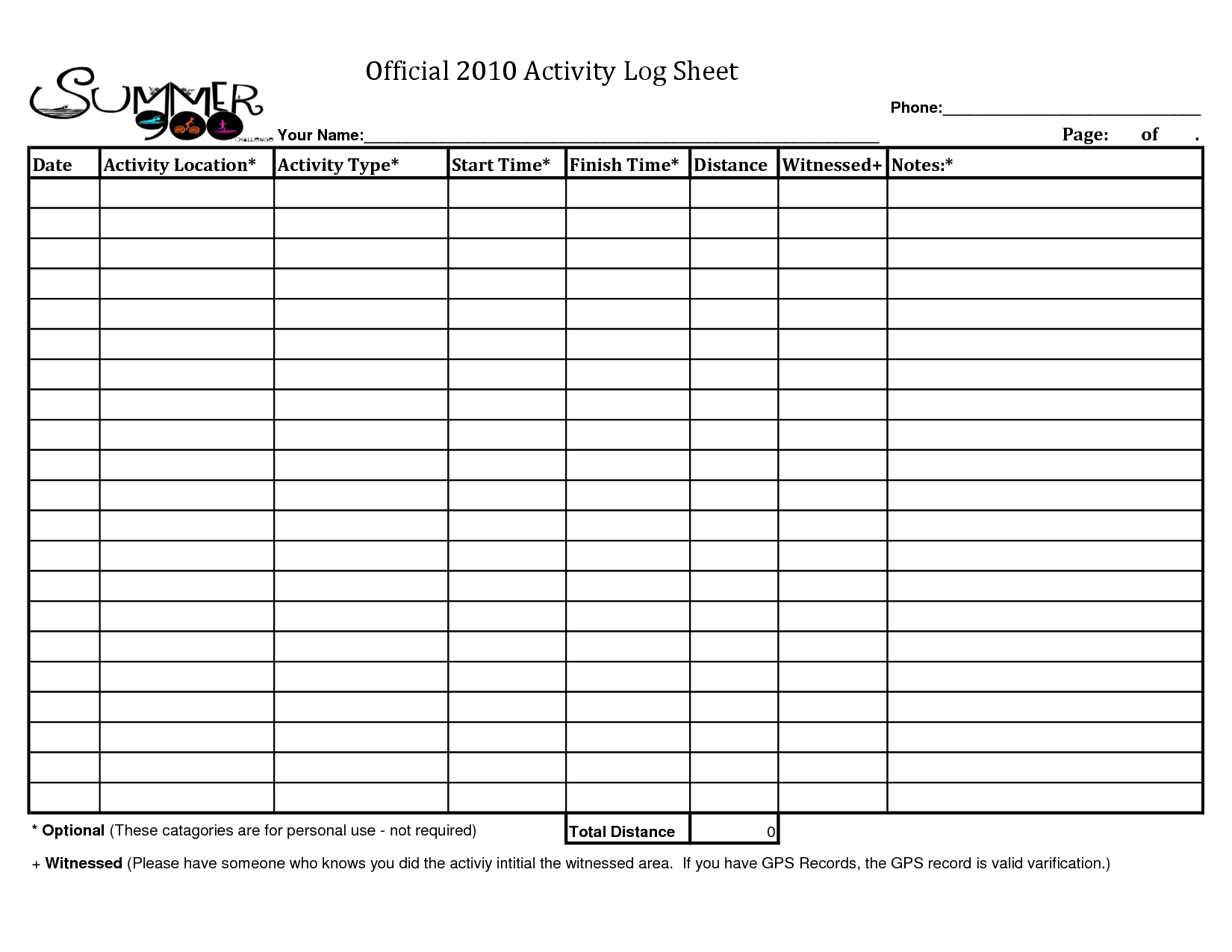

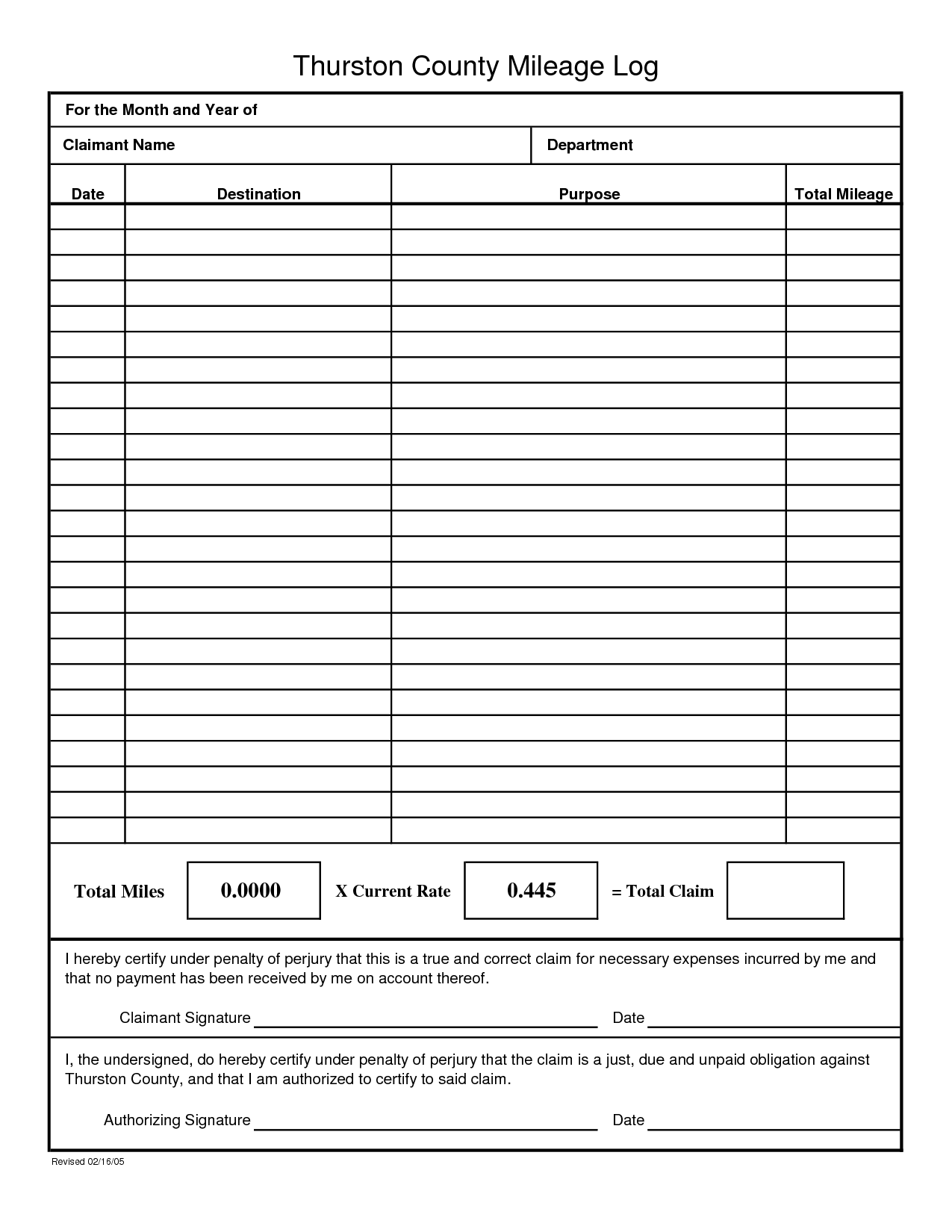

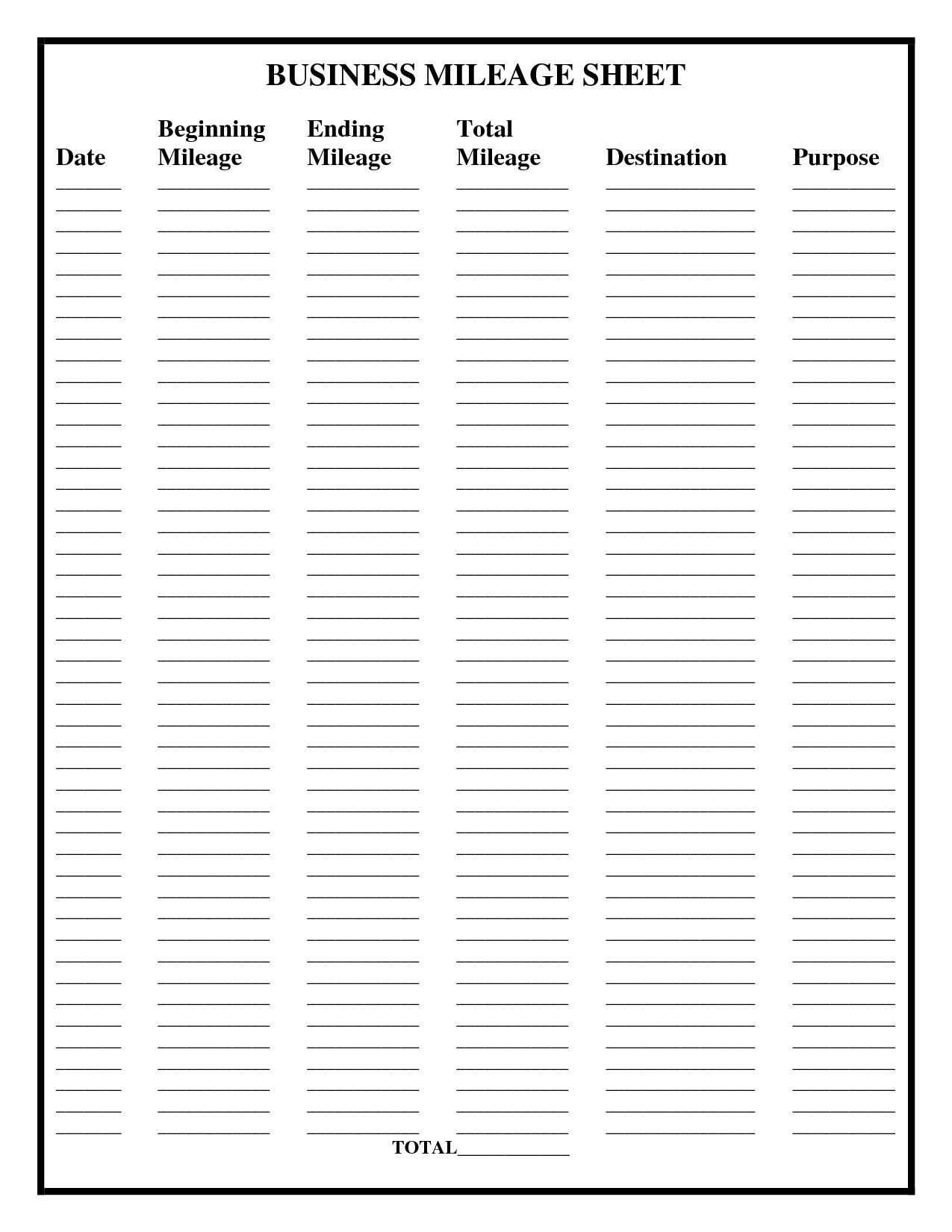

- Free Printable Mileage Log Sheet

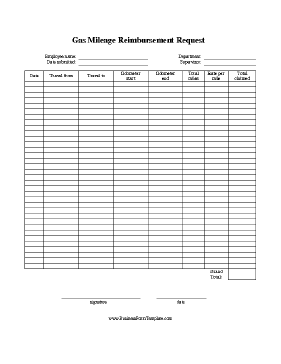

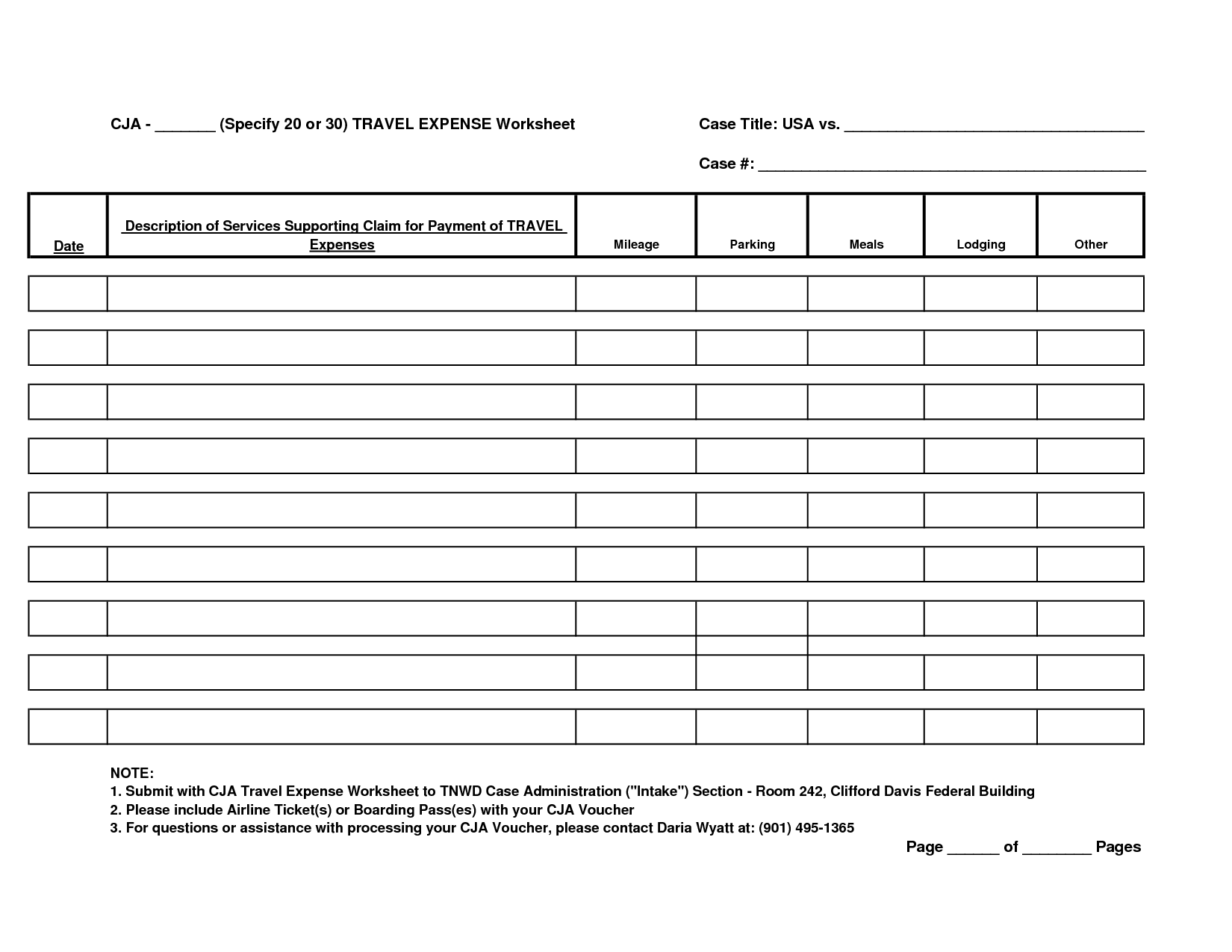

- Gas Mileage Reimbursement Form Template

- Mileage Log Sheet Template

- Mileage Tracking Sheet Template

- Mileage Log Sheet Template

- Gas Mileage Log Sheet Printable

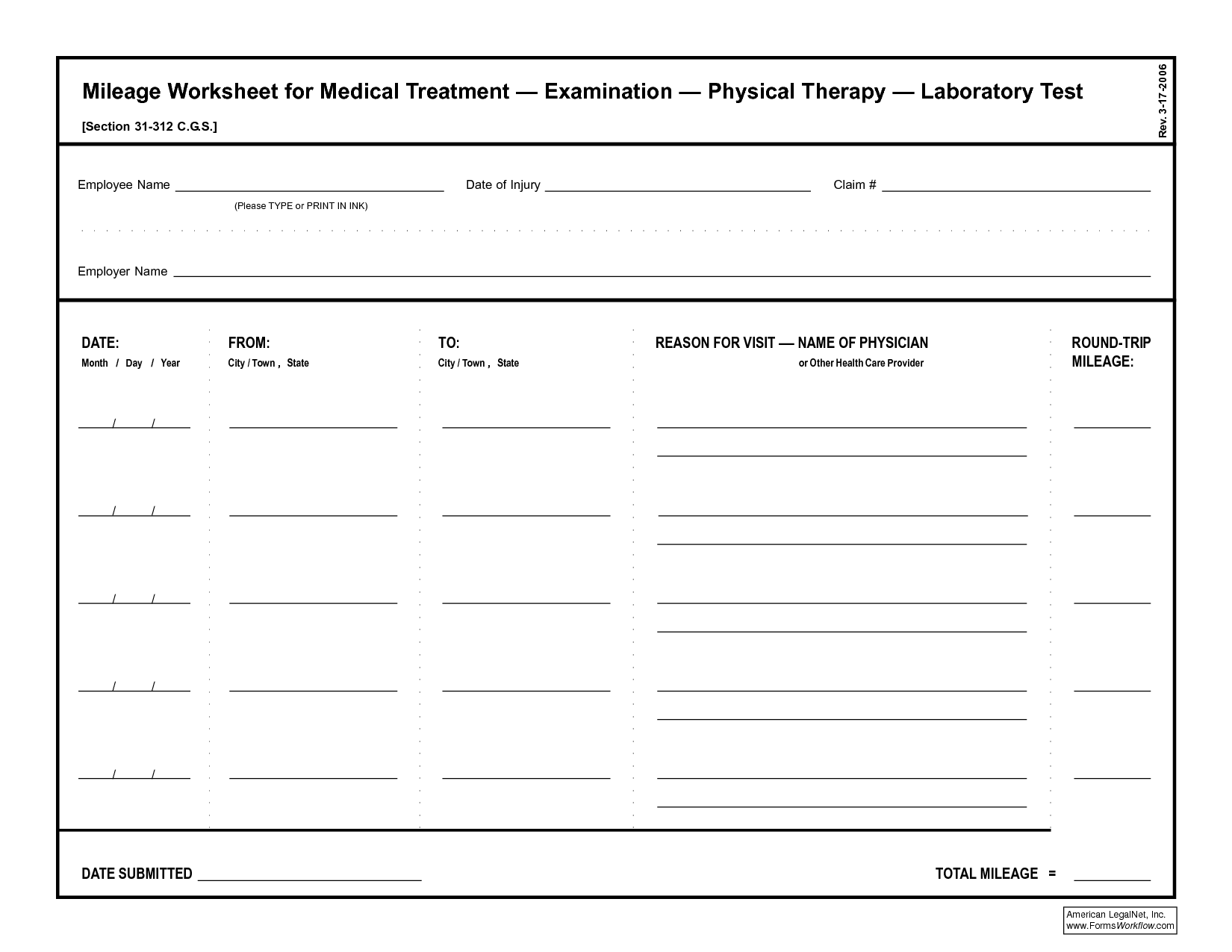

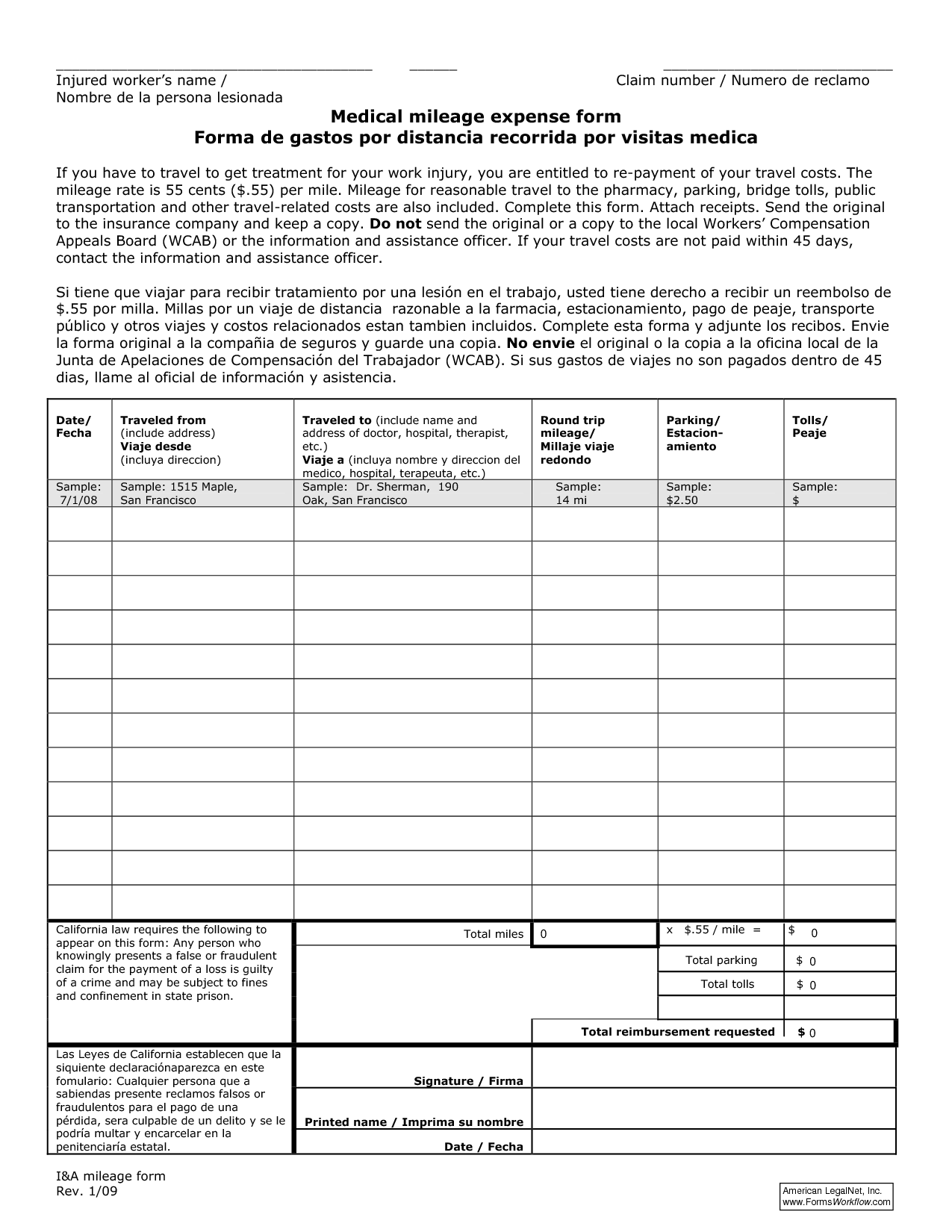

- Medical Mileage Reimbursement Form

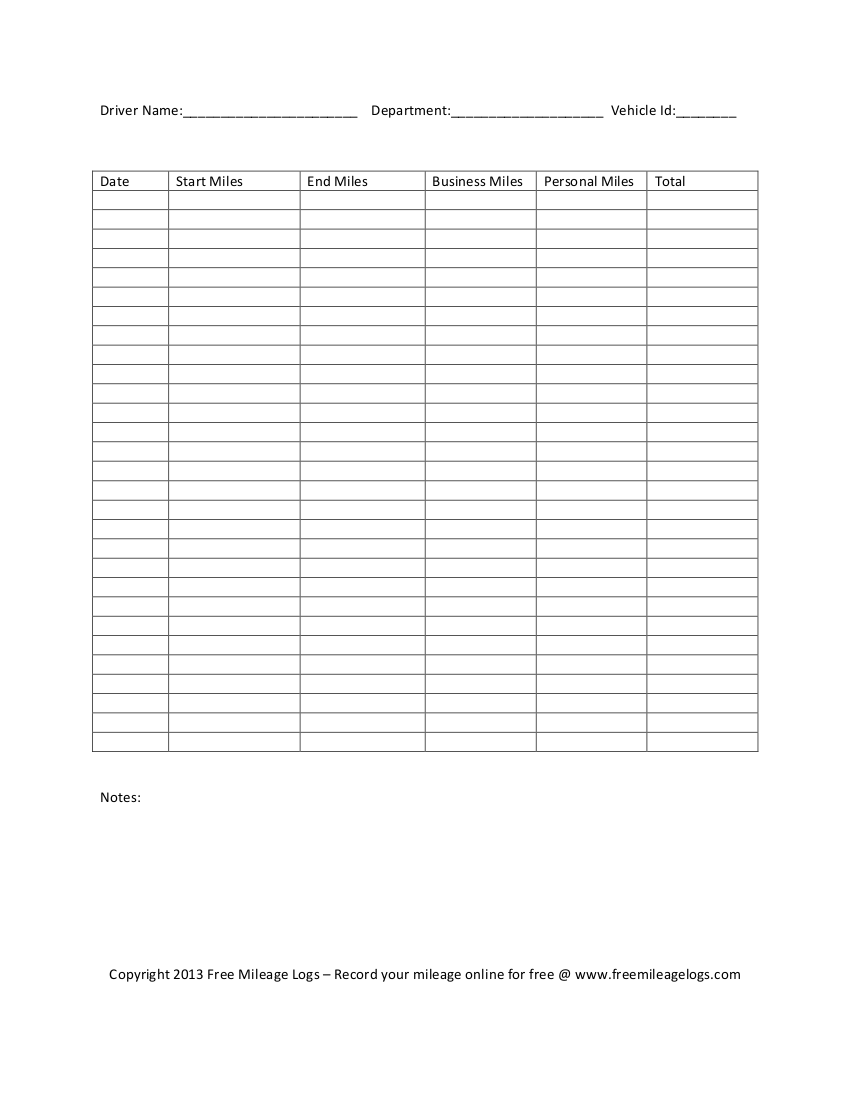

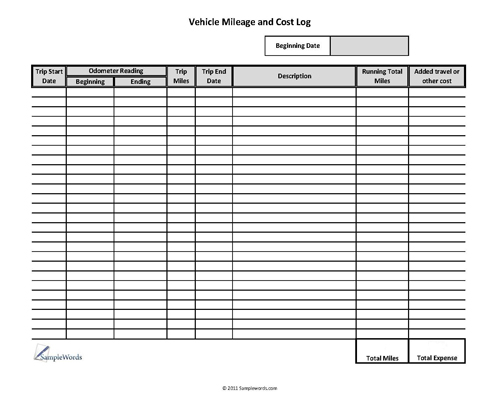

- Vehicle Mileage Log Template

- Simple Mileage Reimbursement Form

- Monthly Mileage Log Sheet

- Travel Expense Worksheet

- Mileage Log Form Template

- Business Destination Sheet

- Medical Mileage Expense Form

- Printable Mileage Log Sheet

- Vehicle Mileage Log Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a Mileage Expense Worksheet?

A Mileage Expense Worksheet is a document used for tracking and calculating business-related travel expenses based on miles driven. It typically includes details such as the date of travel, starting and ending locations, purpose of the trip, and total miles traveled. This information is then used to calculate the total mileage reimbursement owed to the individual for their business-related travel.

What information is typically included on a Mileage Expense Worksheet?

A Mileage Expense Worksheet typically includes details such as the date of travel, starting and ending locations, purpose of the trip, total miles traveled, and the mileage rate used to calculate expenses. Additionally, it may also include other relevant information such as any tolls or parking fees incurred during the trip.

Why is a Mileage Expense Worksheet important for tracking business-related mileage?

A Mileage Expense Worksheet is important for tracking business-related mileage because it helps businesses accurately record and calculate the mileage driven for work purposes, which is crucial for tax deductions or reimbursement purposes. It allows for proper documentation of the distance traveled, giving businesses a clear overview of their transportation costs and ensuring compliance with regulations. Additionally, maintaining organized records on a worksheet can also help in monitoring expenses and budgeting effectively.

How is the mileage rate determined for calculating mileage expenses?

The mileage rate for calculating mileage expenses is typically determined by organizations or governments based on factors such as the cost of gas, vehicle maintenance, insurance, and depreciation. This rate is usually set by looking at average costs associated with owning and operating a vehicle, and may be adjusted periodically to reflect changes in these expenses.

What other expenses related to vehicle use can be included in a Mileage Expense Worksheet?

In addition to mileage, other expenses related to vehicle use that can be included in a Mileage Expense Worksheet are tolls, parking fees, maintenance and repairs, insurance premiums, registration fees, and vehicle depreciation. These expenses can help provide a more comprehensive view of the total cost of using a vehicle for business or personal purposes.

Are Mileage Expense Worksheets required for tax purposes?

Mileage Expense Worksheets are not required for tax purposes by the IRS. However, keeping a detailed record of your mileage is important if you plan to deduct mileage expenses on your tax return. It is recommended to maintain a mileage log that includes the date, starting and ending locations, purpose of the trip, and total miles driven. This documentation can help support your mileage deduction in case of an audit.

Can personal as well as business-related mileage be included on a Mileage Expense Worksheet?

Yes, personal as well as business-related mileage can be included on a Mileage Expense Worksheet. It is important to separate and clearly identify the personal and business mileage to ensure accurate record-keeping and reimbursement. Personal mileage is typically not reimbursed by the employer, whereas business mileage is usually eligible for reimbursement or tax deduction.

How often should a Mileage Expense Worksheet be updated or completed?

A Mileage Expense Worksheet should ideally be updated or completed on a regular basis, such as weekly or biweekly, to ensure accurate and up-to-date recording of mileage expenses. This frequency helps in maintaining organized records and financial tracking of business-related mileage, making it easier to claim reimbursements or tax deductions.

Are there any specific formats or templates for creating a Mileage Expense Worksheet?

Yes, there are various templates available online for creating a Mileage Expense Worksheet. These templates typically include sections for recording details such as date, purpose of the trip, starting and ending locations, total miles driven, reimbursement rate, and the total amount to be reimbursed. You can easily find these templates by searching online or using spreadsheet software like Microsoft Excel which also provides pre-designed templates for such purposes. Customize the template to fit your specific needs and preferences for effectively tracking and managing your mileage expenses.

How can a Mileage Expense Worksheet help with budgeting and cost analysis for a business?

A Mileage Expense Worksheet can help with budgeting and cost analysis for a business by allowing for the tracking and calculation of transportation expenses. By recording mileage for business trips, fuel costs, maintenance expenses, and vehicle depreciation, businesses can accurately calculate the true cost of travel for budgeting purposes. This data can help in identifying areas for cost-saving measures, optimizing travel routes, and accurately forecasting transportation expenses, thereby contributing to better financial planning and management for the business.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments