Itemized Tax Deduction Worksheet

If you are an individual who wants to keep track of your tax deductions in a structured and organized manner, an itemized tax deduction worksheet is an essential tool to consider. This worksheet provides a clear and concise format for listing your qualified expenses and calculating your total deductions. By utilizing an itemized tax deduction worksheet, you can ensure that you are maximizing your tax savings while maintaining accurate records of your expenses. So, using this worksheet helps you to understand what itemized deduction is and various important things related to it, including how to claim an itemized tax deduction. You will also understand various important terms such as expenses, income tax, IRS regulations, and tax returns.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

Use our Itemized Tax Deduction Worksheet to calculate your annual income tax correctly!

What is Itemized Tax Deduction?

For those of you who regularly pay annual taxes, you have two options; standard tax deductions or itemized tax deductions. The standard tax deduction is a predetermined amount of tax on the amount of your income. The amount varies, depending on your tax status.

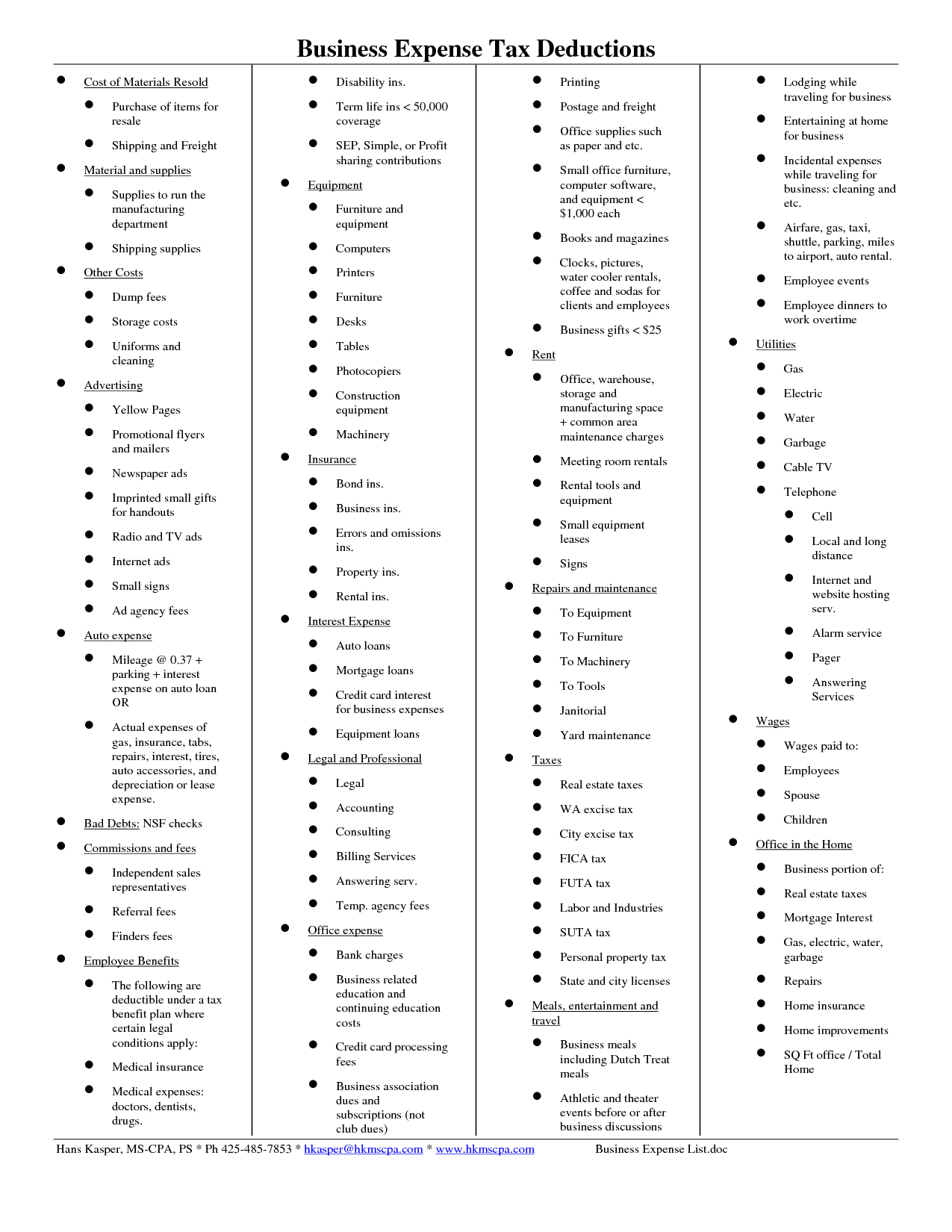

Meanwhile, itemized tax deductions are certain types of costs that must be paid to reduce taxable income. These types of expenses include mortgage interest, state income taxes, medical expenses, charitable donations, and property taxes.

This itemized tax deduction is an expense that is officially permitted by the IRS. This itemized deduction also saves you more on expenses because you can choose certain costs, instead of reducing your income using standard fixed-dollar deductions.

What are the Types of Itemized Tax Deductions?

There are several types of itemized tax deductions that can be used to calculate your annual tax. When choosing to use itemized tax deductions, you need to understand these items to determine profit or loss in selecting these items for your annual tax payment. So, let's discuss those items one by one here!

- Medical Expenses: The IRS gives taxpayers permission to deduct their income from medical expenses in a year. However, there are several conditions that must be met, such as medical costs that are independent costs. It means you can’t use medical expenses to reduce your taxes if you use health insurance.

- Property Tax: You can also reduce your annual taxes using property taxes.

- Mortgage Interest: Another item that can be used to reduce your annual taxes is mortgage interest. The standard rule for the use of mortgage interest in itemized tax deductions is the expense limitation. For a first mortgage, the maximum deduction is $750,000. For those of you who are married, the mortgage interest limit is $375,000.

- Charitable Donations: Your charitable donations can also be considered an expense that can reduce your annual taxes. However, the amount of the deduction depends on the type of charitable donation you make. Usually, the cost range is between 20%-60% of your gross income.

How to Claim Itemized Tax Deduction?

To claim an itemized tax deduction, there are several steps you can take.

- First, understand your current tax. The way to do this is to collect relevant information regarding the items you will choose.

- Compare the amount you can afford using the standard tax deduction.

- If the standard deduction amount meets the requirements, you can choose to use itemized deduction using the item information that you have collected.

- Write these items on the tax form.

- Calculate your tax amount by reducing gross income with itemized deductions. The result is the total annual tax you must pay.

When deciding on an itemized deduction, you must calculate the standard tax deduction amount first. Then, make sure the itemized tax deduction is greater than the standard tax deduction amount. If the standard tax deduction is greater, you will pay high tax fees.

What are the Advantages and Disadvantages of Itemized Deduction?

Before you decide to use itemized deduction, make sure you understand the advantages and disadvantages of itemized deduction.

Advantages

- Itemized deductions have a greater total cost than standard tax deductions. The more total costs, the less tax you have to pay. For this reason, many people choose itemized tax deductions.

- Several situations and conditions also help you to save money using itemized deductions. Examples are mortgage interest and property taxes. So, you can use the special situation you have to save on your annual tax expenses.

Disadvantages

- To use itemized deduction, you must understand the rules. This is because several types of itemized deduction have some problems. An example is medical expenses which can only reduce your gross income by 7.5%.

- You need more time for your tax return. This is because you need extra time to prepare a 1040 form and Schedule A which are needed to calculate itemized tax deductions.

- You also need evidence that can prove your tax deduction. So, you need to record and organize all evidence within one year.

What is an Itemized Tax Deduction Worksheet?

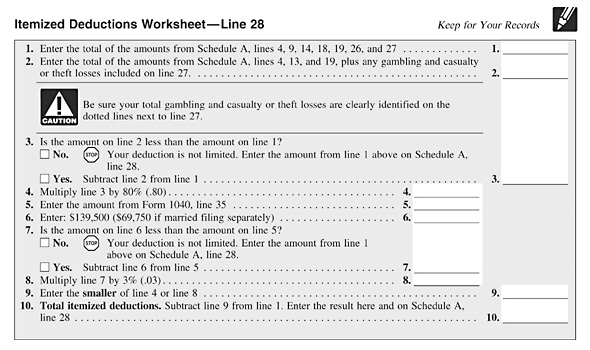

Itemized Tax Worksheet is a worksheet that helps you to record itemized deductions. Usually, the forms used for itemized tax deduction are the 1040 form and Schedule A. So, this worksheet provides these two types of forms for you. With these two forms, you can record cost items in detail and systematically so that it is easier for you to calculate your itemized tax deduction.

You don't need to worry, the worksheets that we provide are very easy to use! You can download and print it for free on our blog. Then, use the worksheet as your preferences. However, make sure the items you write on the worksheet match the items you have.

Remember! Your itemized tax deduction will be accepted if you use qualified deductions. So, make sure the expenses are deductible. You also have to make sure that your calculations comply with IRS regulations to avoid problems.

In using this worksheet, you must also calculate standard tax deductions to compare costs between standard and dedicated itemized taxes. This is a must! If the standard tax calculation is smaller than the dedicated itemized tax, you can use the dedicated itemized tax as your annual income tax.

Itemized Tax Deduction Worksheet is a worksheet that you need to consider because it can help you understand IRS regulations and several important things related to itemized deduction. This worksheet can be used by business owners or investors. This is a useful worksheet to help you keep your tax documentation in a structured and systematic way.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments