Household Budget Worksheet Excel

Are you seeking a simple and efficient way to track your household expenses? Look no further than the Household Budget Worksheet in Excel. This handy tool allows you to easily organize and monitor your income and expenses in one convenient place. Whether you're a meticulous budgeter or someone just starting to take control of your finances, this worksheet is an essential resource to help you keep tabs on your financial well-being.

Table of Images 👆

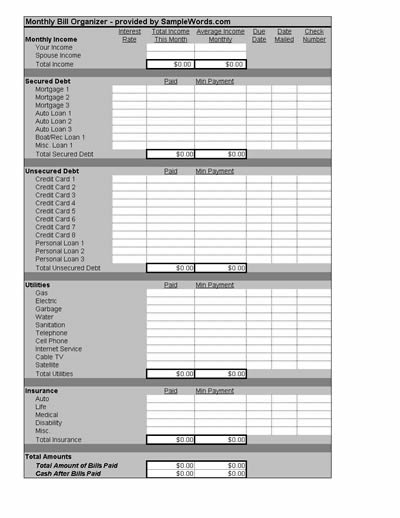

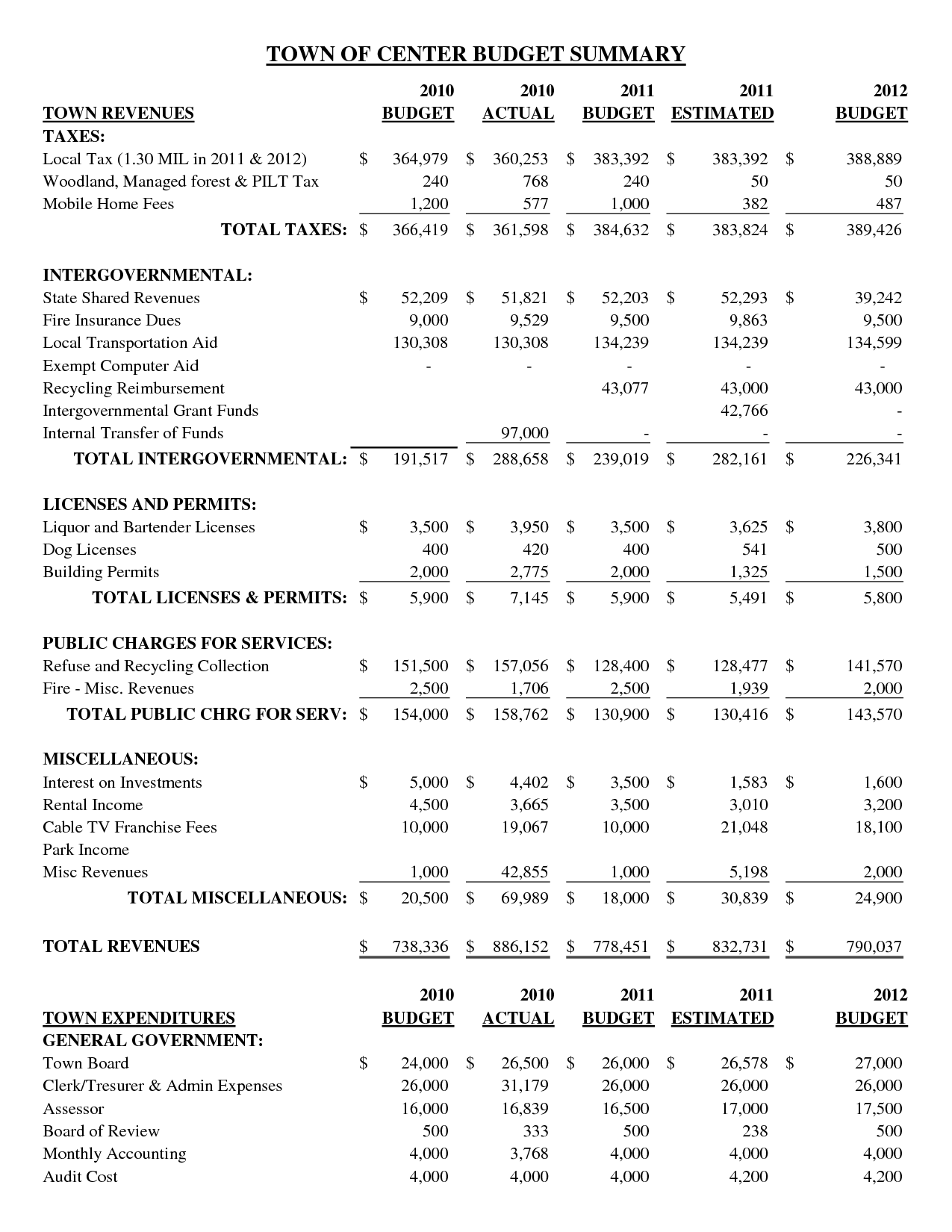

- Monthly Bill Organizer Template

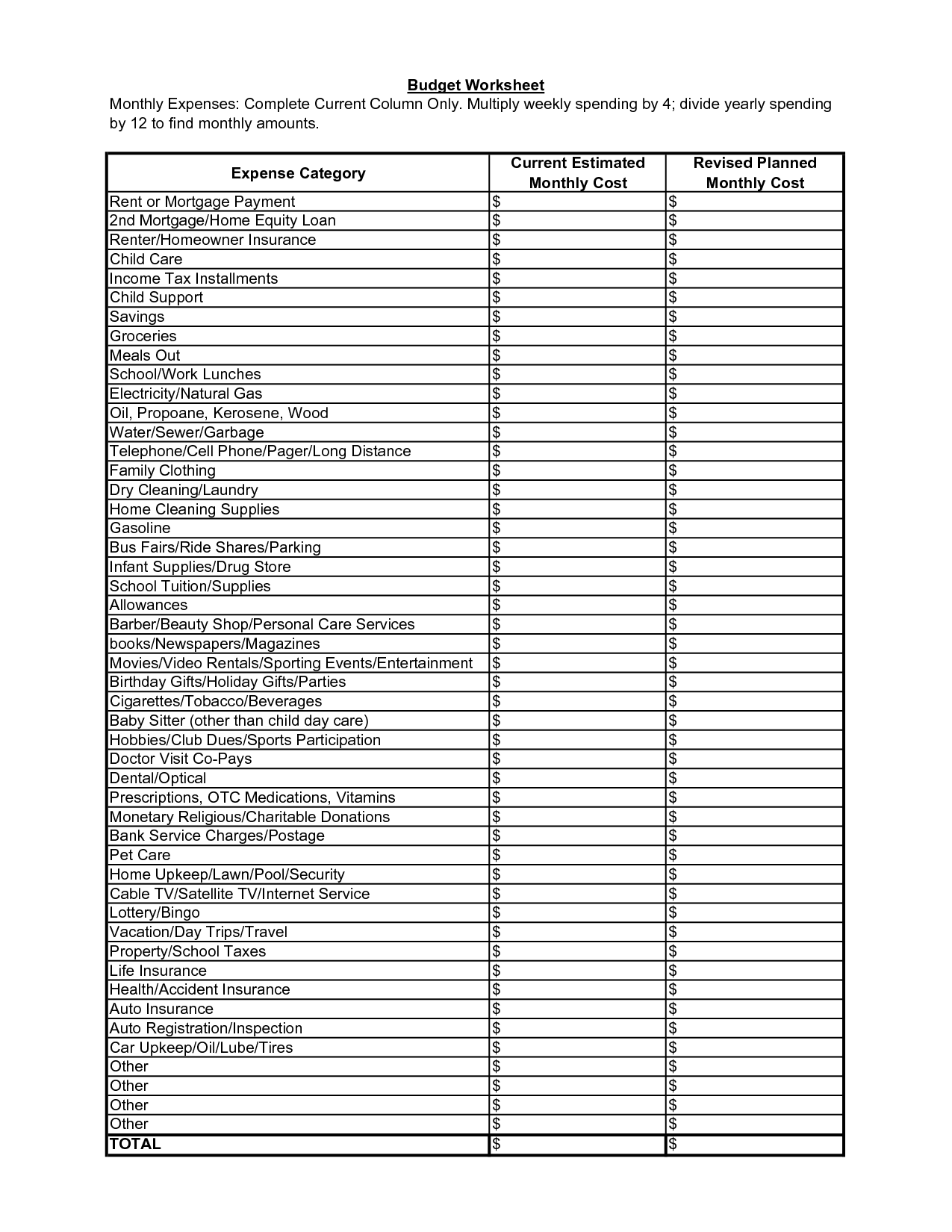

- Income Expense Monthly Budget Worksheet

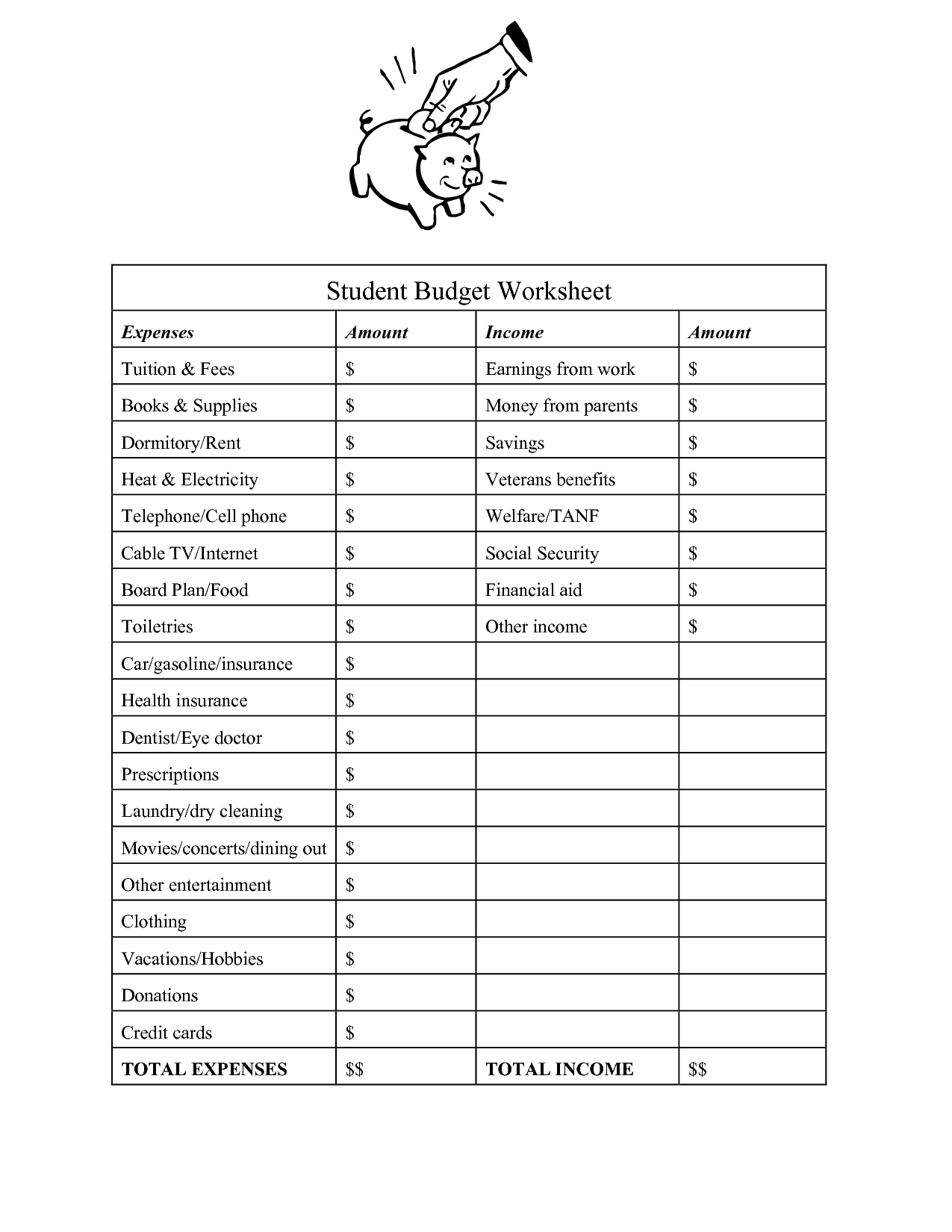

- College Student Budget Worksheet

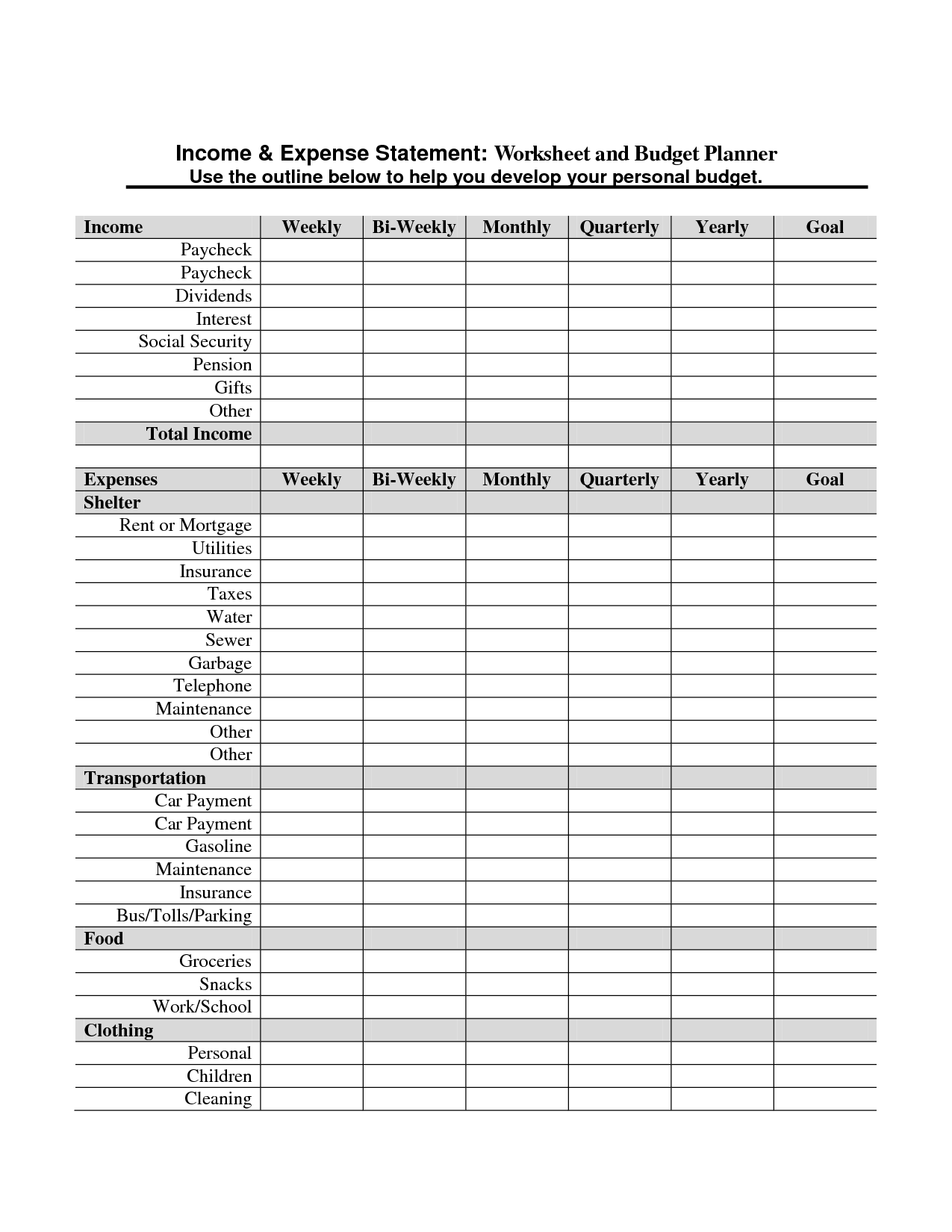

- Income and Expense Statement Template

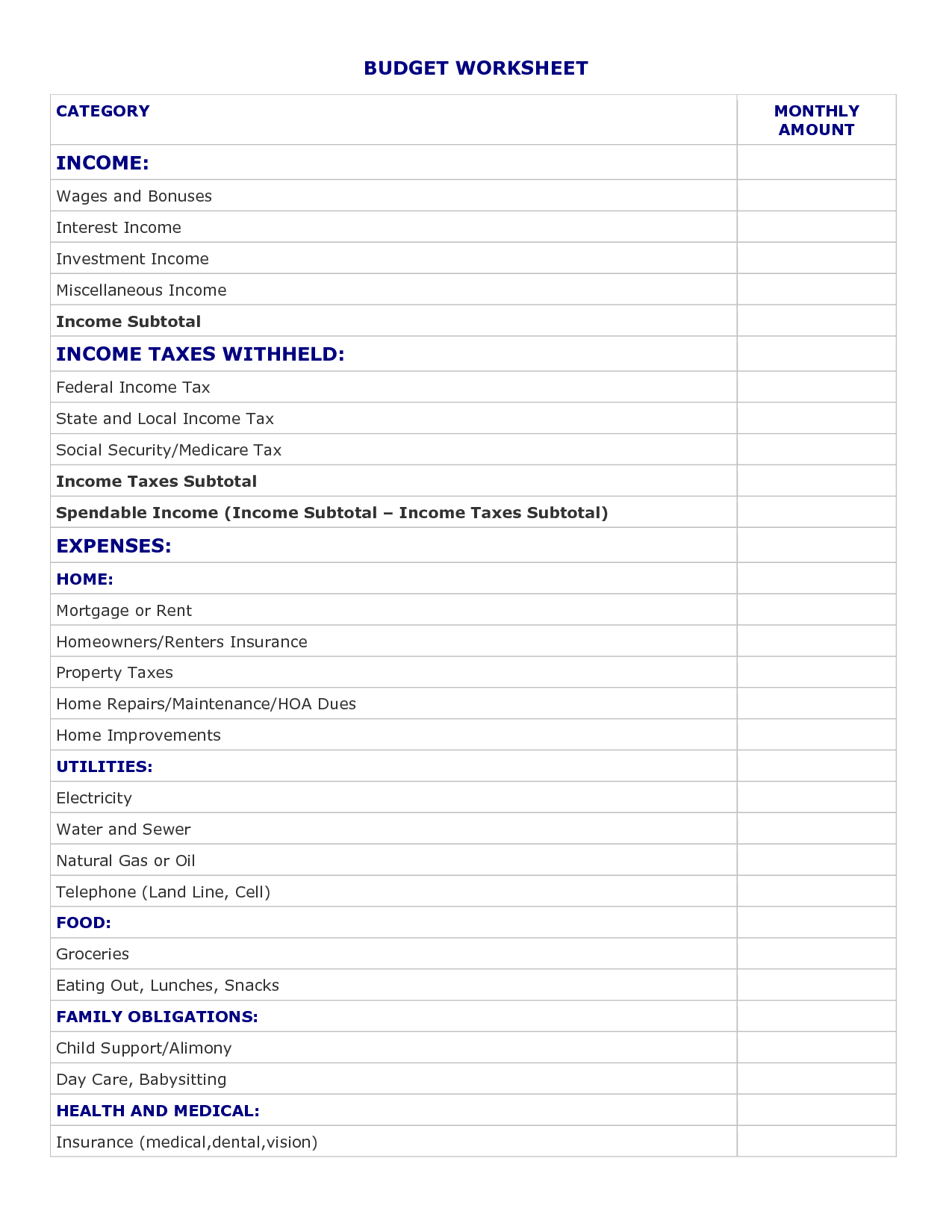

- Budget Worksheet

- Blank Monthly Budget Worksheet

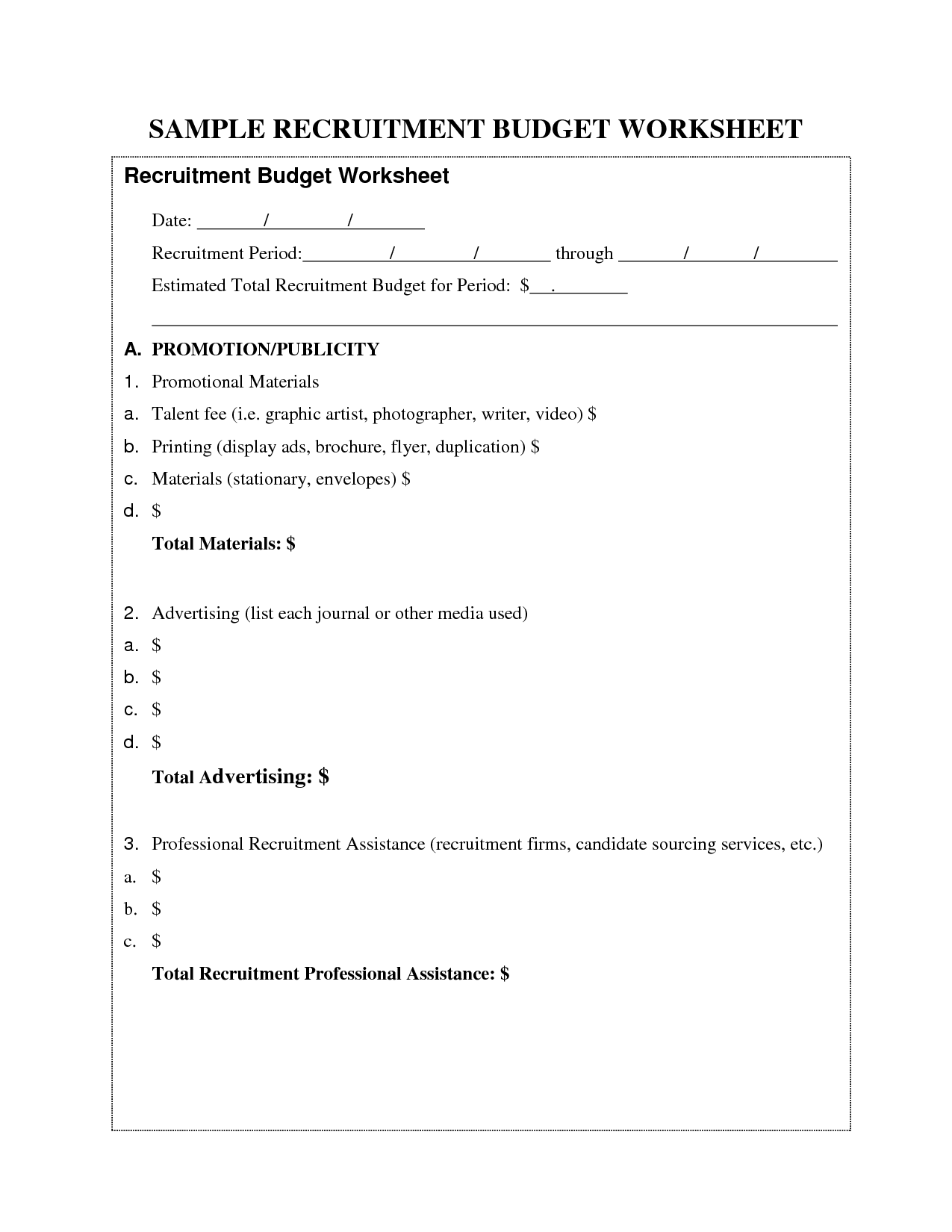

- Sample Recruitment Budget Template

- Blank Spreadsheet Printable

- Printable Budget Worksheet Dave Ramsey Debt

- Free Printable Budget Worksheets

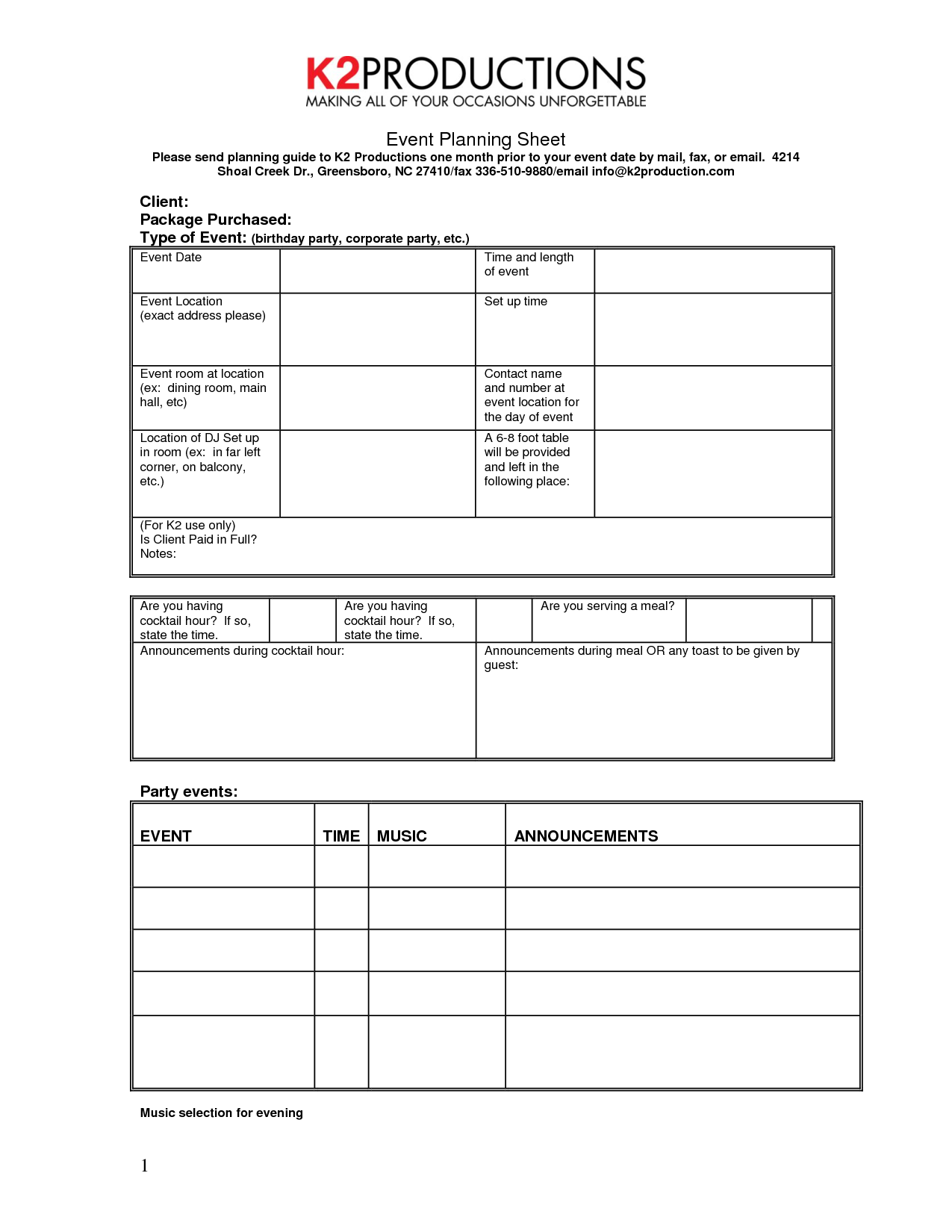

- Event Planning Sheet Template

- Daily Budget Worksheet Printable

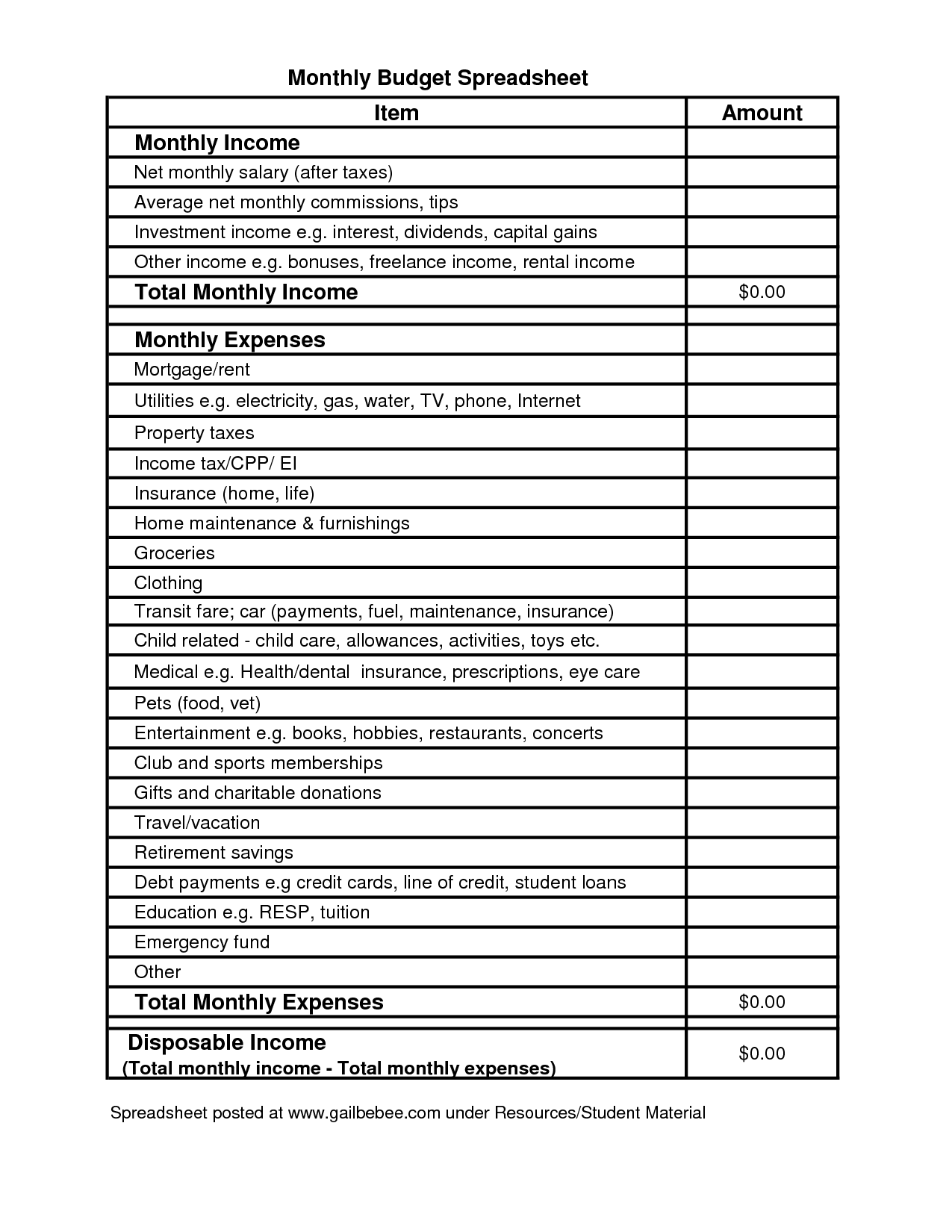

- Sample Monthly Budget Spreadsheet

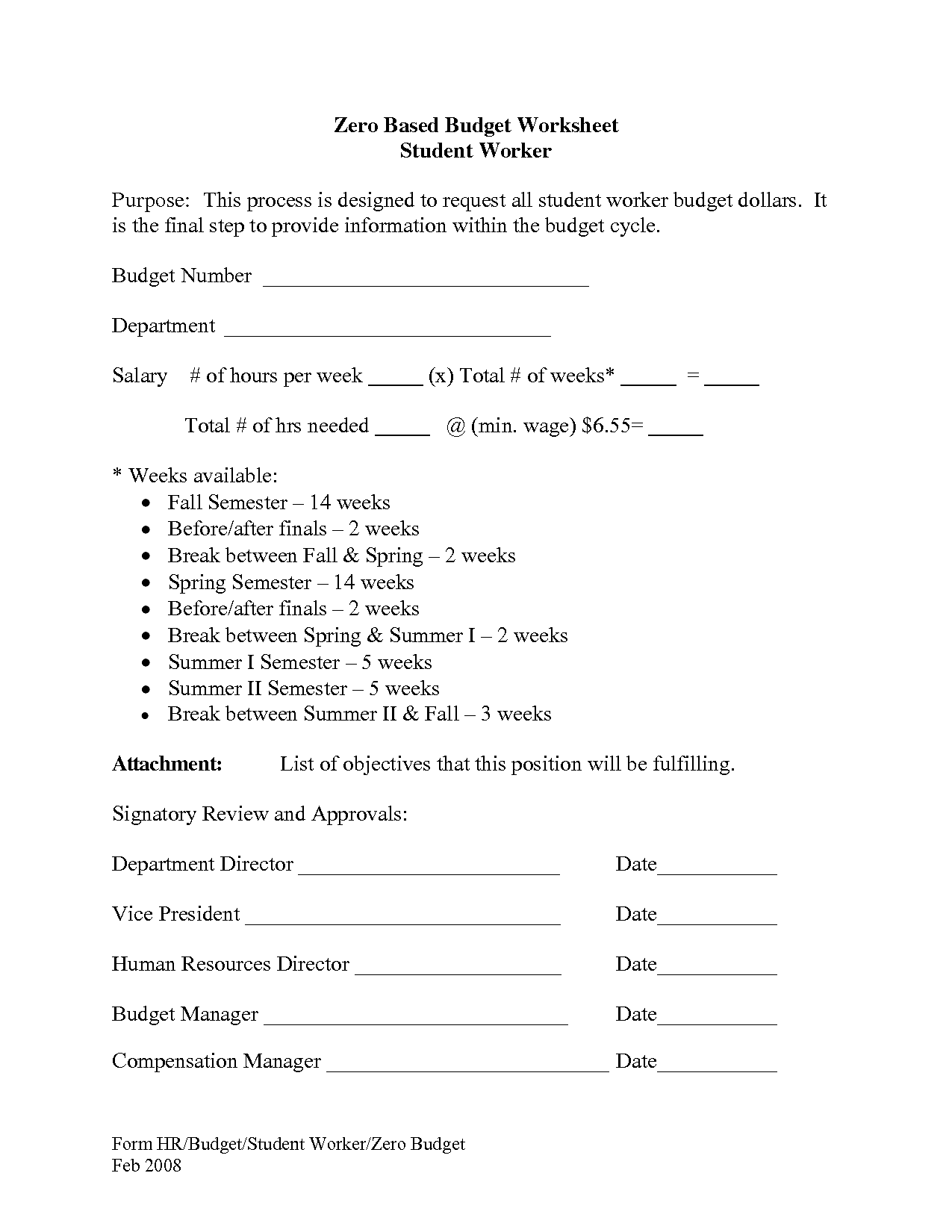

- Dave Ramsey Zero-Based Budget Worksheet

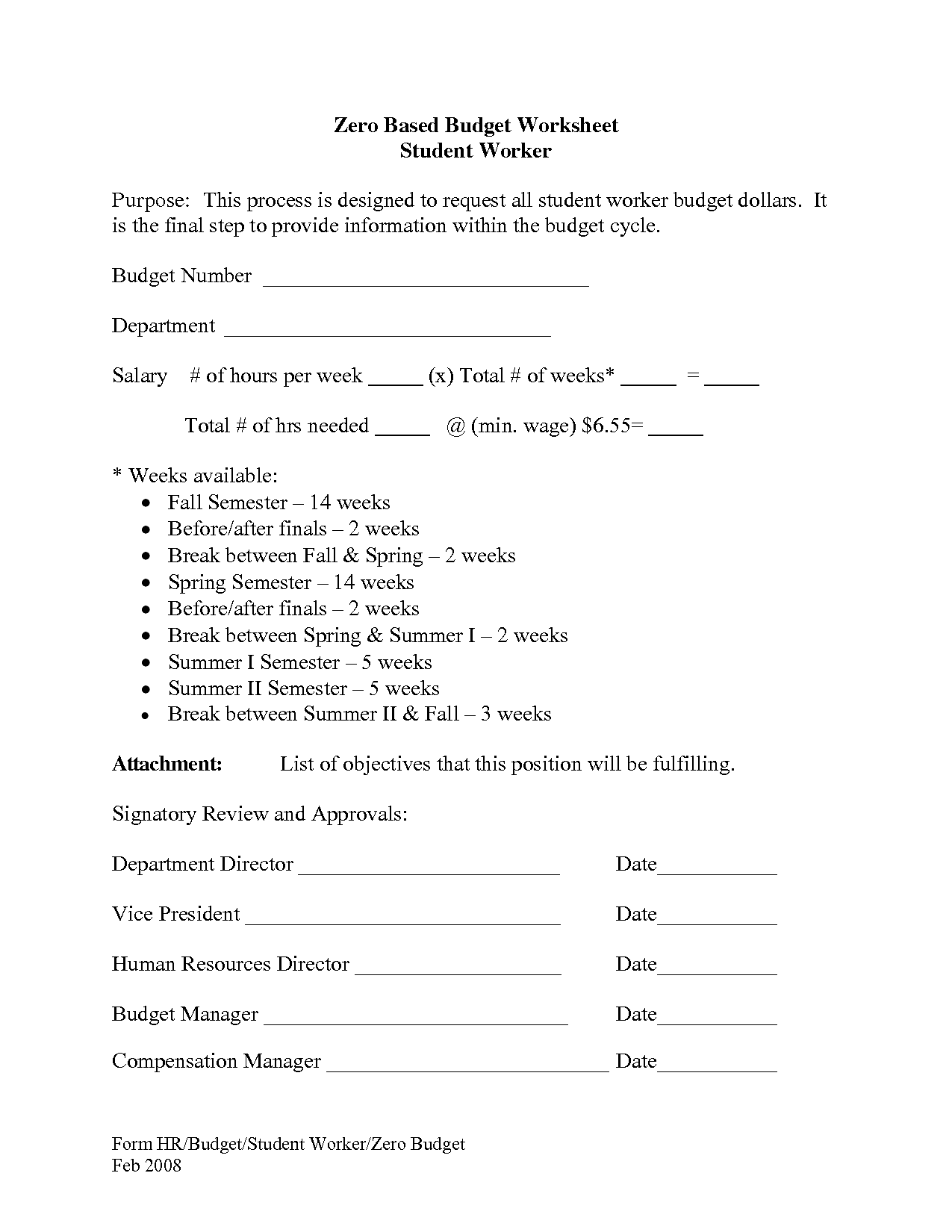

- Dave Ramsey Zero-Based Budget Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a Household Budget Worksheet?

A Household Budget Worksheet is a tool used to track income, expenses, savings, and financial goals for a household. It helps individuals or families monitor their spending habits, identify areas where they can cut costs or save money, and plan for future expenses. By inputting all sources of income and itemizing all expenses, the worksheet provides a clear overview of the household's financial situation, helping them stay on track and achieve financial stability.

How can I create a Household Budget Worksheet in Excel?

To create a Household Budget Worksheet in Excel, you can start by listing all your sources of income in one column and your expenses in another column. Use different rows for various categories such as rent/mortgage, utilities, groceries, transportation, etc. You can then use formulas to calculate totals, track your spending, and compare it against your income. Consider adding a section for savings and emergency funds as well. Use formatting tools like color coding or charts to make it visually appealing and easier to understand. Save your worksheet regularly to keep it updated and track your financial progress effectively.

What are the benefits of using Excel for a Household Budget Worksheet?

Using Excel for a Household Budget Worksheet offers several benefits, such as automated calculations to quickly track income and expenses, easy customization for different budget categories, the ability to visualize data through graphs or charts for better understanding, and the option to set up formulas and conditional formatting for alerts on overspending or savings goals. Additionally, Excel allows for easy updates and adjustments to the budget as financial circumstances change, provides a centralized location to store and organize financial information, and enables efficient sharing and collaboration with other household members.

What categories can be included in a Household Budget Worksheet?

Categories that can be included in a Household Budget Worksheet are typically: income sources, fixed expenses (like rent or mortgage, utilities), variable expenses (such as groceries, transportation), savings and investments, debt payments, personal care, entertainment, and any other relevant categories specific to a household's spending habits or financial goals. It is important to customize the categories to accurately reflect all income and expenses to create a comprehensive budget.

How can I track income and expenses in a Household Budget Worksheet?

To track income and expenses in a Household Budget Worksheet, start by listing all sources of income, such as salaries, bonuses, or rental income. Then, categorize your expenses, including housing, utilities, groceries, and entertainment. Make sure to record all transactions accurately and regularly update your budget worksheet with incoming and outgoing funds. Review your budget periodically to assess your financial health and make any necessary adjustments to stay within your budgeting goals.

Can I set financial goals in a Household Budget Worksheet?

Yes, you can set financial goals in a Household Budget Worksheet. Financial goals can help you track your progress, stay motivated, and make informed decisions about your spending and saving habits. By incorporating financial goals into your Household Budget Worksheet, you can prioritize your expenses and savings to align with your long-term objectives, whether it's building an emergency fund, saving for a vacation, or paying off debt.

Is it possible to analyze and compare monthly spending in a Household Budget Worksheet?

Yes, it is possible to analyze and compare monthly spending in a Household Budget Worksheet. By tracking and categorizing expenses each month, you can easily compare spending across different categories over time to identify patterns, trends, and areas where you may need to adjust or cut back on expenses. This analysis can provide valuable insights and help you make informed decisions to better manage your finances and achieve your budget goals.

How can I customize a Household Budget Worksheet to fit my specific needs?

To customize a Household Budget Worksheet to fit your specific needs, start by assessing your income sources and expenses to determine what categories are relevant to track. Add or delete categories as needed, adjust the amount allocated to each category based on your spending habits, and customize the formulas to calculate totals and percentages according to your preferences. You can also include subcategories, color code items for clarity, and add notes or comments to provide detailed information. Regularly review and adjust your customized budget worksheet to ensure it remains effective in helping you manage your finances.

Is there a way to automate calculations and formulas in a Household Budget Worksheet?

Yes, you can automate calculations and formulas in a Household Budget Worksheet using spreadsheet software like Microsoft Excel or Google Sheets. By inputting your financial data and creating formulas, you can set up automatic calculations for income, expenses, savings, and other budget-related items. This automation can help you track your finances more accurately and efficiently, making it easier to manage your household budget effectively.

Can I generate reports and summaries from a Household Budget Worksheet in Excel?

Yes, you can generate reports and summaries from a Household Budget Worksheet in Excel. You can use features like pivot tables, charts, and formulas to analyze your budget data and create visual summaries that help you track your expenses, income, savings, and more. Additionally, Excel offers various formatting options to customize the appearance of your reports for better clarity and presentation.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments