Financial Worksheet Form

Are you searching for a comprehensive and user-friendly financial worksheet? Look no further as we introduce our new Financial Worksheet Form, designed specifically to cater to individuals and businesses seeking an efficient way to manage their finances. With a user-friendly interface and a variety of customizable features, our worksheet form offers simplicity and effectiveness to help you keep track of your financial goals and expenses. Whether you are an individual trying to budget your monthly expenses or a business owner monitoring your cash flow, our Financial Worksheet Form is the perfect tool for you.

Table of Images 👆

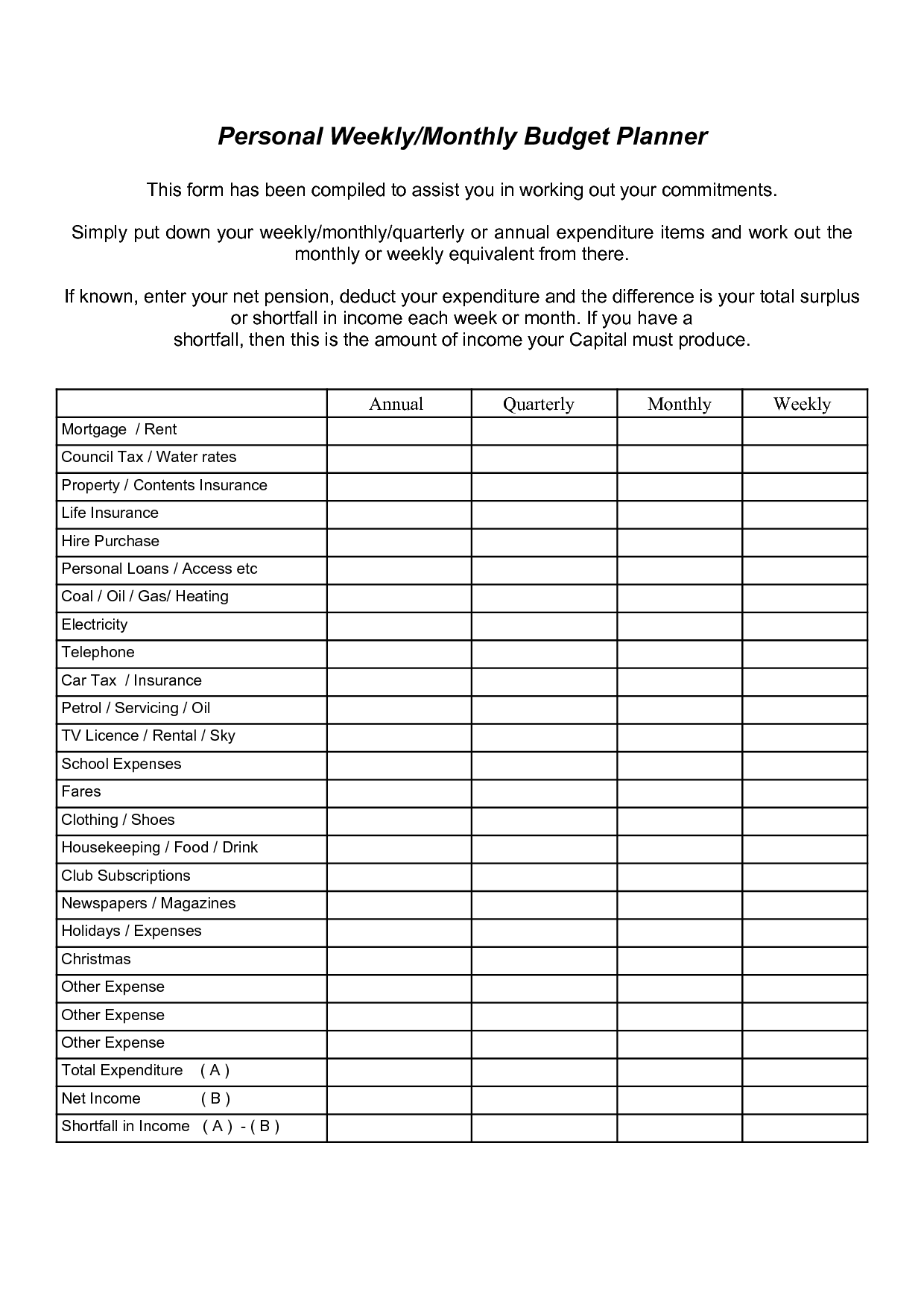

- Free Printable Monthly Budget Planner

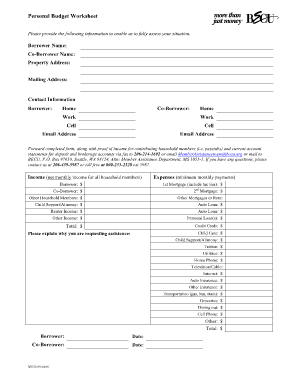

- Budget Worksheet Fillable

- Church Monthly Financial Report Template

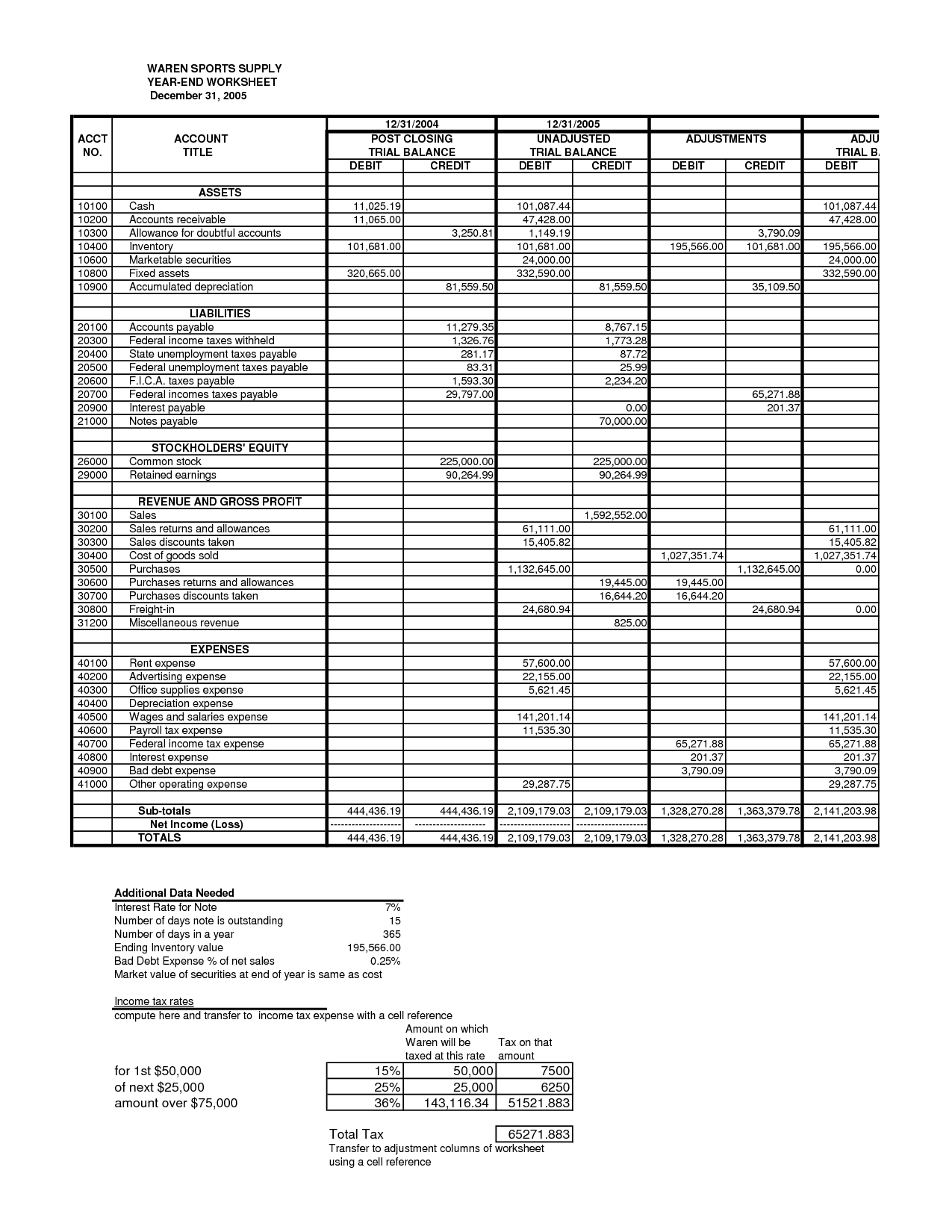

- Accounting Trial Balance Worksheet

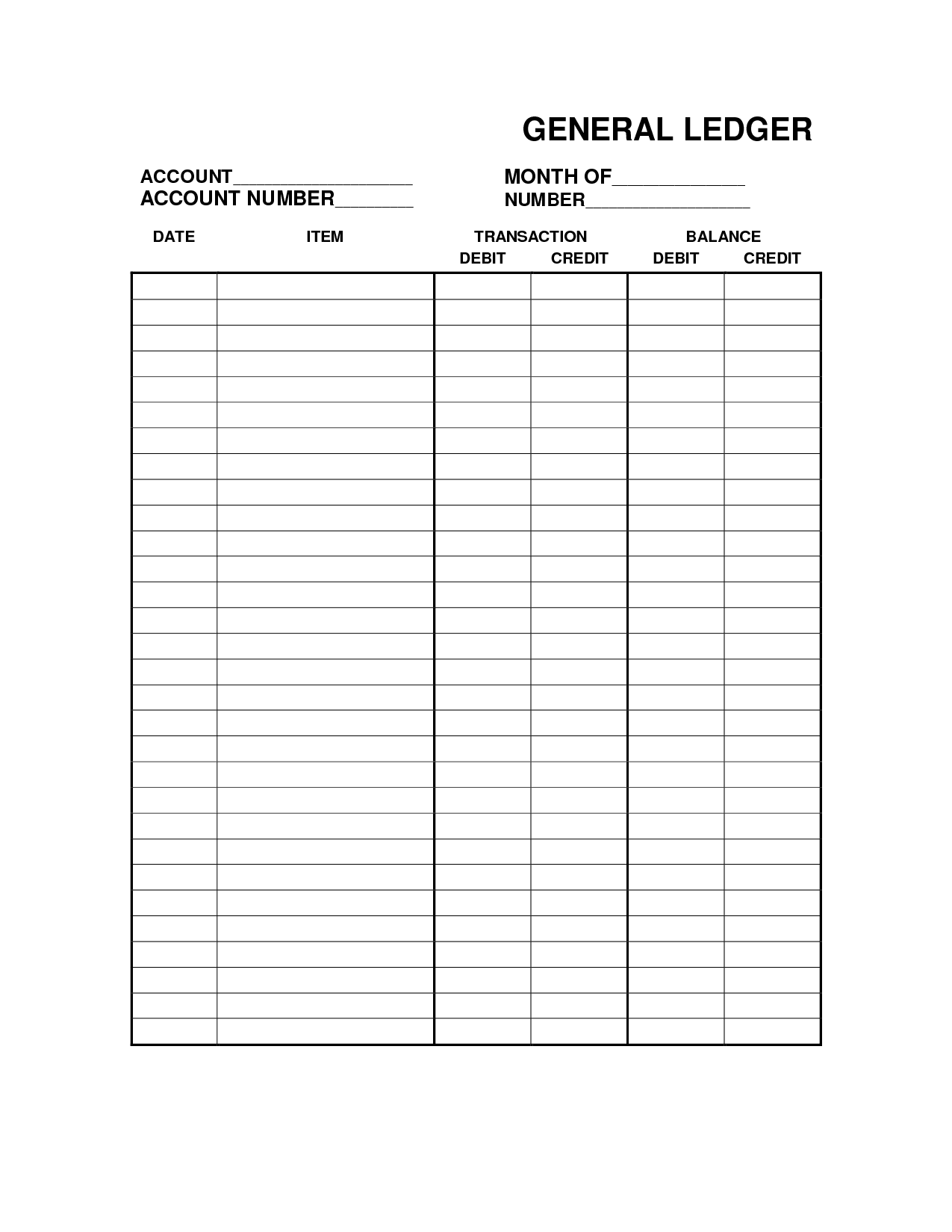

- Free Printable General Ledger Template

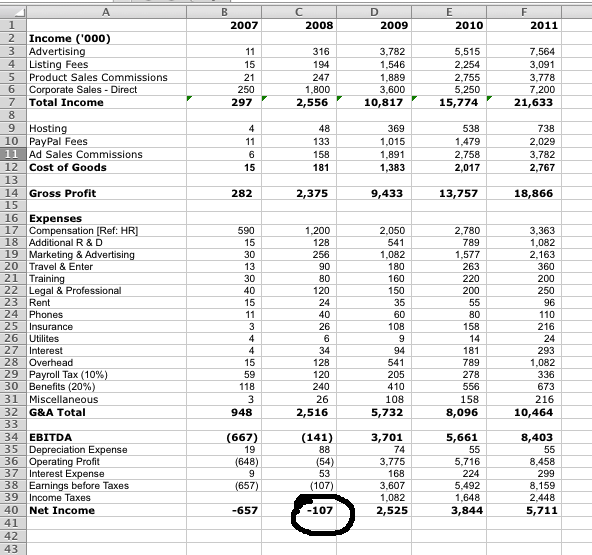

- Example of a 5 Year Business Plan Spreadsheet

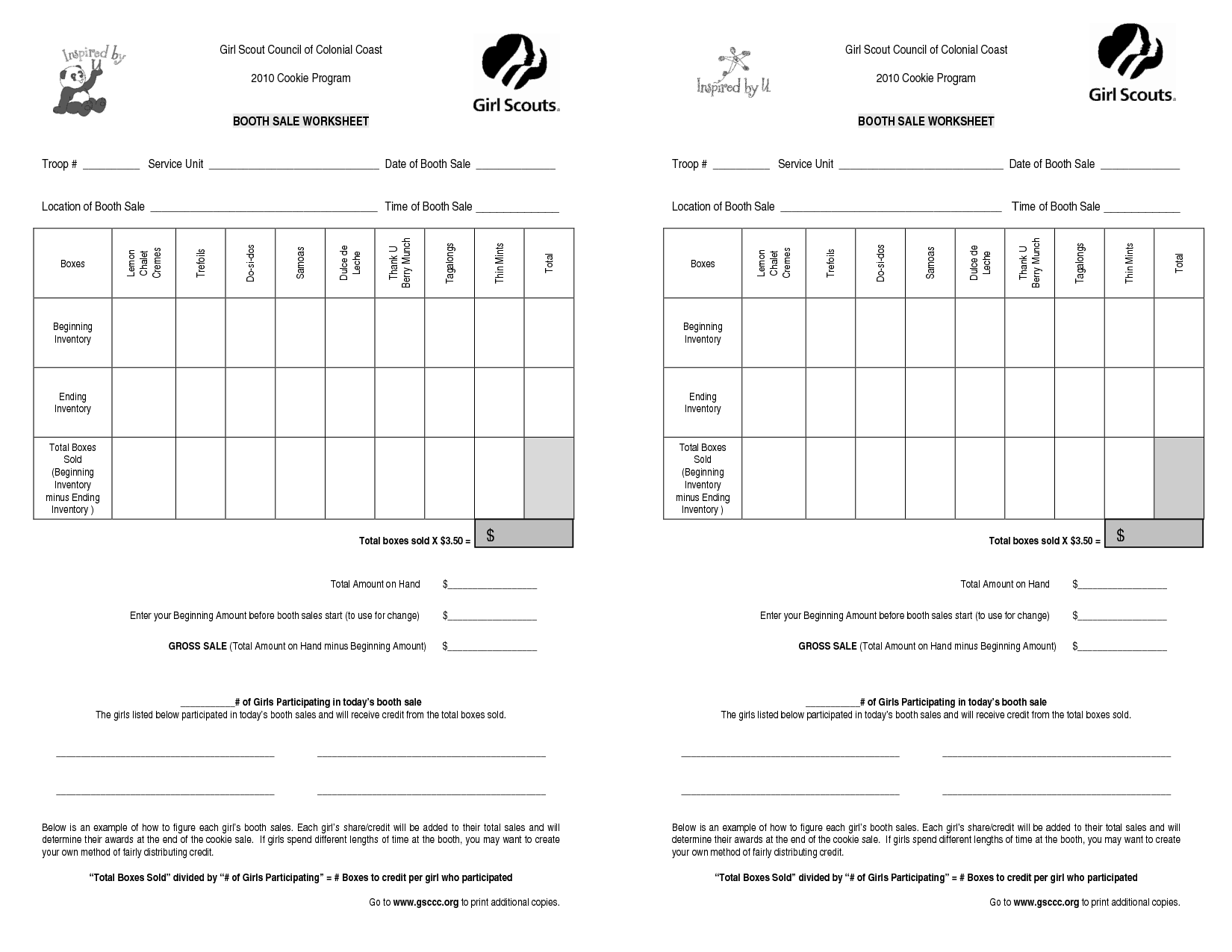

- Girl Scout Cookie Booth Forms

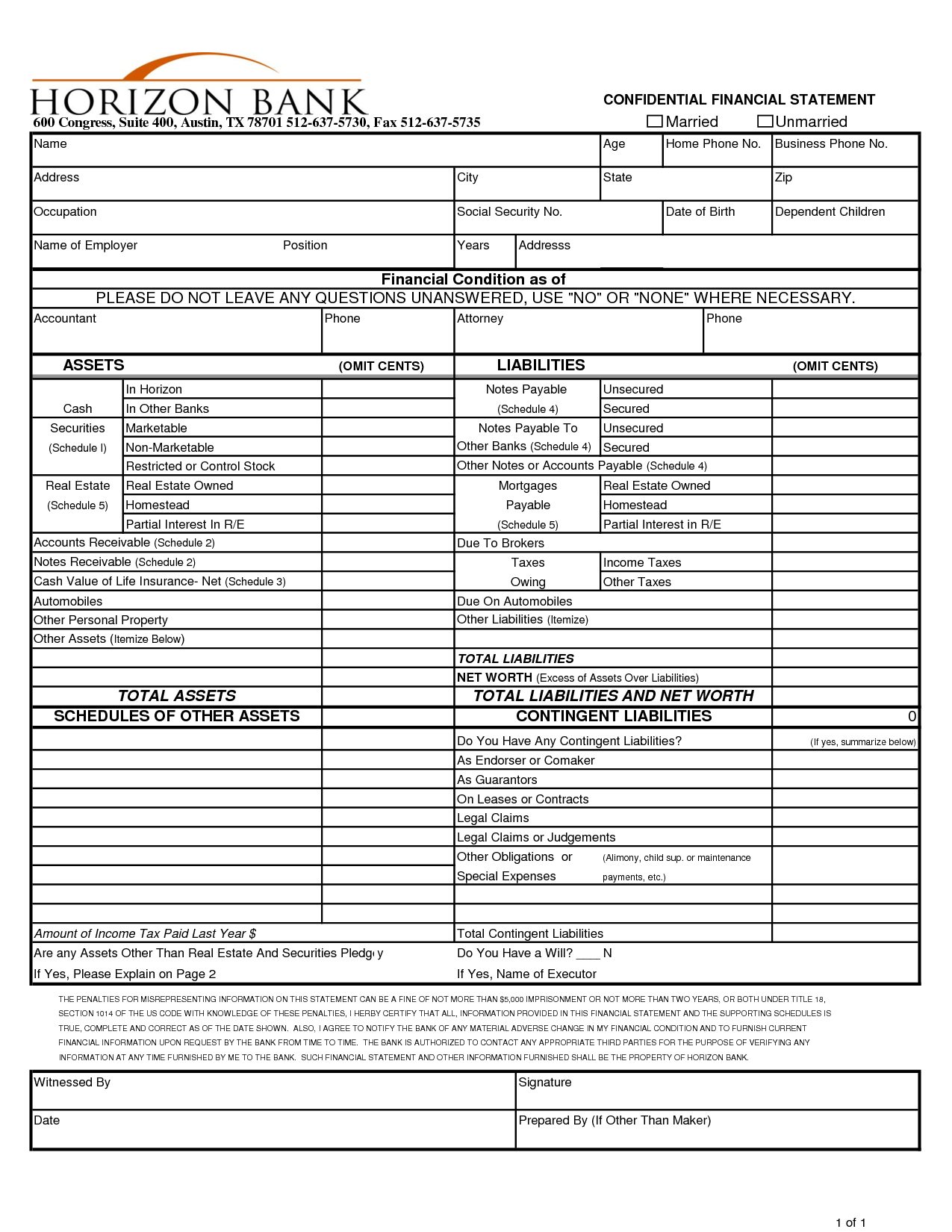

- Personal Financial Statement Form

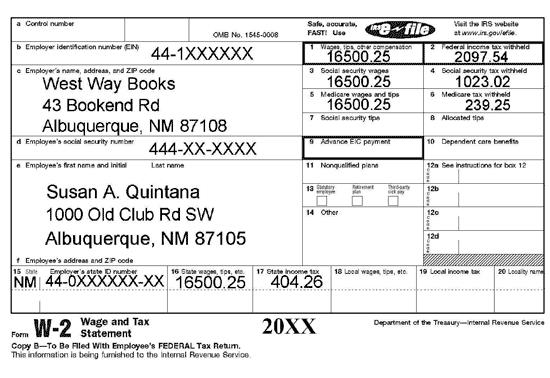

- Sample W2 Completed Form

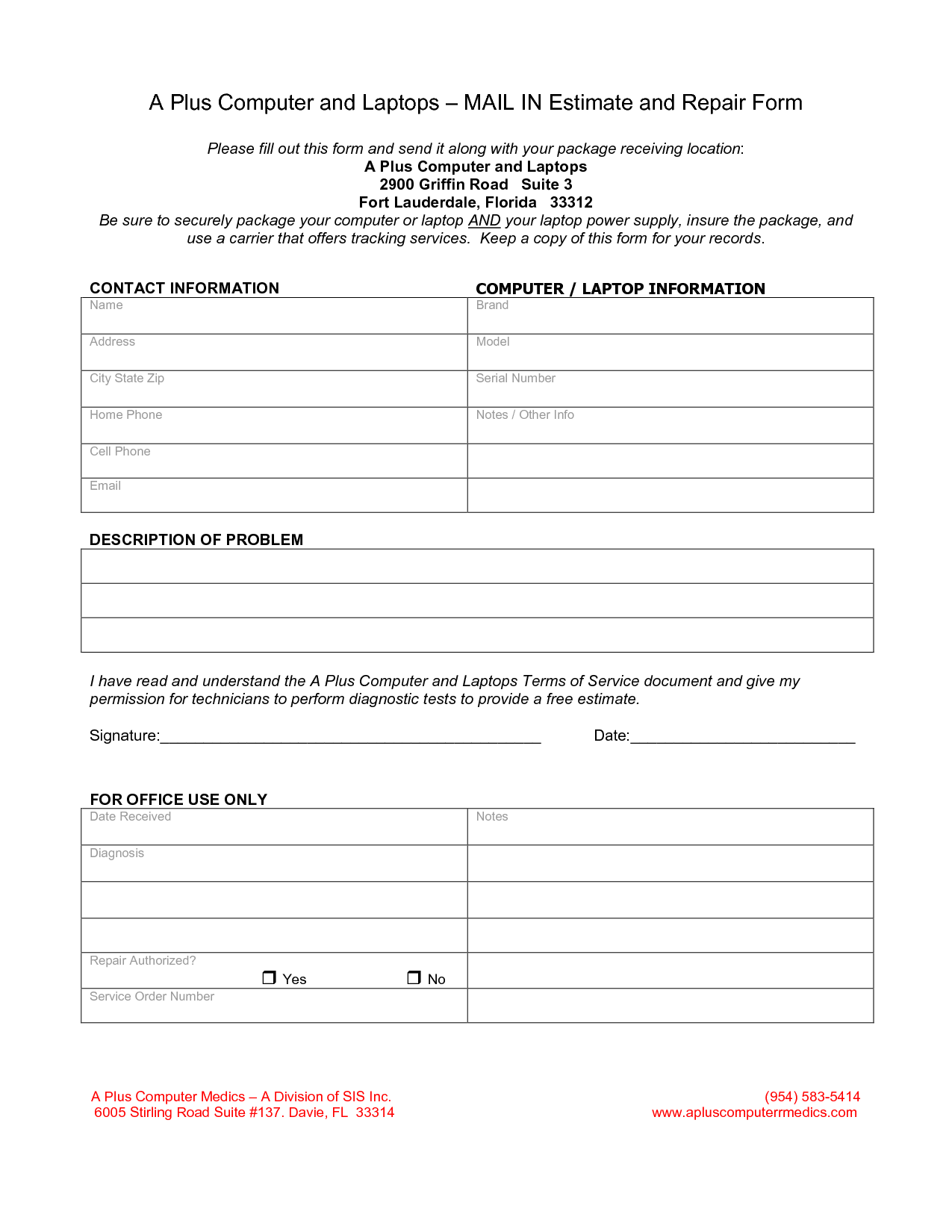

- Computer Repair Work Order Form

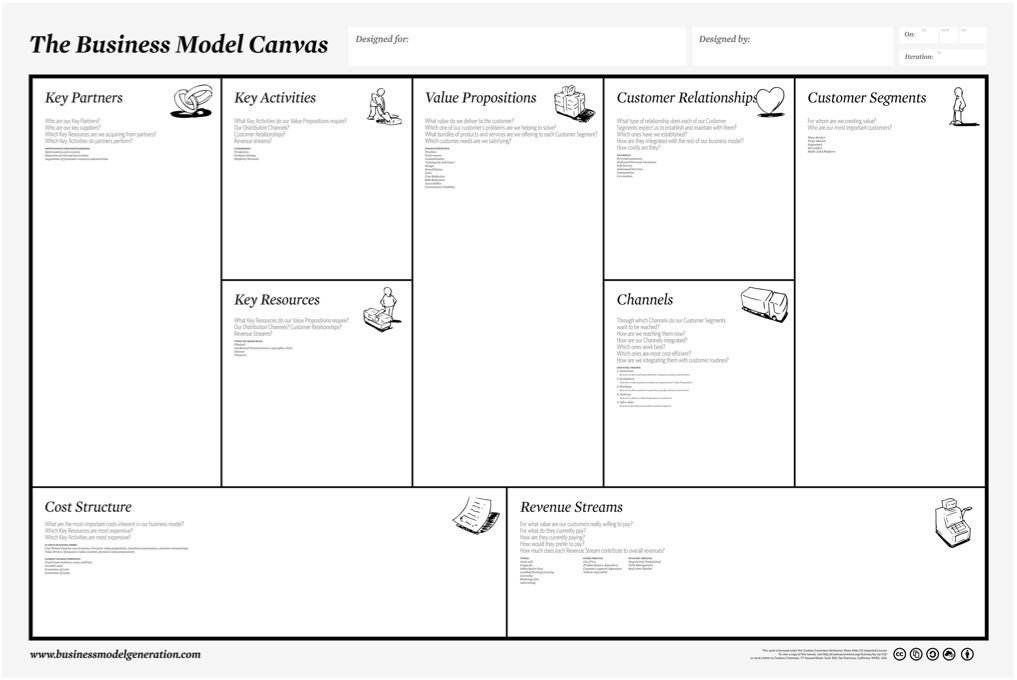

- The Business Model Canvas

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is the purpose of a Financial Worksheet Form?

The purpose of a Financial Worksheet Form is to help individuals or organizations organize and track their finances. It typically includes sections for listing income, expenses, debts, assets, and other financial information to provide a comprehensive overview of one's financial situation. This form can be used for budgeting, financial planning, and assessing one's financial health, and serves as a tool for making informed financial decisions.

How does a Financial Worksheet Form help individuals manage their finances?

A Financial Worksheet Form helps individuals manage their finances by providing a structured template that prompts them to organize and track their income, expenses, assets, liabilities, and financial goals in one place. By filling out this form, individuals can gain a clear overview of their financial situation, identify areas where they can save money or cut expenses, set specific financial goals, and create a realistic budget based on their income and expenses. This tool can also help individuals monitor their progress towards their financial goals, make informed financial decisions, and ultimately work towards achieving financial stability and security.

What types of information are typically included in a Financial Worksheet Form?

A Financial Worksheet Form typically includes information such as income sources, expenses, assets, liabilities, debts, investments, savings, and other financial details that help individuals or organizations assess their financial situation, make budgets, and plan for future financial goals.

Why is it important to update a Financial Worksheet Form regularly?

It is important to update a Financial Worksheet Form regularly to accurately reflect changes in income, expenses, assets, and liabilities over time. By keeping the form current, individuals can make informed financial decisions, track progress towards financial goals, and identify areas for improvement or adjustment. Regular updates ensure that the information remains relevant and up-to-date for effective financial planning and budgeting.

How can a Financial Worksheet Form help in creating a budget?

A Financial Worksheet Form can help in creating a budget by providing a structured template to list all sources of income, expenses, debts, and savings goals in an organized manner. By filling out this form, individuals can clearly see their financial picture, track where their money is going, identify areas where they can cut expenses or save more, and ultimately create a realistic budget that aligns with their financial goals and priorities. This form serves as a valuable tool in visualizing and managing one's finances effectively.

What are the benefits of tracking income and expenses using a Financial Worksheet Form?

Tracking income and expenses using a Financial Worksheet Form provides clarity and organization to your financial situation. It helps you understand where your money is coming from and where it is going, allowing you to make informed decisions about budgeting, saving, and investing. This method also enables you to identify trends and patterns in your spending habits, ultimately helping you to set financial goals and work towards improving your overall financial health.

How can a Financial Worksheet Form help in setting financial goals?

A Financial Worksheet Form can help in setting financial goals by providing a clear and structured overview of your current financial situation. By detailing your income, expenses, debts, and assets, you can analyze where your money is going and identify areas where you can cut back or save more. This information can then be used to set measurable and realistic financial goals, such as saving for a specific purchase, paying off debt, or increasing savings for retirement. The form allows you to track your progress towards these goals, adjust your budget if needed, and stay accountable to your financial objectives.

Why is it crucial to include all sources of income in a Financial Worksheet Form?

It is crucial to include all sources of income in a Financial Worksheet Form because it provides a comprehensive and accurate snapshot of your financial situation. By including all sources of income, such as salary, investments, rental income, and any other forms of revenue, you can better understand your overall cash flow and make informed decisions about your spending habits, savings goals, and financial planning. Failure to include all sources of income may result in incomplete or misleading data, which can lead to poor financial decisions and subsequent financial hardships.

How does categorizing expenses on a Financial Worksheet Form assist in managing finances?

Categorizing expenses on a Financial Worksheet Form helps in managing finances by providing a clear overview of where money is being spent. It allows individuals to track and analyze their spending patterns, identify areas where they may be overspending, set budgets accordingly, and make informed decisions on how to allocate funds more effectively. By organizing expenses into specific categories such as housing, food, transportation, and entertainment, individuals can have a better understanding of their overall financial situation and work towards achieving their financial goals.

What are the advantages of using a Financial Worksheet Form over other personal finance tracking methods?

Using a Financial Worksheet Form offers several advantages over other personal finance tracking methods. It provides a structured and organized way to track income, expenses, savings, and investments in one document, making it easier to see the big picture of your financial situation. Additionally, it allows for detailed categorization and analysis of spending patterns, helping you identify areas where you can cut back or save more effectively. The form also serves as a helpful tool for setting and monitoring financial goals, creating a roadmap for achieving financial stability and growth.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments