Financial Worksheet Excel

If you are an individual or a business owner looking to better organize your finances and track your expenses, a financial worksheet in Excel can be a valuable tool. With its user-friendly interface and powerful calculations, Excel allows you to efficiently analyze your income, expenses, and savings. By creating a financial worksheet, you can gain a clear understanding of your financial situation and make informed decisions to achieve your monetary goals.

Table of Images 👆

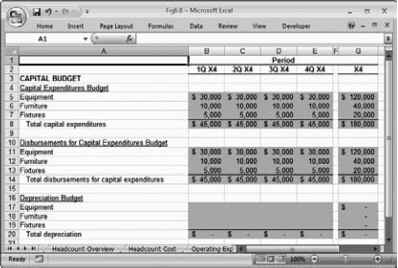

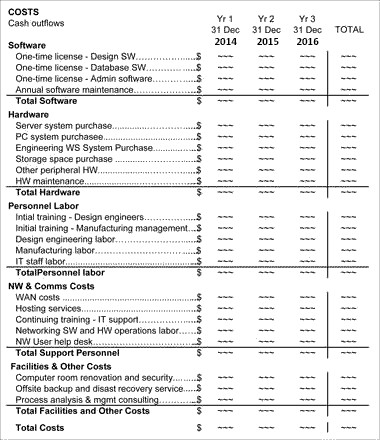

- Capital Expenditure Budget Template

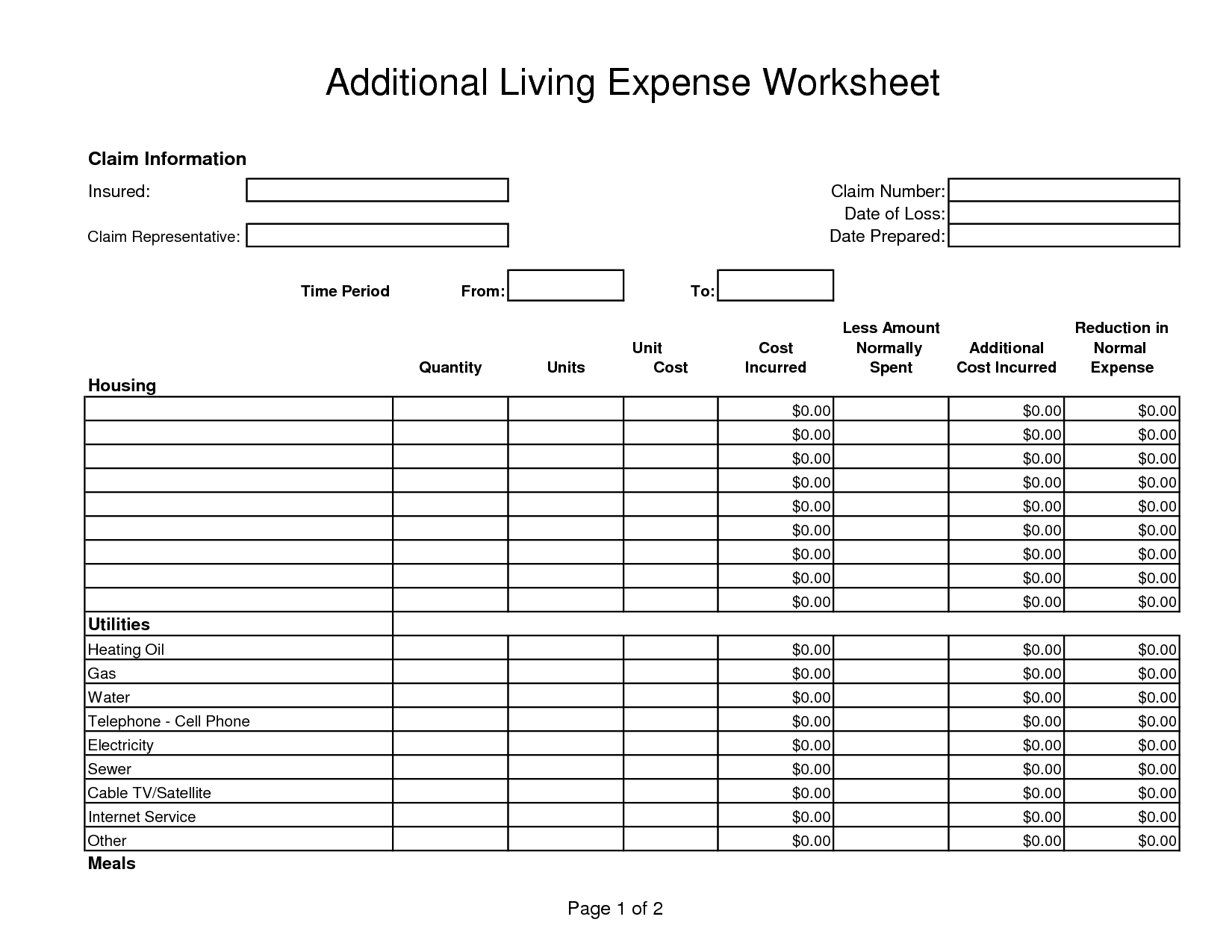

- Living Expense Worksheet Excel

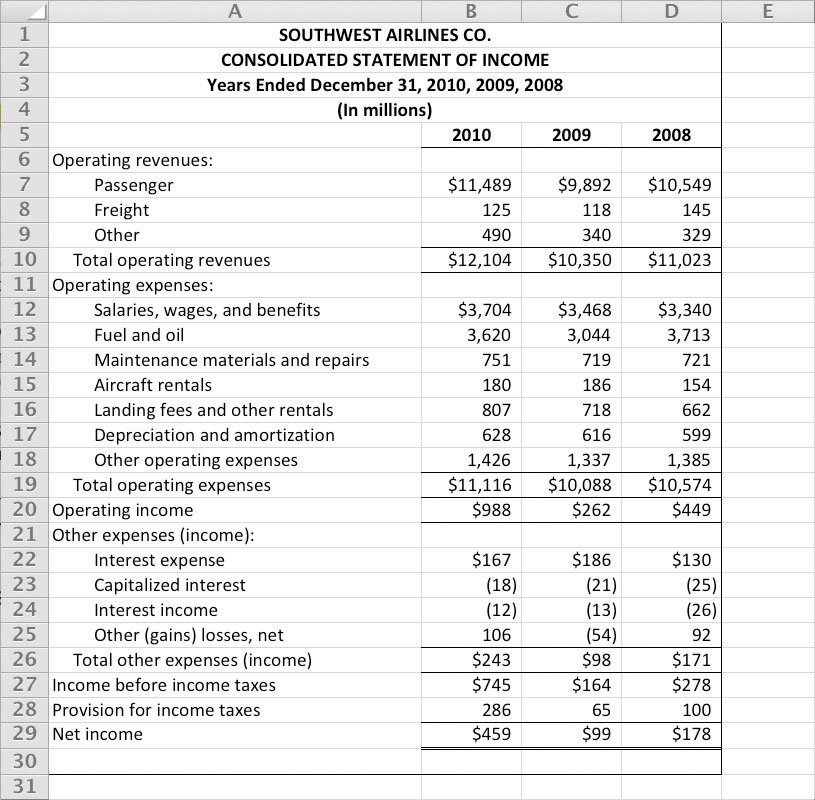

- Excel Spreadsheet Income Statement

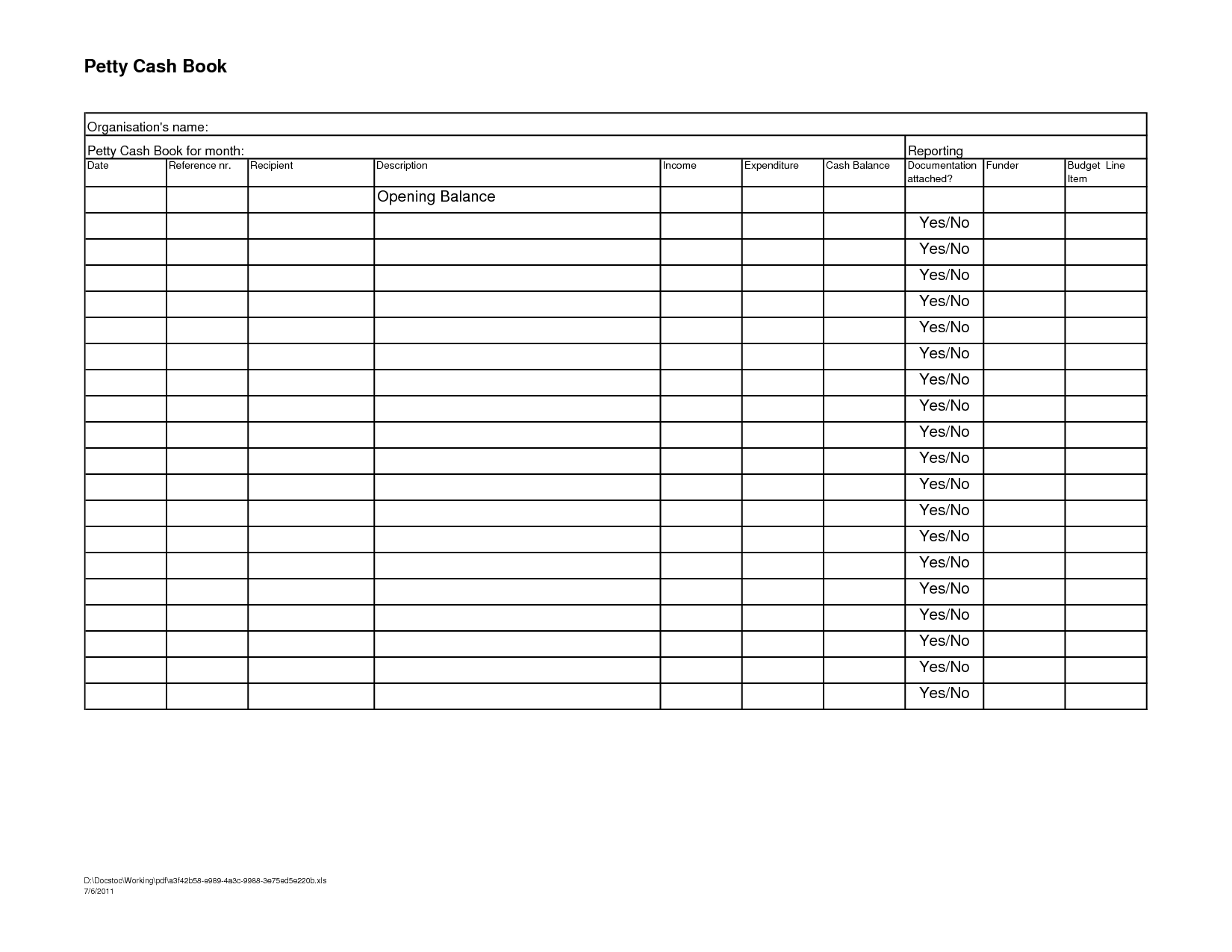

- Petty Cash Book Template

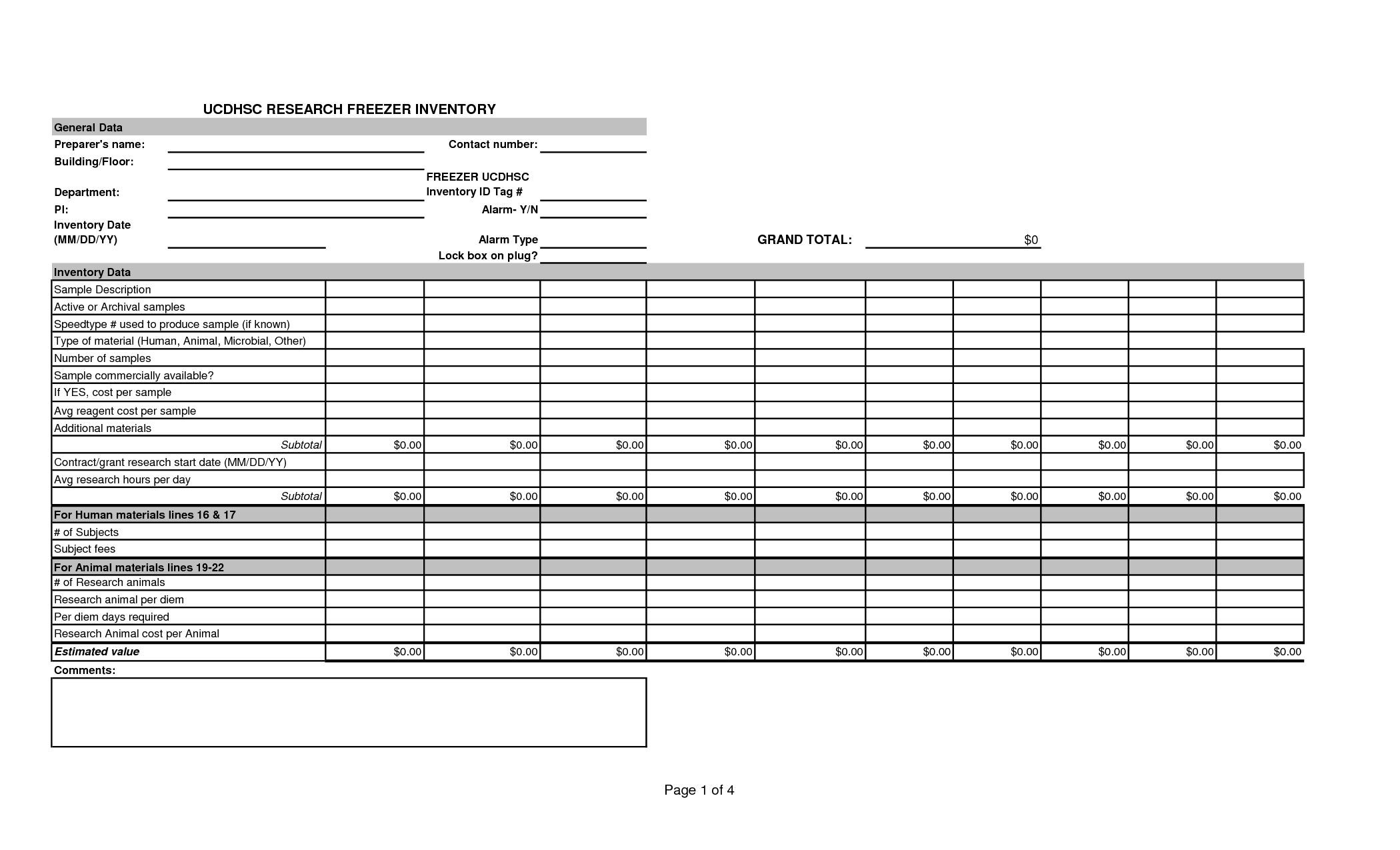

- Personal Inventory Worksheet

- Example of Proposal Cost Analysis

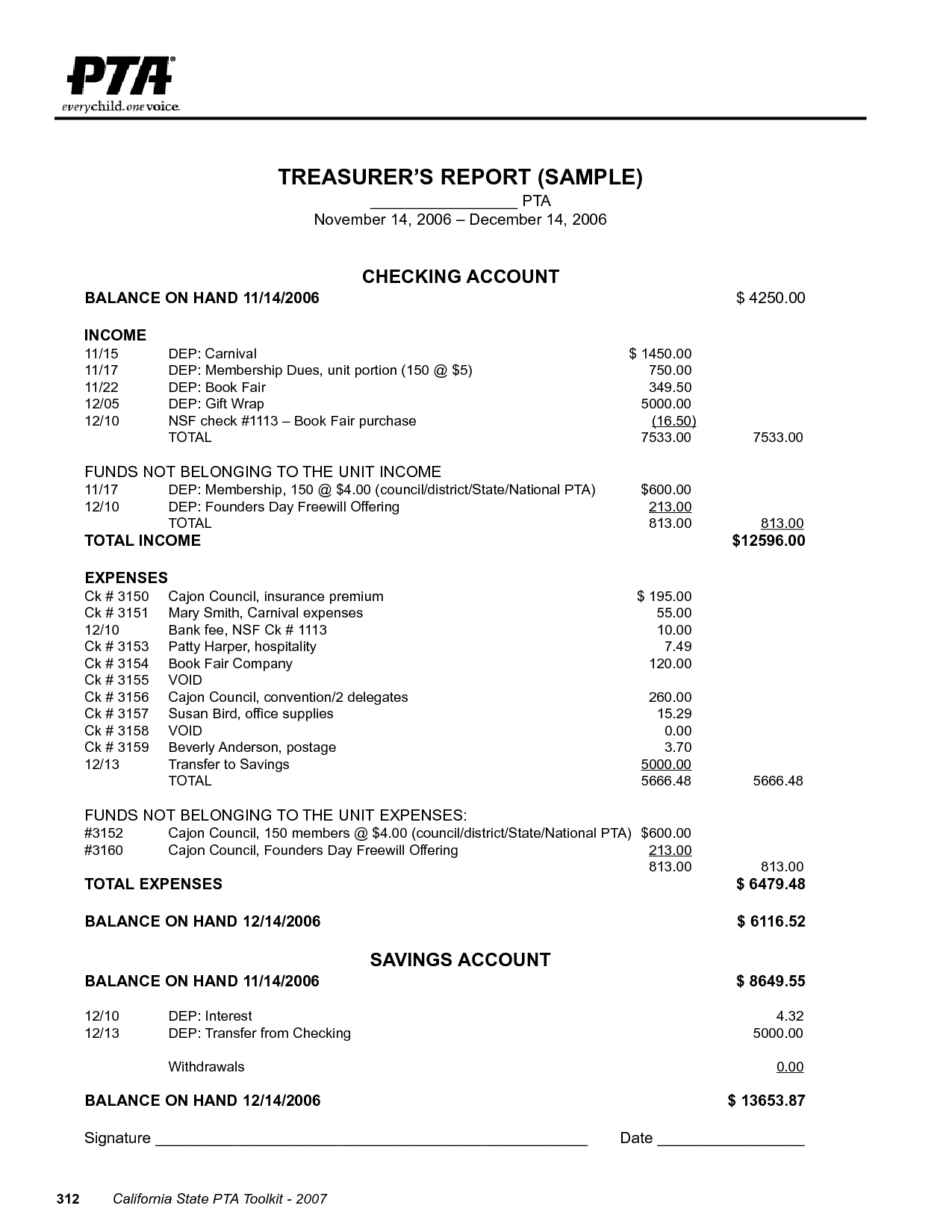

- Treasurers Report Template

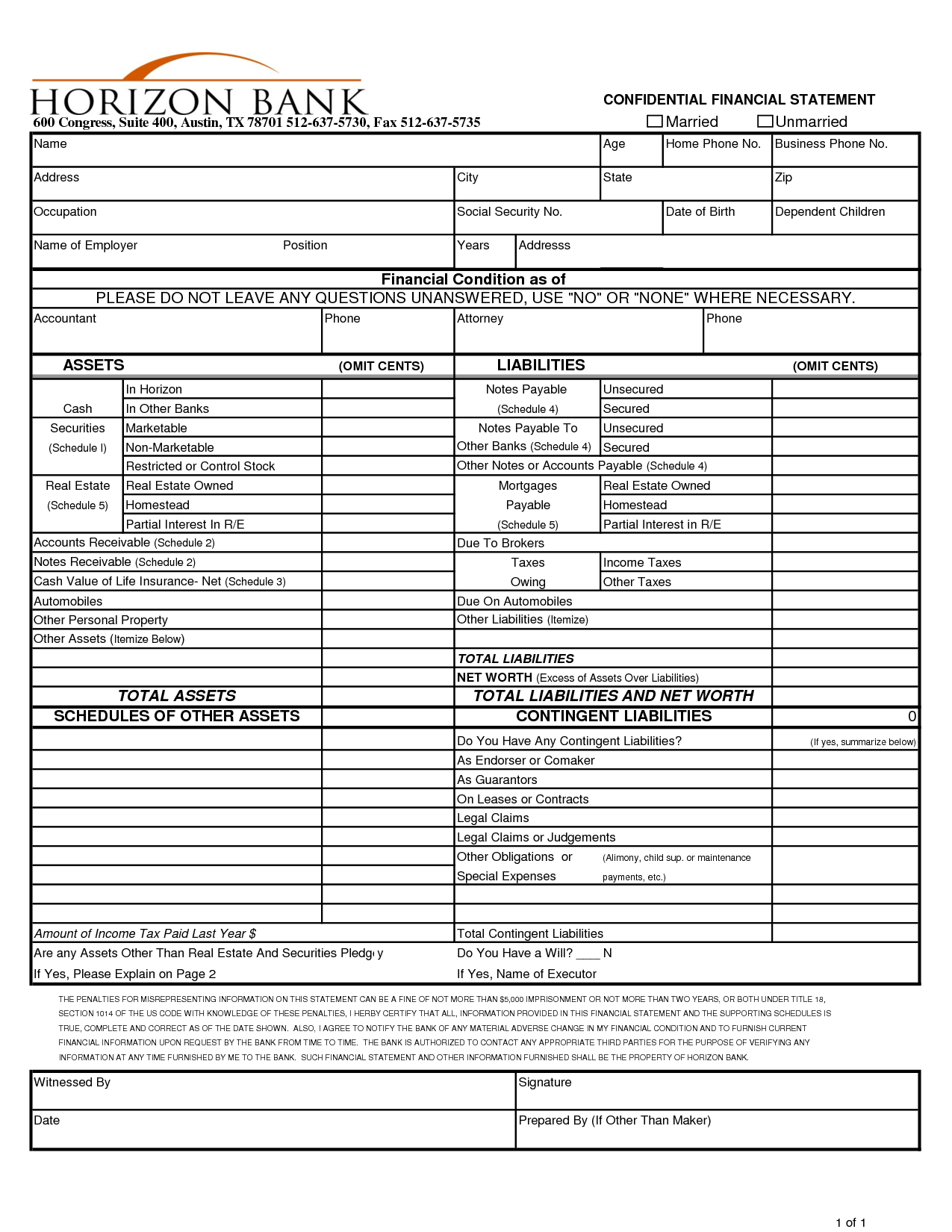

- Personal Financial Statement Form

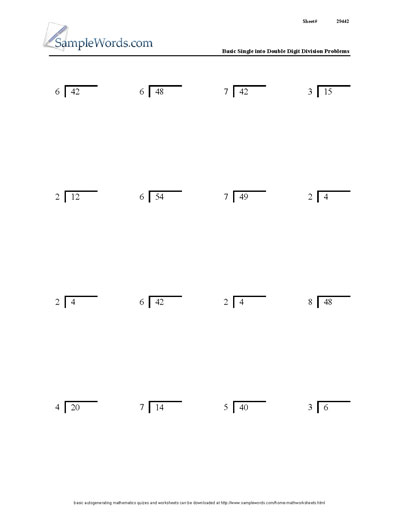

- Math Division Worksheets

- Free Printable Check Registers Template

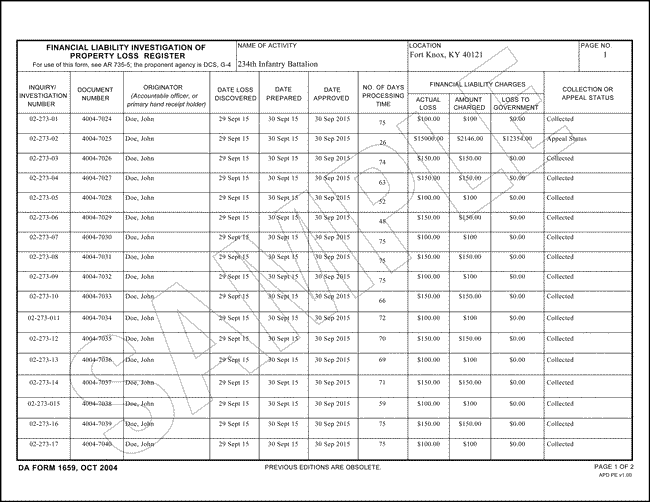

- Army Personal Property Inventory Form

- Free General Ledger Template

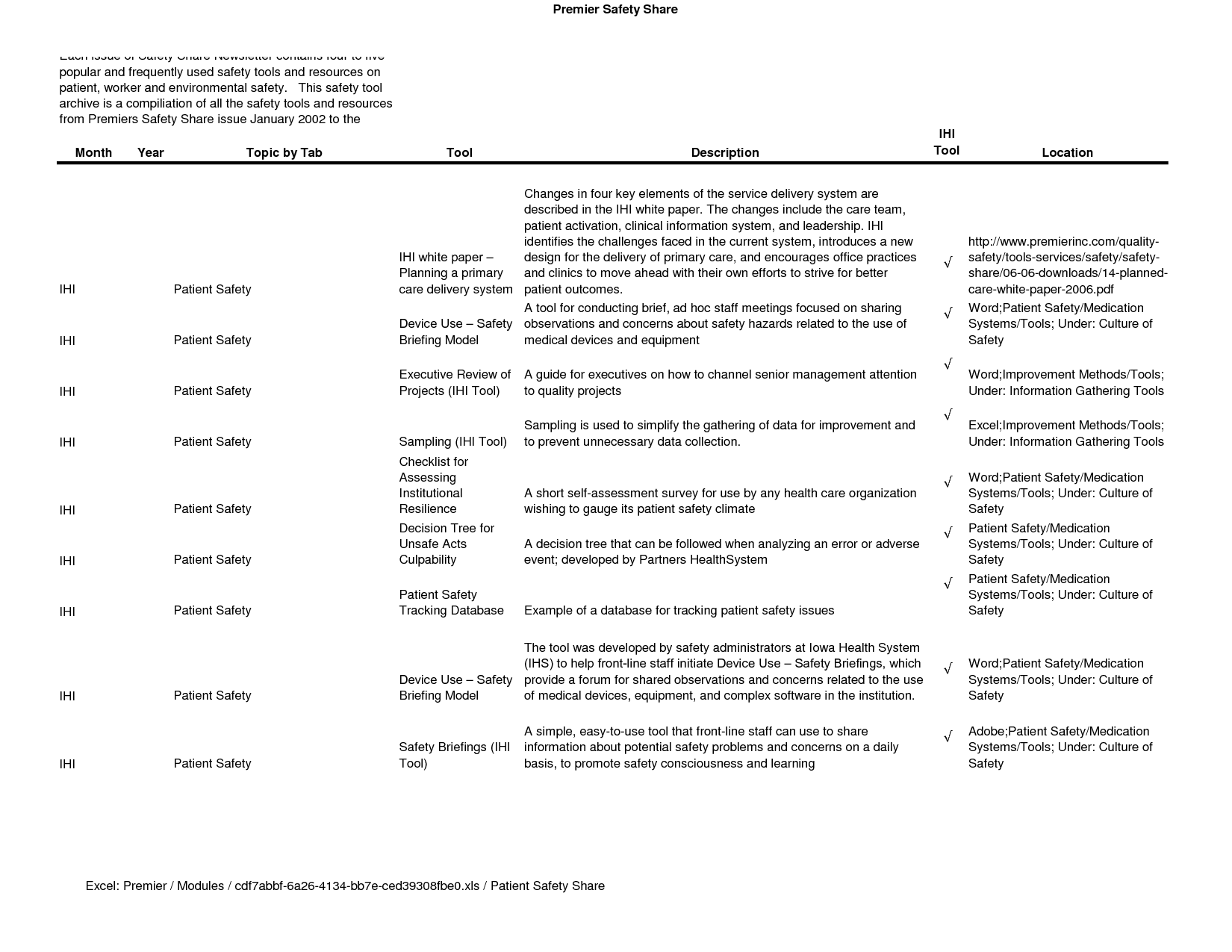

- Sample Performance Plan Template

- Printable Blank Goal Thermometer Template

- Key Sign Out Sheet Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

What is a Financial Worksheet in Excel?

A Financial Worksheet in Excel is a tool used to organize and analyze financial data. It typically includes sections for income, expenses, assets, liabilities, and financial goals, providing a comprehensive overview of an individual or organization's financial position. This worksheet can be customized to track specific financial metrics, create budgets, forecast financial outcomes, and make informed financial decisions.

How can a Financial Worksheet be useful for personal budgeting?

A Financial Worksheet can be useful for personal budgeting by providing a clear overview of income, expenses, savings, and financial goals in one organized document. It helps individuals track their spending habits, identify areas for potential cost-cutting, set achievable financial goals, and monitor progress towards those goals over time. Additionally, by having all financial information in one place, it makes it easier to make informed decisions about saving, investing, and managing money effectively.

What types of financial information can be included in a Financial Worksheet?

A Financial Worksheet can include various types of financial information such as income sources, expenses, assets, liabilities, debts, savings, investments, and budgeting data. It is a comprehensive tool that helps individuals or businesses organize and track their financial details to gain a clear understanding of their financial health and make informed decisions.

What are some common formulas and functions used in a Financial Worksheet?

Common formulas and functions used in a financial worksheet include SUM (to calculate the total of a range of cells), AVERAGE (to calculate the average value of a range of cells), IF (to perform conditional calculations), PMT (to calculate loan payments), PV (to determine the present value of an investment), FV (to calculate the future value of an investment), and VLOOKUP (to search for a value in a table). These functions help in performing various financial calculations and analysis efficiently in a worksheet.

How can data be organized and formatted in a Financial Worksheet?

In a financial worksheet, data can be organized and formatted by categorizing it into relevant sections such as income, expenses, assets, liabilities, and so on. Each category can have subcategories for more detailed breakdown. Data can be formatted using clear headings, consistent labeling, and proper alignment to enhance readability. Utilizing spreadsheet software like Microsoft Excel can be helpful for organizing data in rows and columns, performing calculations, and creating visual representations such as charts or graphs to present financial information effectively.

Can a Financial Worksheet calculate income and expenses over a specific time period?

Yes, a Financial Worksheet can calculate income and expenses over a specific time period by inputting the relevant financial data such as income sources, expenses, and their respective amounts. By organizing and tracking this information, the worksheet can provide a clear overview of your financial situation for the designated time frame, allowing you to analyze your financial health, identify trends, and make informed decisions.

How can conditional formatting be applied to highlight specific financial data in a Financial Worksheet?

To highlight specific financial data in a Financial Worksheet using conditional formatting, you can select the range of cells containing the financial data, go to the "Conditional Formatting" option in the toolbar, choose the criteria (such as values greater than a certain amount or below a threshold), and then select a formatting style (like bold, color, or a specific icon) to be applied when the data meets the set condition. This allows you to visually identify important financial data based on the conditions you specify, making it easier to analyze and interpret the information presented in the worksheet.

Can a Financial Worksheet generate charts or graphs to visualize financial trends?

Yes, a Financial Worksheet can generate charts or graphs to visualize financial trends by utilizing functions and features available in spreadsheet software like Excel or Google Sheets. By inputting financial data and selecting the appropriate chart type, a user can create visual representations of trends such as income vs. expenses, profit margins over time, or comparisons between different financial metrics. These charts and graphs can help users analyze and understand their financial data more effectively.

How can a Financial Worksheet assist in tracking savings or debt repayment goals?

A Financial Worksheet can assist in tracking savings or debt repayment goals by providing a clear overview of income, expenses, and financial goals in one centralized document. By inputting all sources of income and expenses, individuals can easily calculate how much money is available to allocate towards savings or debt repayment each month. This enables individuals to set specific targets and track progress over time, helping them stay accountable and make adjustments as needed to reach their financial goals efficiently.

Can a Financial Worksheet be password protected to ensure data privacy and security?

Yes, a Financial Worksheet can be password protected to ensure data privacy and security. This feature allows only individuals with the correct password to access and modify the data stored in the worksheet, helping to prevent unauthorized access and maintaining the confidentiality of sensitive financial information.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments