Financial Planner Worksheet

Creating a financial plan is essential for anyone seeking to take control of their financial future. And when it comes to organizing your financial information and managing your goals, a financial planner worksheet is the ideal tool. Designed to help individuals and families track their income, expenses, and savings, this worksheet serves as a comprehensive entity to streamline the planning process. Whether you are a young professional looking to establish a budget, a newly married couple combining finances, or a retiree aiming to maximize your income, a financial planner worksheet is a practical and straightforward tool tailored to fit your financial needs.

Table of Images 👆

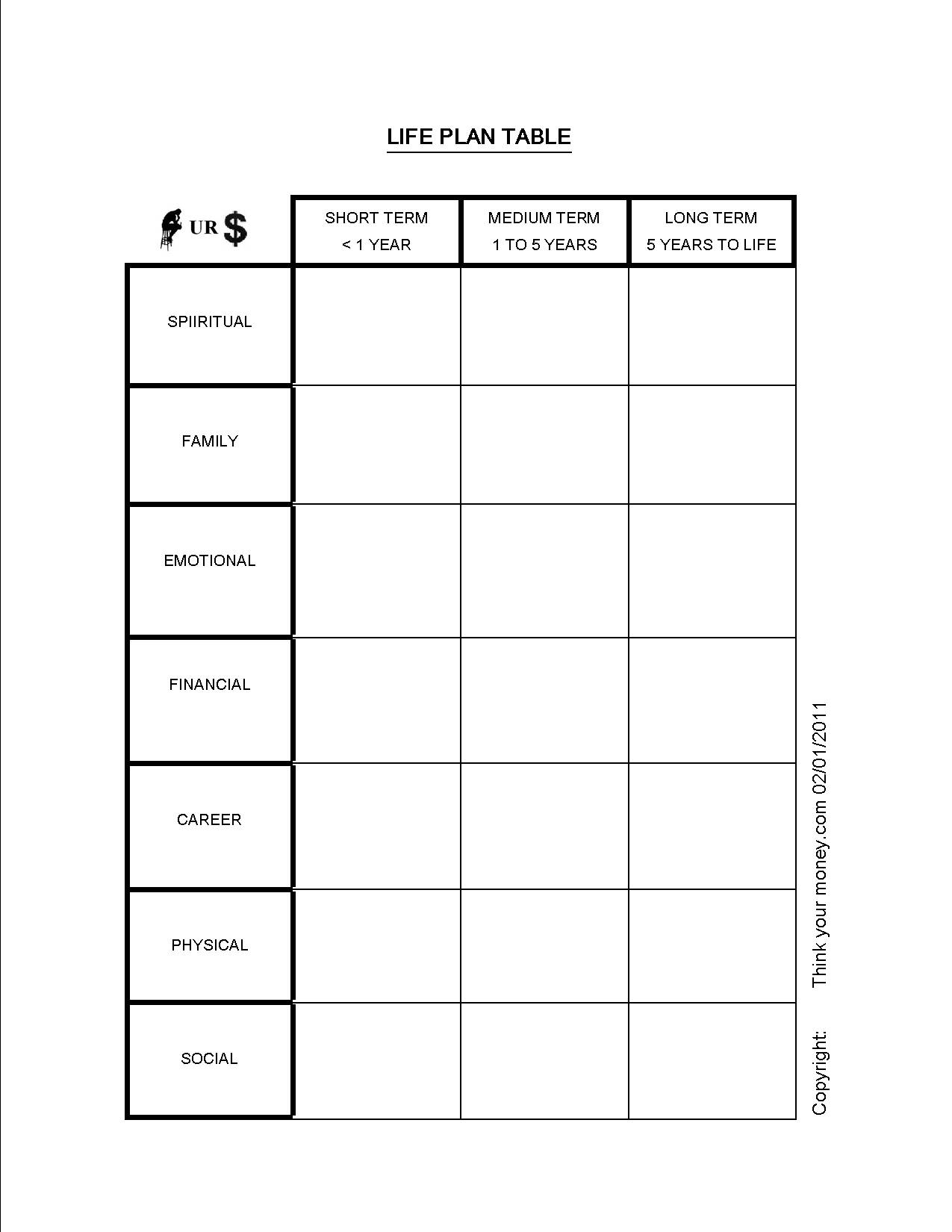

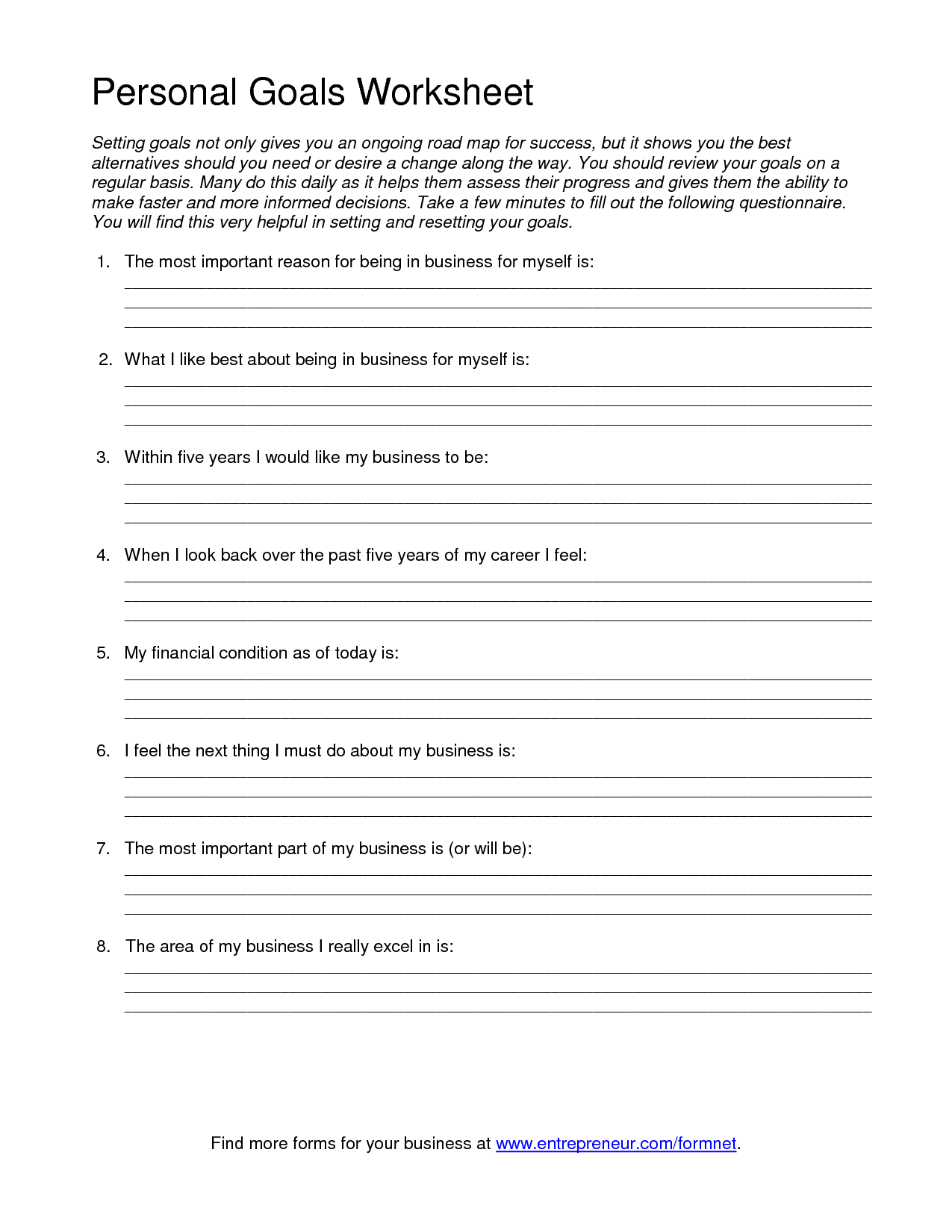

- Templates for Goal Setting Worksheets

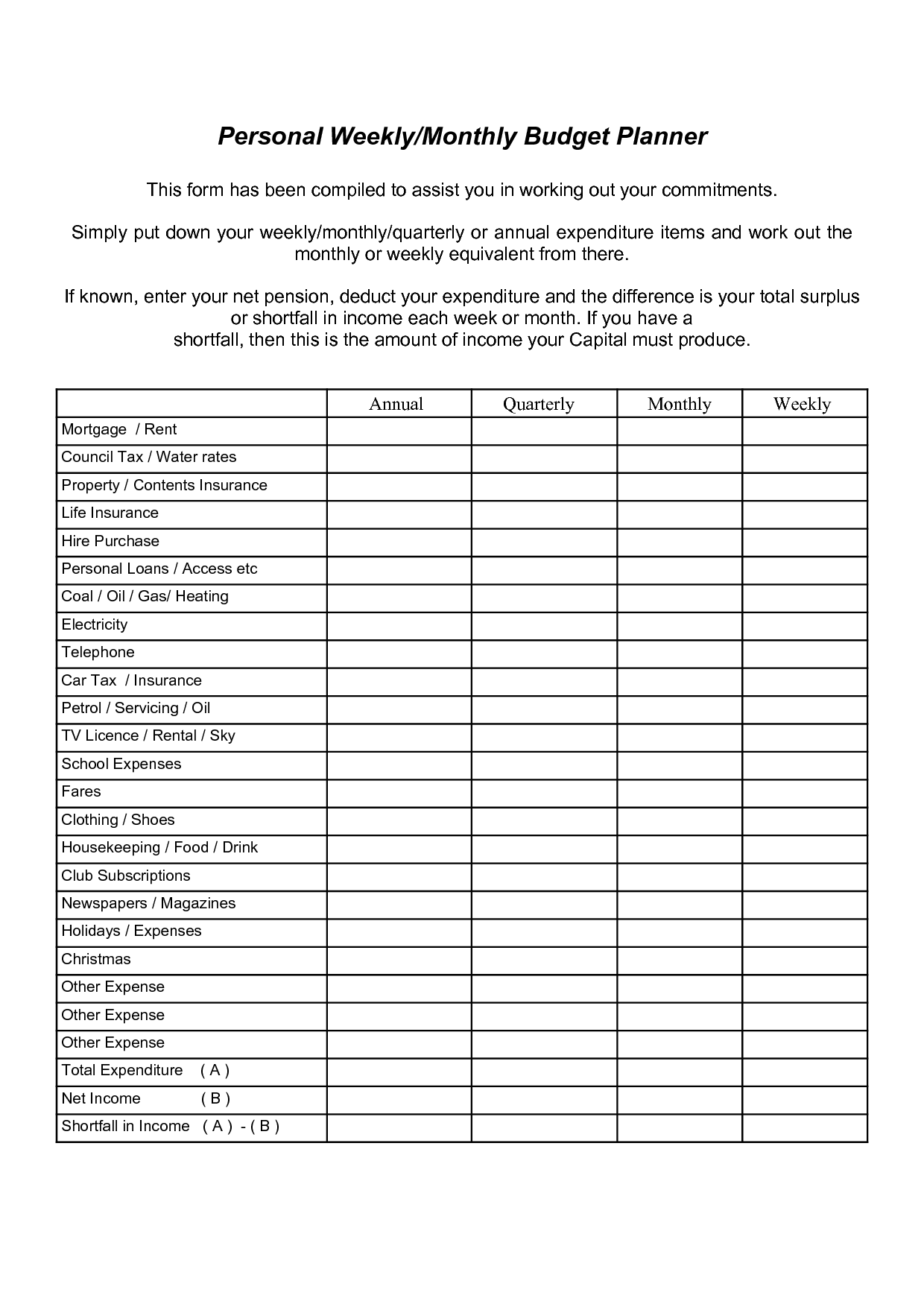

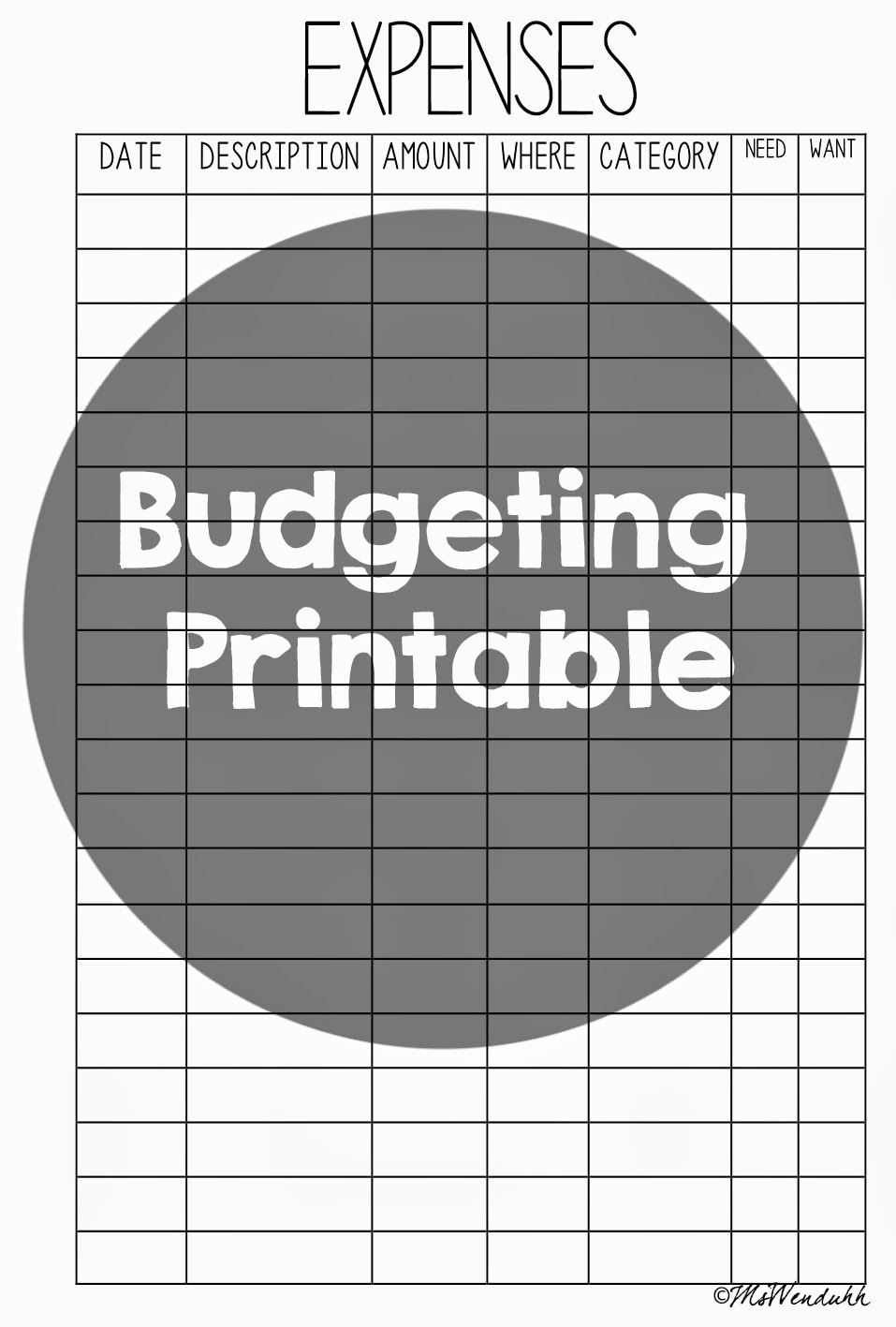

- Free Printable Monthly Budget Planner

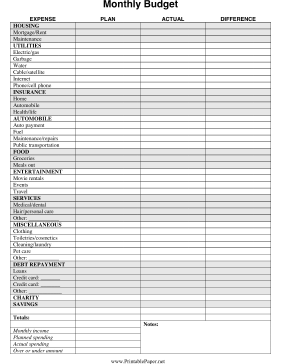

- Printable Monthly Budget Paper

- Debt Free Printable Bill Payment Sheet

- Pre Vocational Skills Lesson Plans

- Printable Monthly Budget Planner

- Personal Goal Setting Worksheet Template

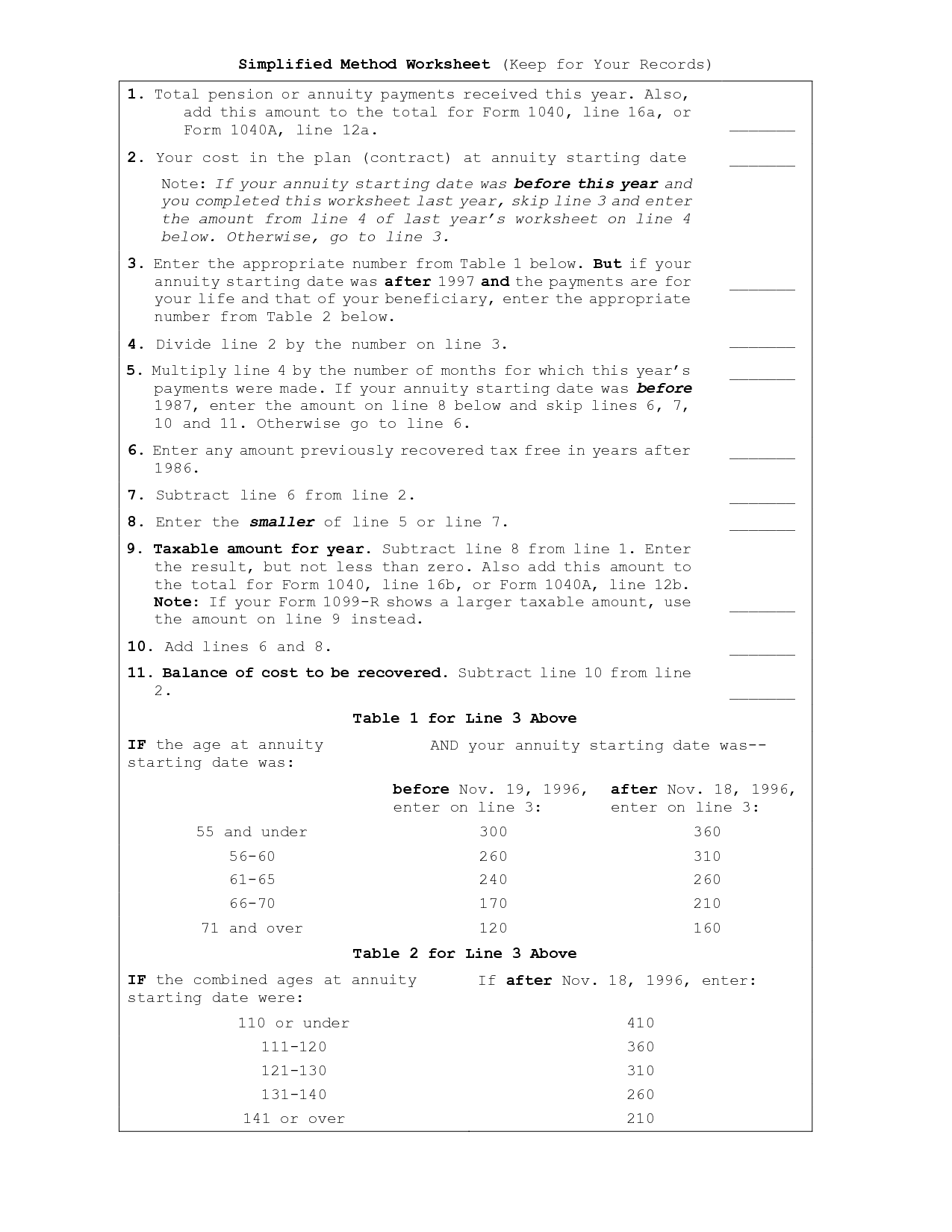

- 1040 Simplified Worksheet Form

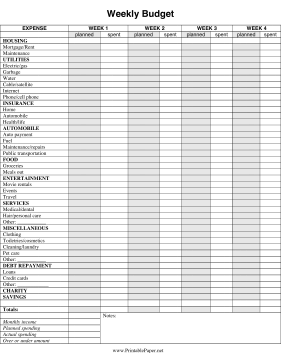

- Free Printable Weekly Budget Template

- Free Printable Bill Organizer Form

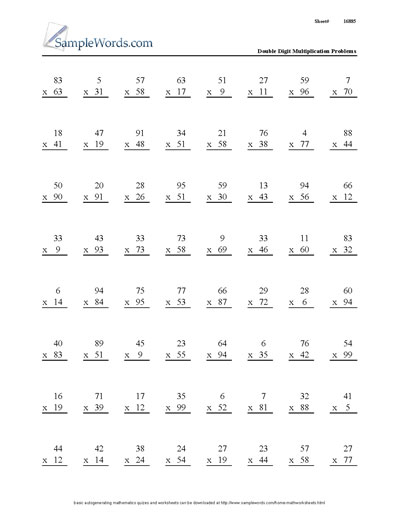

- Math Problems Multiplication Worksheets

- College Planner Free Printables Stickers

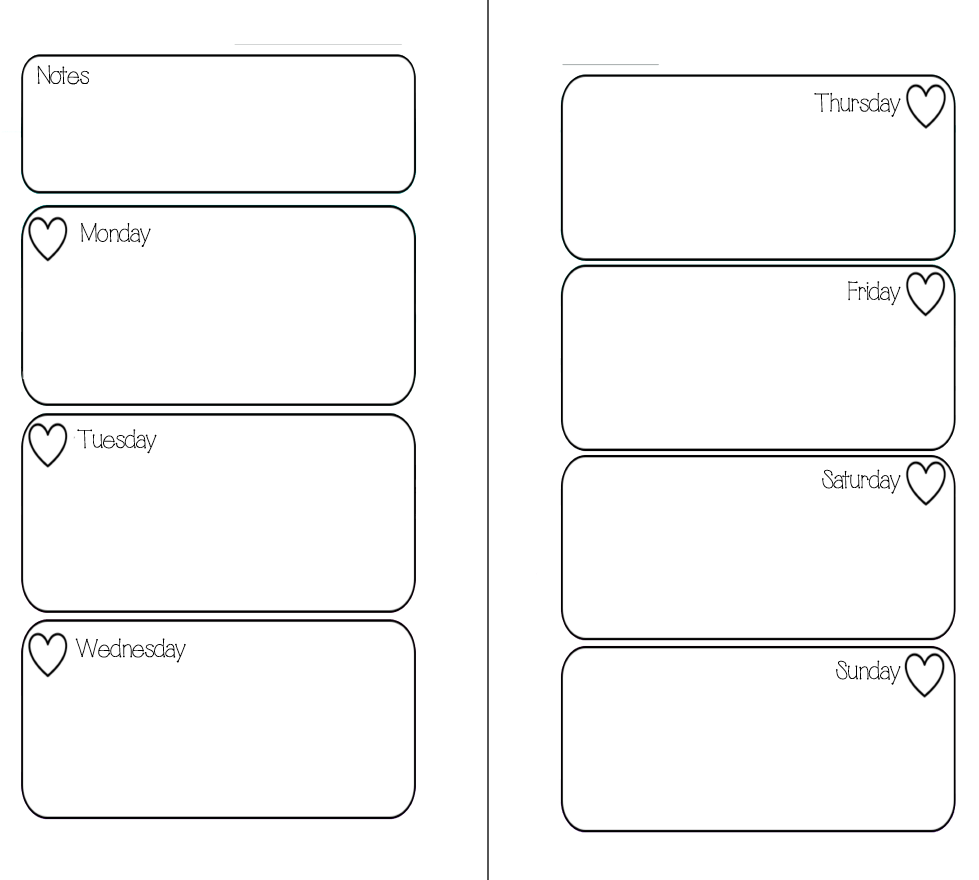

- Free Printable Planner Pages Week On Two

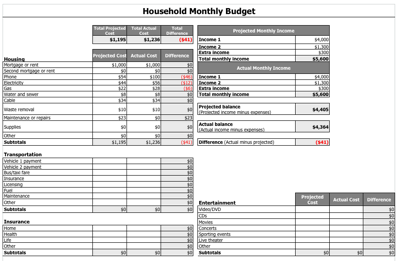

- Monthly Household Budget Template

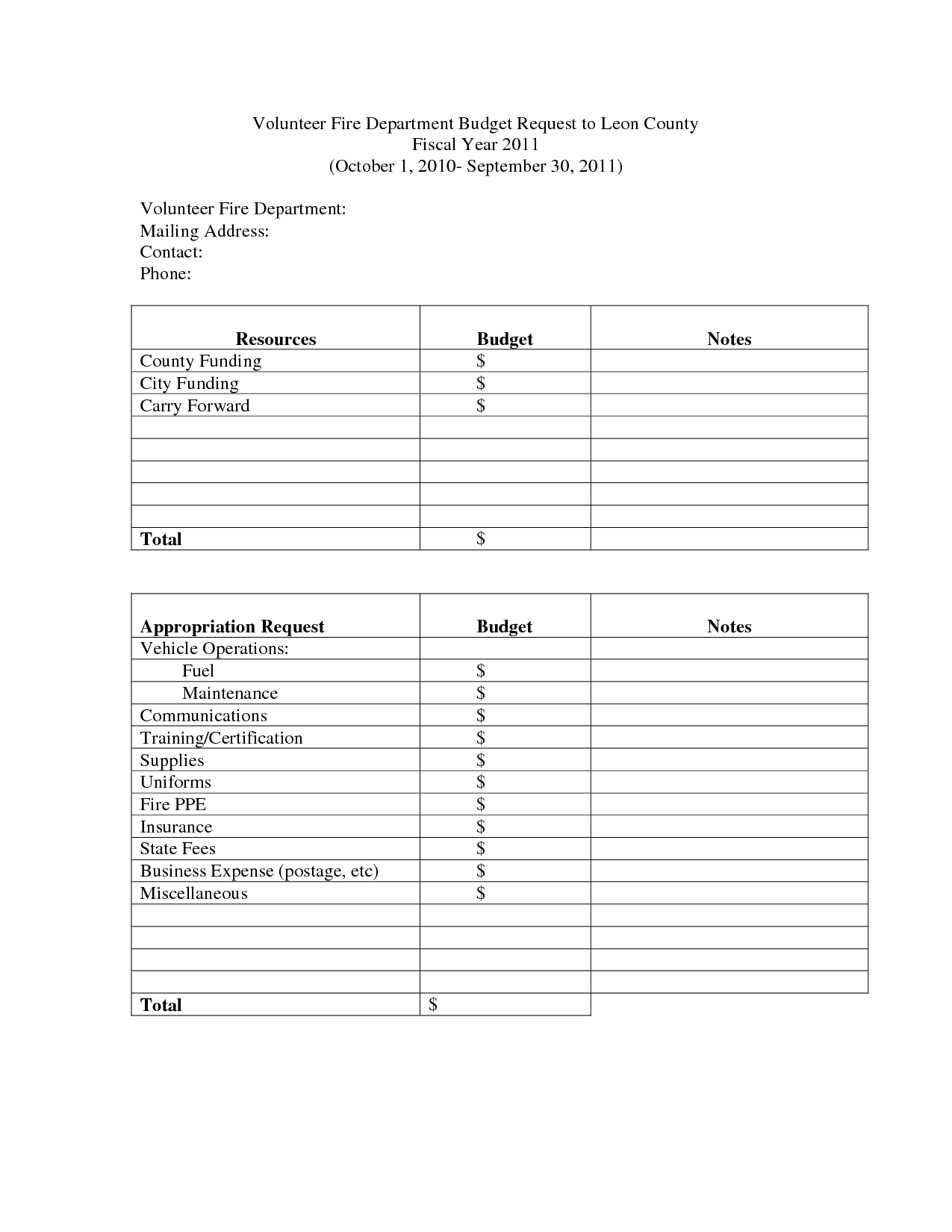

- Fire Department Budget Request Form Template

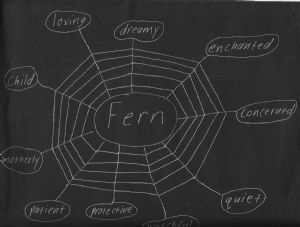

- Charlottes Web Characters

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a Financial Planner Worksheet?

A Financial Planner Worksheet is a tool used by individuals or professionals to help organize and track financial information, such as income, expenses, assets, debts, and financial goals. It is typically used to create budgets, analyze cash flow, plan for future expenses, and develop strategies to achieve financial objectives.

How can a Financial Planner Worksheet help individuals with their financial planning?

A Financial Planner Worksheet can help individuals with their financial planning by providing a structured framework to understand their current financial situation, set financial goals, track expenses, evaluate income sources, and create a budget. By organizing this information in one place, individuals can analyze their financial health, identify areas for improvement, and make informed decisions about saving, investing, and spending. It can also serve as a motivational tool to stay on track with financial goals and track progress over time.

What types of information are typically included in a Financial Planner Worksheet?

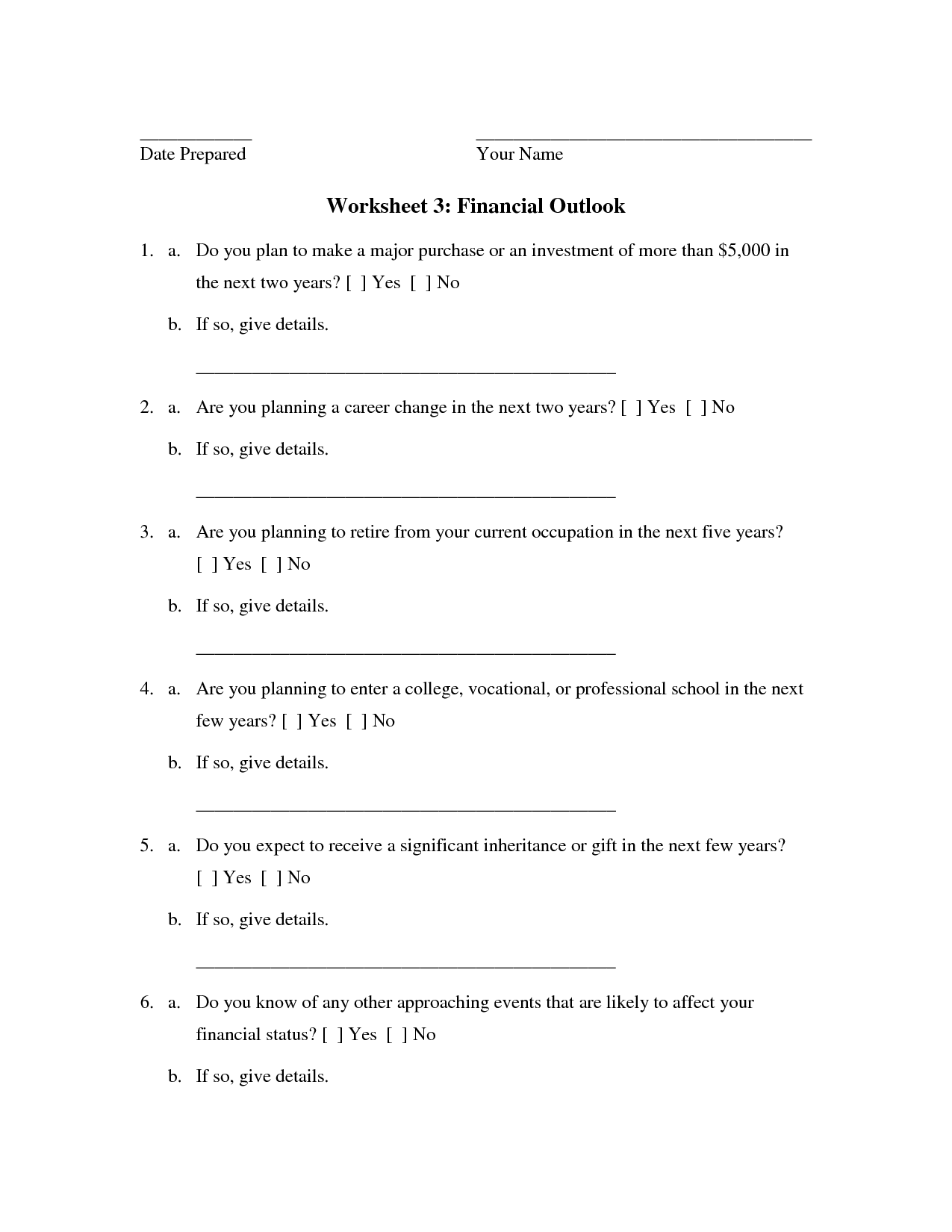

A Financial Planner Worksheet typically includes information such as a detailed list of income sources and amounts, expenses and spending habits, financial goals and objectives, assets and liabilities, investment accounts and portfolios, retirement plans, insurance coverage, tax information, and any other relevant financial details that can help the financial planner assess the client's overall financial situation and develop a personalized plan.

How can a Financial Planner Worksheet assist in setting financial goals?

A Financial Planner Worksheet can assist in setting financial goals by providing a structured framework for individuals to assess their current financial situation, clarify their financial objectives, and prioritize their goals. By documenting income, expenses, assets, and debts, individuals can gain a clear understanding of their overall financial health and identify areas for improvement. The worksheet also helps individuals define specific, measurable, achievable, relevant, and time-bound (SMART) financial goals, making it easier to create a realistic action plan for achieving those goals. Additionally, tracking progress and adjusting the plan as needed can help individuals stay motivated and focused on reaching their financial milestones.

What role does a Financial Planner Worksheet play in tracking income and expenses?

A Financial Planner Worksheet plays a crucial role in tracking income and expenses by providing a structured format to accurately document and categorize financial transactions. It helps individuals or households organize their finances, set budgetary goals, monitor cash flow, and identify areas where adjustments may be needed to improve financial health. By documenting income sources and recording expenses in a systematic manner, a Financial Planner Worksheet enables individuals to gain a holistic view of their financial situation, make informed decisions, and plan for future financial stability and growth.

How does a Financial Planner Worksheet help individuals create a budget?

A Financial Planner Worksheet helps individuals create a budget by providing a structured framework to organize and analyze their income and expenses. By inputting their financial information into the worksheet, individuals can clearly see where their money is coming from and where it is going, making it easier to identify areas where adjustments can be made to align spending with financial goals. This tool helps individuals track their expenses, set savings targets, and ultimately plan for a more secure financial future.

What are the benefits of tracking and analyzing spending habits using a Financial Planner Worksheet?

Tracking and analyzing spending habits using a Financial Planner Worksheet can provide several benefits. It helps individuals gain a clear understanding of where their money is going, identify any unnecessary expenses, and set realistic budgets. It can also highlight patterns in spending behavior, enabling individuals to make informed decisions on saving and investing. Furthermore, using a financial planner worksheet can promote accountability and discipline in managing finances, leading to better financial stability and long-term success in achieving financial goals.

How does a Financial Planner Worksheet assist in managing debt and loans?

A Financial Planner Worksheet assists in managing debt and loans by providing a clear overview of one's financial situation, including the amount of debt owed, interest rates, and monthly payments. It allows individuals to organize their debts, prioritize payoff strategies, and create a budget that allocates funds towards debt repayment. By visually mapping out their financial obligations, individuals can better track their progress, identify areas for improvement, and make informed decisions to reduce debt effectively.

How can a Financial Planner Worksheet aid in saving and investing for the future?

A Financial Planner Worksheet can aid in saving and investing for the future by helping individuals track their income, expenses, assets, and liabilities. By creating a comprehensive overview of their financial situation, individuals can identify areas where they can cut costs, increase savings, and allocate funds towards investments with the goal of growing their wealth over time. By regularly updating and reviewing the worksheet, individuals can set and track financial goals, create a budget, and make informed decisions to secure their financial future.

What are some additional features or tools that may be included in a Financial Planner Worksheet to enhance financial planning efforts?

Additional features or tools that may enhance a Financial Planner Worksheet include budgeting calculators, investment analysis tools, retirement savings projections, debt payoff calculators, tax planning tools, risk assessment questionnaires, and goal-setting trackers. These can help individuals make more informed decisions, set realistic financial targets, and track progress towards their financial goals effectively.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments