Financial Expenses Worksheet

Are you an individual or business owner seeking a practical and structured way to keep track of your financial expenses? Look no further, because our Financial Expenses Worksheet is here to help streamline this process for you. Designed with simplicity and efficiency in mind, this worksheet provides an organized and comprehensive approach to managing your expenses, eliminating the hassle of manually sorting through receipts and invoices.

Table of Images 👆

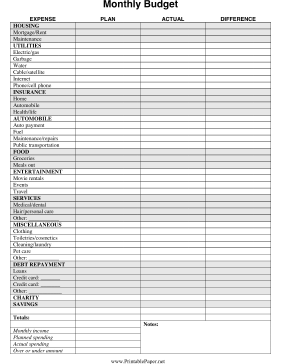

- Printable Monthly Budget Paper

- Monthly Business Expenses Worksheet Printable

- Debt Free Printable Bill Payment Sheet

- Free Printable Budget Worksheets

- Daily Food Tracker Printable

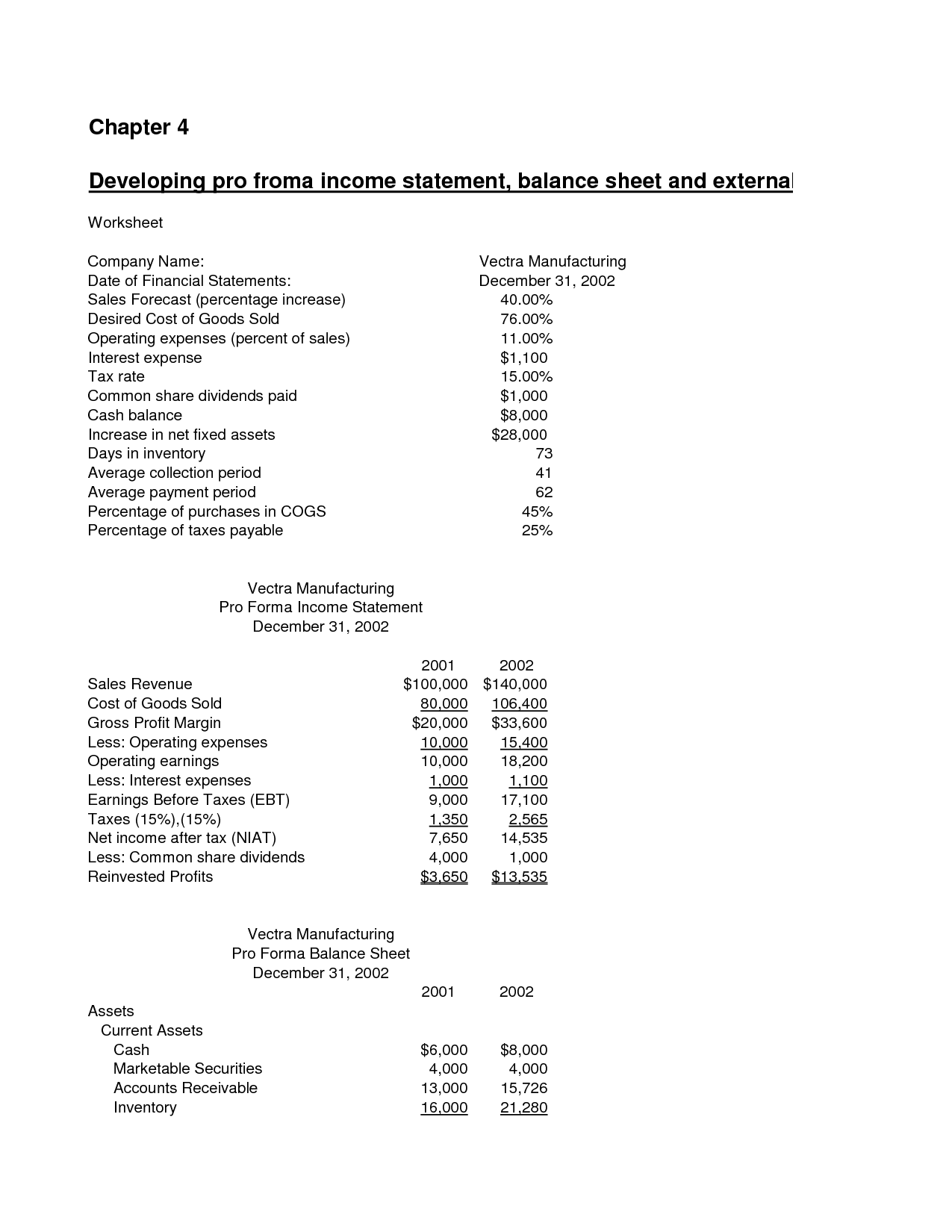

- Income Statement and Balance Sheet Worksheet

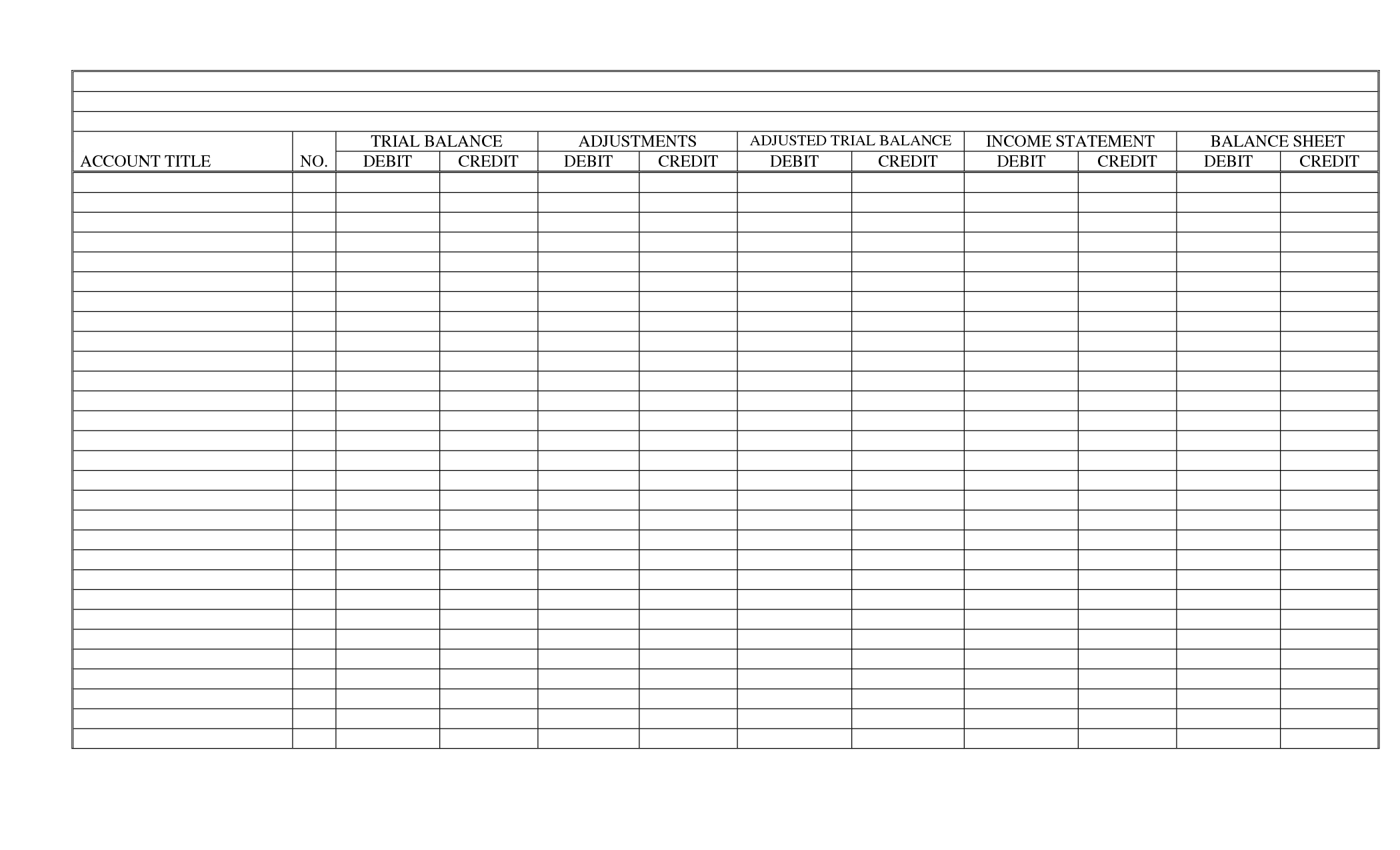

- 10 Column Worksheet Excel Template

- Monthly Spending Plan Worksheet Printable

- Prepaid Expenses On Balance Sheet

- Creole Cottage House Plans

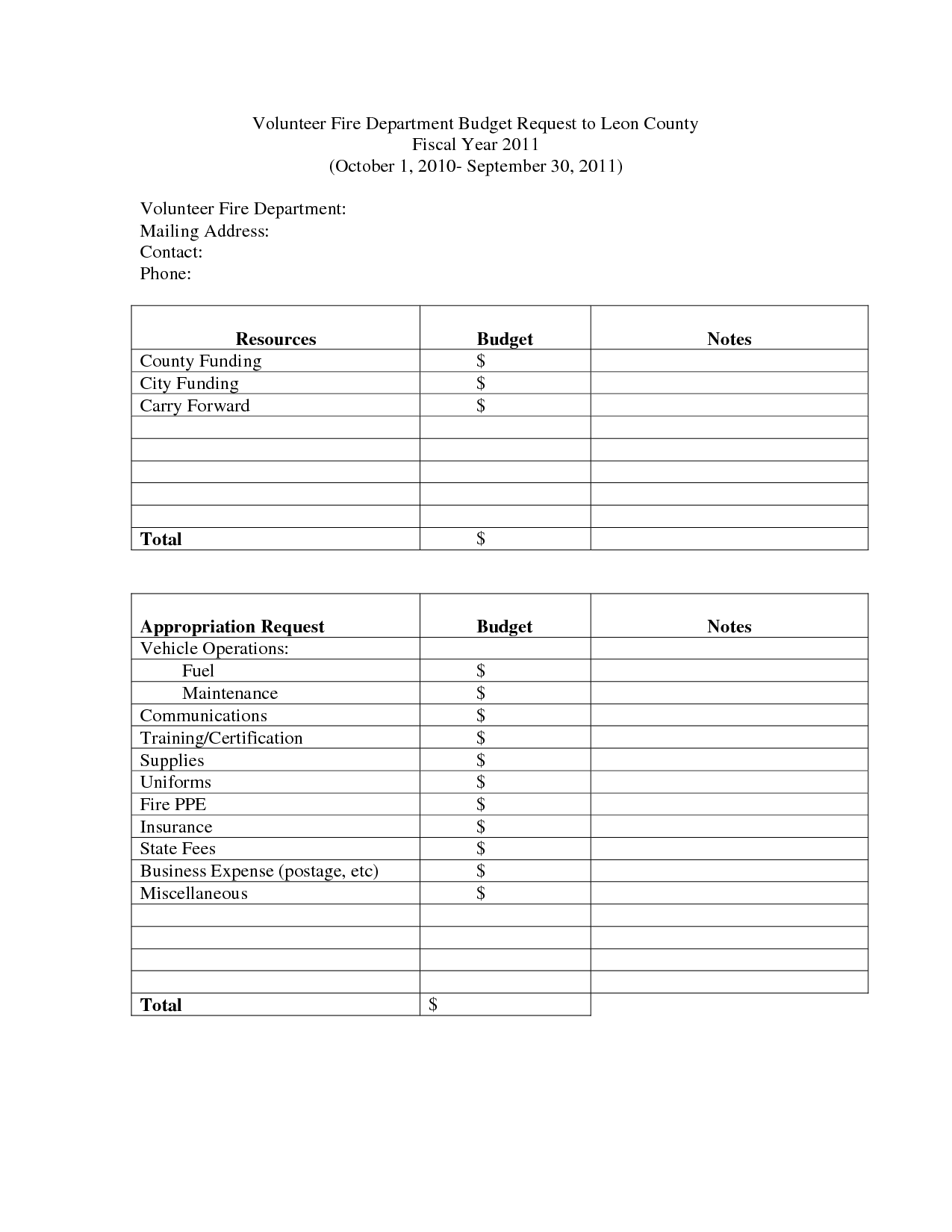

- Fire Department Budget Request Form Template

- Fire Department Budget Request Form Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a Financial Expenses Worksheet?

A Financial Expenses Worksheet is a document used to track and record all expenses related to finances. It typically includes categories such as rent/mortgage, utilities, groceries, transportation, insurance, and other necessary expenses. This worksheet helps individuals or businesses to monitor their spending, identify areas where they can reduce costs, and create a realistic budget to manage their finances effectively.

What purpose does a Financial Expenses Worksheet serve?

A Financial Expenses Worksheet serves the purpose of helping individuals or businesses track and manage their expenses effectively. It allows for organizing and categorizing expenses, creating a clear overview of where money is being spent, identifying areas for potential cost savings, and ultimately aiding in budgeting and financial planning efforts.

How can a Financial Expenses Worksheet help in budget planning?

A Financial Expenses Worksheet can help in budget planning by providing a comprehensive overview of all expenses incurred over a specific period. By itemizing and categorizing expenses, individuals can identify areas where they are overspending, make informed decisions on where to cut costs, and allocate funds more effectively. This tool allows for better tracking of expenses, aids in setting realistic budget goals, and promotes better financial discipline and awareness.

What types of financial expenses should be included on the worksheet?

When creating a financial worksheet, it is important to include all types of financial expenses such as fixed expenses (e.g. rent, utilities, insurance), variable expenses (e.g. groceries, entertainment, transportation), debt payments (e.g. credit card payments, loan payments), savings contributions, and any other necessary expenses that are regularly incurred. By including all these expenses, you can accurately assess your financial situation and create a budget that aligns with your financial goals.

What expenses are typically not included on a Financial Expenses Worksheet?

Expenses that are typically not included on a Financial Expenses Worksheet include non-financial expenses such as personal grooming, entertainment, hobbies, and other discretionary spending. Additionally, expenses related to long-term investments or savings goals, such as retirement contributions or college funds, may not be captured on a standard Financial Expenses Worksheet. It's important to understand the distinctions between essential and non-essential expenses when creating a budget or financial plan.

How often should a Financial Expenses Worksheet be updated?

A Financial Expenses Worksheet should ideally be updated regularly, such as monthly or quarterly, to accurately track and monitor expenses. This allows individuals or businesses to stay informed about their financial health, identify trends, and make informed decisions. Regular updates help ensure that the worksheet remains current and reflective of the most recent financial activities.

What information should be recorded for each expense on the worksheet?

For each expense on the worksheet, important information that should be recorded includes the date of the expense, a brief description or purpose of the expense, the amount spent, the method of payment, and any applicable category or account code. This information helps to accurately track and categorize expenses for budgeting, financial reporting, and decision-making purposes.

How can a Financial Expenses Worksheet help in identifying areas of unnecessary spending?

A Financial Expenses Worksheet can help in identifying areas of unnecessary spending by clearly laying out all expenses in one place, allowing individuals to see their spending habits at a glance. By categorizing and totaling expenses, individuals can easily pinpoint areas where money is being spent unnecessarily or on nonessential items. This visual representation can act as a wake-up call, prompting individuals to make more informed decisions and cut back on unnecessary expenses in order to improve their overall financial health.

Can a Financial Expenses Worksheet be used for both personal and business finances?

While a Financial Expenses Worksheet can technically be used for both personal and business finances, it is generally recommended to have separate worksheets for each to ensure better organization and clarity. Mixing personal and business expenses on the same worksheet can lead to confusion and inaccuracies in tracking financial activities. It is best practice to maintain separate records for personal and business expenses to maintain a clear overview of each and to simplify financial management.

Are there any tools or templates available to assist in creating a Financial Expenses Worksheet?

Yes, there are various tools and templates available online to help you create a Financial Expenses Worksheet. You can find free templates in Excel, Google Sheets, or other budgeting apps that can be customized to track your expenses, categorize spending, and monitor your financial health. Additionally, many personal finance websites and apps offer expense tracking features that can help you create and maintain a detailed financial expenses worksheet.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments