Excel Credit Card Worksheet

Are you searching for a reliable and user-friendly tool to keep track of your credit card expenses? Look no further! The Excel Credit Card Worksheet is designed to provide individuals with an efficient and practical way to manage their financial transactions. With this worksheet, you can easily track your purchases, payments, and balances, allowing you to stay on top of your credit card finances with ease and accuracy.

Table of Images 👆

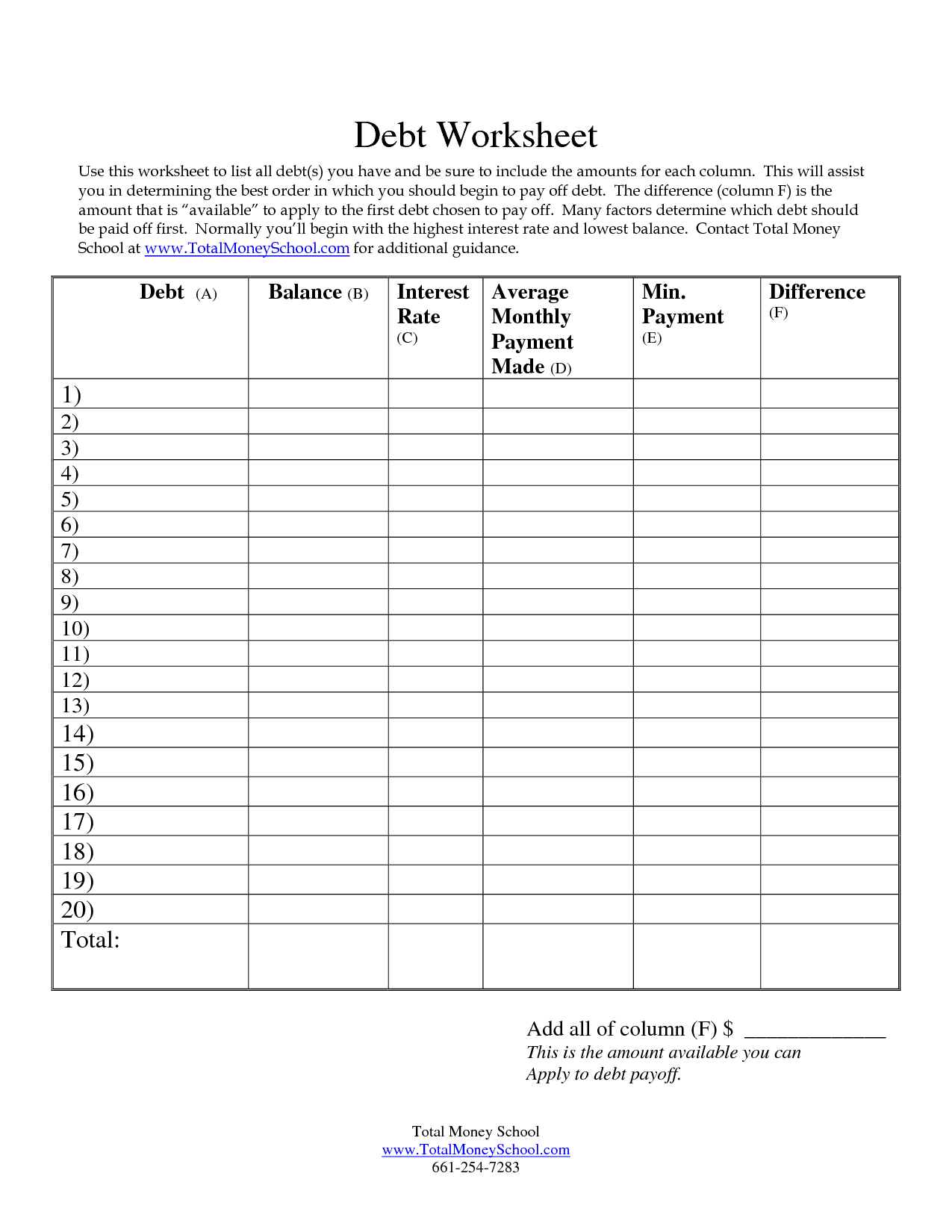

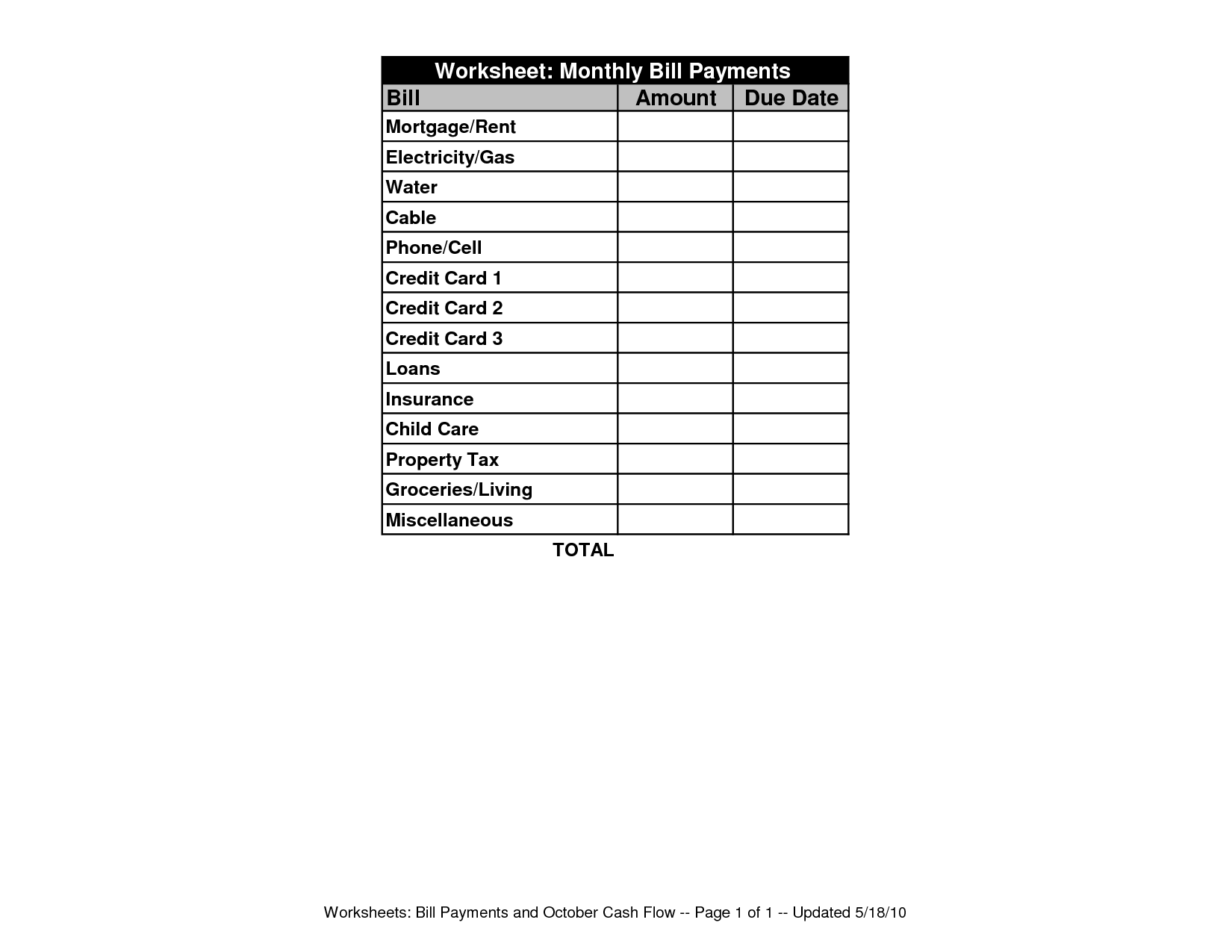

- Debt Free Printable Bill Payment Sheet

- Printable Credit Card Worksheet

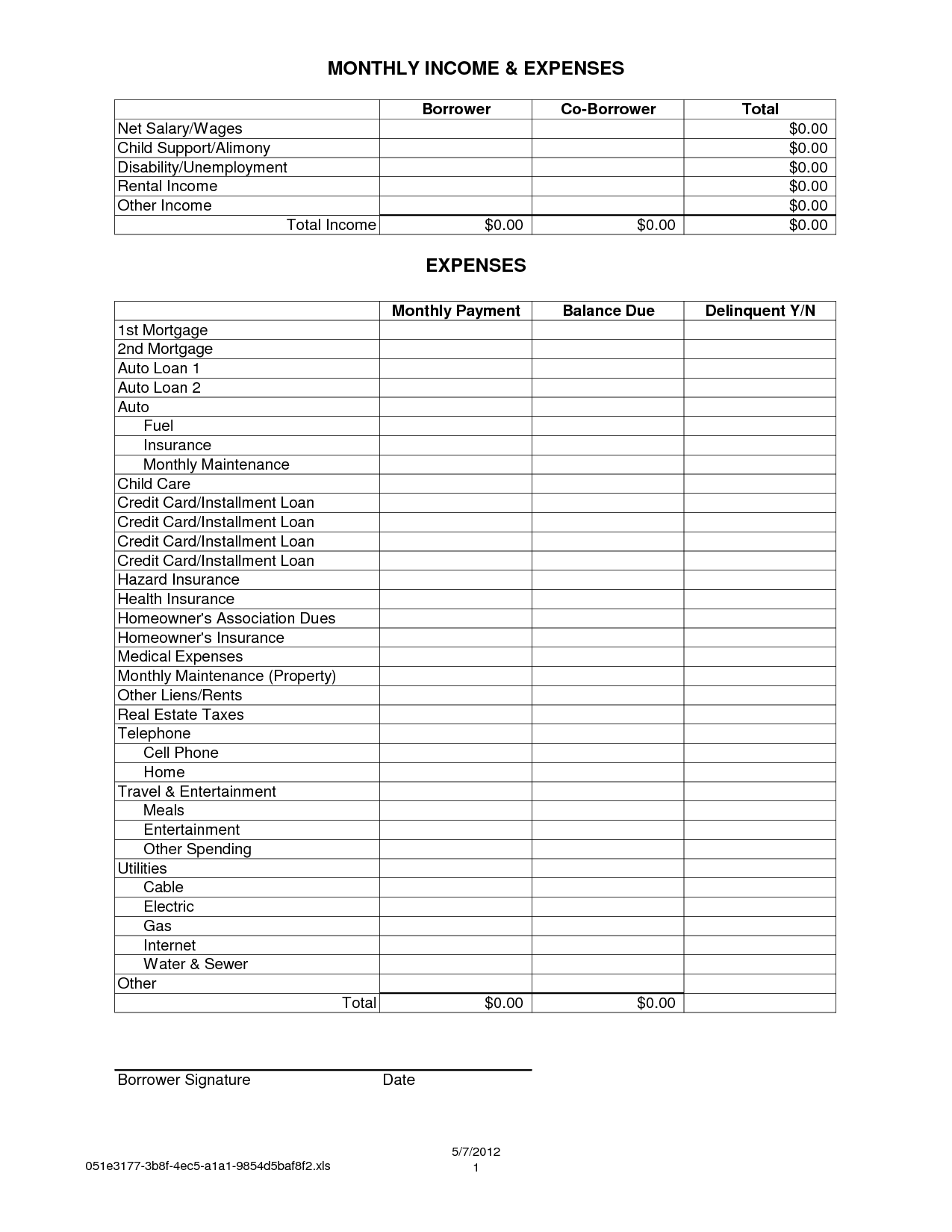

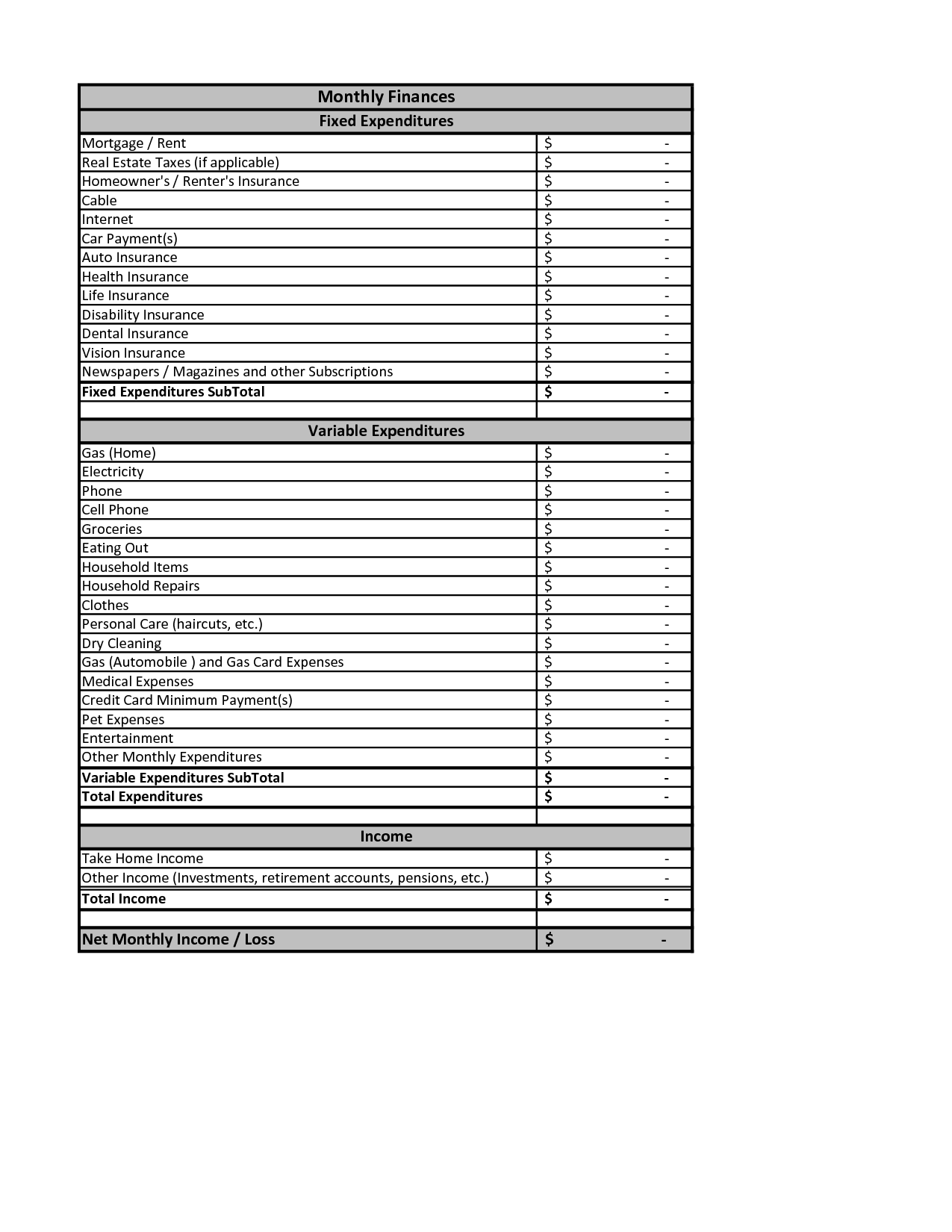

- Monthly Income Expense Worksheet Template

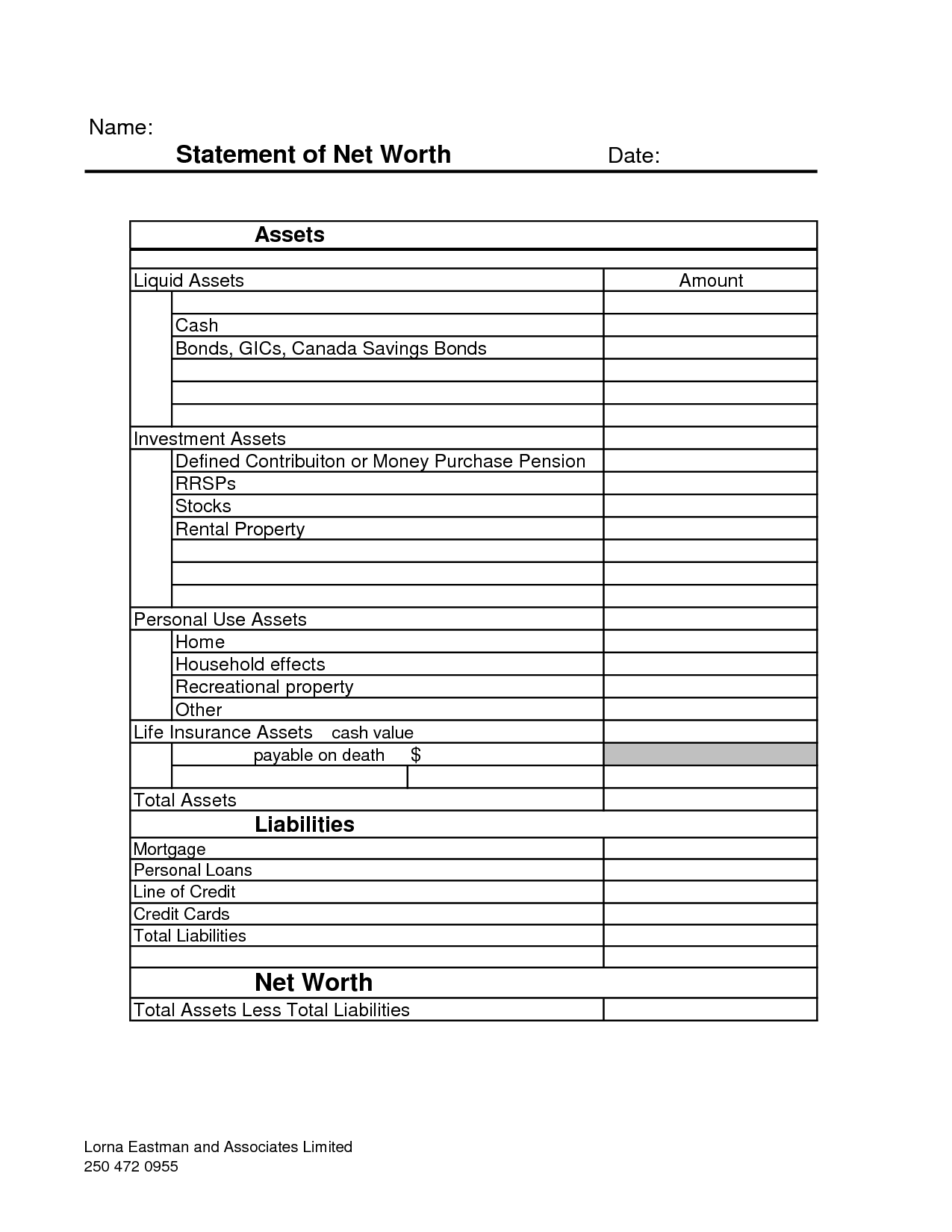

- Net Worth Statement Worksheet

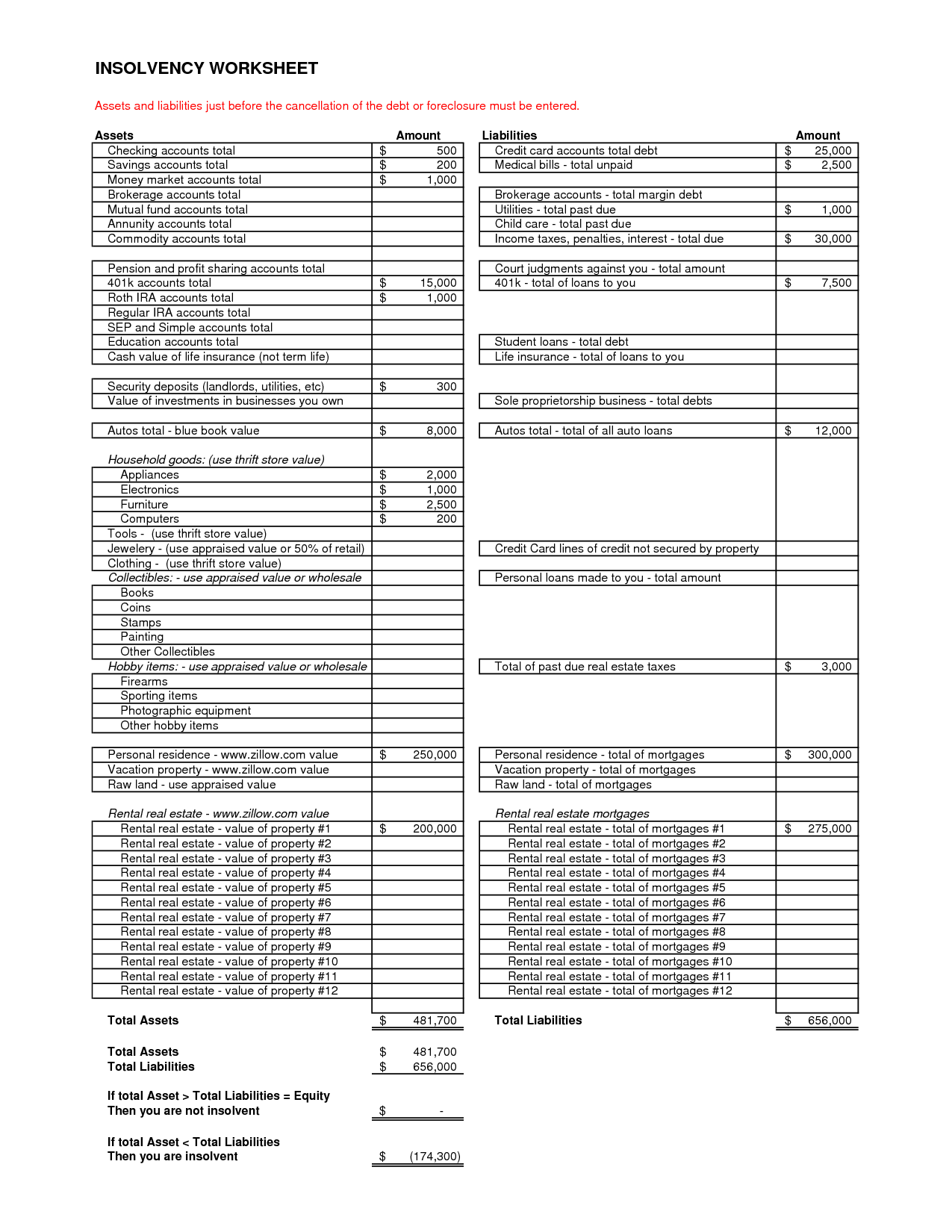

- Excel Assets and Liabilities Worksheet

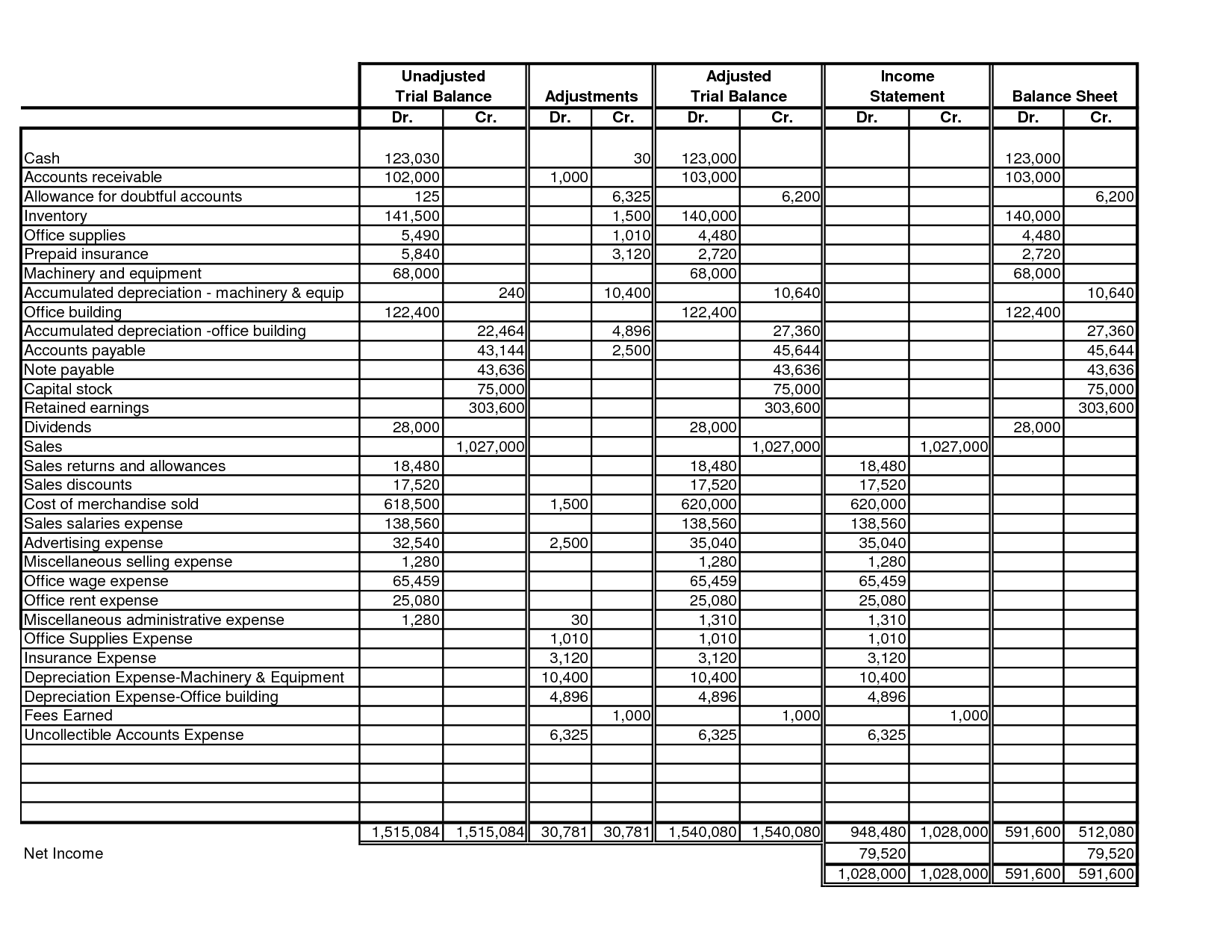

- Trial Balance Worksheet Template

- Free Printable Meal Sign Up Sheet

- Personal Financial Worksheet

- Monthly Income Expense Worksheet

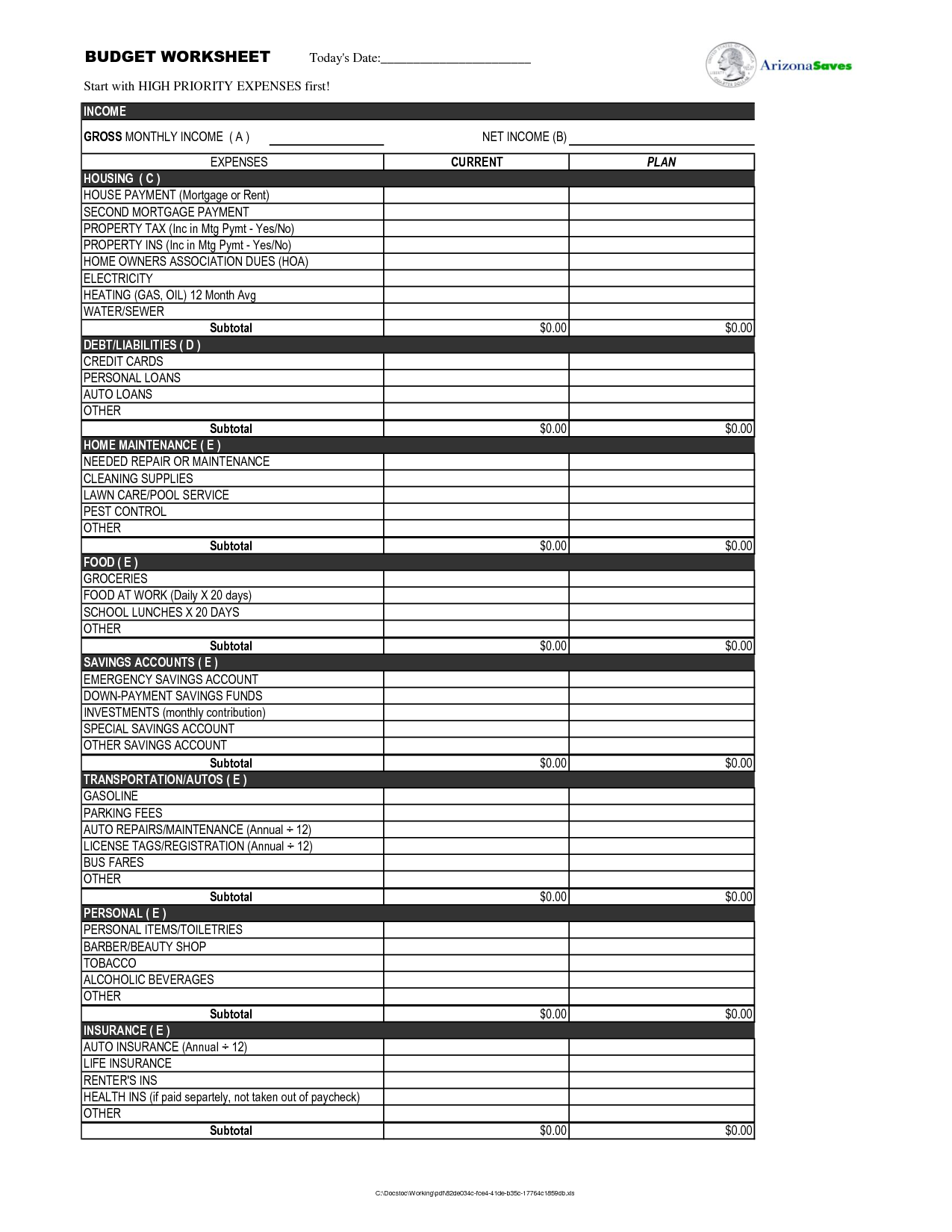

- Microsoft Excel Budget Spreadsheet Template

- Monthly Bill Organizer Template

- Credit Card Account Tracker Printable

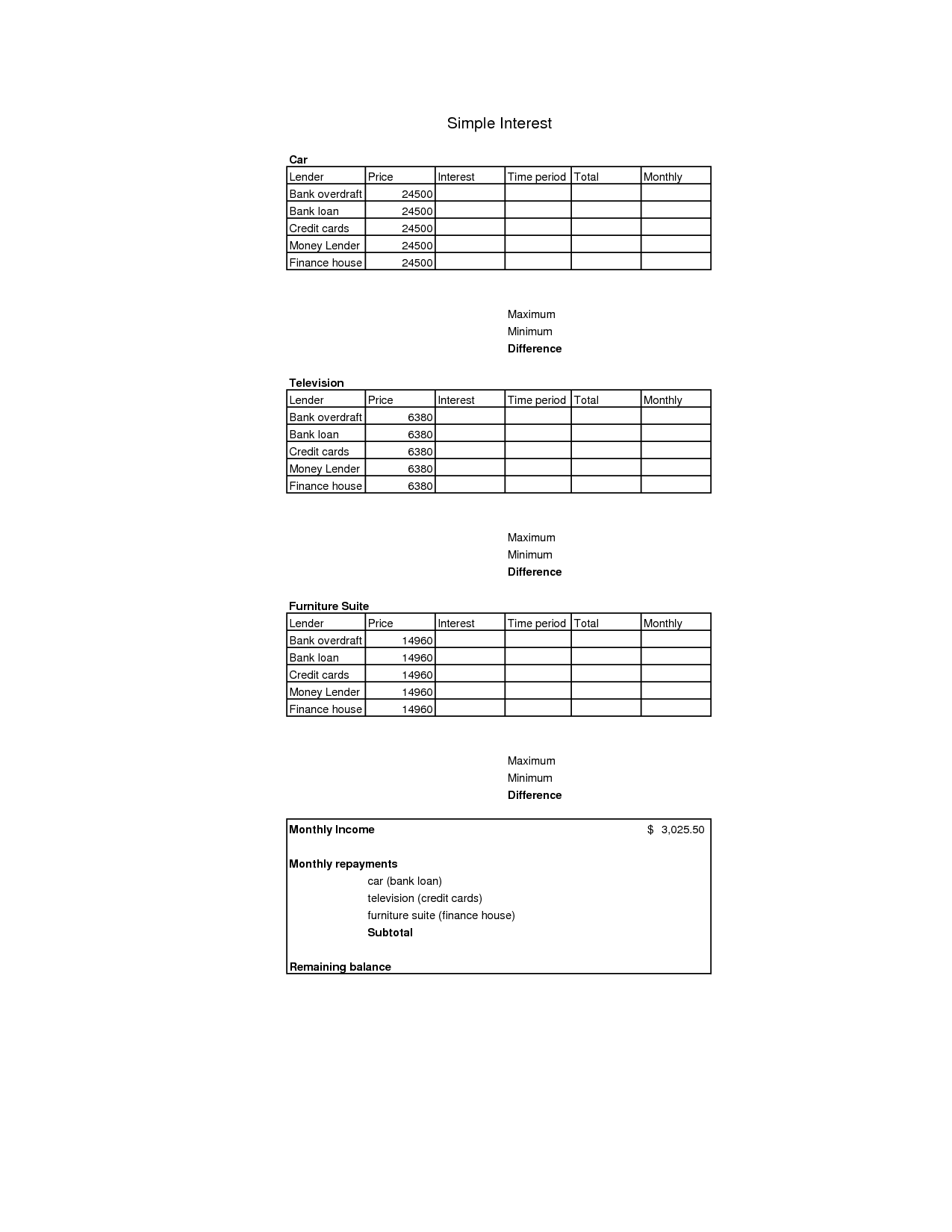

- Simple-Interest Math Worksheets

- Credit Card Worksheet Template

- Monthly Bill Payment Worksheet Excel

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

What is the purpose of an Excel Credit Card Worksheet?

The purpose of an Excel Credit Card Worksheet is to track and manage credit card transactions, balances, payments, and other related financial information in a structured and organized manner. It can help individuals or businesses better understand their spending habits, monitor their credit card debt, create budgets, and make informed financial decisions based on the data tracked within the worksheet.

How do you create a new worksheet in Excel?

To create a new worksheet in Excel, simply click on the "+" icon located next to the existing worksheet tabs at the bottom of the Excel window. Alternatively, you can also right-click on an existing worksheet tab and select "Insert" to add a new worksheet.

Can you customize the layout of the worksheet?

Yes, you can customize the layout of a worksheet by changing the column width, row height, adding grids, borders, colors, and merging cells. Additionally, you can insert headers, footers, and pictures to customize the appearance of the worksheet according to your preferences.

How do you input credit card transactions into the worksheet?

To input credit card transactions into a worksheet, you can create a column for the date, description of the transaction, amount, and any additional relevant details. For each transaction, enter the corresponding information into the appropriate cells in the worksheet. Ensure accuracy by double-checking the information before finalizing the entries. Summarize the total credit card transactions at the end of the worksheet to keep track of your financial records effectively.

Does the worksheet automatically calculate totals and balances?

Yes, the worksheet automatically calculates totals and balances based on the formulas and functions you input into the cells. This can help you quickly analyze and organize data without having to manually compute figures.

Can you track multiple credit cards on the same worksheet?

Yes, you can track multiple credit cards on the same worksheet by creating separate sections or tables for each credit card. Label each section clearly with the name of the credit card to easily differentiate between them. Input the relevant information such as balance, due date, minimum payment, and transaction details in their designated sections to keep track of each credit card effectively. Remember to update information regularly to maintain accurate records.

Are there built-in functions or formulas for credit card calculations?

Yes, many programming languages and financial software provide built-in functions or libraries for credit card calculations, such as validating card numbers, calculating check digits, checking expiration dates, and performing other related operations. These functions can help developers to efficiently handle credit card information securely and accurately in their applications.

How do you categorize expenses on the worksheet?

To categorize expenses on a worksheet, you can create different columns or sections for each category of expenses such as "Utilities," "Rent," "Groceries," "Transportation," and "Entertainment." Record the amount spent under the respective category to easily track and analyze your spending habits. This organization helps you have a clear overview of where your money is going and enables you to effectively budget and manage your finances.

Can you generate reports or summaries based on the credit card transactions?

Yes, I can generate reports or summaries based on credit card transactions. By analyzing and organizing transaction data, I can create detailed reports that provide insights into spending patterns, expenses, trends, and more, helping you to track and manage your finances effectively. Just provide me with the necessary information and criteria, and I can generate customized reports to meet your specific needs.

Is it possible to password protect the worksheet for security?

Yes, it is possible to password protect a worksheet for security purposes in programs like Microsoft Excel. This feature allows you to restrict access to the worksheet by setting a password that needs to be entered in order to view or modify the contents. This can help prevent unauthorized users from accessing or making changes to sensitive data within the worksheet.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments