Discount Point Worksheet

Are you a homeowner who is looking to lower their monthly mortgage payments? If so, you may be interested in using a discount point worksheet to help determine if this option is right for you.

Table of Images 👆

- Oral Presentation Rubric Elementary

- Sample College Essay Outline

- Character Analysis Essay Outline

- Great Depression New Deal Cartoons

- Basic English Grammar Worksheets

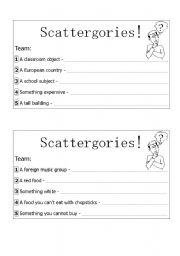

- Printable Scattergories Lists 1

- Spanish Comparative and Superlatives Quiz

- 5th Grade Worksheets

- 5th Grade Worksheets

- 5th Grade Worksheets

- 5th Grade Worksheets

- 5th Grade Worksheets

- 5th Grade Worksheets

- 5th Grade Worksheets

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a Discount Point Worksheet?

A Discount Point Worksheet is a form used by lenders to outline the cost and benefits of purchasing discount points to lower the interest rate on a mortgage. The worksheet typically includes information such as the loan amount, interest rate, potential savings over time with discount points, and the break-even point where the savings from lower monthly payments surpass the upfront cost of purchasing the points. This worksheet helps borrowers make an informed decision about whether buying discount points makes financial sense for their individual situation.

How is a Discount Point Worksheet used in the mortgage industry?

A Discount Point Worksheet is used in the mortgage industry to help calculate the costs and savings associated with paying discount points at the time of closing on a mortgage loan. Discount points are fees that can be paid upfront to lower the interest rate on the loan. The worksheet shows the impact of paying discount points on the overall cost of the loan over time, helping borrowers make an informed decision on whether paying points is beneficial based on their financial situation and how long they plan to hold the mortgage.

What information is typically included on a Discount Point Worksheet?

A Discount Point Worksheet typically includes details such as the loan amount, interest rate, number of discount points paid or to be paid, cost of each discount point, total cost of discount points, and the resulting interest rate after purchasing discount points. It is used to help borrowers assess the potential benefits of paying discount points to lower their interest rate.

How does a Discount Point Worksheet calculate the cost of discount points?

A Discount Point Worksheet calculates the cost of discount points by multiplying the loan amount by the discount point percentage. This calculation gives the total cost of the discount points, which is added to the closing costs to determine the borrower's total upfront costs for purchasing discount points to lower the interest rate on their mortgage.

What are discount points, and how do they affect the interest rate on a mortgage?

Discount points are fees paid upfront to a lender at closing in exchange for a lower interest rate on a mortgage. Each discount point typically costs 1% of the loan amount and can lower the interest rate by a certain percentage, usually 0.25%. By paying for discount points, borrowers can reduce their monthly mortgage payments over the life of the loan. It's important for borrowers to calculate whether paying discount points upfront makes financial sense based on how long they plan to stay in the home in order to cover the upfront cost with the savings from the lower interest rate.

Can discount points be tax-deductible, and how is this information included in the worksheet?

Yes, discount points may be tax-deductible as mortgage interest on your primary residence. The deduction for discount points is pro-rated over the life of the mortgage. To include this information in the worksheet, you would typically input the amount of discount points paid at closing in the section for deductible mortgage interest expenses. This would be reported on IRS Form 1098 provided by your lender for tax reporting purposes.

Are discount points always beneficial for borrowers, or are there situations when they may not be worthwhile?

Discount points can be beneficial for borrowers by lowering the interest rate on their mortgage, resulting in lower monthly payments over the life of the loan. However, whether discount points are worthwhile depends on individual circumstances such as how long the borrower plans to stay in the home. If a borrower intends to sell or refinance the home in the near future, paying discount points may not be worth it as they may not recoup the upfront costs through interest savings. It is important for borrowers to carefully consider their financial goals and calculate the break-even point to determine if discount points are a good option for them.

Are there any restrictions or limitations on the number of discount points a borrower can purchase?

Yes, there may be restrictions or limitations on the number of discount points a borrower can purchase. Lenders may have their own policies or guidelines on the maximum number of discount points that can be purchased, and loan programs or regulations may also have specific limits in place. It's important for borrowers to discuss this with their lender and review their loan documents to understand any restrictions or limitations on purchasing discount points.

Can a borrower change their decision on purchasing discount points after completing the worksheet?

Yes, a borrower can change their decision on purchasing discount points after completing the worksheet. The decision to purchase discount points is typically made based on the costs and potential savings calculated in the worksheet, but the borrower is not obligated to proceed with purchasing discount points if they change their mind. They may decide to reconsider based on their financial situation or other factors, and can inform their lender of their decision before finalizing the mortgage.

How does a Discount Point Worksheet help borrowers make informed decisions about their mortgage financing options?

A Discount Point Worksheet helps borrowers make informed decisions about their mortgage financing options by providing a detailed breakdown of the costs and benefits associated with buying down the interest rate on their loan. By looking at the potential savings over time versus the upfront cost of purchasing discount points, borrowers can evaluate whether the investment aligns with their financial goals and timeline for homeownership. This information allows borrowers to compare different scenarios and choose the option that best suits their specific needs and budget, ultimately helping them make a more informed decision about their mortgage financing.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments