Dental Insurance Worksheet

A dental insurance worksheet is a useful tool that can help individuals and families make the most of their dental coverage. By providing a clear breakdown of the covered services, copayments, deductibles, and annual maximums, the worksheet helps users understand their insurance benefits and plan their dental treatments accordingly. Whether you're a dental professional looking to educate your patients about their insurance coverage or an individual wanting to maximize your dental benefits, a dental insurance worksheet is a valuable resource to have.

Table of Images 👆

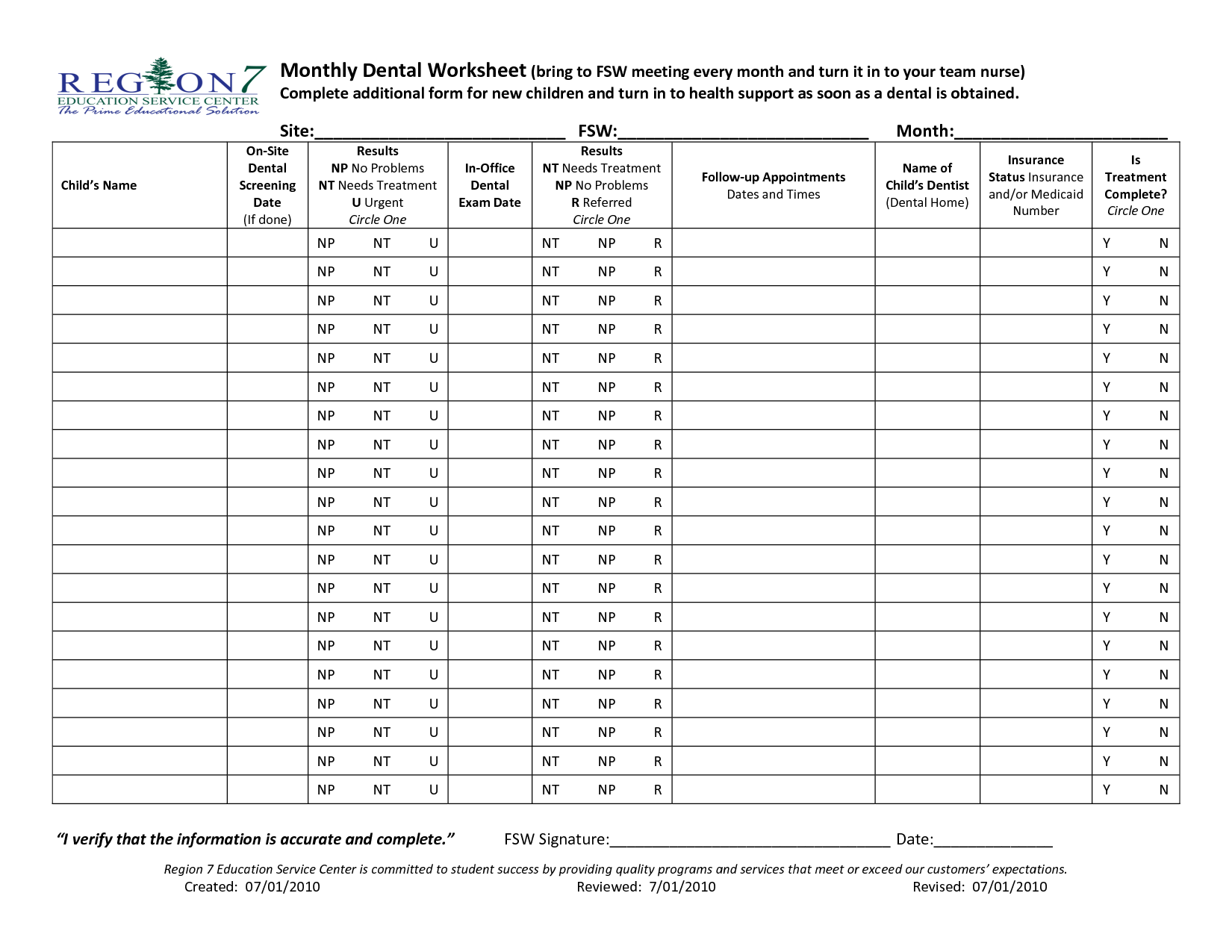

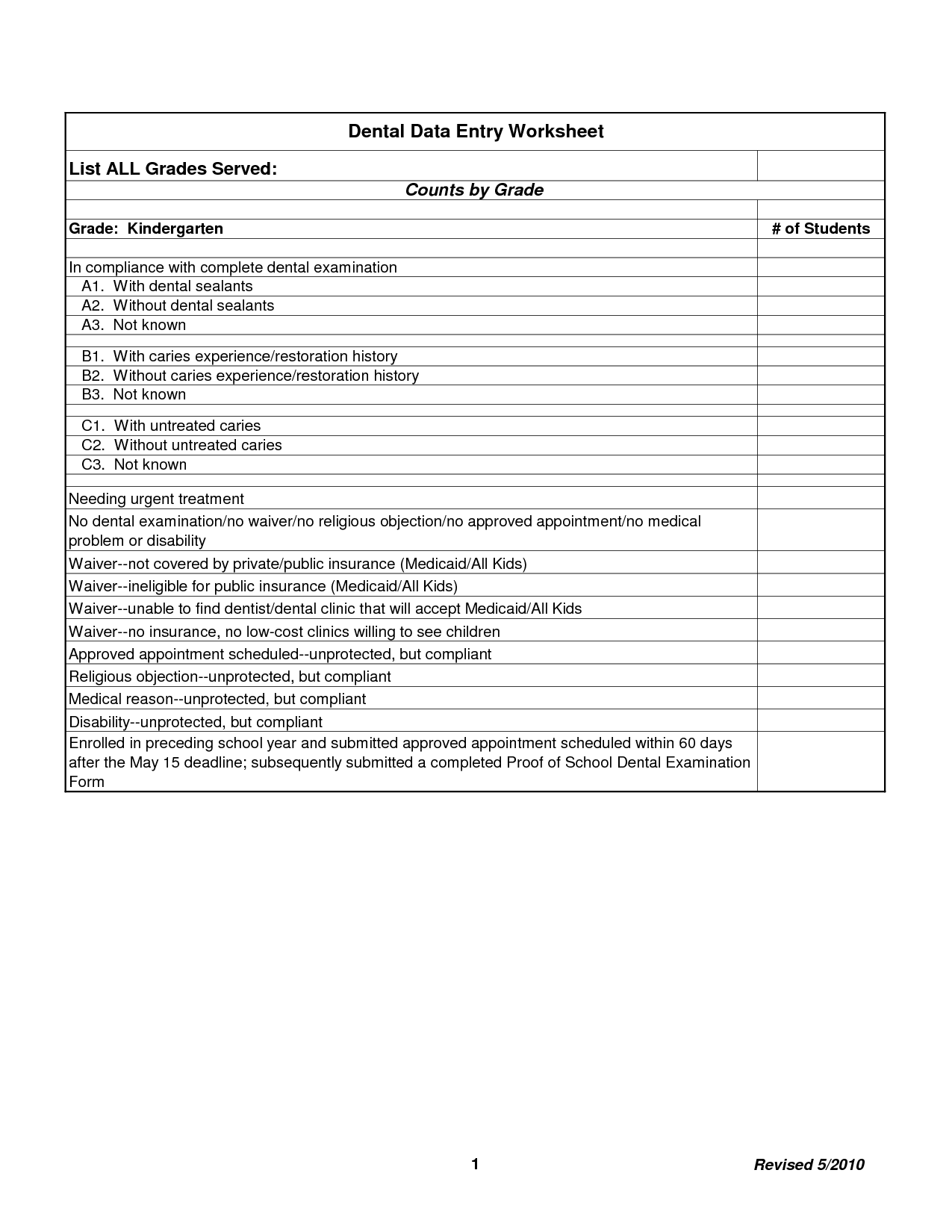

- Dental Health Printable Worksheets

- Dental Treatment Worksheet

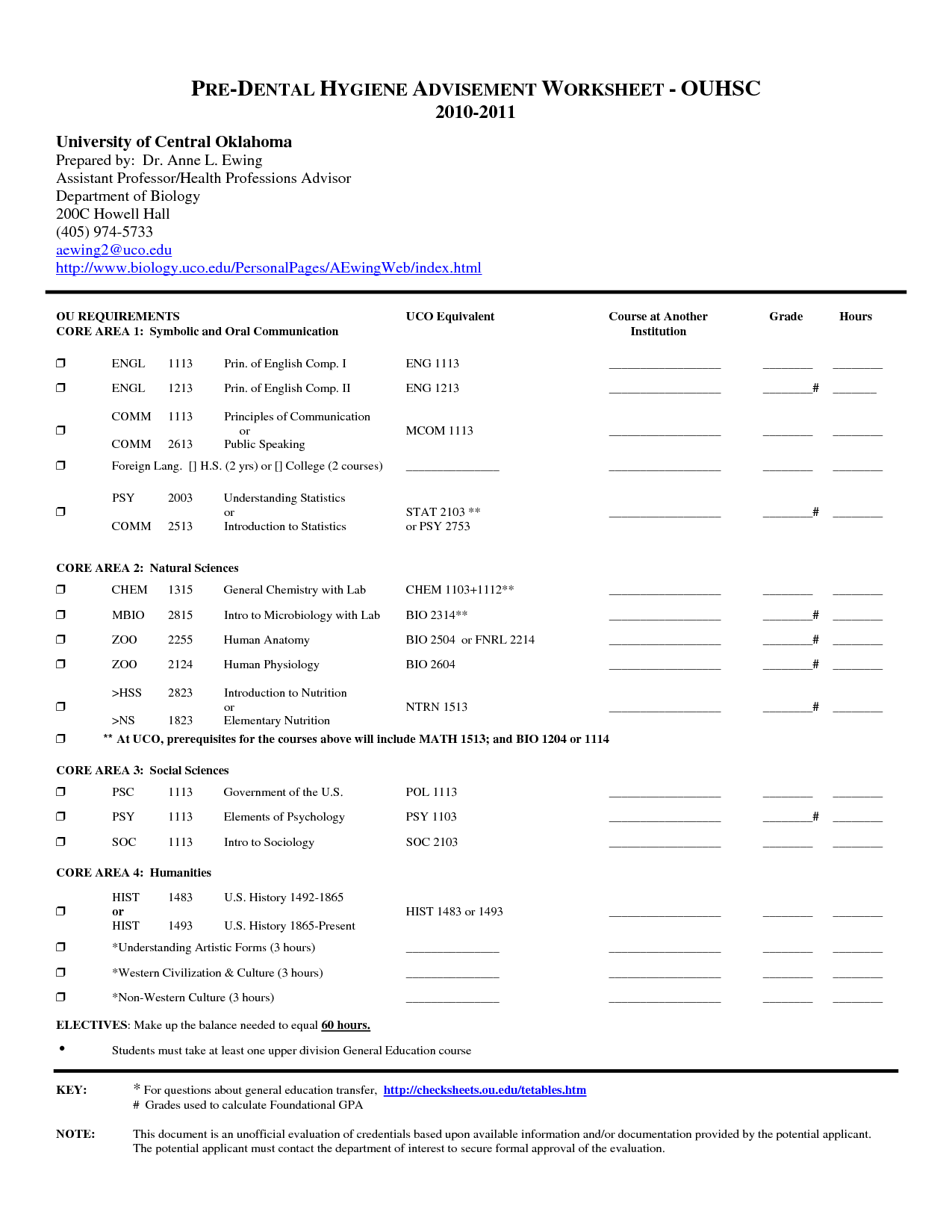

- Dental Hygiene Worksheet Printable

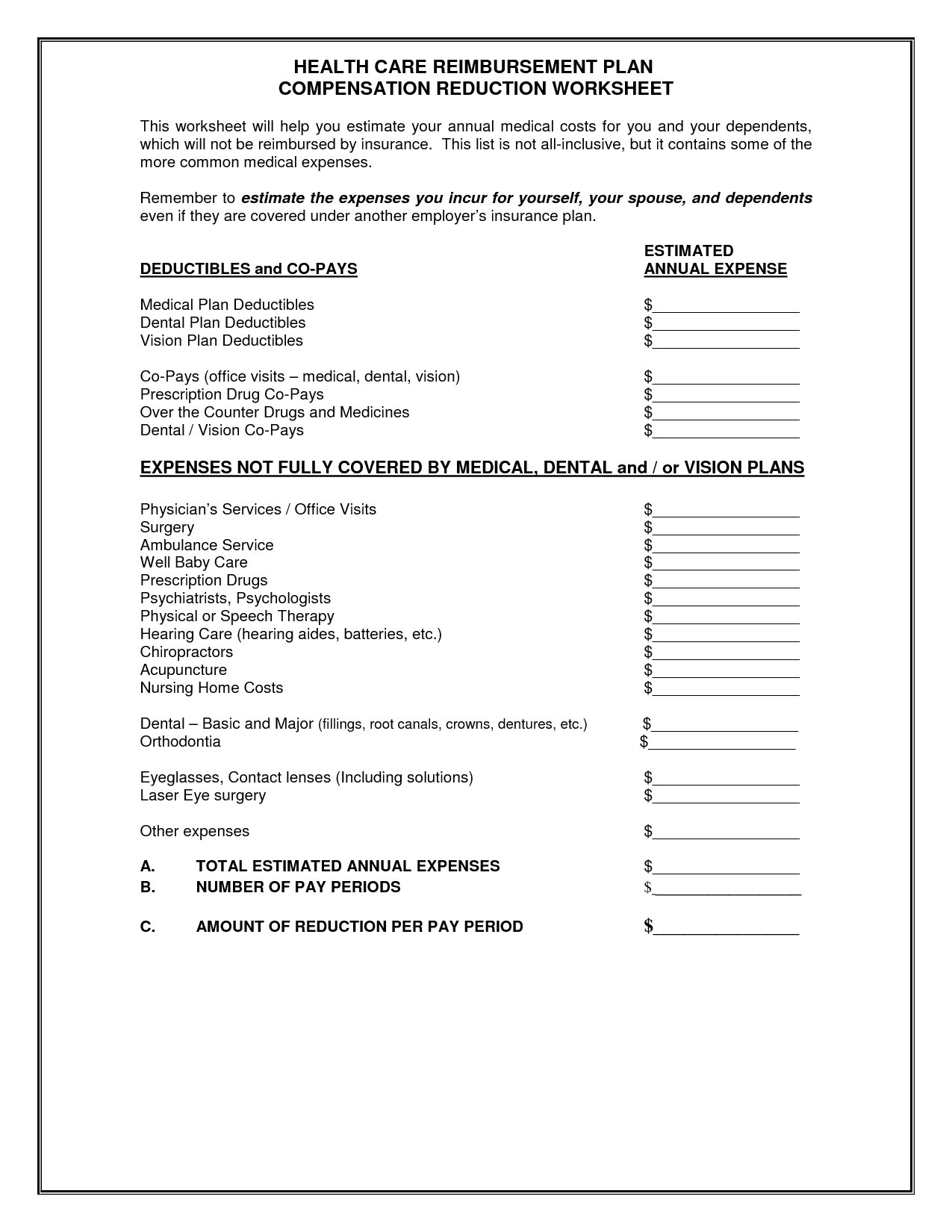

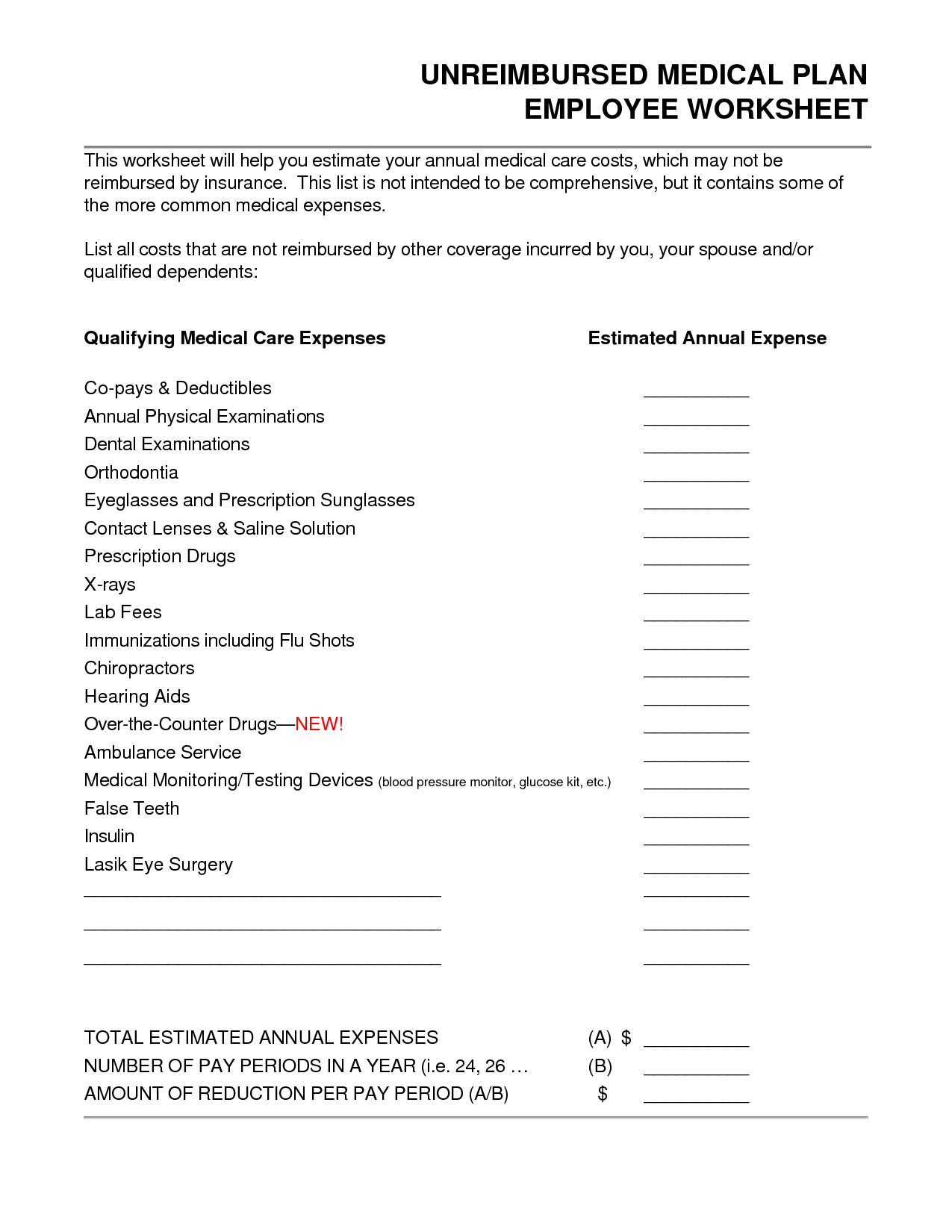

- Plans Health Care Reimbursements

- Printable Dental Worksheets

- Marijuana Education Worksheet

- Dental Care Worksheets for Kids

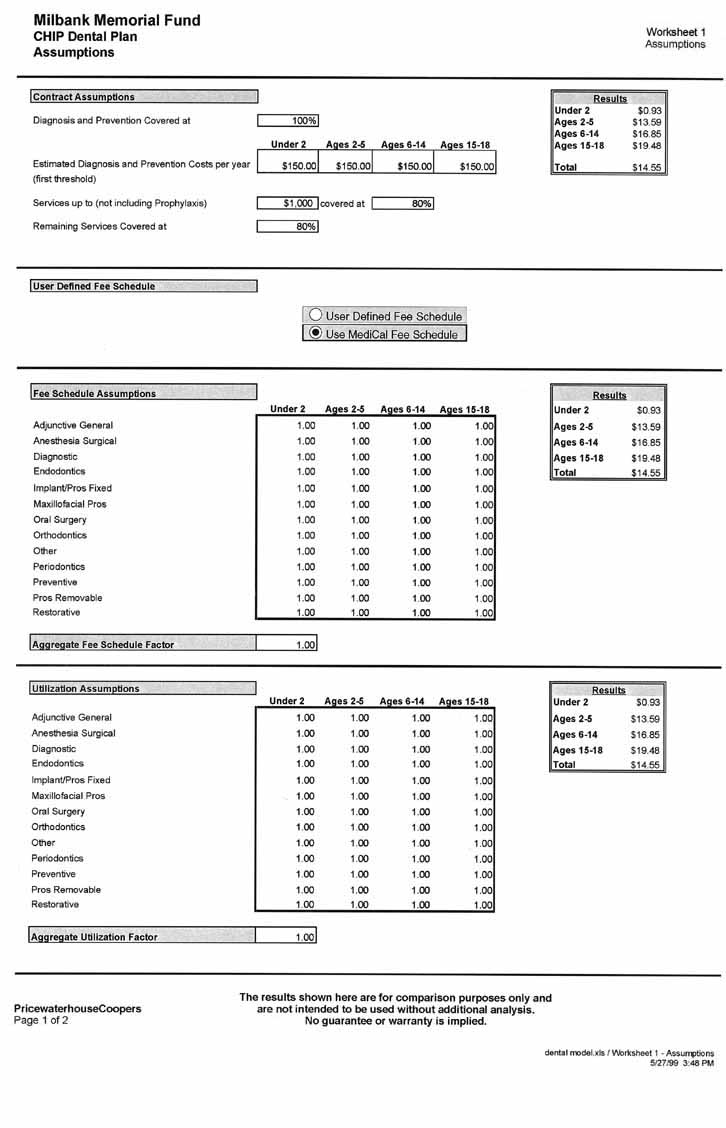

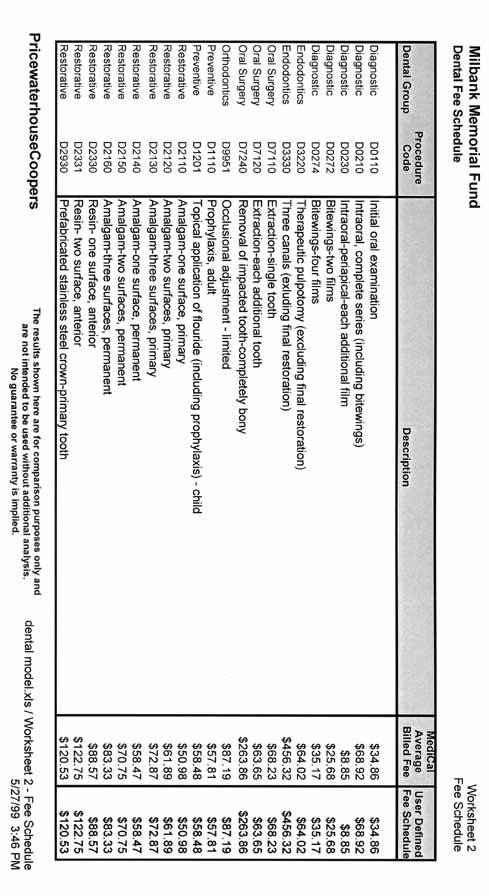

- Dental Fee Schedule

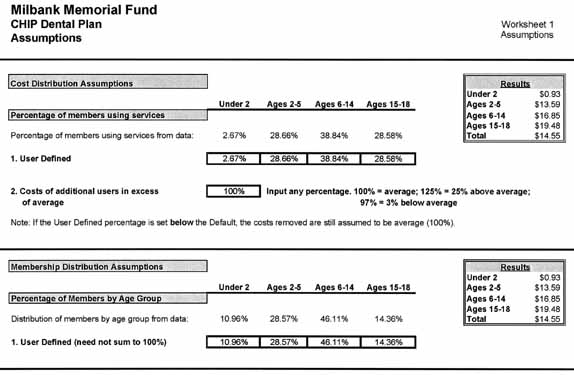

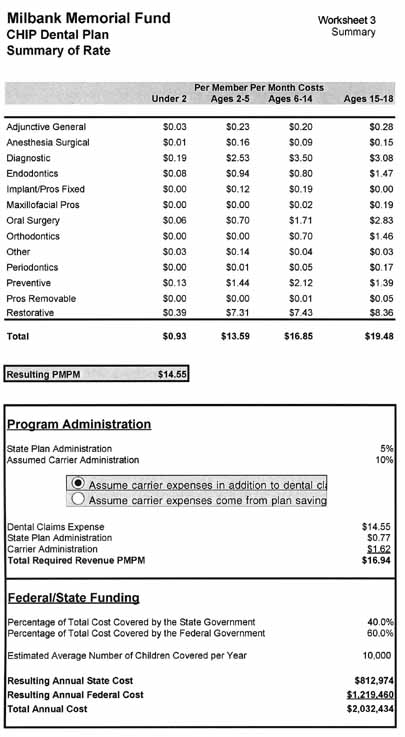

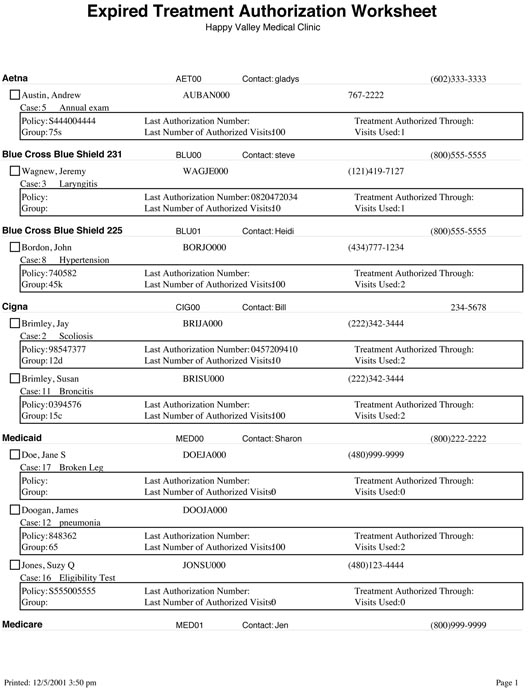

- Insurance Summary Worksheet

- Dental Assistant Worksheets

- Dental Patient Treatment Plan Forms

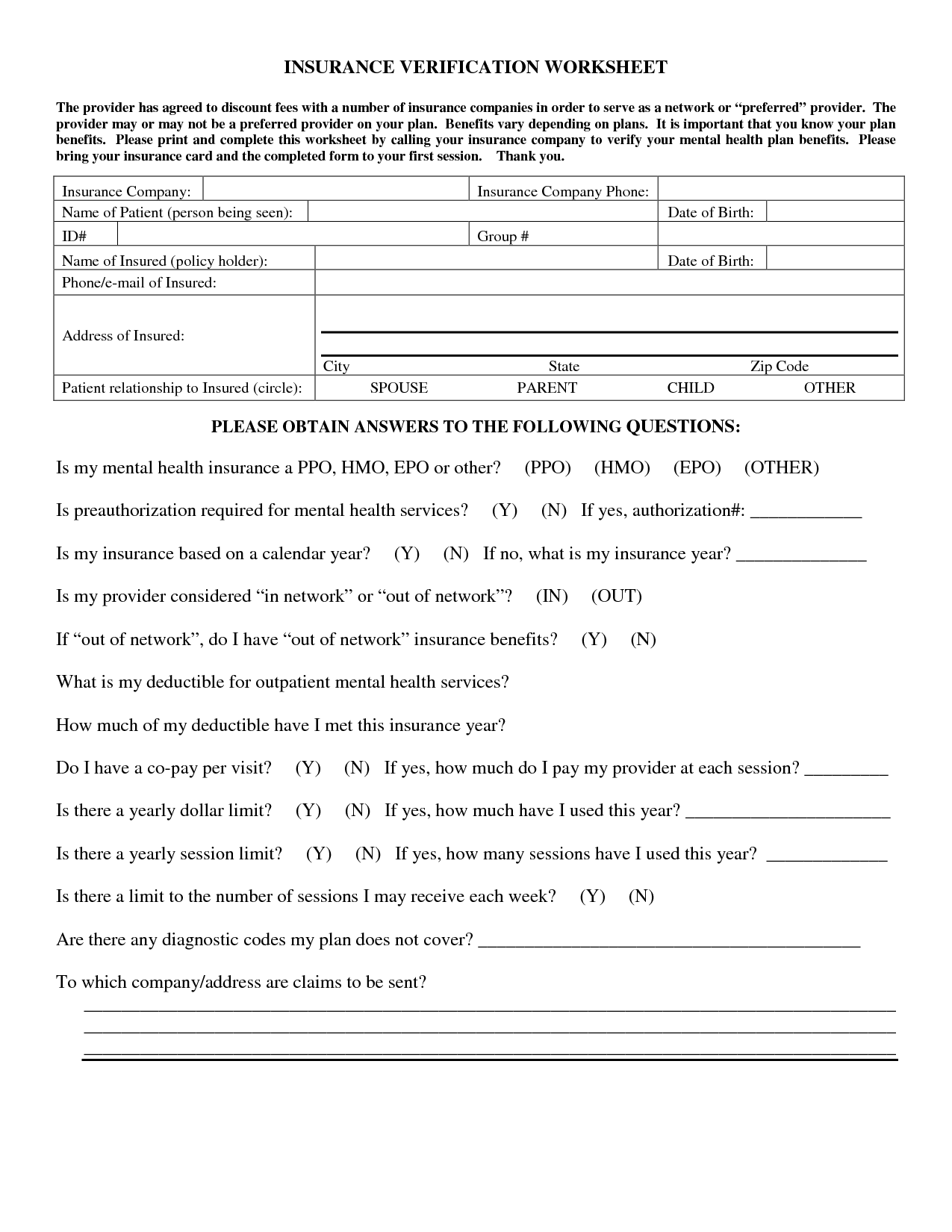

- Insurance Verification Form

- Patient Care Report Worksheet

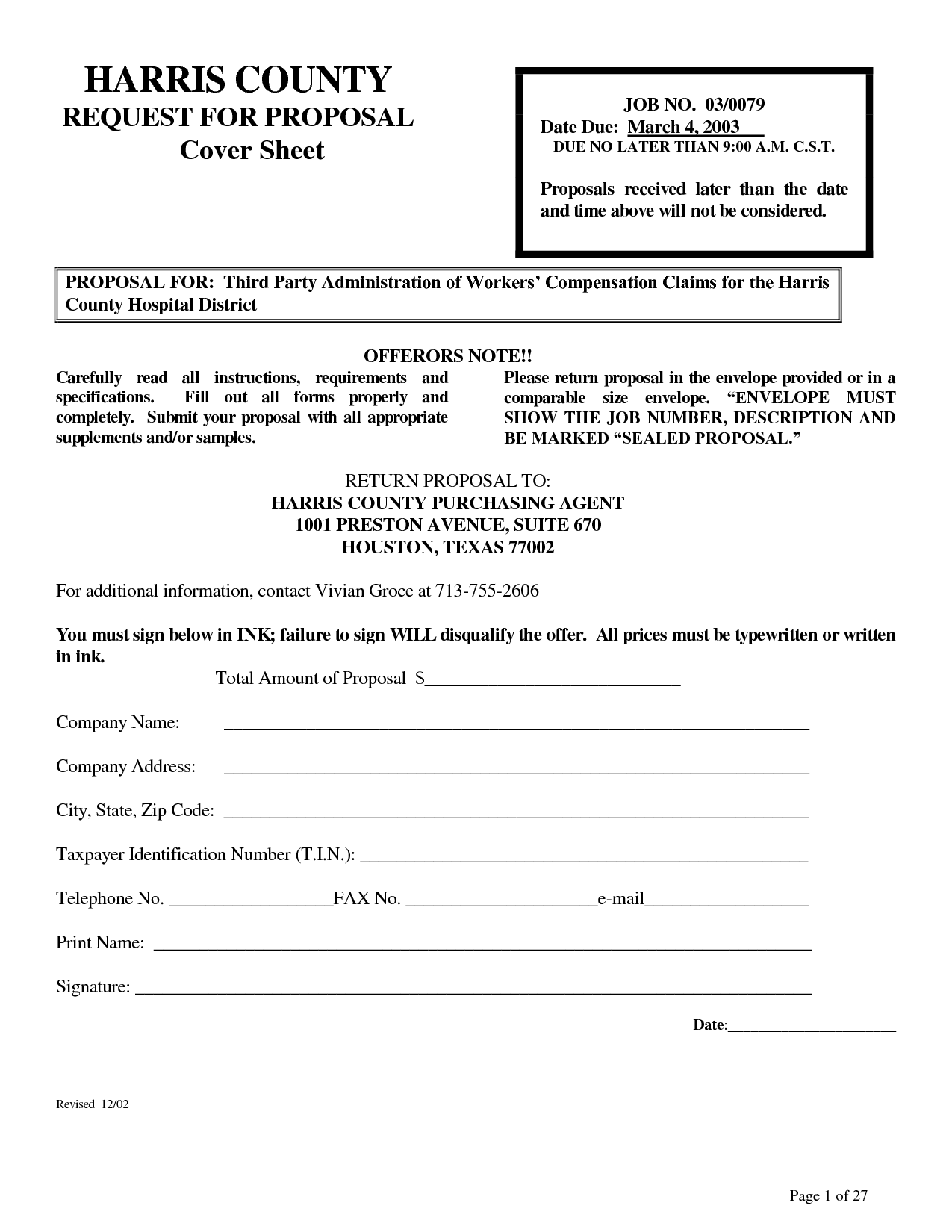

- Sample Insurance Proposal Template

- Business Interruption Insurance Worksheet

- Delta Dental Fee Schedule

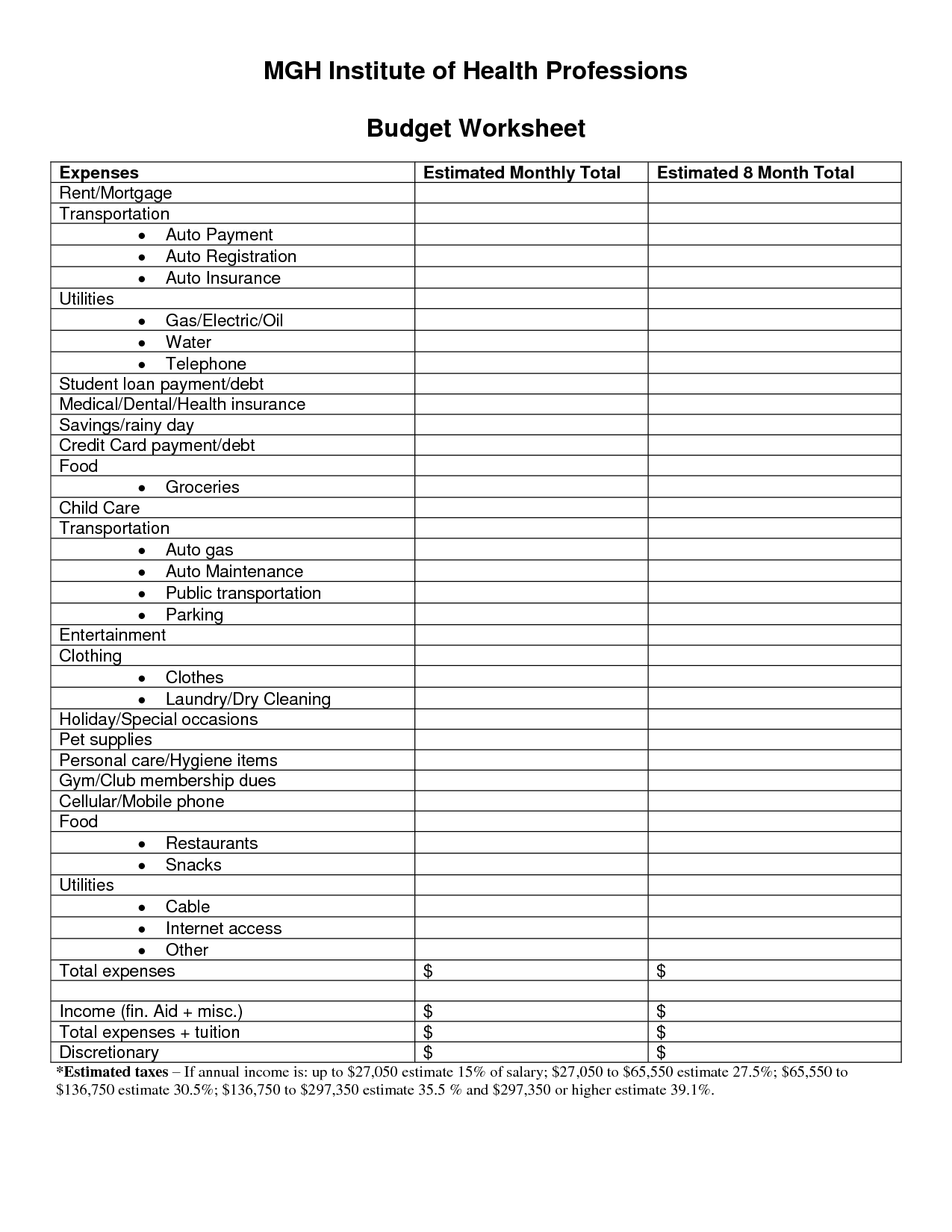

- Health Care Budget Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is dental insurance?

Dental insurance is a type of health insurance policy that helps individuals cover the costs associated with dental care, including routine check-ups, cleanings, and certain dental procedures. It typically works by paying a portion of the costs for covered services, with the insured individual responsible for any remaining expenses. Dental insurance can help make dental care more affordable and accessible for individuals and families.

How does dental insurance work?

Dental insurance works by individuals paying a monthly premium to an insurance company in exchange for coverage of a portion of their dental costs. When someone needs dental care, they visit a dentist who is in-network with their insurance plan. The insurance company will then pay for a percentage of the cost of the covered services, while the individual is responsible for paying the remaining portion, which may include copays, coinsurance, or deductibles. Dental insurance typically covers preventative care, basic procedures like fillings, and major treatments such as root canals or crowns, up to certain limits and within specific guidelines outlined in the insurance plan.

What types of dental procedures are typically covered by dental insurance?

Dental insurance typically covers preventive services such as regular cleanings, check-ups, and X-rays, as well as basic procedures like fillings, extractions, and root canals. Some plans may also cover more extensive procedures such as crowns, bridges, and orthodontic treatments. However, coverage can vary depending on the specific insurance plan, so it's important to review your policy to understand what procedures are included.

Are there any limitations or exclusions in dental insurance coverage?

Yes, dental insurance may have limitations and exclusions, such as waiting periods before certain procedures can be covered, annual maximum coverage limits, exclusions for certain pre-existing conditions or cosmetic treatments, restrictions on the number of visits or treatments allowed in a specific time period, and limitations on coverage for specific services like orthodontics or dental implants. It is important to review the details of your specific dental insurance policy to understand any limitations or exclusions that may apply.

Do dental insurance plans have a waiting period before coverage begins?

Yes, dental insurance plans often have a waiting period before coverage begins for certain services. The waiting period can vary depending on the insurance provider and the specific plan you choose. It is important to review the terms and conditions of your dental insurance plan to understand the details of any waiting periods that may apply to your coverage.

Can I choose my own dentist with dental insurance?

Yes, with most dental insurance plans, you can choose your own dentist. It is important to review your insurance policy to ensure that your chosen dentist is in-network to maximize your benefits. If you prefer a specific dentist who is out-of-network, you may still be able to visit them, but your out-of-pocket costs may be higher.

Are cosmetic dental procedures covered by dental insurance?

Cosmetic dental procedures are typically not covered by dental insurance as they are considered elective and not necessary for the health of the teeth and gums. Most dental insurance plans only cover procedures that are deemed medically necessary, such as fillings, extractions, and root canals. Patients seeking cosmetic procedures like teeth whitening, veneers, or bonding may need to pay out of pocket for these services. It is important to check with your dental insurance provider to understand what procedures are covered under your plan.

What is the difference between in-network and out-of-network providers?

In-network providers are healthcare professionals or facilities that have a contract with a health insurance company to provide services at pre-negotiated rates. Typically, seeing an in-network provider results in lower out-of-pocket costs for the insured individual. On the other hand, out-of-network providers do not have contracts with the insurance company, leading to potentially higher costs for the individual seeking care. It is important for individuals to understand their insurance coverage and seek services from in-network providers whenever possible to maximize their benefits and minimize expenses.

Are there any deductibles or co-pays associated with dental insurance?

Yes, dental insurance policies typically have deductibles and co-pays associated with them. A deductible is the amount you must pay out of pocket before your insurance begins to cover expenses, while a co-pay is a fixed amount you pay for specific services. These costs can vary depending on your insurance plan and the services you receive.

How can I maximize my dental insurance benefits?

To maximize your dental insurance benefits, start by understanding your plan's coverage, including annual maximums, deductibles, and covered services. Schedule regular dental check-ups and cleanings to prevent larger issues that may require costly treatments. Use in-network providers to lower out-of-pocket costs, and consider scheduling major treatments towards the end of the year to fully utilize annual benefits. Keep track of your insurance usage and communicate with your dentist to ensure you're taking full advantage of your coverage.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments