Debt Worksheet Printable

Are you looking for a practical tool to help you keep track of your debts and manage your finances more efficiently? Look no further. We have created a debt worksheet printable that will provide you with a simple and organized way to analyze your financial situation and develop a plan to pay off your debts. With this worksheet, you can easily track your outstanding debts, calculate your monthly payments, and prioritize your repayments based on interest rates and due dates. Whether you are a student, young professional, or someone seeking to improve their financial health, our debt worksheet printable is designed to help you take control of your financial future.

Table of Images 👆

- Free Printable Meal Sign Up Sheet

- Debt Free Printable Bill Payment Sheet

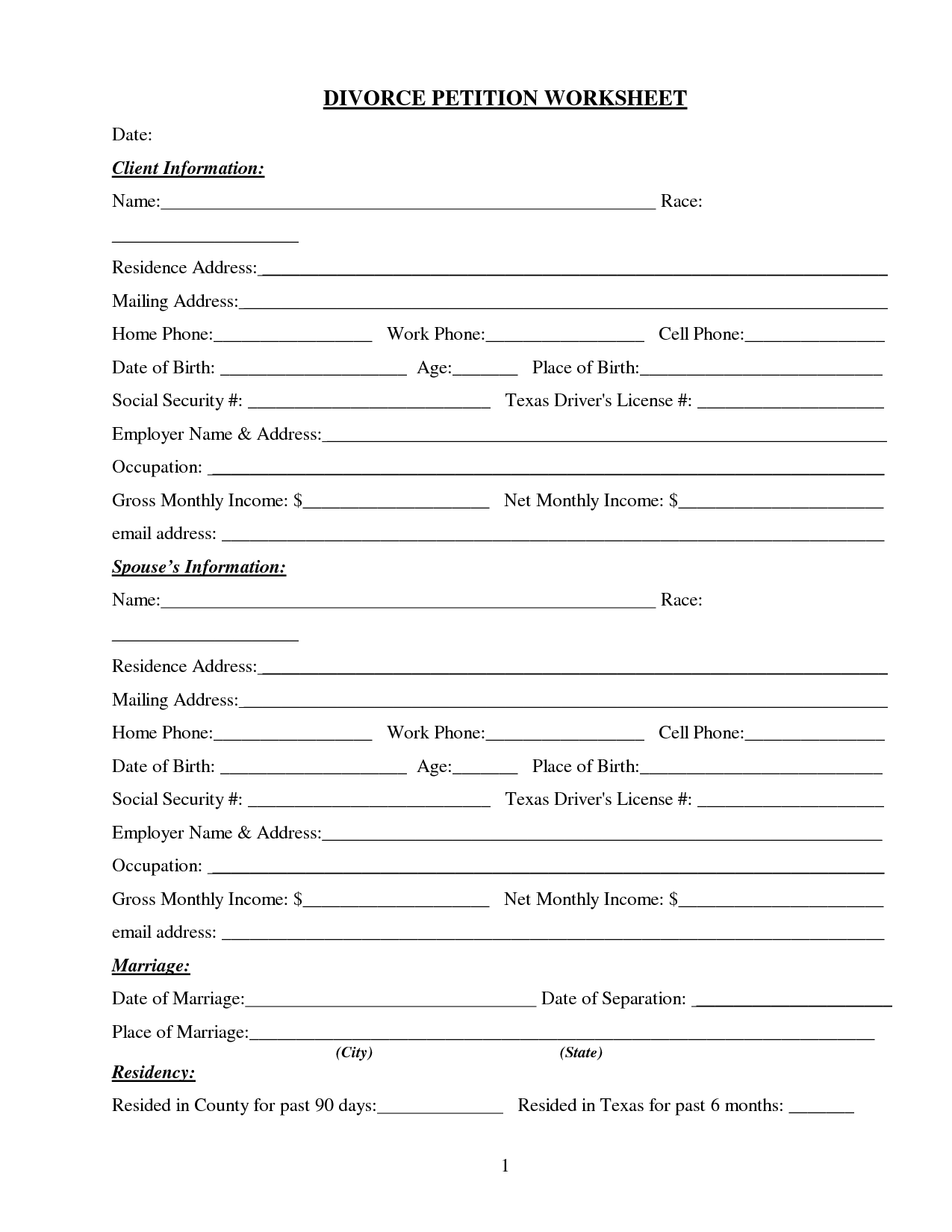

- Printable Divorce Worksheet

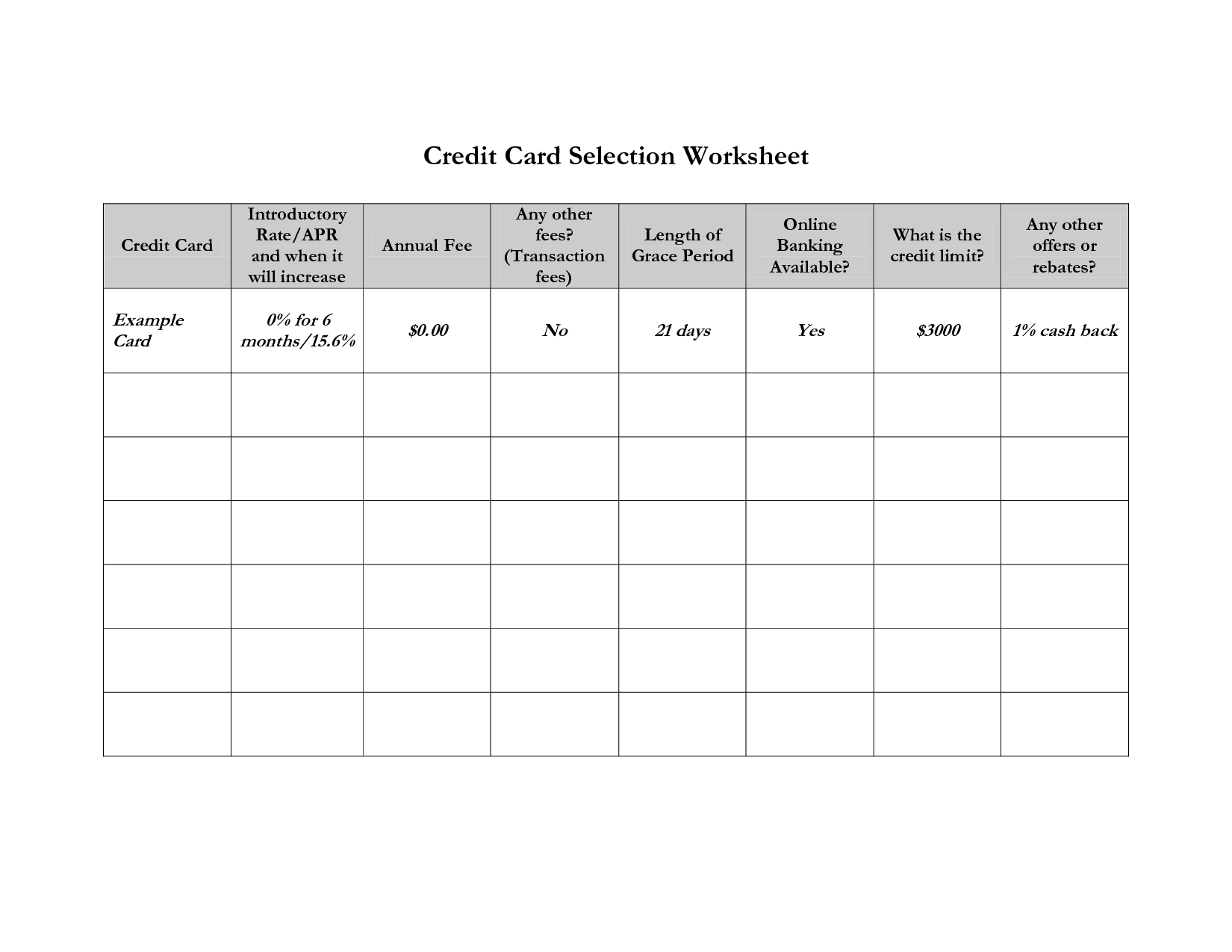

- Printable Credit Card Worksheet

- Church Budget Worksheet Template

- Debt Snowball Worksheet Printable

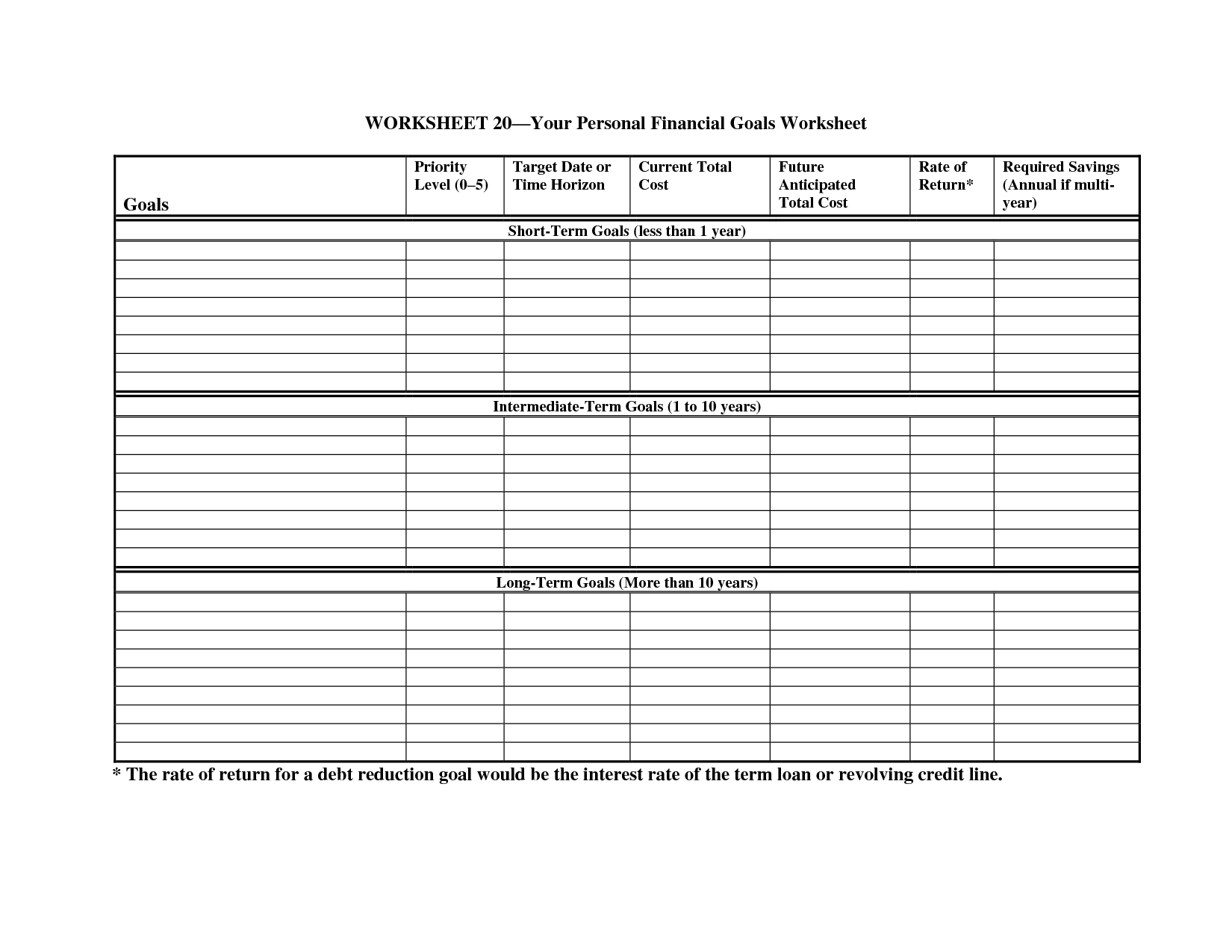

- Personal Financial Goals Worksheet

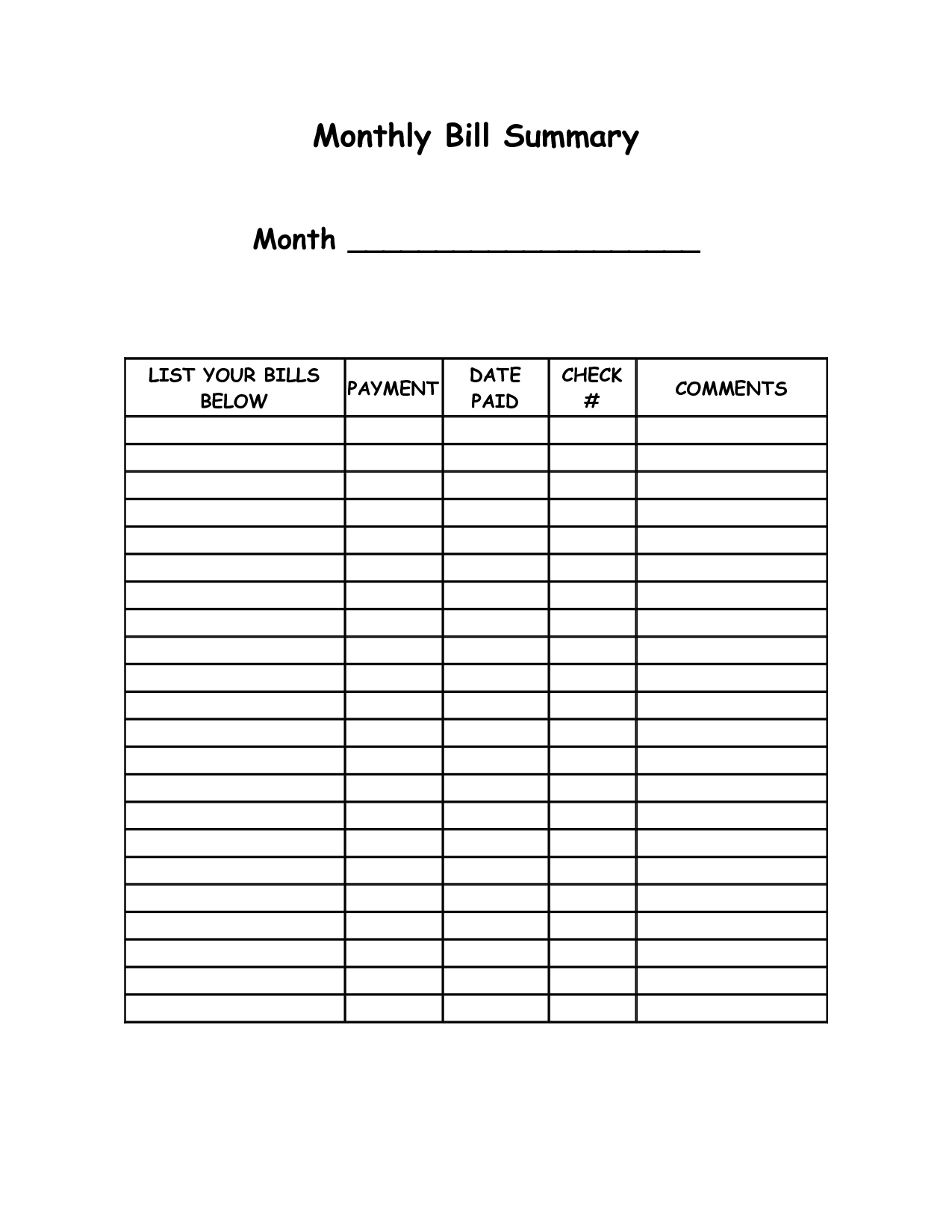

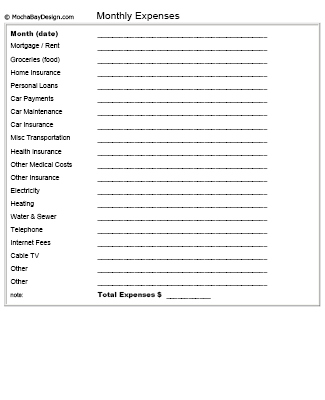

- Monthly Bill Organizer Template

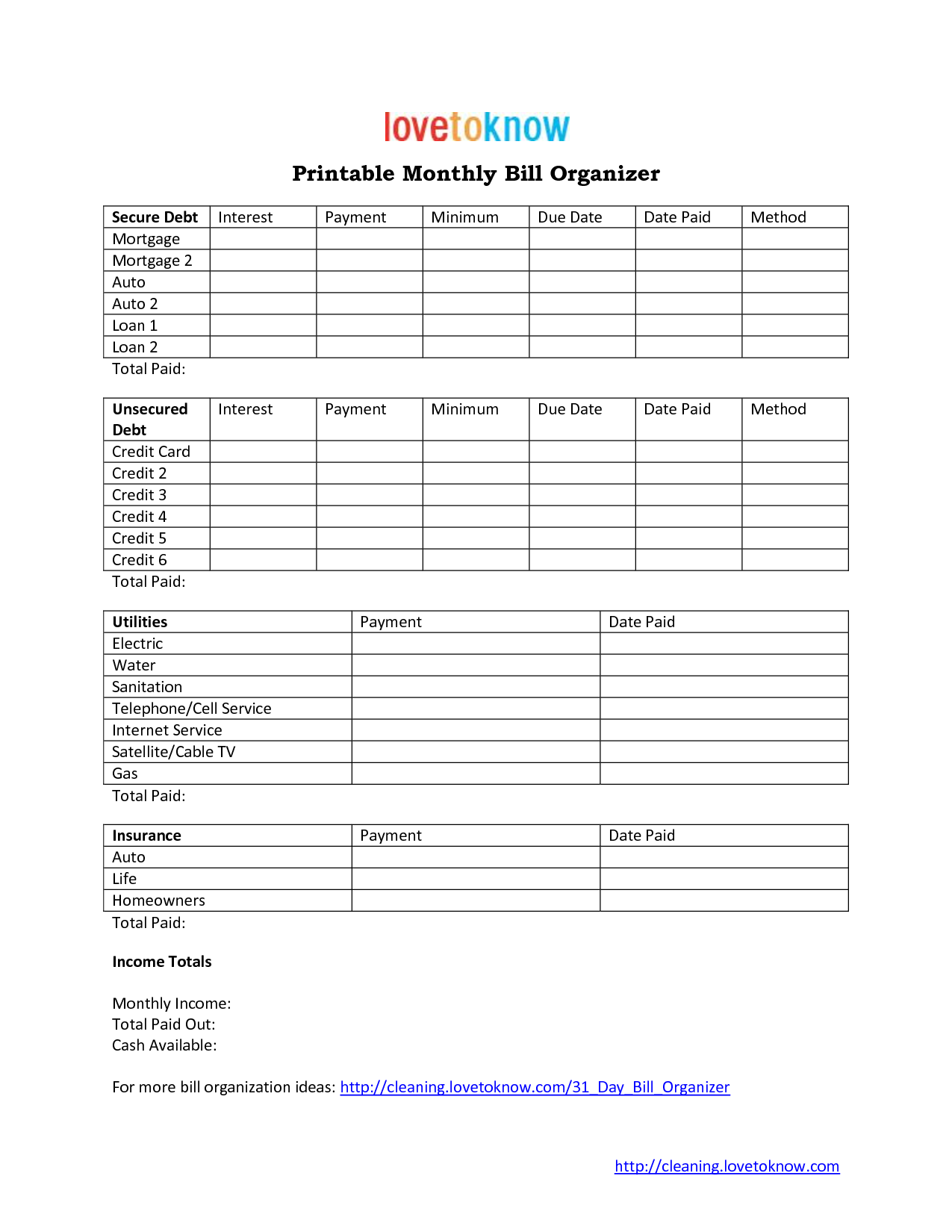

- Printable Monthly Bill Organizer Template

- Blank Monthly Budget Chart

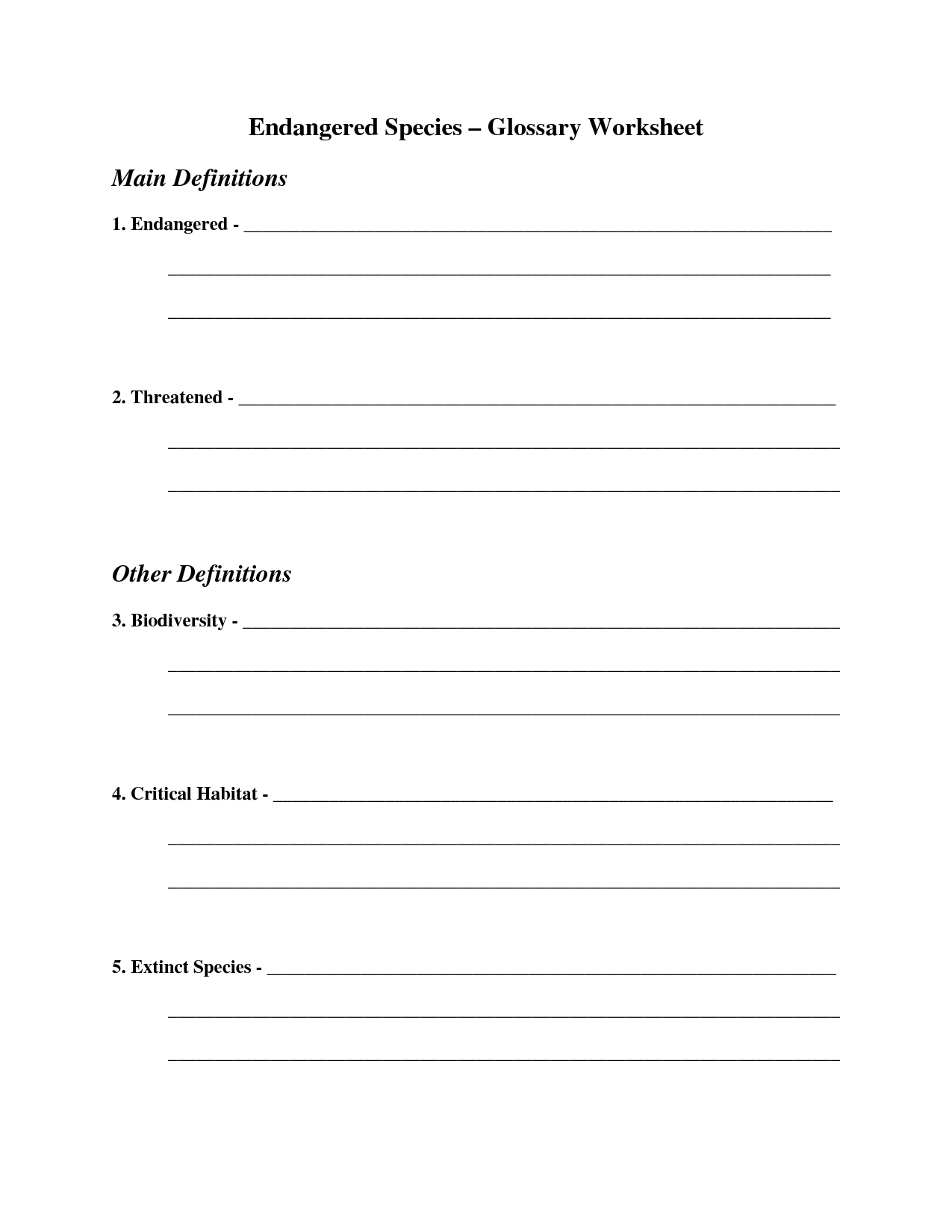

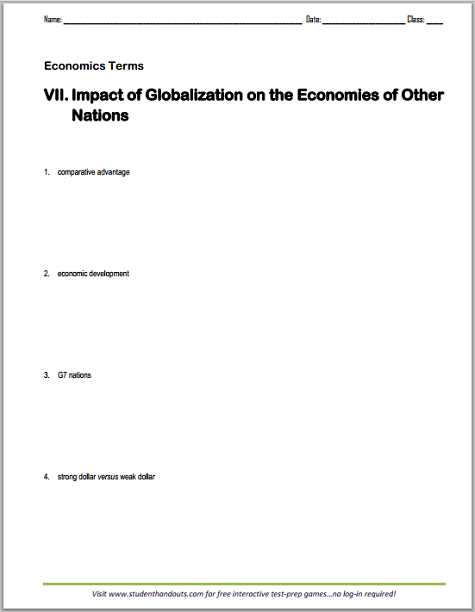

- Economic Terms Worksheet

- Calorie Counter Food List

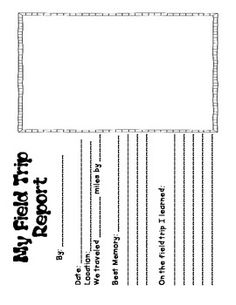

- Homeschool Field Trip Form

- Simple Monthly Budget Worksheet Printable

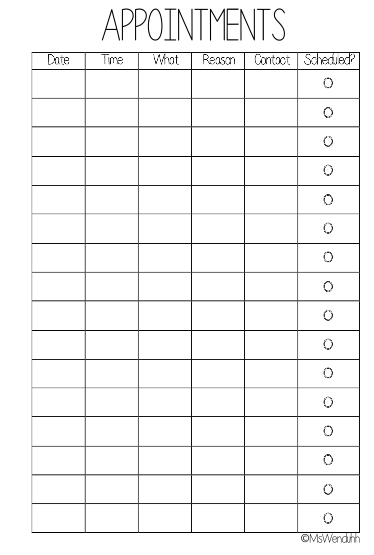

- Free Printable Appointment Book

- Blank Facebook Profile Template Worksheet

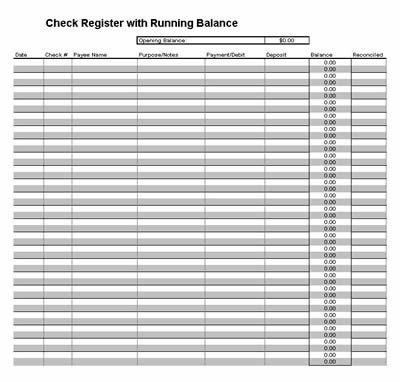

- Free Printable Check Register

- Order of Operations Math Worksheets Printable

- Money Word Problem Worksheets

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

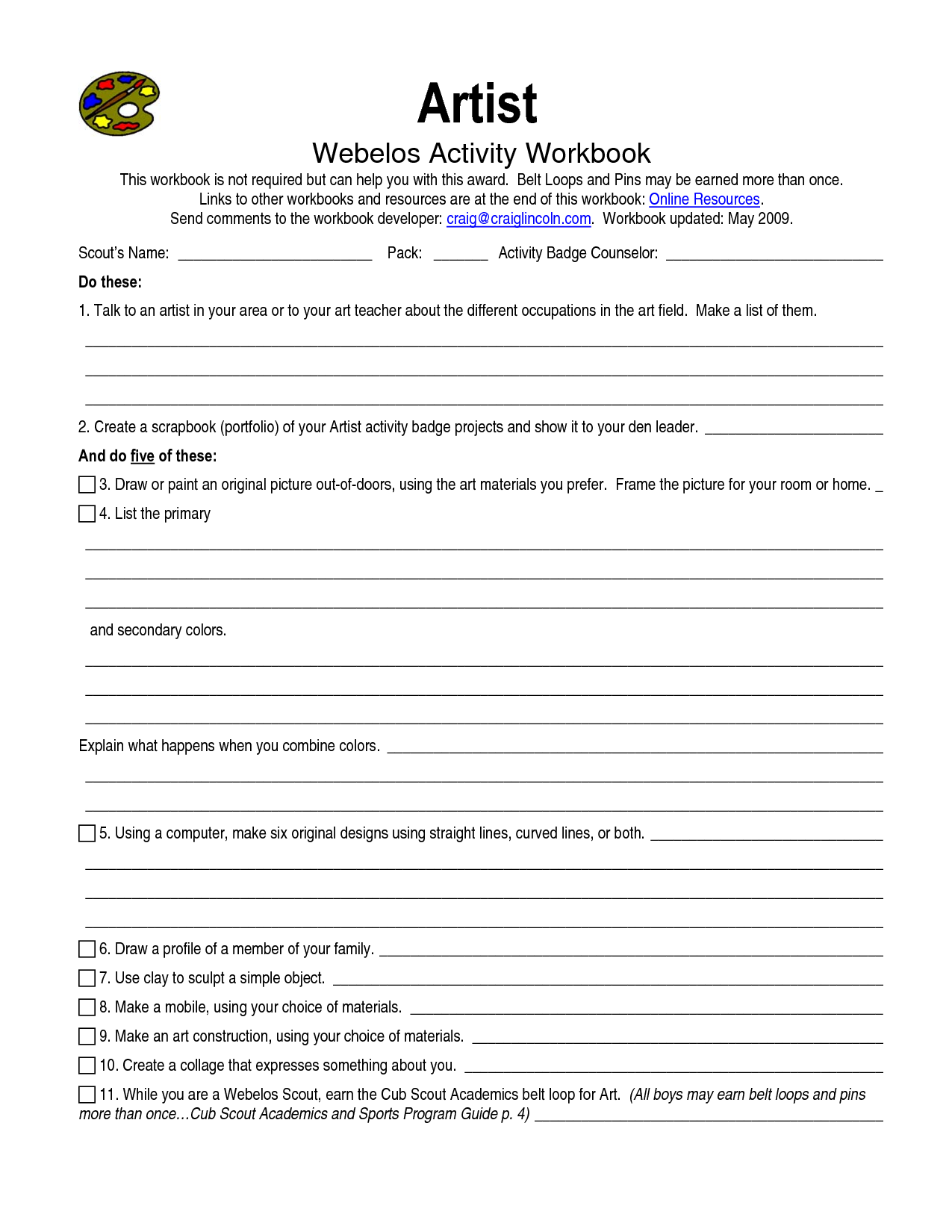

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a Debt Worksheet Printable?

A Debt Worksheet Printable is a tool that helps individuals track and organize their outstanding debts in a convenient and easily accessible format. It typically includes columns for listing each debt's creditor, outstanding balance, interest rate, monthly payment, and due date. Users can use the worksheet to create a clear picture of their financial obligations and develop a plan to manage and pay off their debts effectively.

How can a Debt Worksheet Printable help in managing and tracking debt?

A Debt Worksheet Printable can help in managing and tracking debt by providing a structured format to list all debts, including details such as the creditor, balance, interest rate, and monthly payments. This enables individuals to have a clear overview of their total debt and prioritize repayments based on interest rates or outstanding balances. By regularly updating and referencing the worksheet, individuals can track progress in reducing debt, make informed financial decisions, and stay organized in managing their finances effectively.

What are the key components of a Debt Worksheet Printable?

A Debt Worksheet Printable typically includes sections for listing all debts such as credit cards, loans, and other liabilities, with columns for details like balances, interest rates, minimum payments, and due dates. It may also include sections for tracking monthly payments, creating a debt payoff plan, and monitoring progress towards becoming debt-free. The worksheet serves as a tool to organize and prioritize debt repayment, analyze budgeting capabilities, and set financial goals.

How can a Debt Worksheet Printable assist in organizing and prioritizing debts?

A Debt Worksheet Printable can assist in organizing and prioritizing debts by providing a structured template to list all debts, including the amount owed, interest rates, and due dates. This allows individuals to visualize their debt obligations in one place and create a clear overview of their financial situation. By having this information readily available, individuals can prioritize debts based on factors such as interest rates or due dates and develop a repayment plan that helps reduce debt efficiently. Additionally, using a Debt Worksheet Printable can help individuals track their progress and stay motivated as they work towards becoming debt-free.

What information should be included in a Debt Worksheet Printable?

A Debt Worksheet Printable should include details such as the names of the creditors, types of debts owed (e.g., credit card debt, student loans, medical bills), outstanding balances, interest rates, minimum monthly payments, and due dates. Additionally, it may be helpful to include any additional fees or charges associated with the debts, as well as a total debt amount to provide a clear overview of the financial situation.

How often should a Debt Worksheet Printable be updated?

A Debt Worksheet Printable should be updated regularly, ideally monthly, to track your progress in paying off debts, monitor changes in outstanding balances, and adjust your repayment strategy as needed. Keeping the worksheet up to date will help you stay organized, motivated, and better manage your financial goals.

Can a Debt Worksheet Printable be customized to fit individual financial situations?

Yes, a Debt Worksheet Printable can be customized to fit individual financial situations. It can be adjusted to include specific debts, payment schedules, interest rates, and any other relevant financial information that is unique to each individual's circumstances. By tailoring the worksheet to match one's financial situation, it can be a more effective tool for organizing and managing debts.

Are there any specific strategies or tips for using a Debt Worksheet Printable effectively?

To use a Debt Worksheet Printable effectively, start by listing all your debts along with details such as the outstanding balance, interest rate, minimum payment, and due date. Next, prioritize your debts based on factors like interest rates or amounts owed. Develop a realistic repayment plan that fits your budget, allotting extra funds towards high-interest debts while making minimum payments on others. Regularly update the worksheet to track your progress and adjust your plan as needed. Stay disciplined and focused on your financial goals to effectively manage and reduce your debts using the Debt Worksheet Printable.

Are there any online resources or templates available for downloading Debt Worksheet Printables?

Yes, there are numerous online resources and websites where you can download debt worksheet printables for free or for a fee. Popular platforms like Pinterest, Etsy, and personal finance blogs offer a wide range of templates tailored to different types of debts, such as credit card debt, student loans, or mortgages. Simply search for "debt worksheet printable" in your preferred search engine or visit websites specializing in financial planning and organization to access and download these resources.

How can a Debt Worksheet Printable contribute to developing and implementing a debt repayment plan?

A Debt Worksheet Printable can contribute to developing and implementing a debt repayment plan by providing a clear and organized way to track all debts, their respective interest rates, minimum payments, and total outstanding balances. This helps individuals visualize their debt situation, prioritize which debts to pay off first based on interest rates or amounts owed, and create a feasible repayment plan with specific goals and timelines. By using a Debt Worksheet Printable, individuals can monitor their progress, stay motivated, and make informed financial decisions to ultimately become debt-free.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments