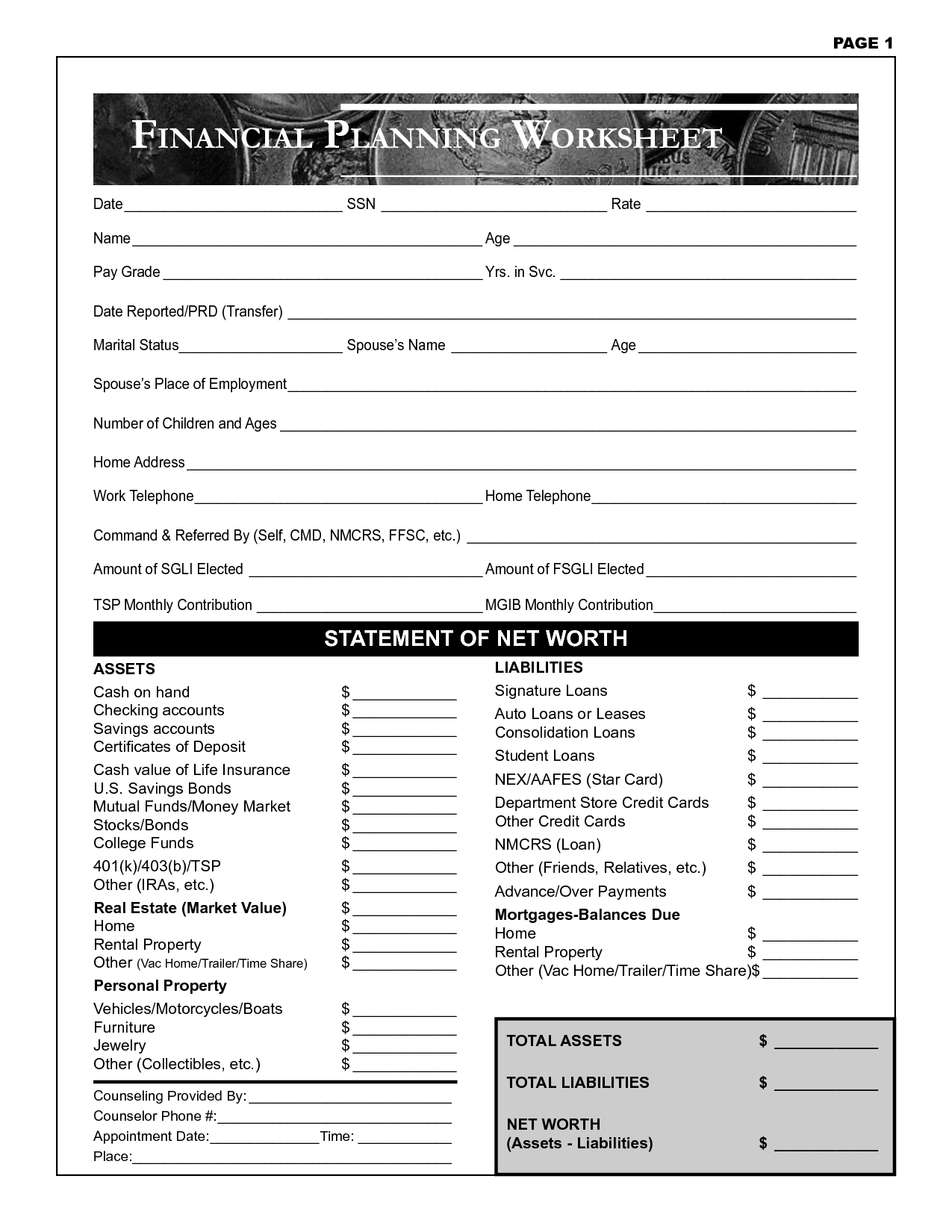

College Financial Planning Worksheet

Are you a college student looking to effectively manage your finances? Look no further! We have developed the perfect college financial planning worksheet that will help you stay on top of your expenses and make informed financial decisions. With this comprehensive tool, you can easily track your income, expenses, and savings goals while ensuring you have a clear picture of your financial situation. Whether you are a freshman just starting out or a senior preparing to enter the real world, our college financial planning worksheet is designed to help you take control of your financial future.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is the purpose of a college financial planning worksheet?

The purpose of a college financial planning worksheet is to help students and their families create a comprehensive overview of the costs and resources available for financing a college education. By detailing expenses, anticipated income, scholarships, grants, loans, and other financial aid options, the worksheet enables individuals to better understand the financial commitment of attending college and develop a plan to cover these costs. It also serves as a tool for budgeting and making informed decisions about how to finance higher education.

What information should be included in a college financial planning worksheet?

A college financial planning worksheet should include the costs of tuition, fees, books, and supplies, as well as room and board, transportation, and personal expenses. It should also account for any scholarships, grants, and other financial aid, as well as potential sources of income such as part-time work or savings. Additionally, a budget for managing expenses and a plan for borrowing student loans, if necessary, should be outlined. Finally, the worksheet should include a timeline for payment deadlines and a strategy for managing and monitoring finances throughout the college years.

How can a college financial planning worksheet help with budgeting and tracking expenses?

A college financial planning worksheet can help with budgeting and tracking expenses by providing a structured layout for categorizing income sources, fixed expenses, variable expenses, and savings goals. By documenting all sources of income and expenses, individuals can identify areas where they may be overspending and make adjustments to stay within their budget. Tracking expenses on the worksheet allows for better financial awareness and accountability, enabling individuals to prioritize their spending and make informed decisions to reach their financial goals.

What are the benefits of using a college financial planning worksheet?

A college financial planning worksheet provides a structured way to organize and track all financial aspects related to attending college, helping students and their families understand and plan for the costs associated with higher education. Benefits include gaining a clear overview of expenses, creating a budget to manage costs effectively, identifying potential sources of funding such as scholarships or financial aid, and making informed decisions to minimize student debt. It also helps in setting realistic financial goals and allows for adjustments to the financial plan as needed.

How can a college financial planning worksheet help with estimating college costs?

A college financial planning worksheet can help with estimating college costs by outlining all potential expenses such as tuition, fees, room and board, textbooks, and personal expenses, and comparing them with sources of funding such as scholarships, grants, loans, and work-study programs. By detailing all costs and available resources, a financial planning worksheet provides a comprehensive overview of the financial landscape, enabling students and their families to make informed decisions and create a realistic budget for college.

In what ways can a college financial planning worksheet aid in identifying potential sources of financial aid?

A college financial planning worksheet can aid in identifying potential sources of financial aid by systematically organizing and listing relevant information such as the cost of tuition, room and board, supplies, and other expenses associated with attending college. By detailing this information, students can more accurately assess their financial need and eligibility for various types of financial aid such as scholarships, grants, work-study programs, and student loans. This allows them to explore all available options and create a comprehensive plan to finance their education effectively.

How can a college financial planning worksheet assist in estimating student loan amounts?

A college financial planning worksheet can assist in estimating student loan amounts by providing a detailed breakdown of expenses associated with attending college, such as tuition, fees, room and board, books, and personal expenses. By calculating these costs and subtracting any scholarships, grants, savings, and expected family contributions, students and their families can determine the remaining amount that may need to be covered by student loans. This comprehensive overview helps in creating a more accurate estimate of the total loan amount needed to finance a college education.

What role does a college financial planning worksheet play in evaluating the affordability of different colleges?

A college financial planning worksheet plays a crucial role in evaluating the affordability of different colleges by helping students and their families compare the costs associated with each school, including tuition, fees, room and board, and other expenses. By outlining the total expenses and potential sources of financial aid, scholarships, grants, and loans, the worksheet provides a comprehensive overview of the financial commitment required for each college, enabling students to make informed decisions based on their financial situation. It helps students assess their ability to afford the cost of attendance at each institution, weigh the pros and cons of different college options, and determine the most cost-effective choice for their education.

How can a college financial planning worksheet help with setting and prioritizing financial goals?

A college financial planning worksheet can help individuals set and prioritize financial goals by providing a structured way to assess current financial standing, anticipated expenses, and income sources. By outlining the costs associated with attending college, such as tuition, books, housing, and meals, individuals can gain a clearer understanding of their financial needs and potential funding gaps. This information can then be used to establish specific financial goals, such as saving a certain amount of money each month or applying for scholarships and grants. The worksheet can also help in prioritizing goals by highlighting urgent financial needs, such as paying for tuition or covering essential living expenses, and secondary goals, like building an emergency fund or investing for the future. Overall, a college financial planning worksheet serves as a valuable tool to track progress, make informed financial decisions, and ultimately achieve financial stability during the college years and beyond.

What are some common mistakes to avoid when using a college financial planning worksheet?

Some common mistakes to avoid when using a college financial planning worksheet include underestimating expenses (such as books, transportation, and personal items), disregarding potential sources of income (like scholarships, grants, and work-study programs), failing to account for inflation and tuition increases, not updating the worksheet regularly as circumstances change, and not seeking guidance from a financial aid advisor or counselor to ensure accuracy and maximize financial aid opportunities. It's important to be thorough, realistic, and proactive in your financial planning to successfully manage college expenses.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments