Cash Flow Statement Worksheet

A cash flow statement worksheet is a valuable tool for individuals or businesses to better understand and manage their finances. By documenting and analyzing the cash coming in and going out, this worksheet allows users to gain a clear picture of their entity's financial health. Whether you're an entrepreneur trying to keep track of your business expenses or an individual looking to better manage your personal finances, a cash flow statement worksheet can provide the organization and insights you need.

Table of Images 👆

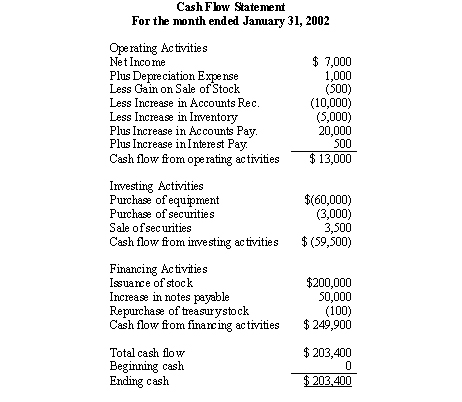

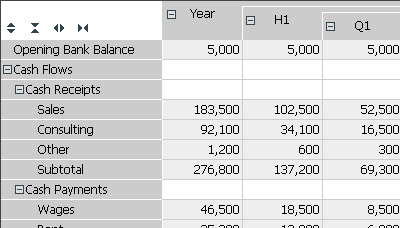

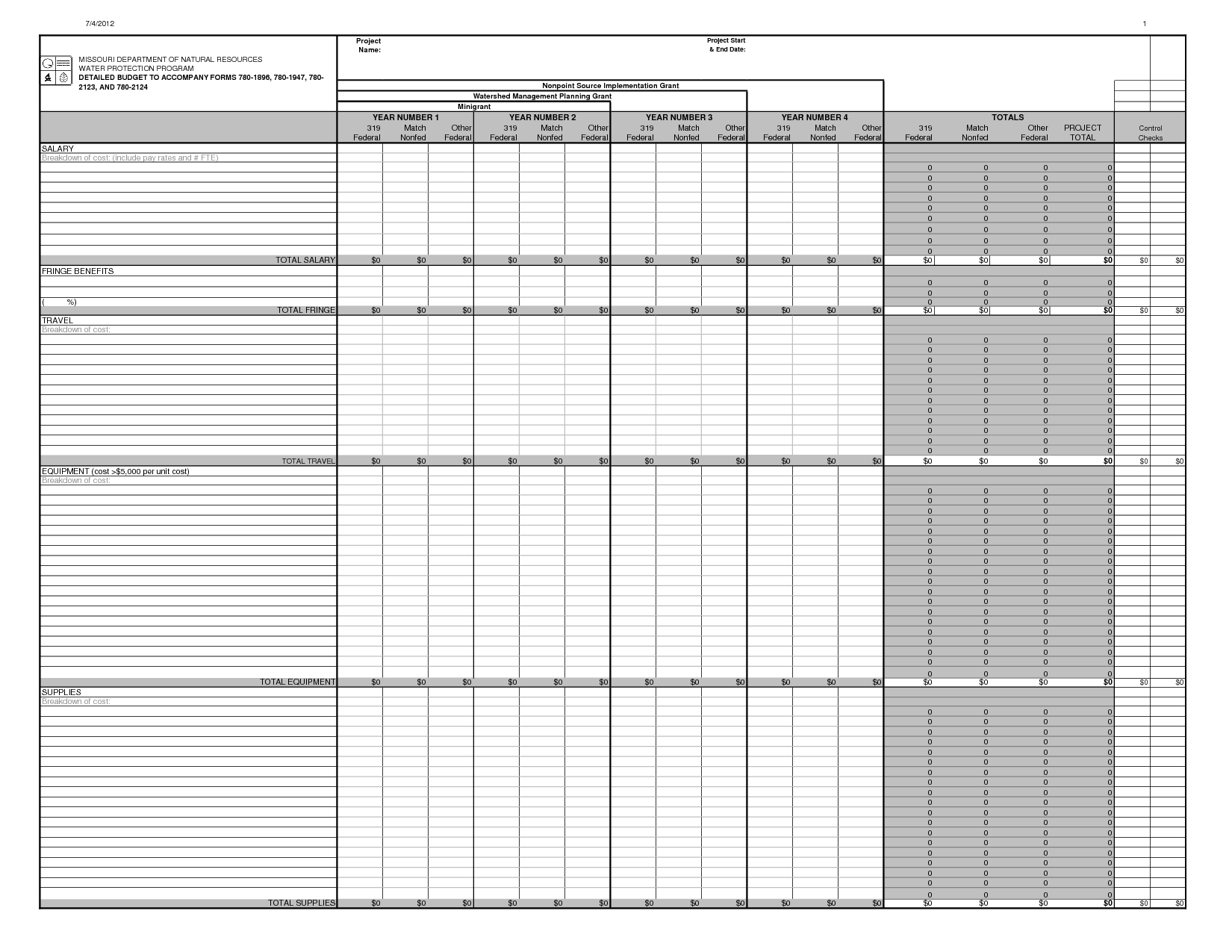

- Cash Flow Statement Indirect Method

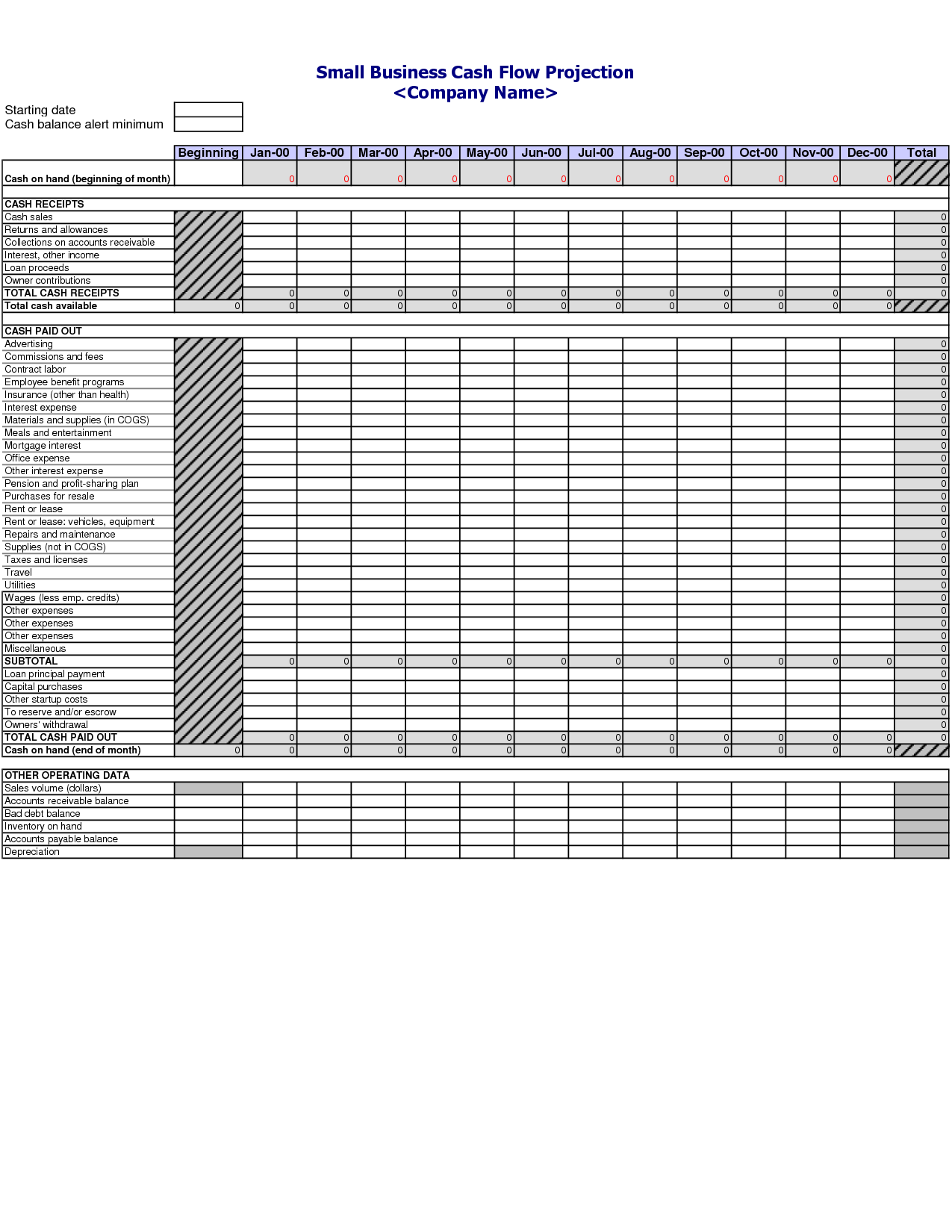

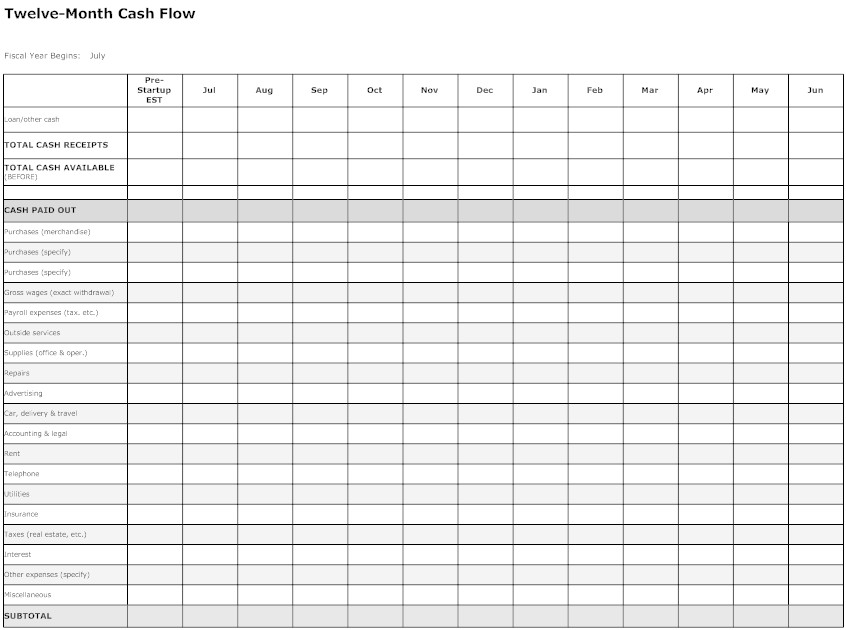

- Small Business Cash Flow Projection

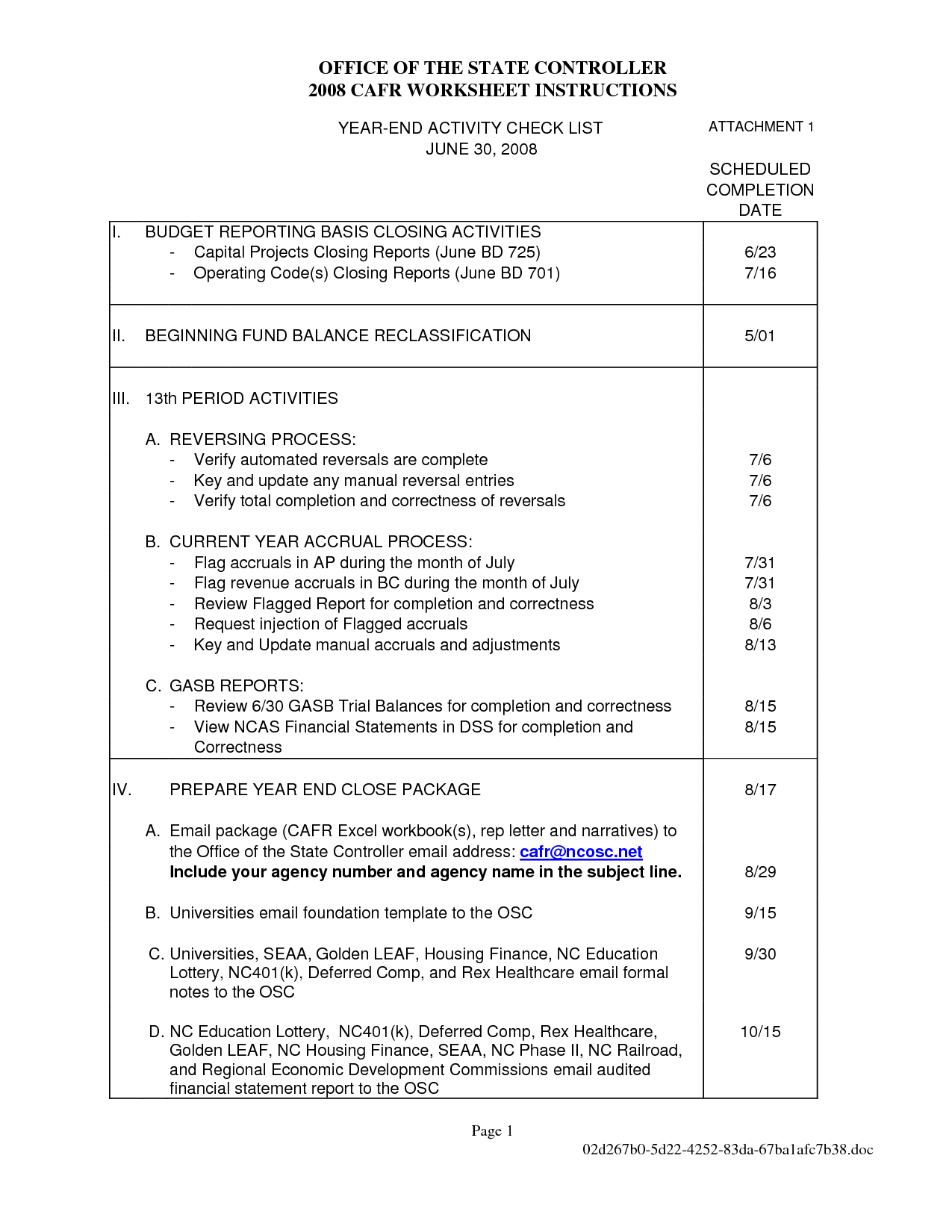

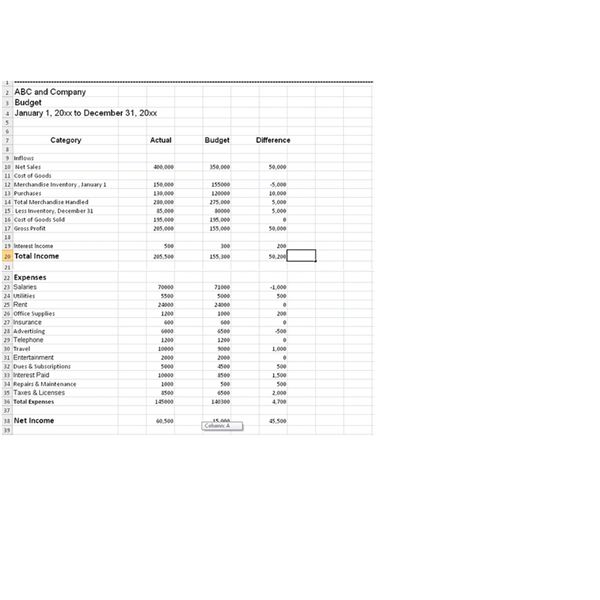

- Expense Accrual Worksheet Template

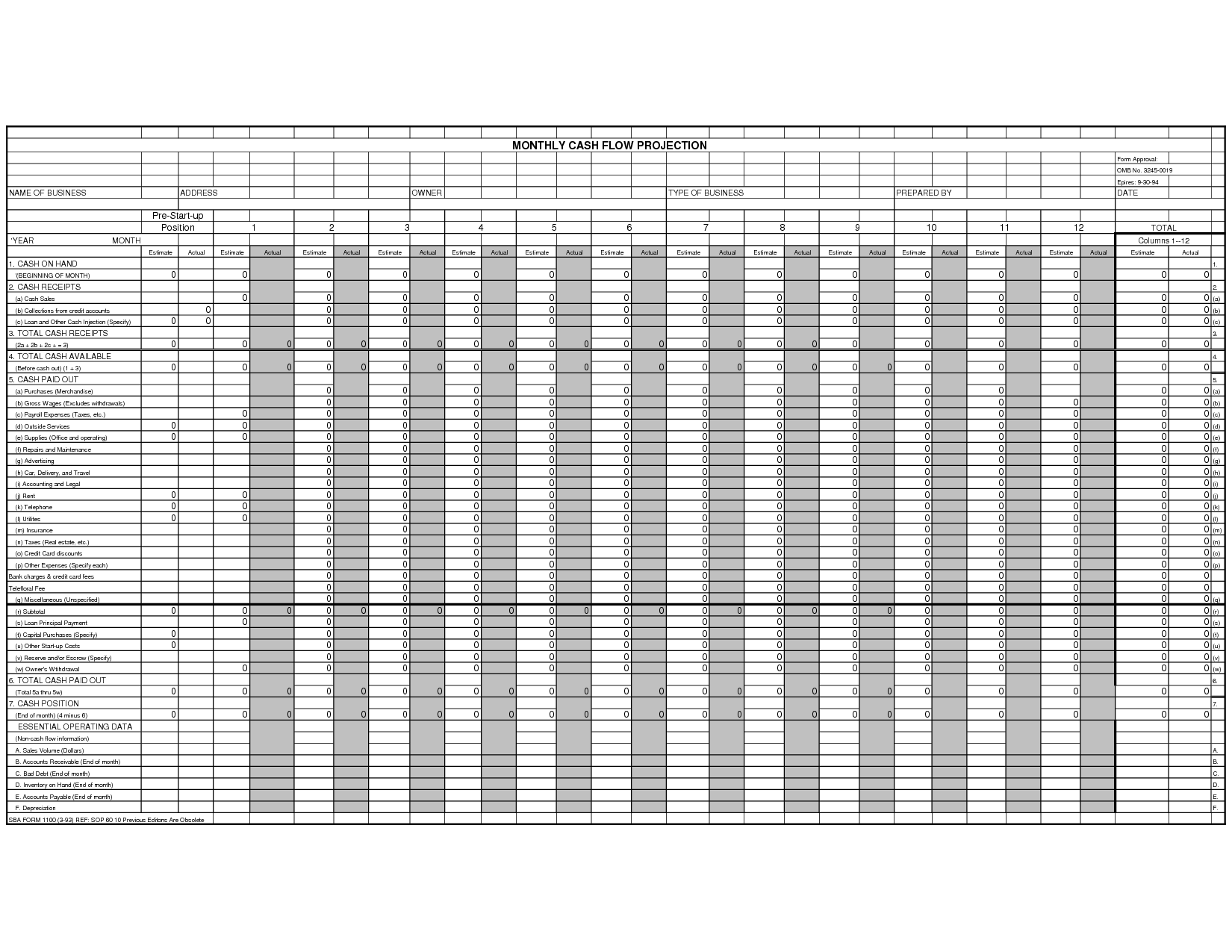

- Cash Flow Projection Sheet

- Simple Cash Flow Forecast Template

- Free Printable Cash Flow Sheets

- Small Business Budget Worksheet

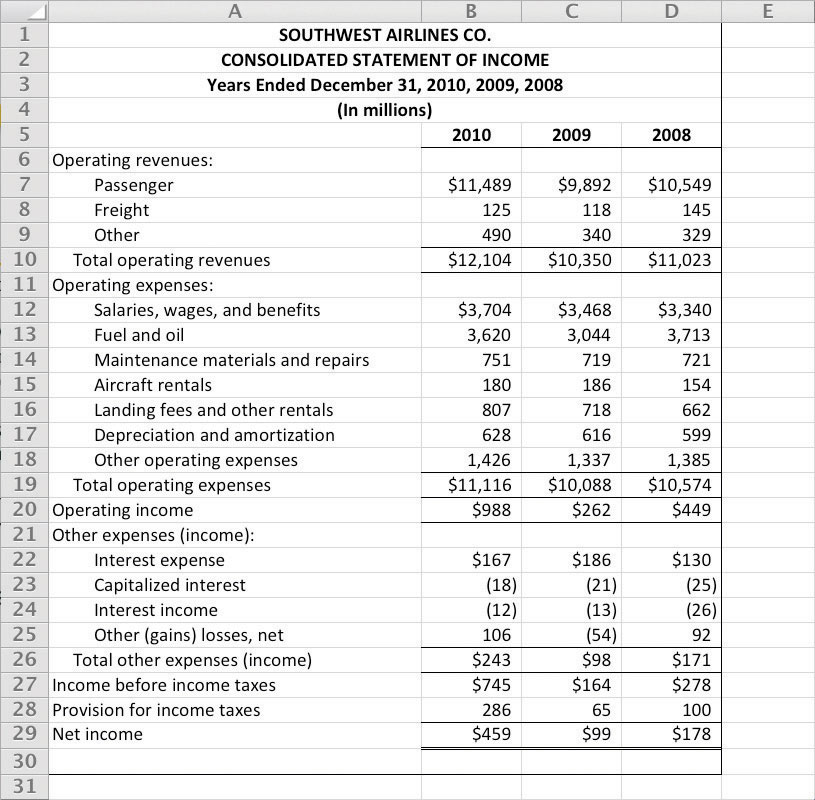

- Excel Spreadsheet Income Statement

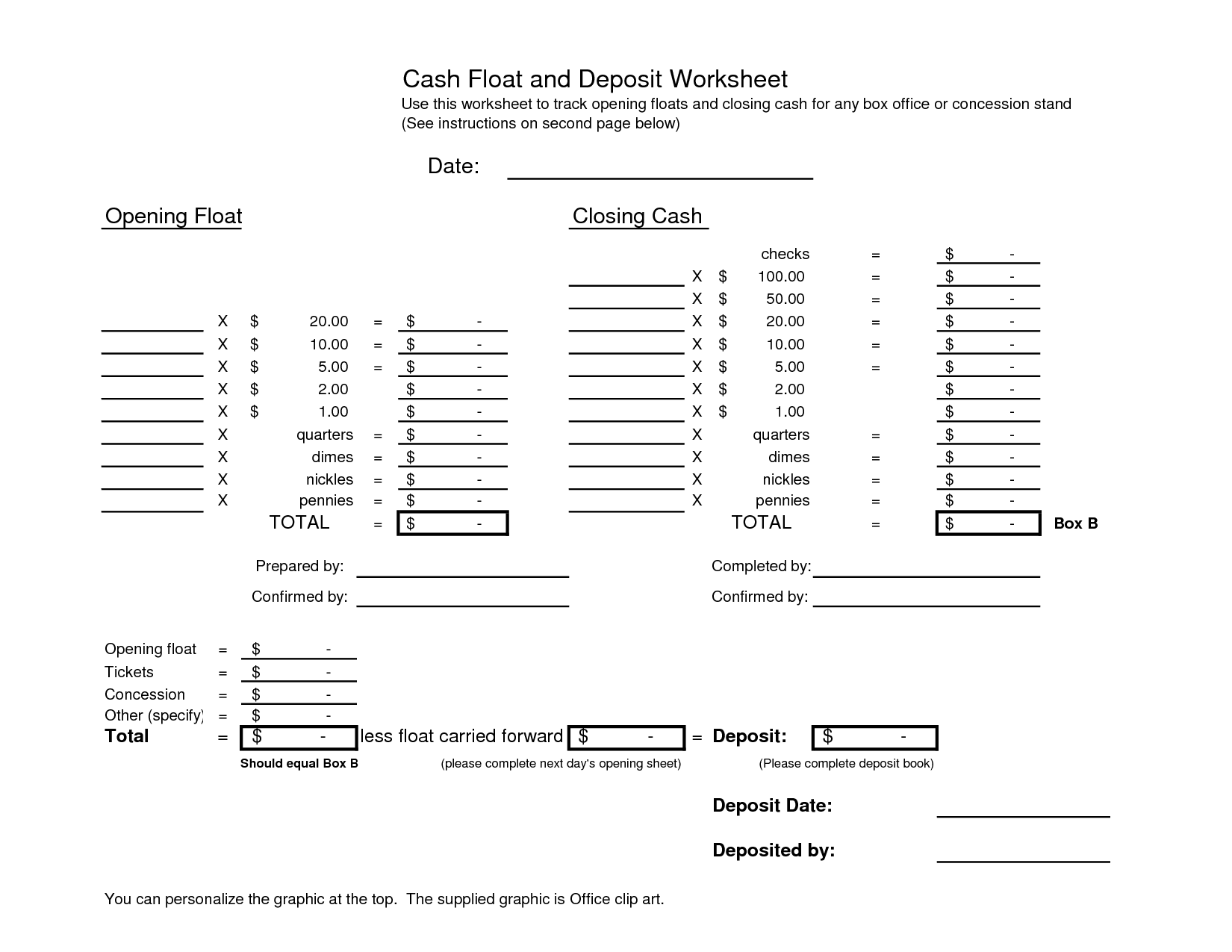

- Cash Register Daily Balance Sheet Template

- Day Care Profit and Loss Statement

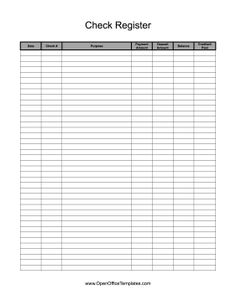

- Free Printable Check Register

- Church Monthly Financial Report Template

- Blank Worksheet Budget Sheet

- Blank Bank Reconciliation Form

- Accountability Form Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a cash flow statement worksheet?

A cash flow statement worksheet is a tool used by businesses to track and analyze the inflows and outflows of cash over a specific period of time. It typically includes sections for operating activities, investing activities, and financing activities, allowing companies to monitor their cash position and make informed decisions about how to allocate their resources. This worksheet is an essential component of financial reporting and planning, providing insights into the liquidity and financial health of the organization.

Why is a cash flow statement worksheet important for a business?

A cash flow statement worksheet is important for a business because it provides a detailed analysis of how money is flowing in and out of the business over a specific period of time. It helps in monitoring and managing the liquidity of the business, ensuring that there is enough cash available to meet financial obligations such as paying bills, investing in growth opportunities, and covering operational expenses. By understanding the cash flow trends, a business can make informed decisions, anticipate potential cash shortages, and maintain financial stability.

What are the main sections or categories typically included in a cash flow statement worksheet?

The main sections or categories included in a cash flow statement worksheet are operating activities, investing activities, and financing activities. The operating activities section shows cash flows from the core business operations of the company, while the investing activities section reflects cash flows from buying and selling long-term assets. The financing activities section demonstrates cash flows related to raising capital or repaying investors and creditors.

How does a cash flow statement worksheet differ from other financial statements?

A cash flow statement worksheet focuses specifically on tracking the flow of cash into and out of a business over a period of time, providing a detailed account of cash receipts and cash payments. Unlike other financial statements such as the income statement and balance sheet that focus on profitability and overall financial position respectively, the cash flow statement worksheet emphasizes the liquidity and ability of a company to generate cash to meet its short-term obligations and fund its operations. It helps in assessing the cash management and financial health of a business by providing insight into how cash is generated and utilized within the organization.

How is the cash flow statement worksheet used to assess the financial health of a business?

The cash flow statement worksheet is used to assess the financial health of a business by showing the sources and uses of cash over a specific period, providing insights into the liquidity and operational efficiency of the business. By analyzing the cash flow statement, stakeholders can determine the ability of the business to generate cash from its core operations, evaluate its ability to meet financial obligations, assess its investing and financing activities, and identify any potential financial risks or inefficiencies that may impact the overall financial health of the business.

What types of activities are typically included in the cash flow from operating activities section of the worksheet?

The cash flow from operating activities section of the worksheet typically includes cash transactions related to a company's core business activities, such as sales revenue, operating expenses, and changes in working capital like accounts receivable, accounts payable, and inventory. It also includes non-cash items like depreciation and amortization expenses. Additionally, cash payments for interest and income taxes are included in this section.

What types of activities are typically included in the cash flow from investing activities section of the worksheet?

Activities typically included in the cash flow from investing activities section of a worksheet are purchases and sales of long-term assets such as property, plant, and equipment, investments in securities of other companies, and loans made to other entities. Additionally, any cash received from the sale of long-term assets or repayment of loans made by the company are also included in this section.

What types of activities are typically included in the cash flow from financing activities section of the worksheet?

Activities typically included in the cash flow from financing activities section of the worksheet include proceeds from issuing stock or bonds, repayment of debt, dividends paid to shareholders, repurchase of company stock, and any other financing activities that involve raising or returning capital from investors or lenders. It reflects how the company is funding its operations and expansion through external sources of capital.

How does the cash flow statement worksheet help in identifying a business's sources and uses of cash?

The cash flow statement worksheet helps in identifying a business's sources and uses of cash by categorizing cash inflows and outflows into operating, investing, and financing activities. By analyzing these categories, it becomes clearer where the cash is coming from and where it is being used within the business. This detailed breakdown allows for a comprehensive understanding of how cash is moving in and out of the business, helping to highlight trends, strengths, and areas that may need attention.

What potential challenges or limitations may arise when preparing a cash flow statement worksheet?

Some potential challenges or limitations that may arise when preparing a cash flow statement worksheet could include difficulty in accurately forecasting cash flows, reconciling discrepancies between cash flow and income statement figures, dealing with non-cash transactions that need to be adjusted for, handling complex financial transactions that do not fit neatly into traditional cash flow categories, and ensuring consistency and completeness of information across all cash flow activities. Additionally, changes in accounting policies or errors in data input could also pose challenges in accurately reflecting cash flows in the worksheet.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments