Cash Flow Planning Worksheet

Managing your cash flow effectively is essential for financial stability and success. To help you keep track of your income and expenses, a cash flow planning worksheet can be a valuable tool. This worksheet allows you to document and analyze your financial activities, helping you gain a clearer understanding of your financial situation. With the ability to organize and track your income and expenses in one place, this worksheet is perfect for individuals or small business owners who are seeking a practical way to monitor their cash flow.

Table of Images 👆

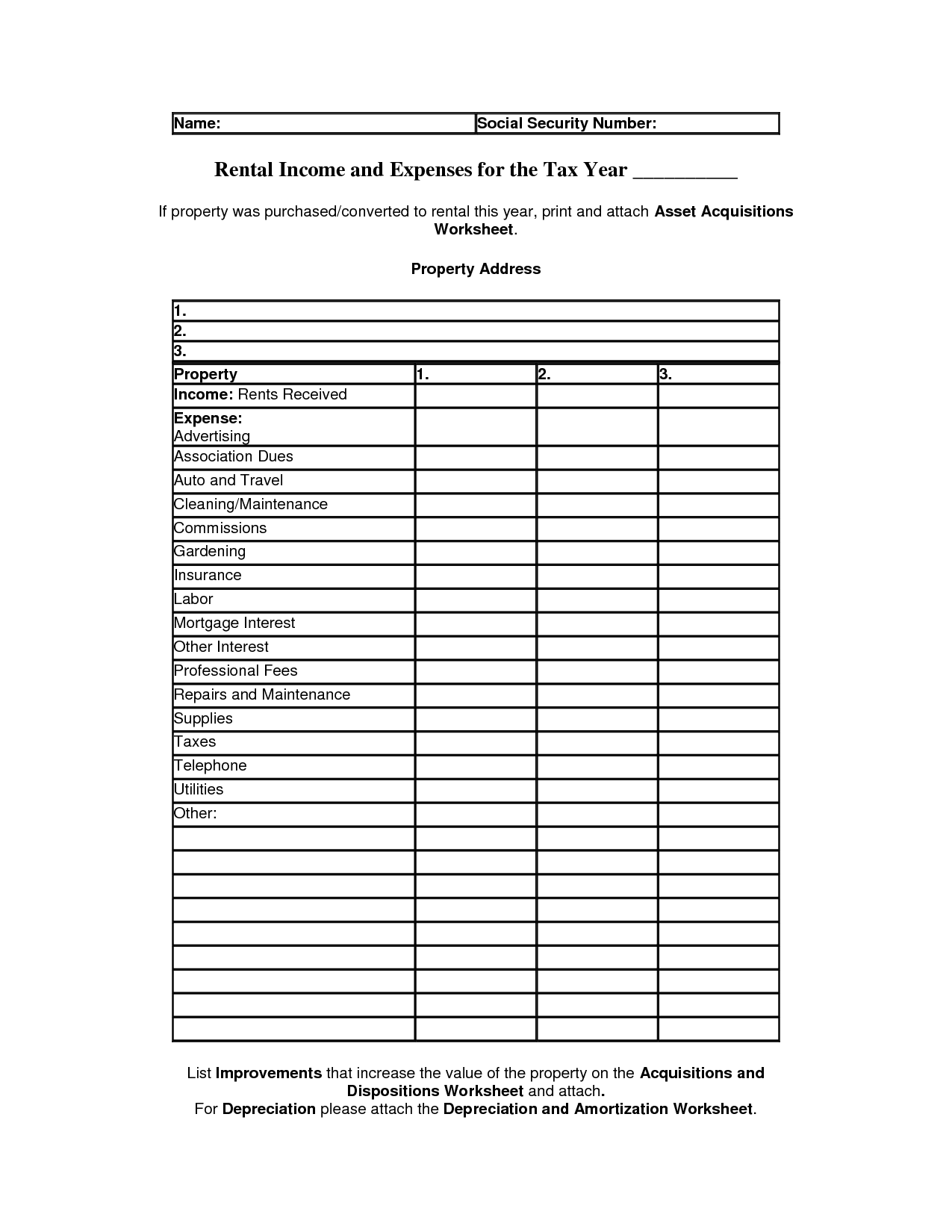

- Rental Property Income and Expense Worksheet

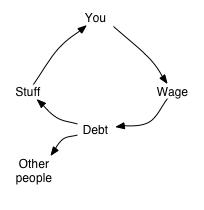

- Flow Chart Retirement Savings

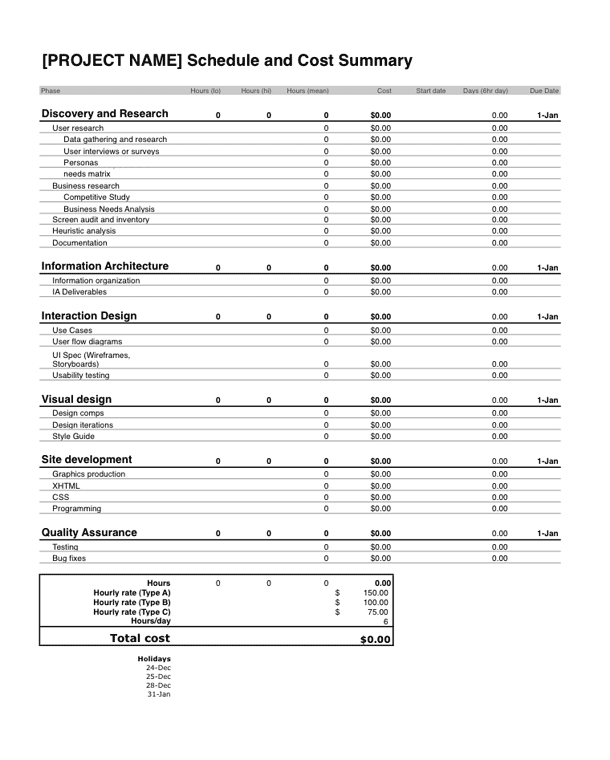

- Project Cost Schedule Template

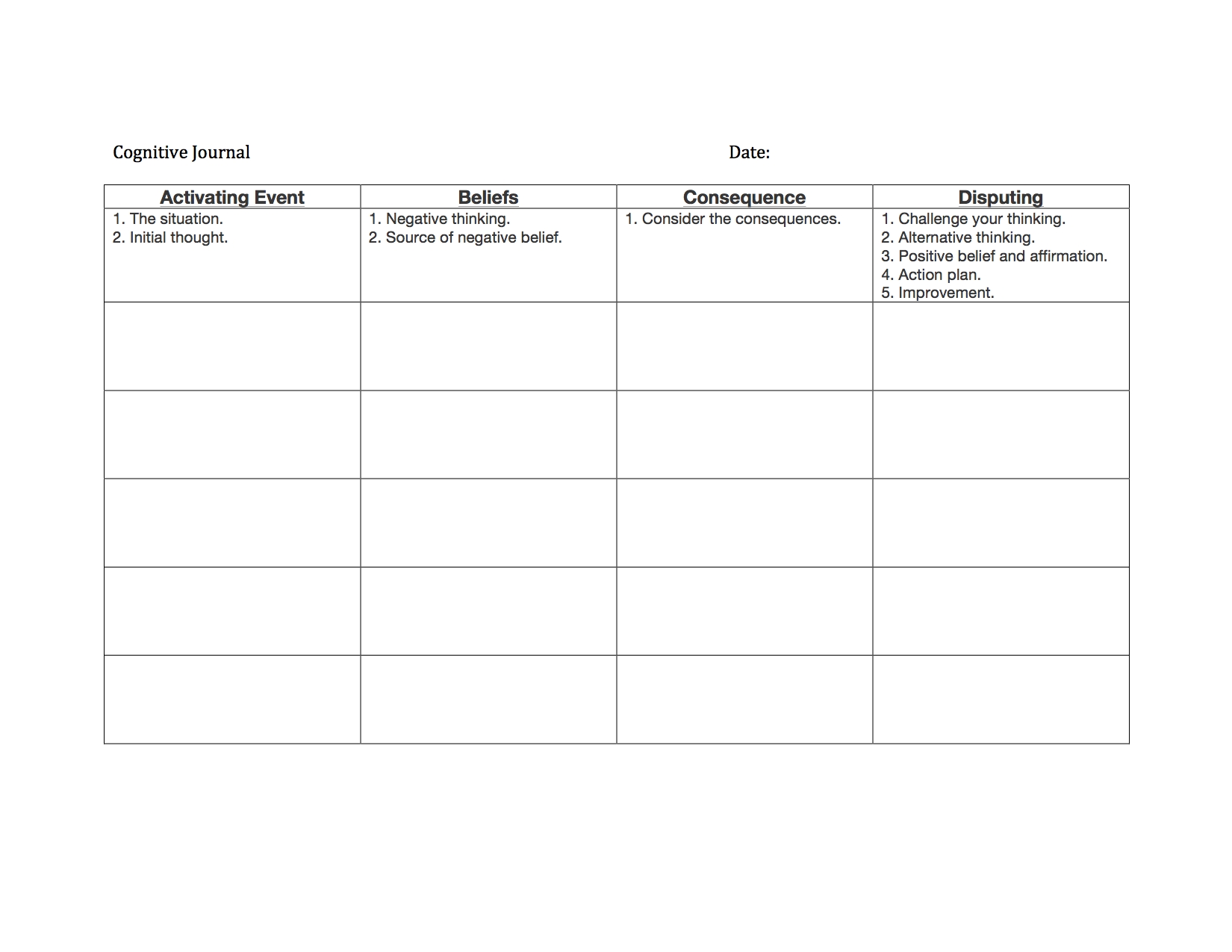

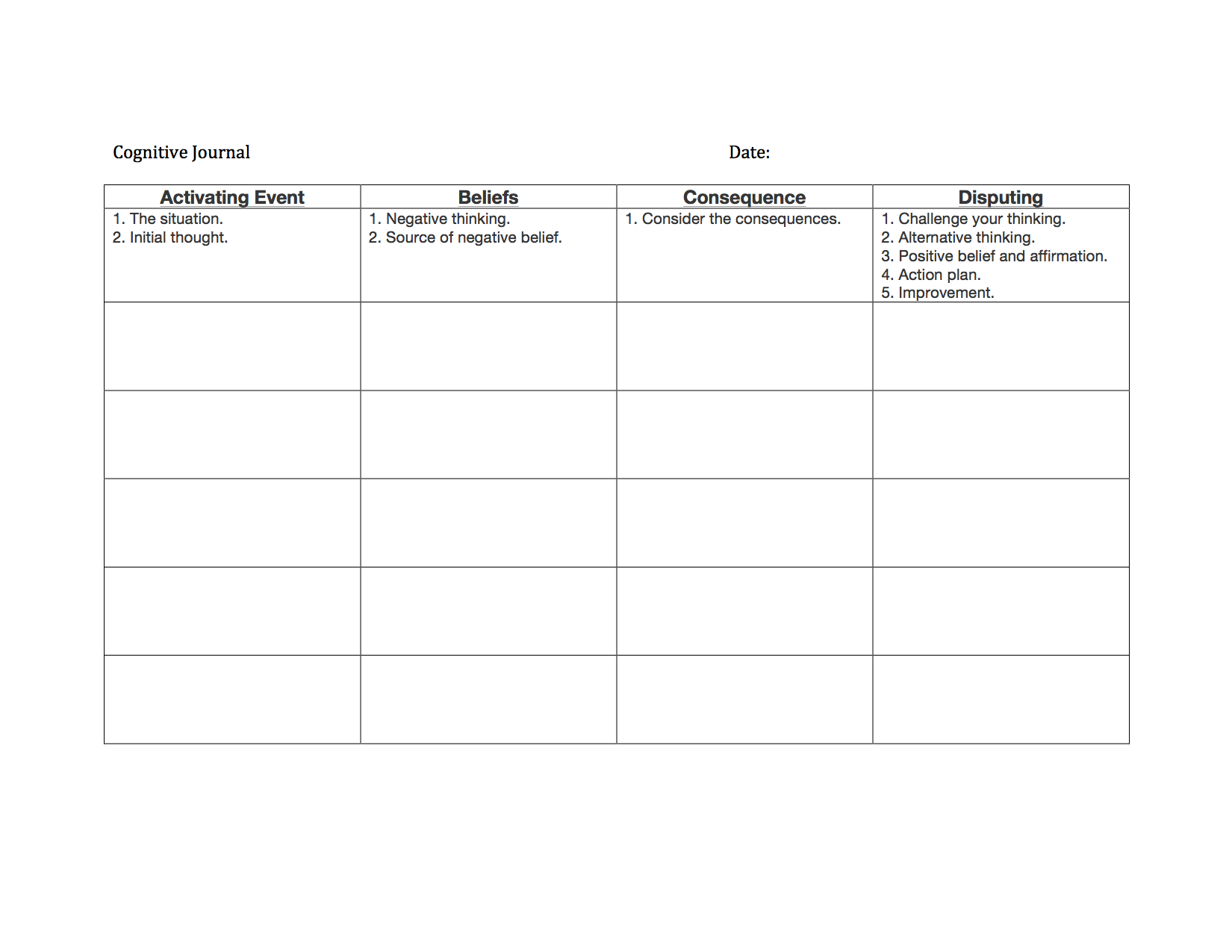

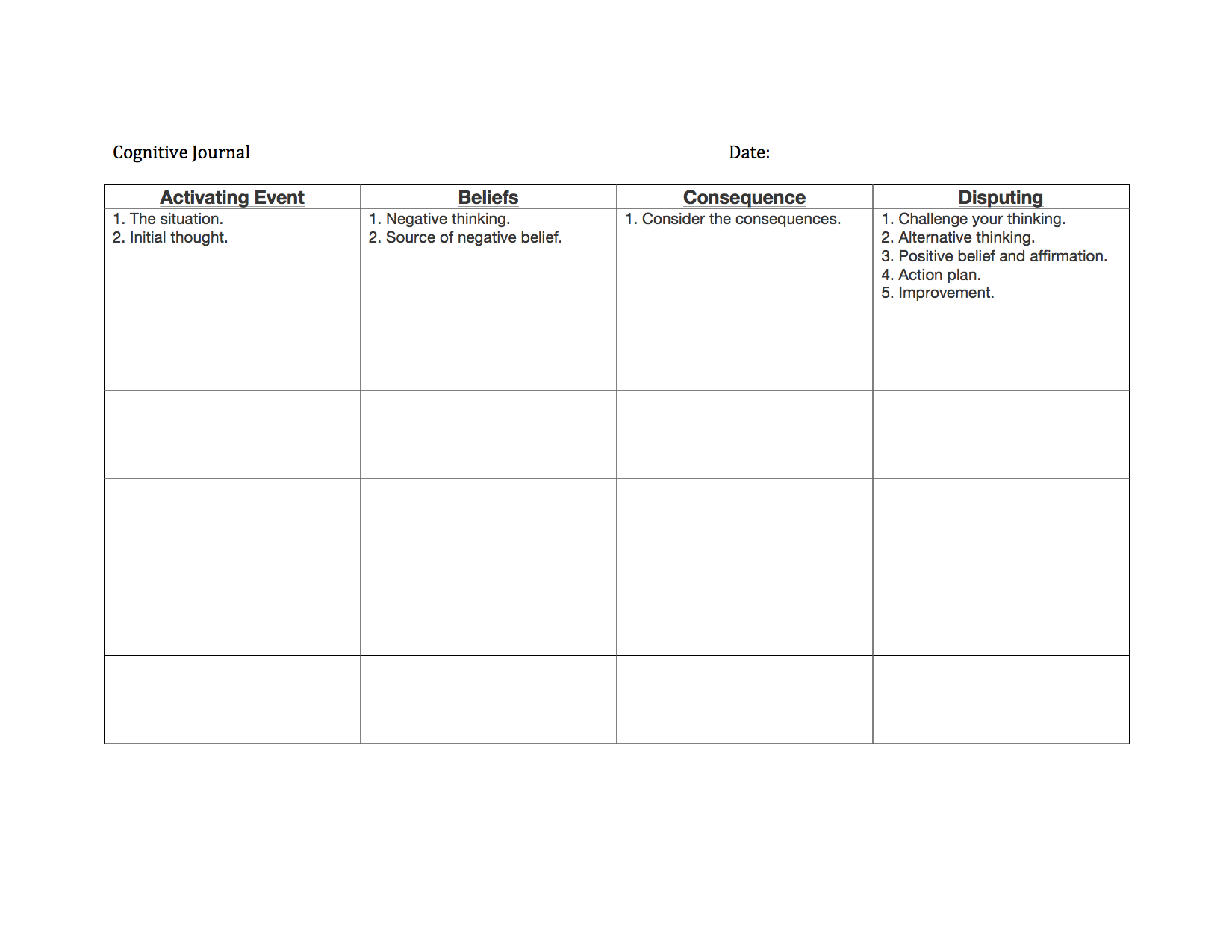

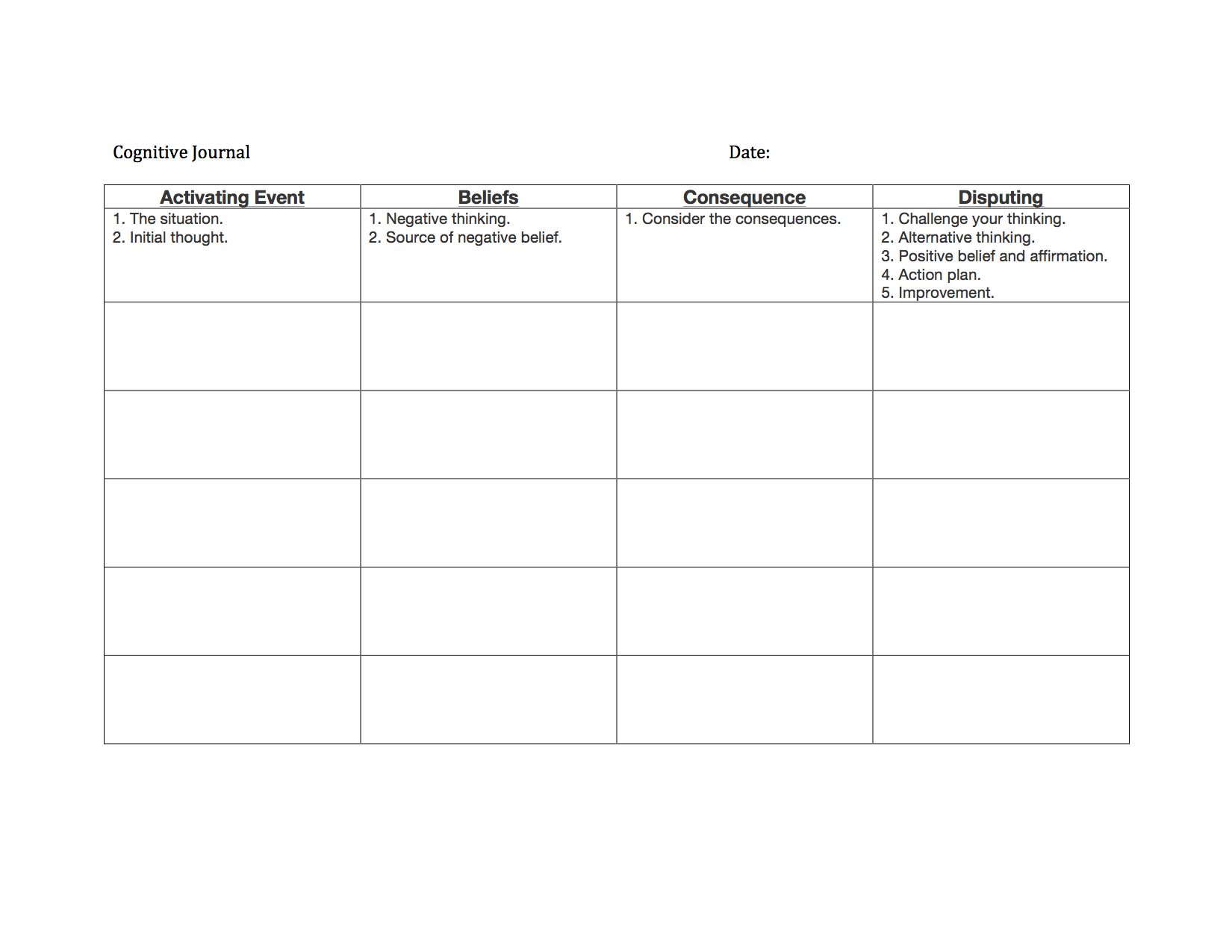

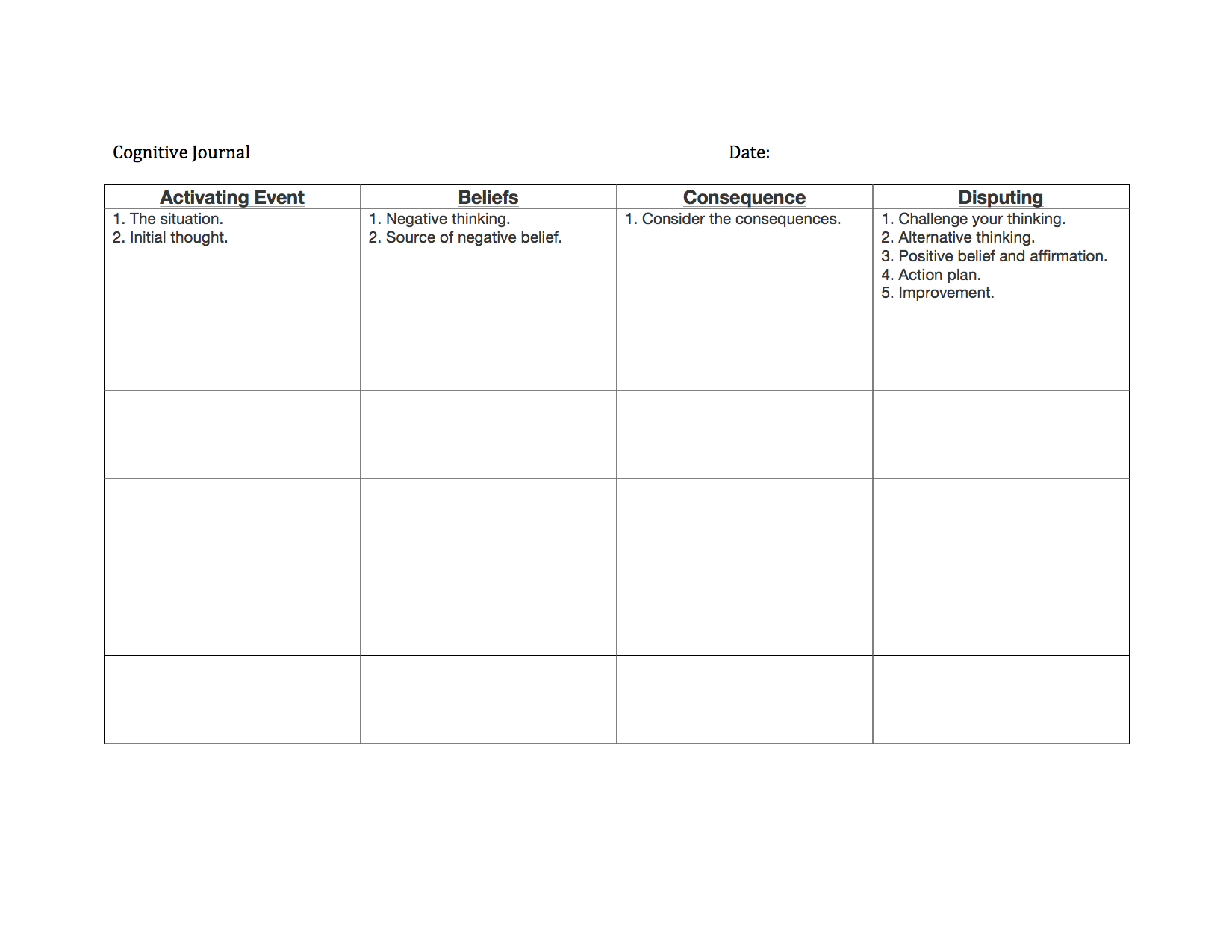

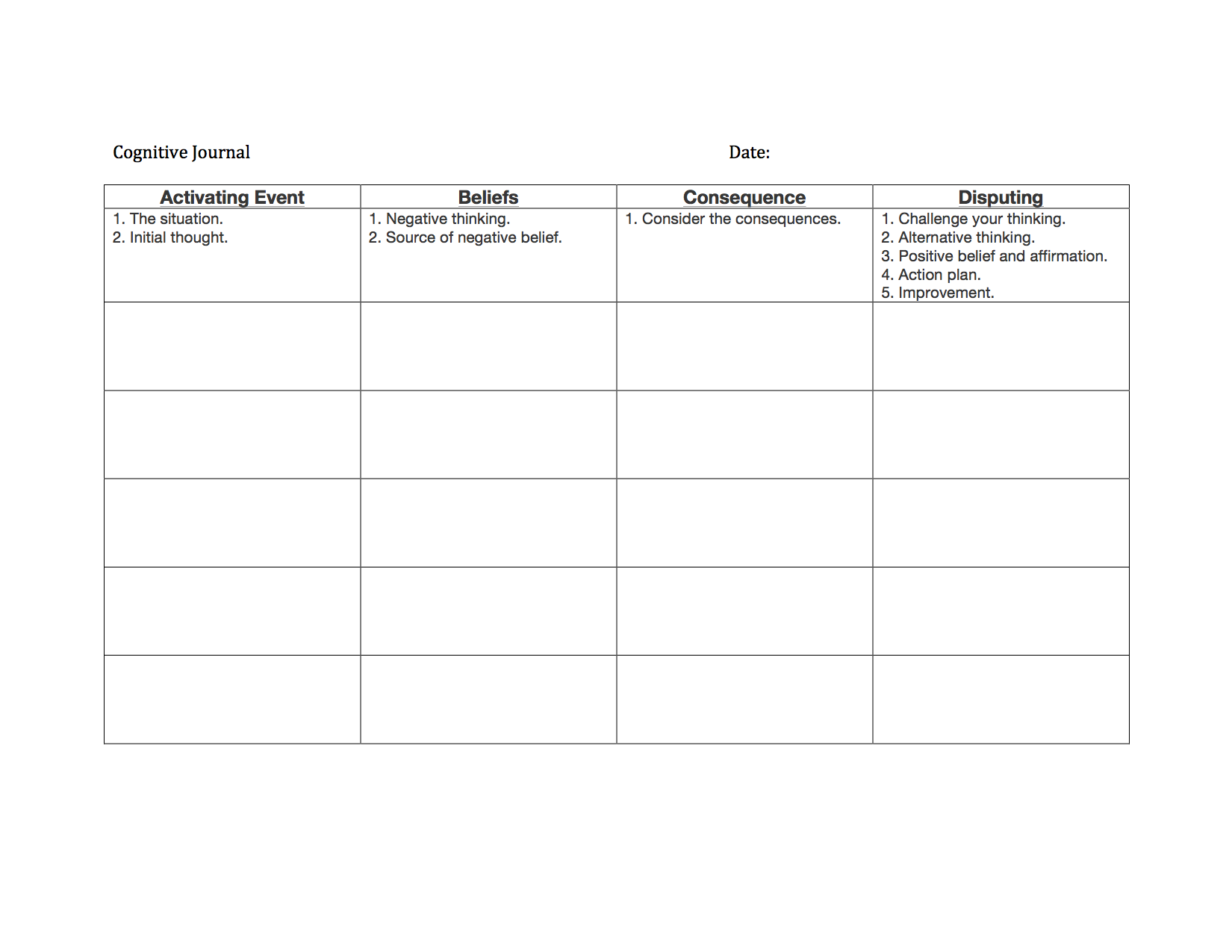

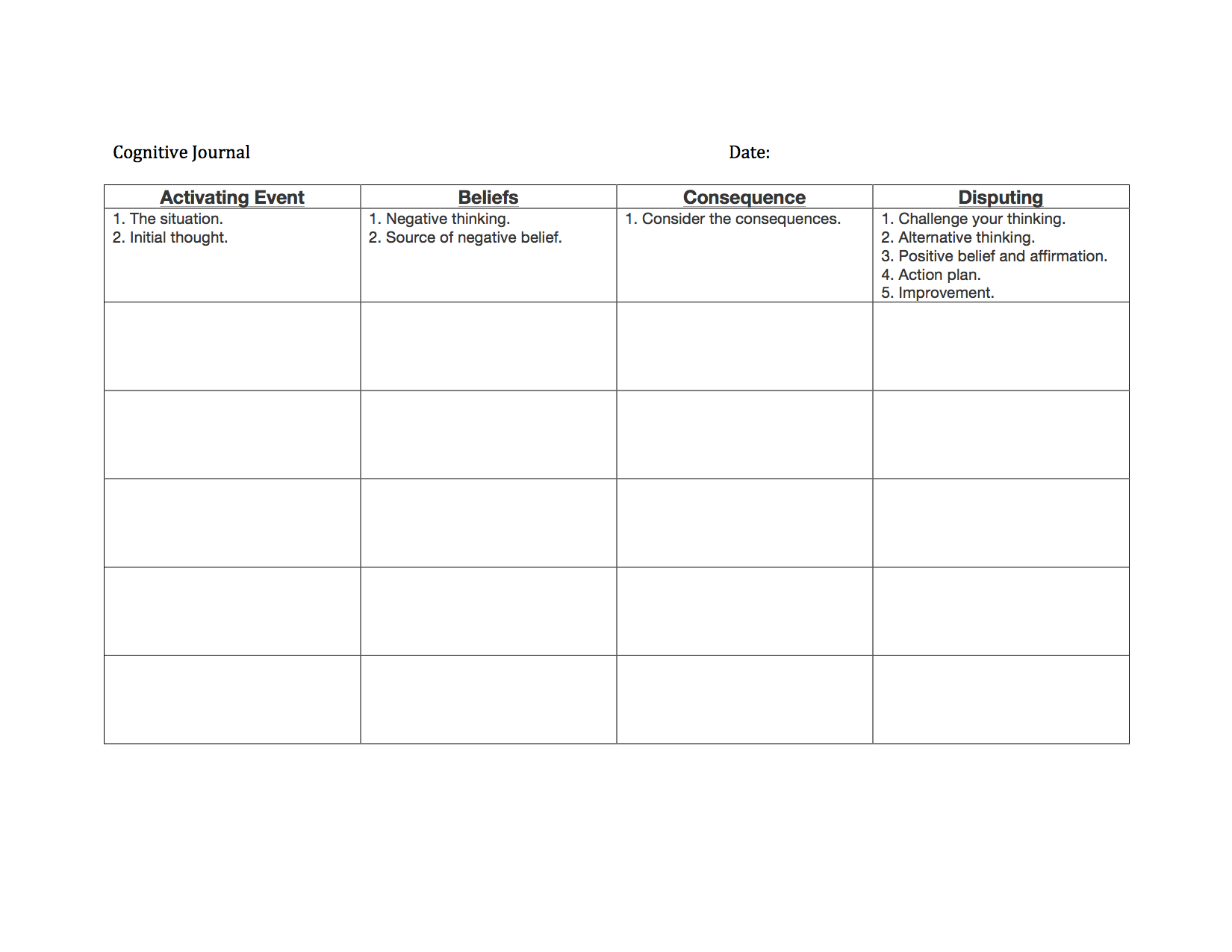

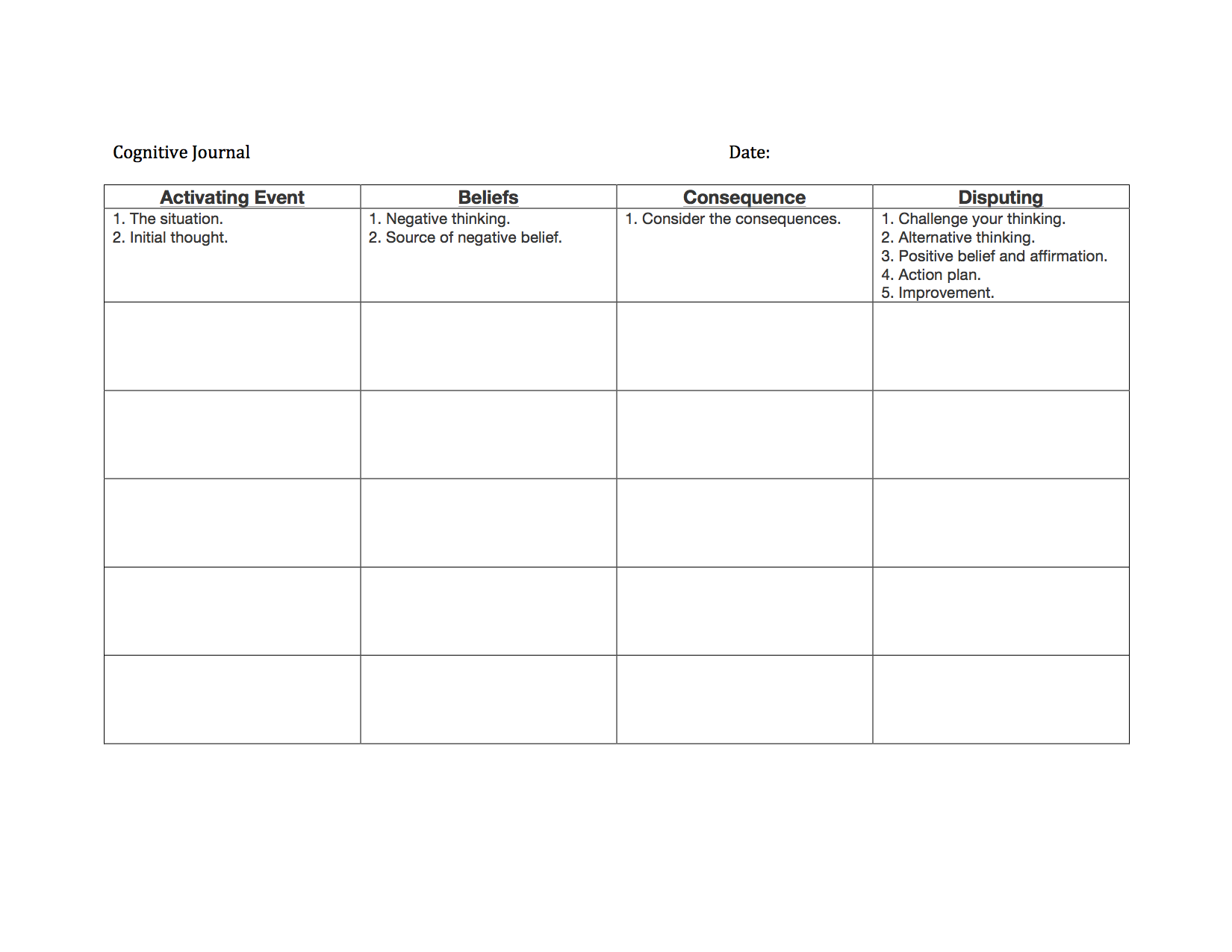

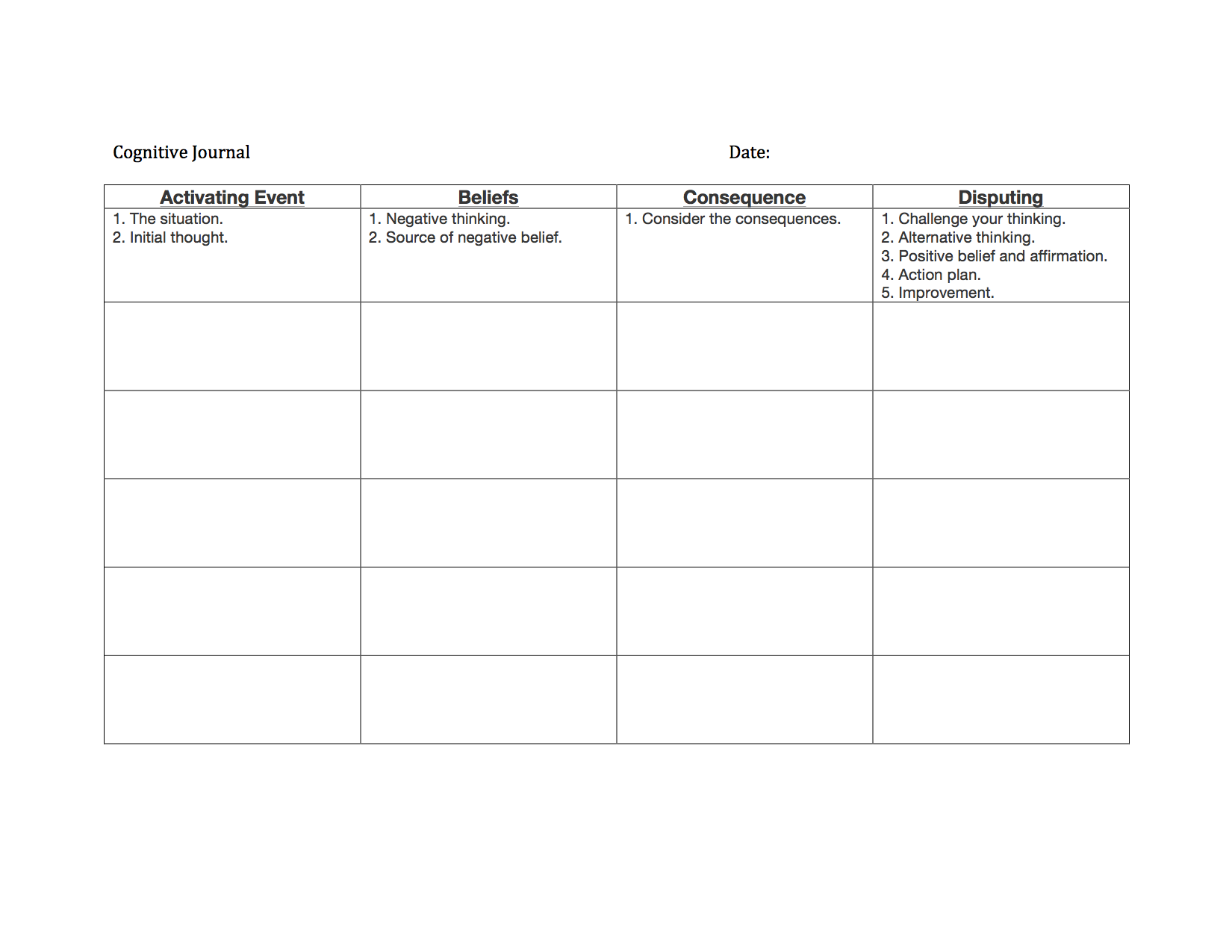

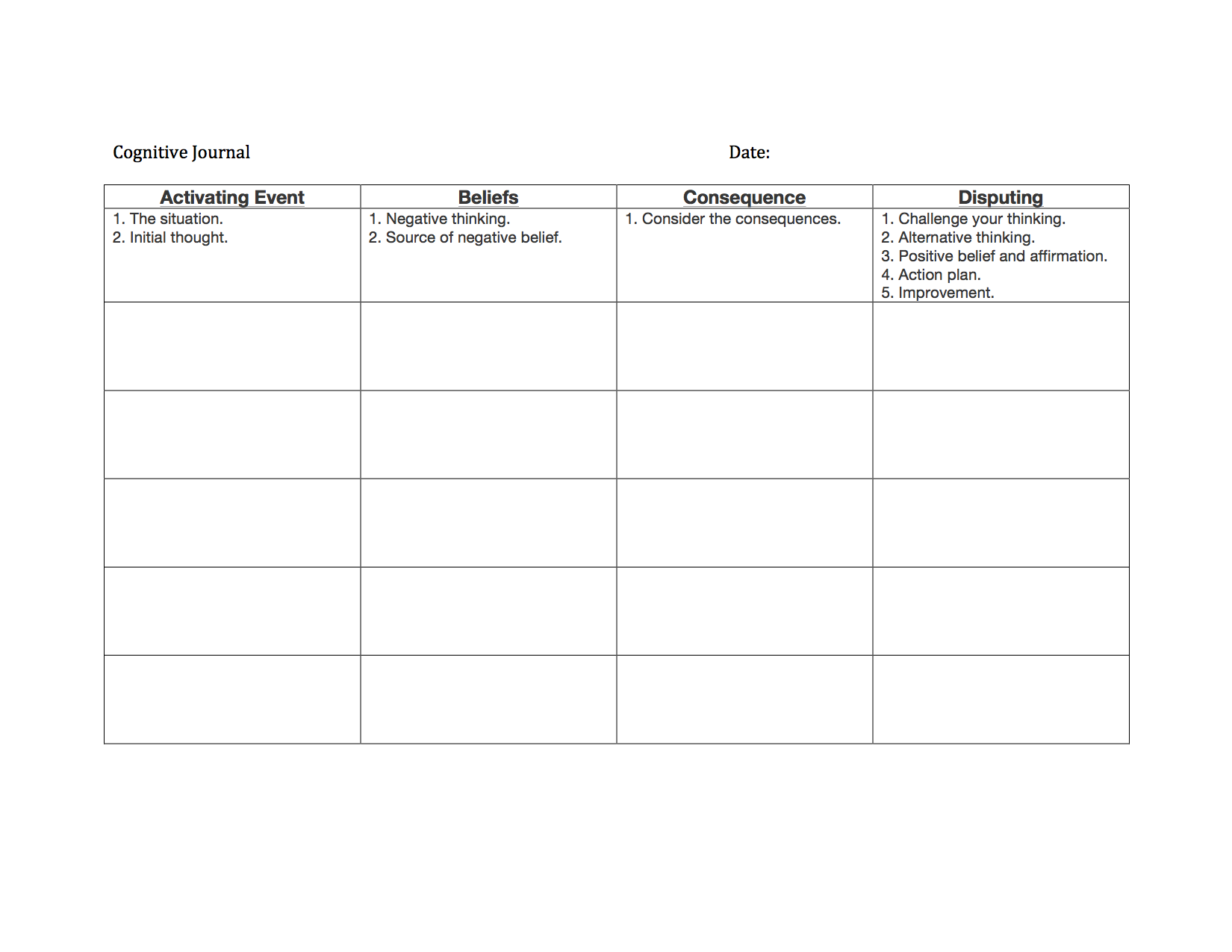

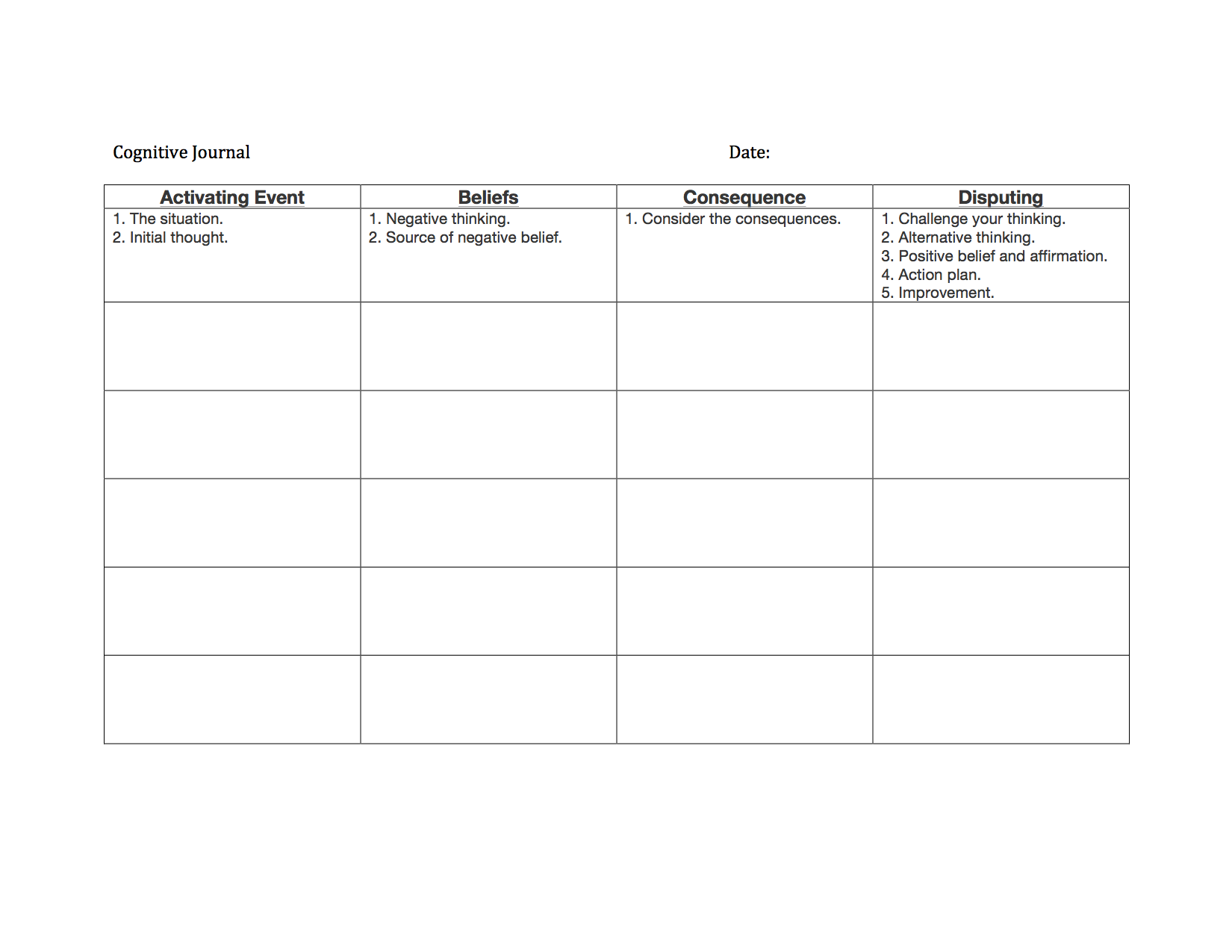

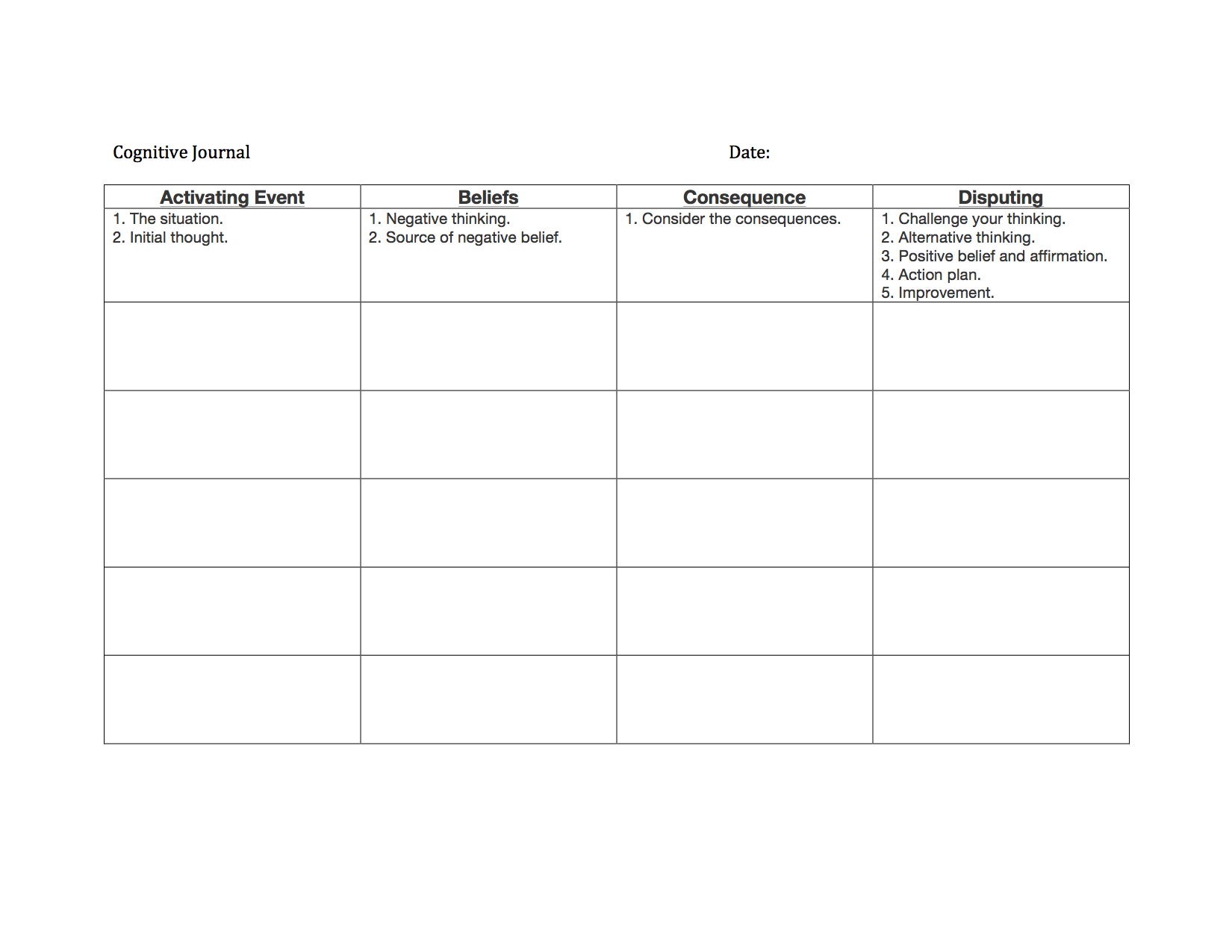

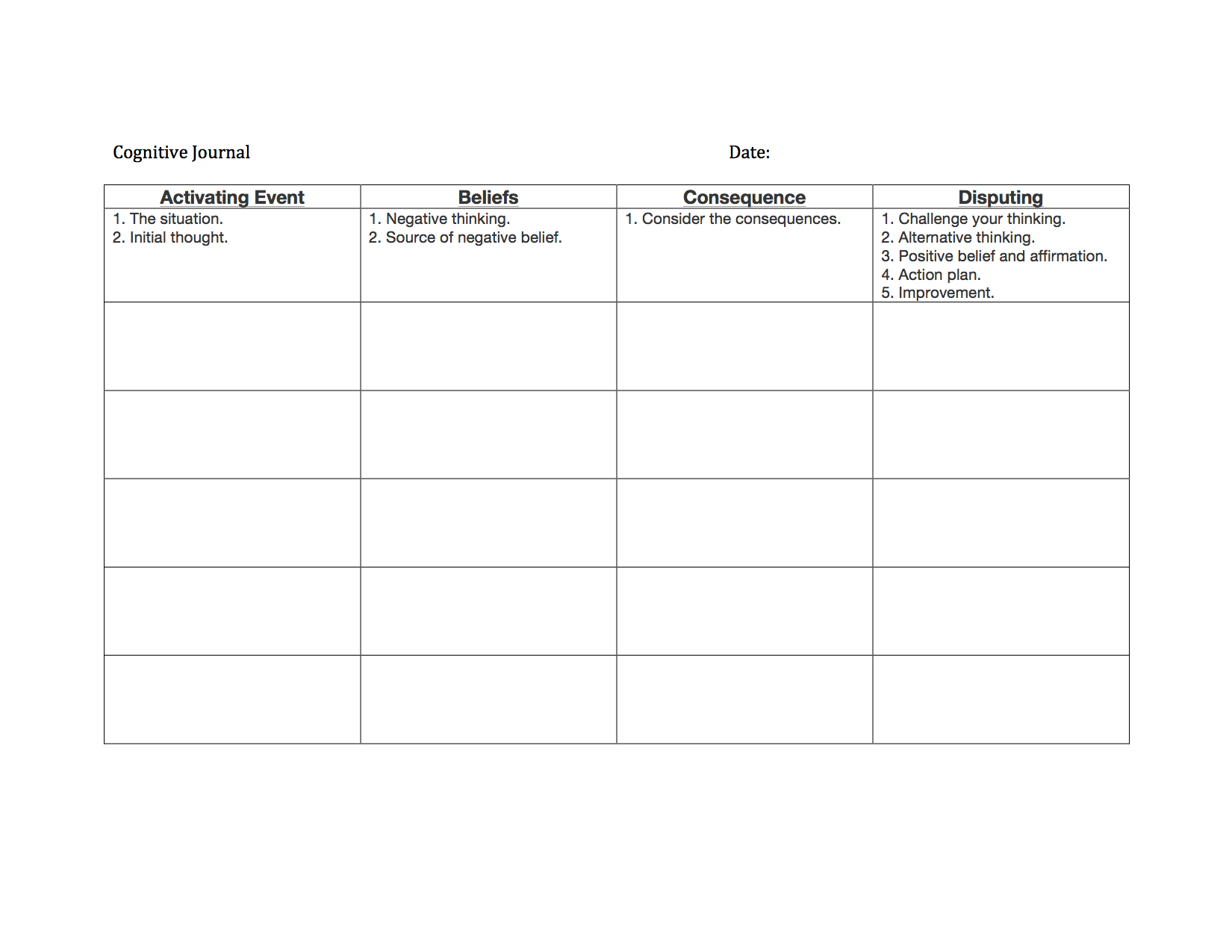

- Cognitive Behavioral Therapy Worksheets

- Cognitive Behavioral Therapy Worksheets

- Cognitive Behavioral Therapy Worksheets

- Cognitive Behavioral Therapy Worksheets

- Cognitive Behavioral Therapy Worksheets

- Cognitive Behavioral Therapy Worksheets

- Cognitive Behavioral Therapy Worksheets

- Cognitive Behavioral Therapy Worksheets

- Cognitive Behavioral Therapy Worksheets

- Cognitive Behavioral Therapy Worksheets

- Cognitive Behavioral Therapy Worksheets

- Cognitive Behavioral Therapy Worksheets

- Cognitive Behavioral Therapy Worksheets

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a Cash Flow Planning Worksheet?

A Cash Flow Planning Worksheet is a financial tool used to track and manage the flow of money into and out of a person or organization's finances over a specific period of time. It typically involves recording all sources of income, as well as expenses and expenditures, to gain a comprehensive understanding of one's financial situation. This helps in creating a financial plan, identifying potential areas for cost savings, and ensuring that there is enough cash available to cover necessary expenses.

How can a Cash Flow Planning Worksheet help with financial management?

A Cash Flow Planning Worksheet can help with financial management by providing a detailed overview of a person's or company's cash inflows and outflows. It allows for better tracking and management of expenses, income, and savings, enabling individuals or businesses to identify potential cash shortfalls or surpluses. By using the worksheet to forecast cash flow, one can make more informed financial decisions, plan for unforeseen expenses, prioritize spending, and ensure better financial stability in the long run.

What are the key components of a Cash Flow Planning Worksheet?

A Cash Flow Planning Worksheet typically includes categories such as income, expenses, savings, investments, and planned purchases. It also consists of sections where individuals can list their sources of income, fixed and variable expenses, as well as savings and investment goals. The worksheet may also include a section for tracking actual versus projected cash flow to help individuals better understand their financial habits and make necessary adjustments to achieve their financial goals.

How often should a Cash Flow Planning Worksheet be updated?

A Cash Flow Planning Worksheet should ideally be updated on a monthly basis to ensure accuracy and relevance. This frequency allows individuals and businesses to track their financial activities, monitor fluctuations in income and expenses, and make timely adjustments to their financial plans. Regular updates enable better decision-making and help in achieving financial goals effectively.

What types of expenses should be included in a Cash Flow Planning Worksheet?

Expenses that should be included in a Cash Flow Planning Worksheet are all regular monthly expenses such as rent or mortgage payments, utilities, groceries, transportation costs, insurance, debt repayments, and any other fixed or variable expenses. It is also important to include discretionary spending like entertainment, dining out, and other non-essential expenses as they can impact overall cash flow. Additionally, savings and investment contributions should be accounted for as part of expenses to ensure a comprehensive financial picture.

How can a Cash Flow Planning Worksheet help identify areas of financial improvement?

A Cash Flow Planning Worksheet can help identify areas of financial improvement by providing a clear overview of income sources and expenses. By analyzing the information in the worksheet, individuals can see where their money is being allocated and identify areas where costs can be reduced or income increased. This tool allows for greater visibility into cash flow patterns and helps in creating a budget to better manage finances, ultimately leading to the identification of areas for improvement and optimization.

What are the typical sources of income that should be included in a Cash Flow Planning Worksheet?

Typical sources of income that should be included in a Cash Flow Planning Worksheet are salaries, wages, bonuses, commissions, rental income, investment income (dividends, interest), business income, alimony, child support, and any other sources of money coming into the household on a regular basis. Additionally, it is important to consider any sporadic or irregular sources of income such as tax refunds, gifts, or one-time payouts that may also impact cash flow.

How can a Cash Flow Planning Worksheet be used to track and analyze cash flow patterns?

A Cash Flow Planning Worksheet can be used to track and analyze cash flow patterns by listing all sources of income and expenses in an organized manner. By recording the timing and amounts of cash inflows and outflows, one can identify trends, pinpoint areas of concern, and plan ahead for potential cash shortages or surpluses. Regularly updating and reviewing the worksheet allows for better financial decision-making, helping individuals and businesses to achieve financial stability and reach their goals.

What are some potential benefits of regularly using a Cash Flow Planning Worksheet?

Regularly using a Cash Flow Planning Worksheet can help individuals or businesses track their income and expenses more effectively, identify areas of overspending or potential savings, improve financial decision-making, reduce financial stress, and ultimately work towards achieving financial goals such as saving for a big purchase, building an emergency fund, or paying off debt. By having a clear overview of their cash flow, individuals can make informed decisions about their money and plan for a more secure financial future.

How can a Cash Flow Planning Worksheet be customized to fit individual financial goals and needs?

A Cash Flow Planning Worksheet can be customized by incorporating specific financial goals and needs into the worksheet. This can be done by including categories tailored to the individual's income sources, expenses, debt payments, savings goals, and investment plans. By adjusting the amounts allocated to each category based on the individual's financial goals, such as saving for a home, paying off student loans, or building an emergency fund, the Cash Flow Planning Worksheet can be personalized to meet the individual's unique financial situation and aspirations. Additionally, regularly reviewing and updating the worksheet can help track progress towards these goals and make necessary adjustments as needed.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments