Business Math Worksheets with Answers

Business math worksheets with answers are an essential tool for students and professionals alike who want to enhance their numerical and analytical skills in the business world. Designed to provide hands-on practice in various business concepts, these worksheets offer a wide range of problems that cover areas such as finance, accounting, economics, and statistics. Whether you are a student looking to improve your grades or a professional seeking to sharpen your skills, these worksheets provide a valuable opportunity to reinforce your understanding of important business concepts and boost your confidence in handling real-life scenarios.

Table of Images 👆

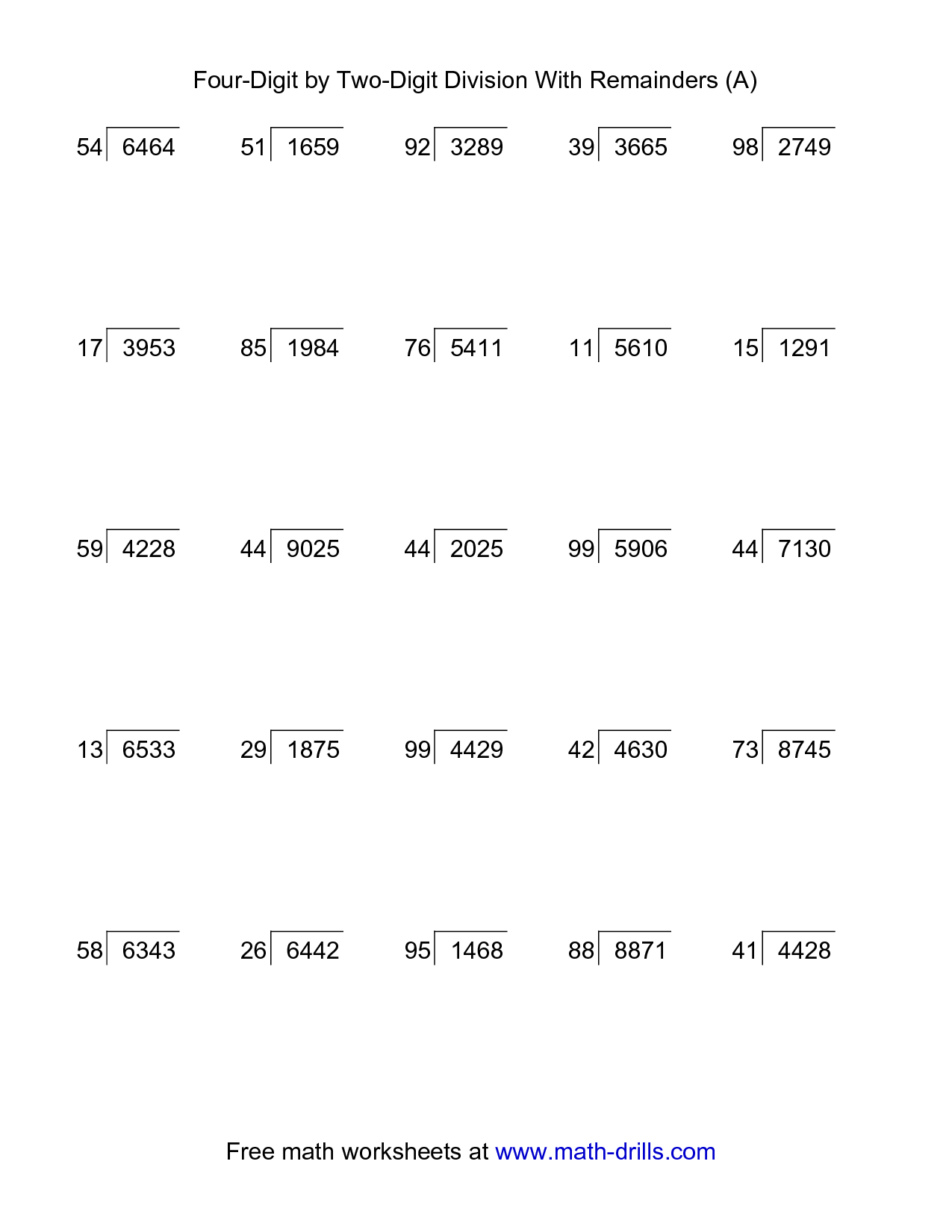

- Two-Digit Division Worksheets

- Kumon Math Level F Answer Book

- Business Math Problems Examples

- Basic Math Fact Printable Worksheets

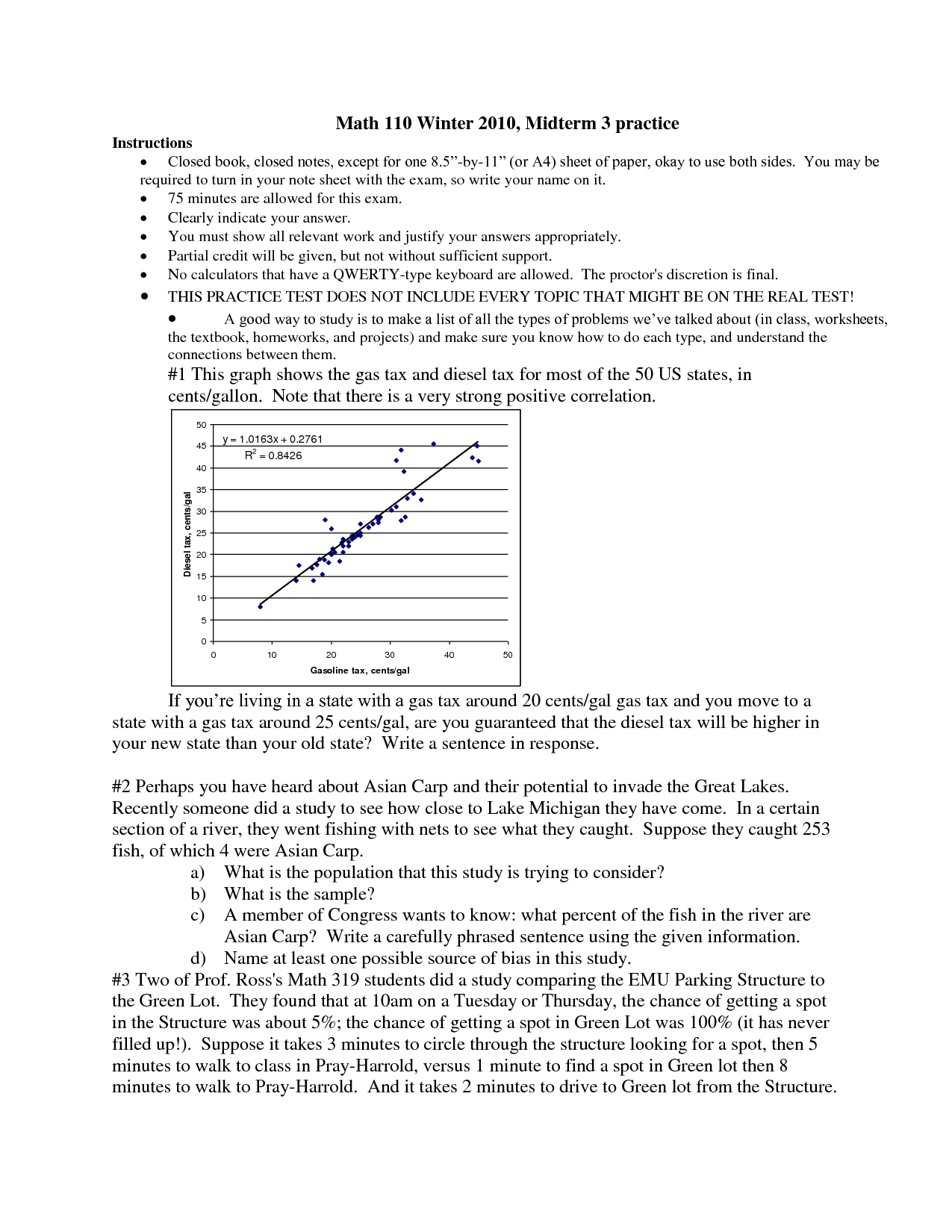

- Common Core Math Test Examples

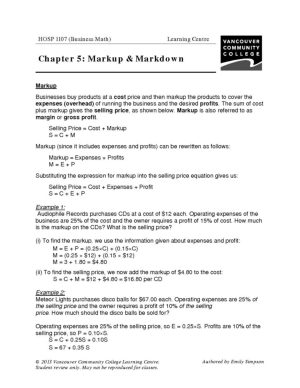

- Math Markup and Mark Down Examples

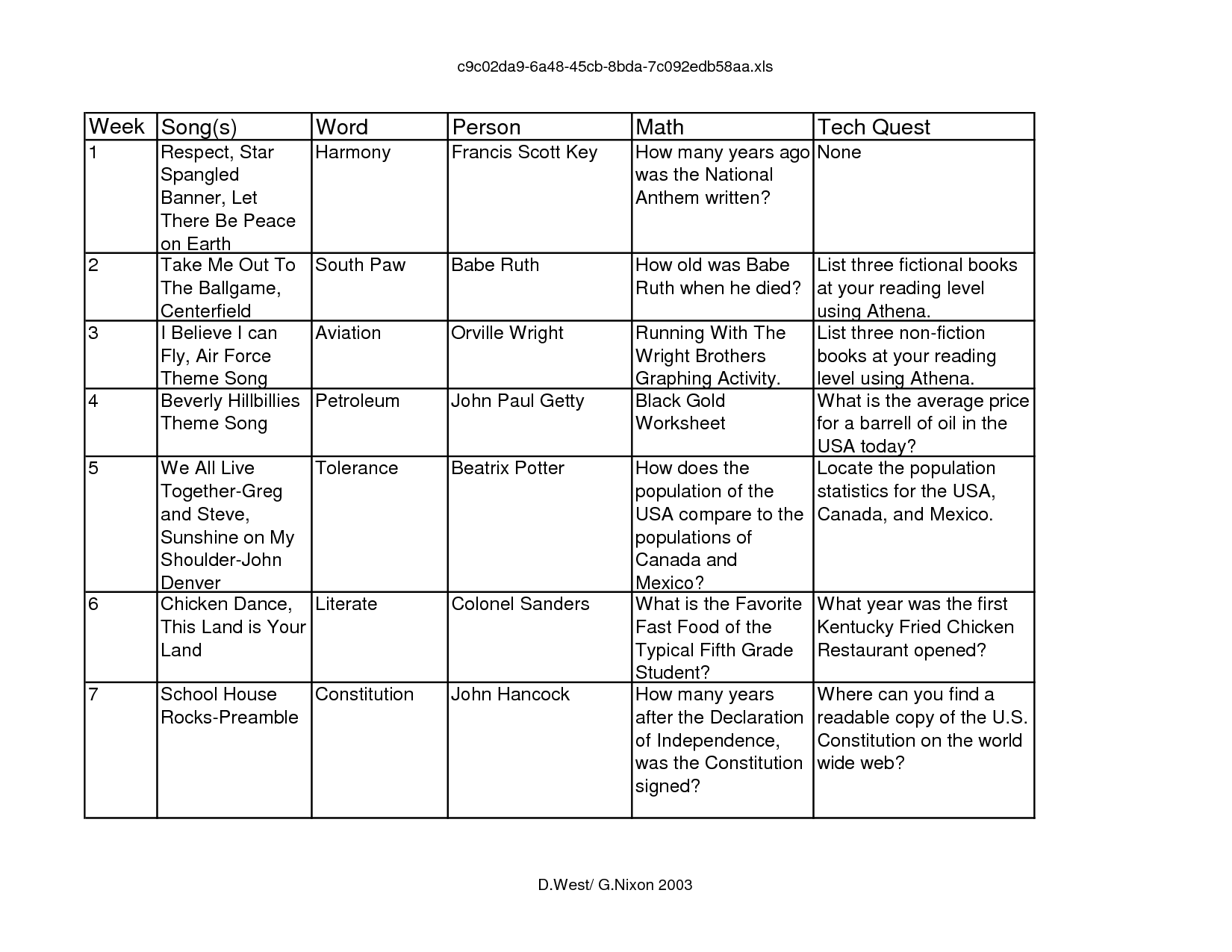

- Fifth Grade Mountain Math Worksheets

- Math Definitions Worksheet

- Glencoe Course 3 McGraw-Hill Worksheet

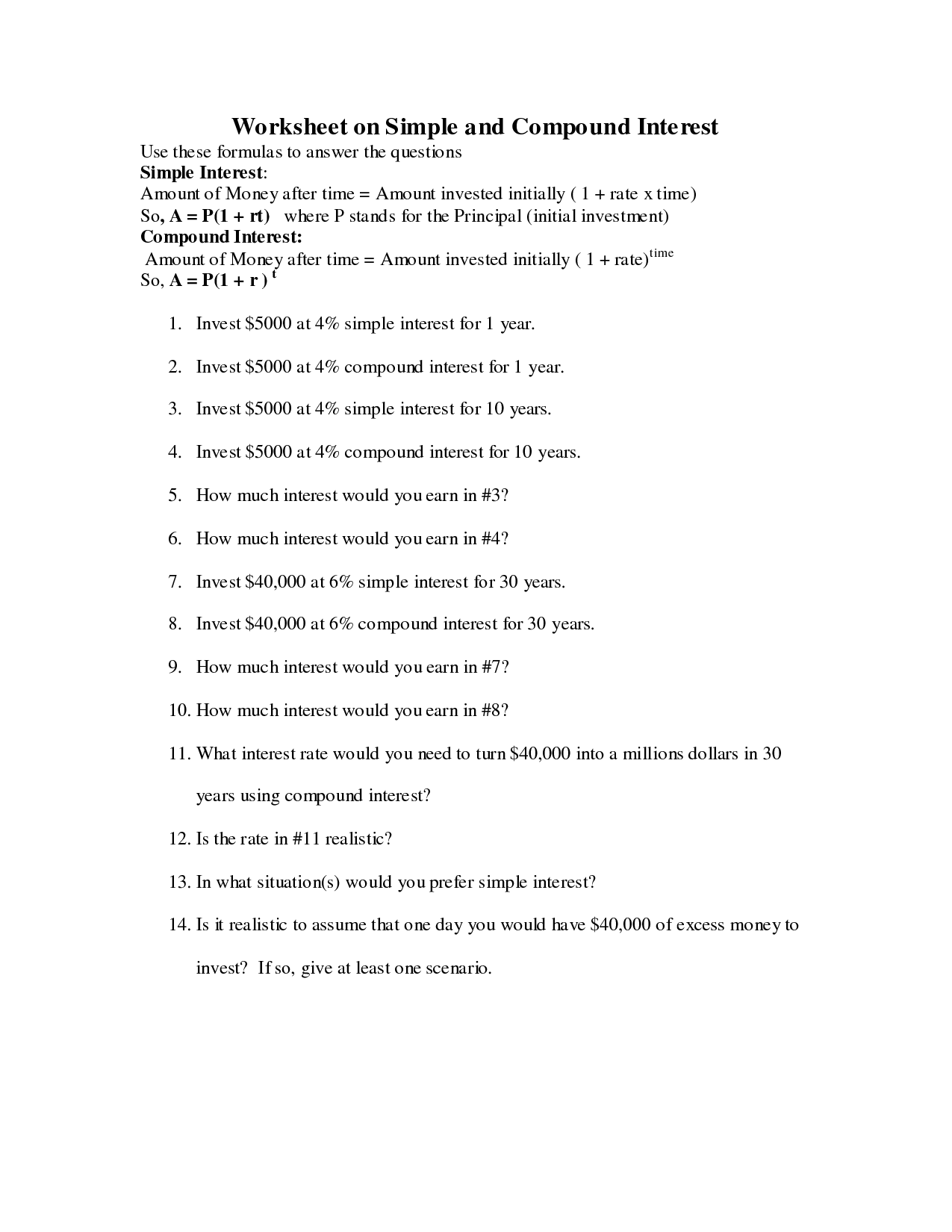

- Simple and Compound Interest Worksheets

- Tissues Worksheet Answers Chapter 4

- Tissues Worksheet Answers Chapter 4

More Math Worksheets

Printable Math WorksheetsMath Worksheets Printable

Printable Math Worksheets Multiplication

Math Worksheets for 2nd Graders

Math Practice Worksheet Grade 6

Math Multiplication Worksheets

First Grade Subtraction Math Worksheets Printable

Rocket Math Practice Worksheets

Math Worksheets Integers

Superhero Math Worksheets

What is the purpose of business math?

The purpose of business math is to provide essential skills and tools for analyzing and managing financial and operational aspects of business. It helps in making informed financial decisions, analyzing performance metrics, solving business problems, forecasting trends, and maximizing profitability. Business math equips individuals with the necessary quantitative skills to understand and interpret numerical data and formulas relevant to business operations, ultimately aiding in efficient and successful business management.

How is compound interest calculated?

Compound interest is calculated by adding the interest accrued in each period back to the principal amount, resulting in the new principal for the next period. The formula for compound interest is A = P(1 + r/n)^(nt), where A is the future value of the investment, P is the principal amount, r is the interest rate, n is the number of times that interest is compounded per year, and t is the number of years the money is invested for.

What is the formula to calculate profit and loss?

The formula to calculate profit is: Profit = Revenue - Cost. The formula to calculate loss is: Loss = Cost - Revenue.

How do you calculate the break-even point?

To calculate the break-even point, you need to divide the fixed costs by the difference between the sales price per unit and the variable cost per unit. This will give you the number of units that need to be sold in order to cover all costs and start generating profit. The formula is Break-even point = Fixed costs / (Sales price per unit - Variable cost per unit).

What is the formula for calculating depreciation?

The formula for calculating depreciation is (Cost of asset - Salvage value) / Useful life of asset. This formula helps determine how much an asset's value decreases over time due to wear and tear or obsolescence.

How is the present value of future cash flows determined?

The present value of future cash flows is determined by discounting the future cash flows to their present value by using a discount rate. This involves taking into consideration the risk associated with the cash flows and adjusting the discount rate accordingly. The formula for calculating the present value of future cash flows is PV = CF / (1 + r)^n, where PV is the present value, CF is the future cash flow, r is the discount rate, and n is the number of periods in the future.

What is the equation for calculating the net present value?

The equation for calculating the net present value (NPV) is NPV = ∑(CFt / (1 + r)^t), where CFt represents the cash flow at time period t, r is the discount rate, and t is the time period.

How do you calculate the return on investment?

You can calculate the return on investment (ROI) by subtracting the initial investment cost from the final value of the investment, then dividing the result by the initial investment cost and multiplying by 100 to get a percentage. The formula for ROI is (Final Value - Initial Investment Cost) / Initial Investment Cost * 100.

What is the formula for calculating the inventory turnover ratio?

The formula for calculating the inventory turnover ratio is Cost of Goods Sold divided by Average Inventory. This ratio measures how many times a company's inventory is sold and replaced over a specific period, typically one year.

How do you determine the cost of goods sold?

To determine the cost of goods sold, you need to start with the beginning inventory value, add the cost of purchases made during the accounting period, and subtract the ending inventory value. The formula is Beginning Inventory + Purchases - Ending Inventory = Cost of Goods Sold. This calculation helps a business determine the cost incurred to produce or purchase the goods that were actually sold during a specific period.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments