Business Expense Worksheet

Keeping track of business expenses is crucial for any entrepreneur or small business owner. It allows you to stay organized, monitor your cash flow, and ensure that you remain within your budgets. To make this process easier and more efficient, using a business expense worksheet is a smart choice. With a variety of worksheets available, you can choose the one that best suits your entity and subject, providing a simple and effective solution for managing your business expenses.

Table of Images 👆

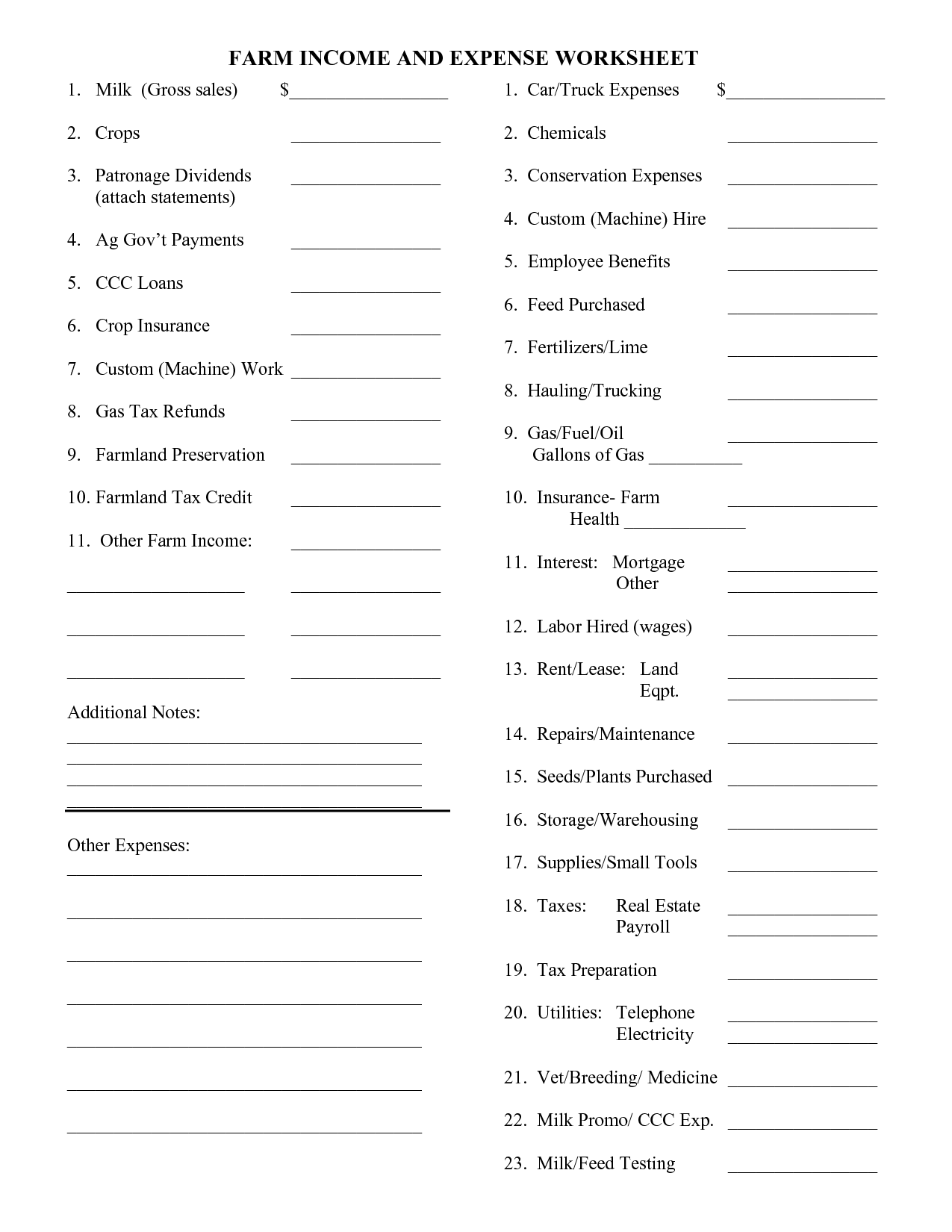

- Income and Expense Worksheet

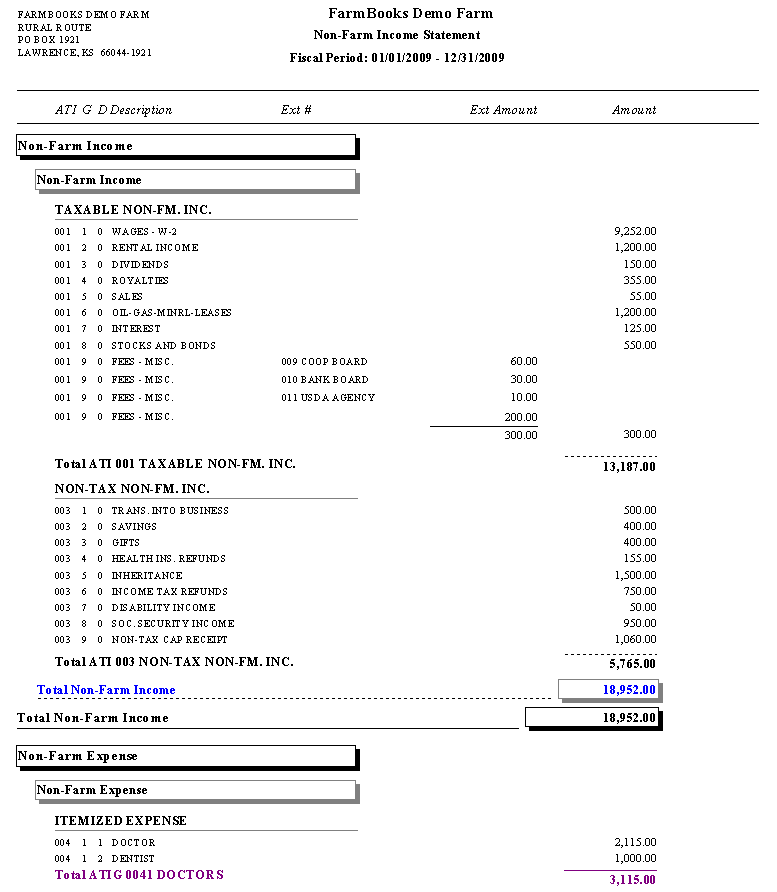

- Farm Income and Expense Worksheet

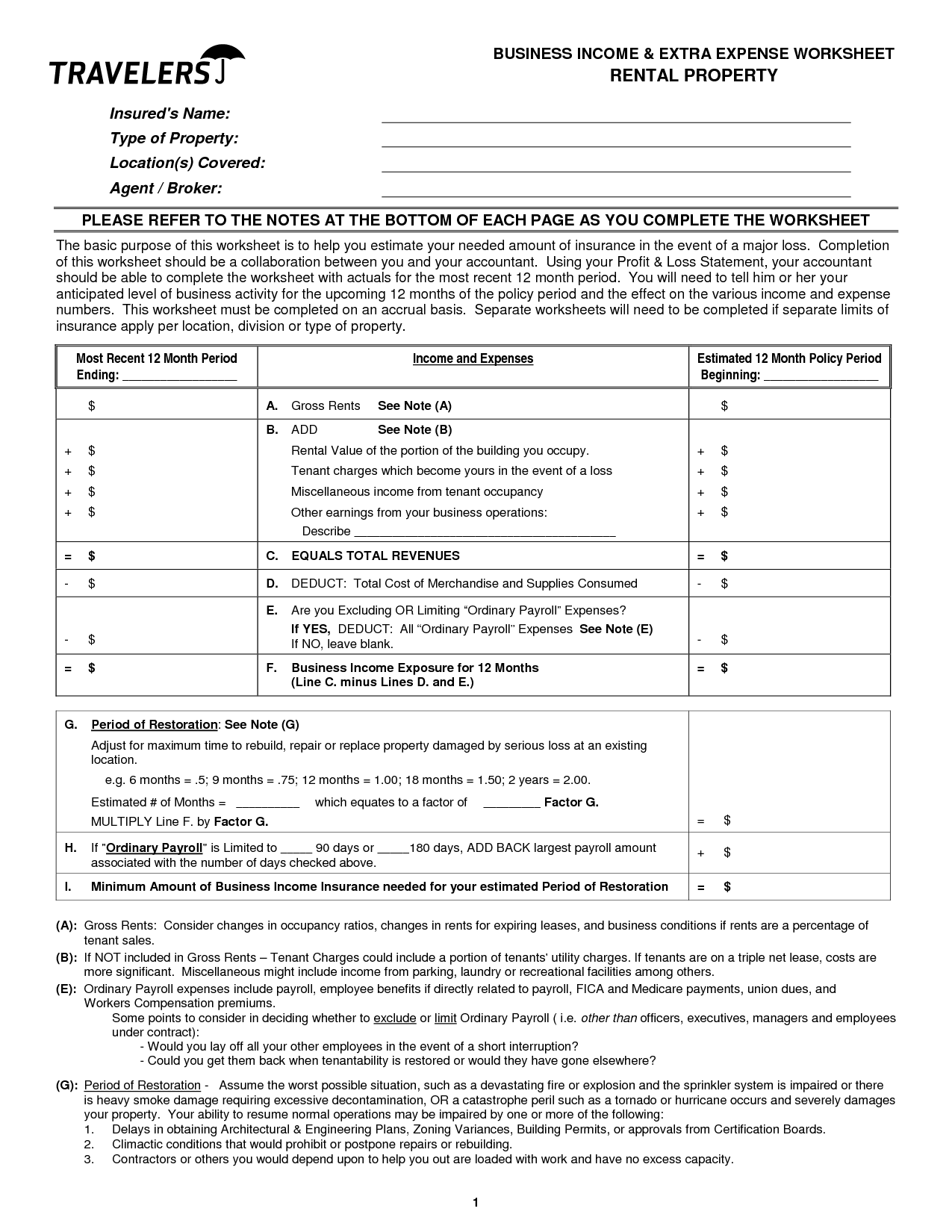

- Business Income Extra Expense Worksheet

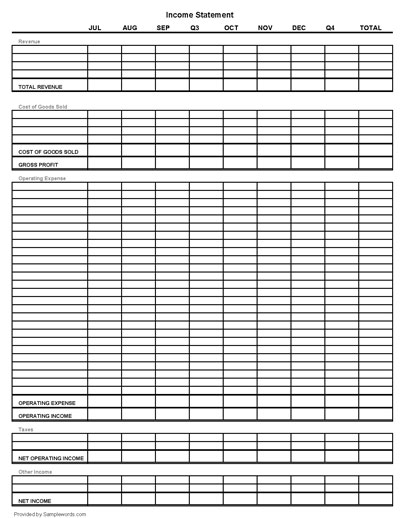

- Free Blank Spreadsheets

- Daily Budget Worksheet Printable

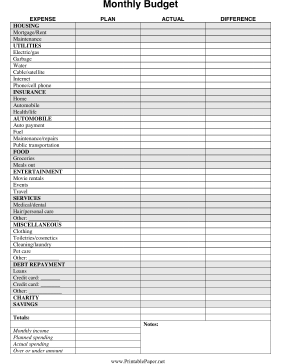

- Printable Monthly Budget Paper

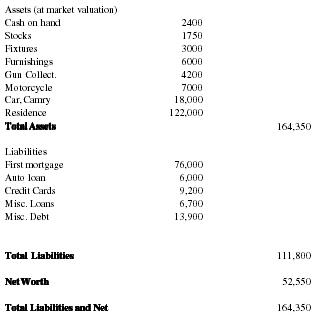

- Sample Balance Sheet for Service Company

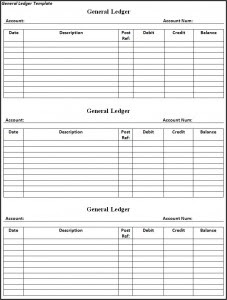

- Free General Ledger Template

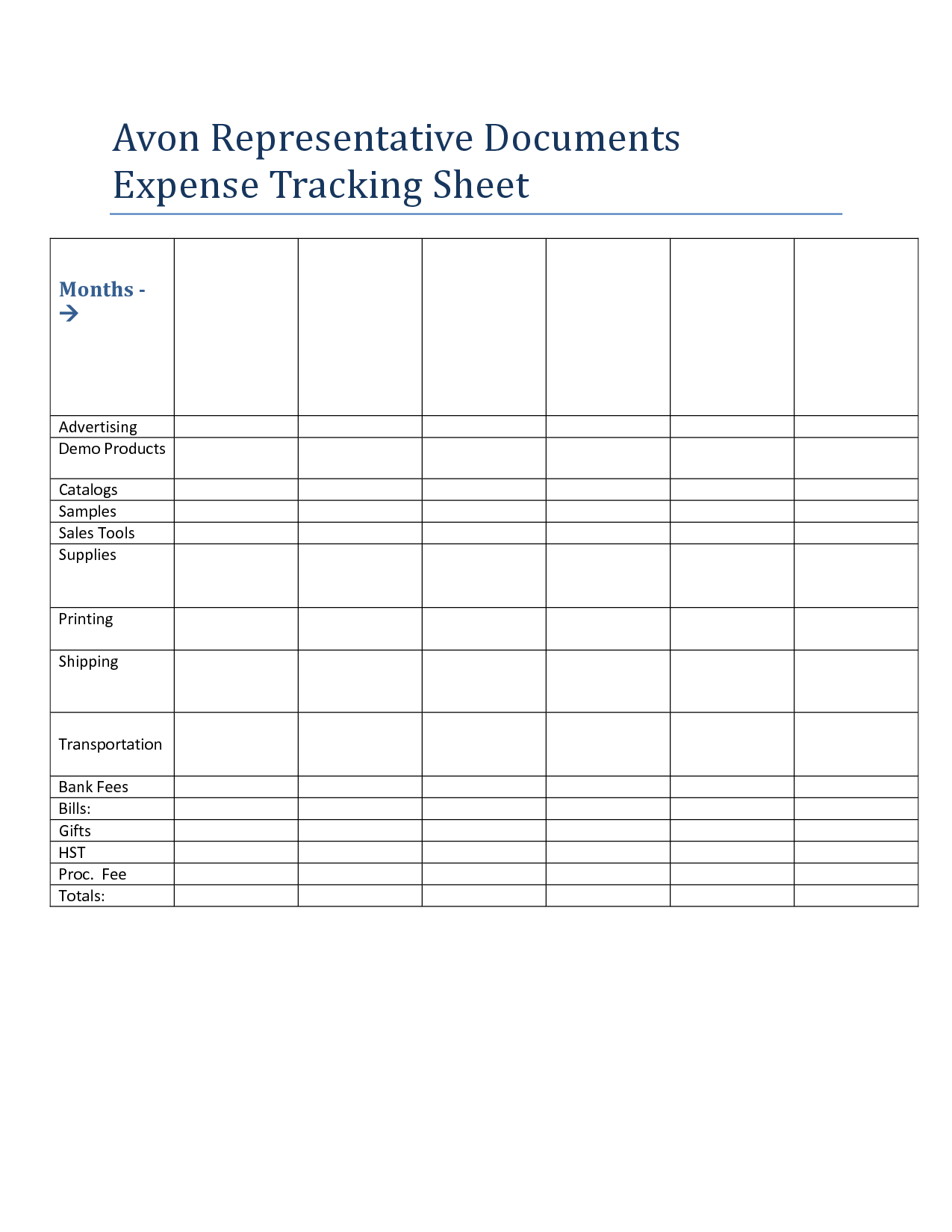

- Avon Expense Sheet Printable

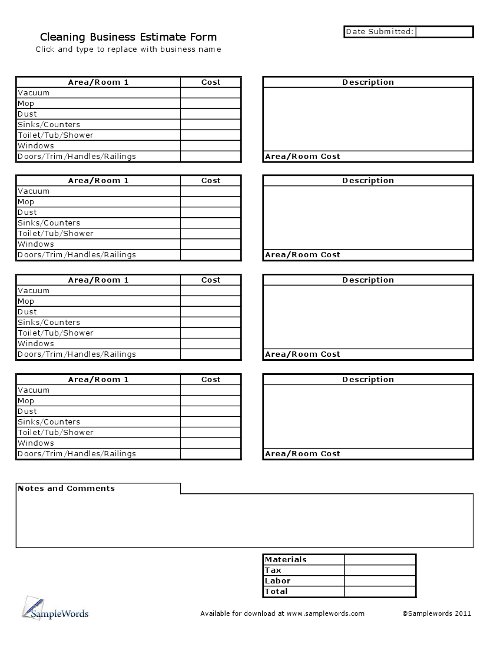

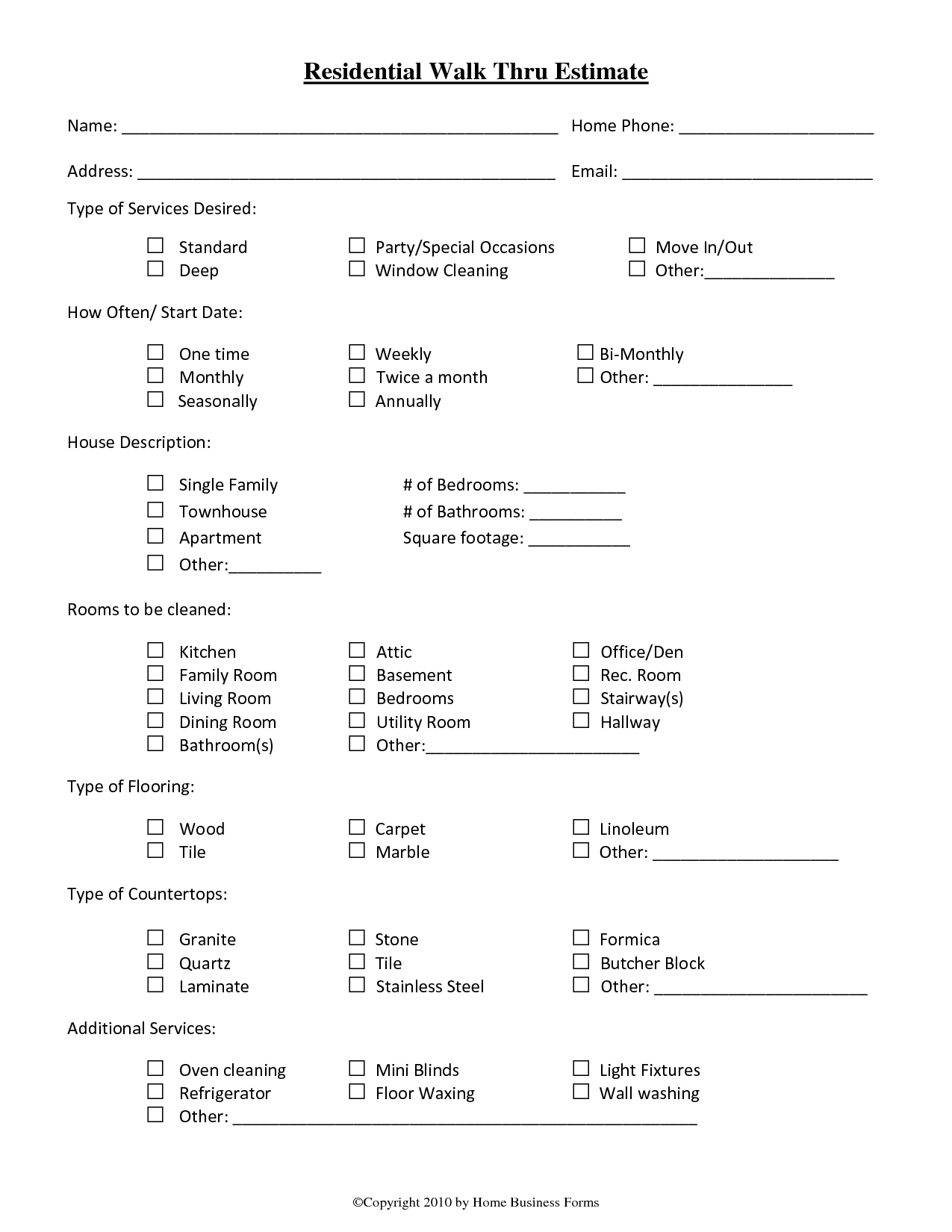

- House Cleaning Estimate Forms Free

- Non-Profit Income Statement

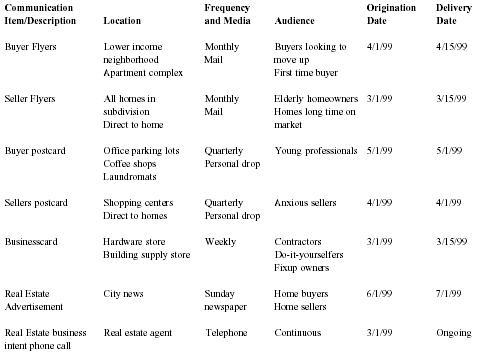

- Real Estate Business Plan Template

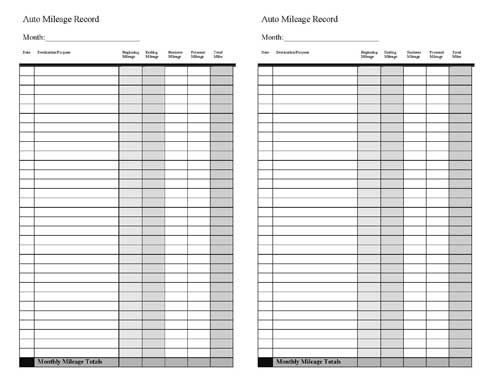

- Free Printable Mileage Log Template

- Free House Cleaning Estimate Sheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a business expense worksheet?

A business expense worksheet is a tool used by businesses to track and categorize their expenses. It typically includes columns for recording details such as transaction date, description, category (e.g., office supplies, utilities, travel), amount spent, and payment method. This worksheet helps businesses monitor and analyze their expenses for budgeting, tax reporting, and financial planning purposes.

How does a business expense worksheet help in managing finances?

A business expense worksheet helps in managing finances by providing a structured way to track and categorize expenses, which allows for better budgeting and forecasting. It helps identify areas where costs can be reduced, ensures accurate record-keeping for tax purposes, and provides insights into cash flow and overall financial health. By regularly updating and analyzing the expense worksheet, businesses can make informed decisions to optimize expenses and improve profitability.

What kinds of expenses are typically tracked on a business expense worksheet?

On a business expense worksheet, various expenses are typically tracked, including but not limited to utilities, office rent, payroll costs, travel expenses, supplies, equipment purchases, marketing and advertising costs, insurance premiums, legal fees, and any other overhead expenses related to running the business. Keeping track of these expenses helps businesses monitor their financial health, budget effectively, and make informed decisions to increase profitability.

How can a business expense worksheet help in budgeting and forecasting?

A business expense worksheet can help in budgeting and forecasting by providing a clear overview of all expenses incurred by the business. By tracking expenses on a worksheet, businesses can identify trends, predict future expenses, and allocate resources more effectively. This data can be used to create accurate budgets and forecasts, enabling businesses to make informed decisions, set realistic financial goals, and plan for potential risks or opportunities. Ultimately, a business expense worksheet plays a crucial role in ensuring financial stability and success.

What key information should be included in a business expense worksheet?

A business expense worksheet should include details such as date of the expense, description of the expense, amount spent, category of the expense (e.g. supplies, utilities, travel), method of payment (cash, credit card, etc.), and any relevant receipts or documentation. Additionally, it is important to track whether the expense is tax-deductible and to regularly update and review the worksheet to ensure accurate record-keeping for financial planning and reporting purposes.

What are some common categories for organizing expenses on a business expense worksheet?

Common categories for organizing expenses on a business expense worksheet may include: office expenses, travel and entertainment, utilities, rent and lease payments, supplies, advertising and marketing, insurance, taxes, and employee wages. These categories help businesses to track and manage their expenses effectively, allowing for better financial planning and decision-making.

How can a business expense worksheet be integrated with accounting software or other systems?

A business expense worksheet can be integrated with accounting software or other systems through the use of APIs (application programming interfaces) or data import/export functions. This allows for seamless transfer of data between the worksheet and the software/system, ensuring accuracy and efficiency in recording and tracking expenses. Setting up proper mapping and connectivity between the two systems is essential to ensure that all relevant information is synchronized and updated in real time. This integration streamlines the process of managing expenses and improves overall financial visibility and control for the business.

Can a business expense worksheet help in identifying areas of potential cost savings or inefficiencies?

Yes, a business expense worksheet can definitely help in identifying areas of potential cost savings or inefficiencies by providing a detailed breakdown of expenses across different categories. By analyzing the data in the worksheet, businesses can pinpoint areas where costs are higher than expected, identify areas where efficiency can be improved, and make informed decisions on where to cut back or invest resources more effectively. This can ultimately lead to better financial management and improved profitability for the business.

How often should a business expense worksheet be updated or reviewed?

A business expense worksheet should ideally be updated and reviewed on a regular basis, such as weekly or monthly, depending on the frequency of expenses being incurred by the business. Regular updates ensure accuracy of financial records, help in tracking cash flow, and assist in making informed financial decisions for the business.

What are some best practices for using a business expense worksheet effectively?

To use a business expense worksheet effectively, it is important to regularly update it with accurate information, categorize expenses properly to track spending patterns, review and analyze the data to identify cost-saving opportunities, set a budget and compare it with actual expenses, and ensure consistency in documenting all expenses for tax purposes. Additionally, it is advisable to keep all receipts and supporting documents organized for easy reference and audit purposes.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments