Business Cash Flow Worksheet Template

Managing cash flow is crucial for any business, as it allows you to track and monitor the movement of money in and out of your company. To make this process easier and more efficient, a business cash flow worksheet template can be a valuable tool. By providing a structured format for recording and analyzing financial data, these worksheets help business owners and finance professionals better understand their entity's cash flow and make informed decisions. If you're in need of a reliable and user-friendly tool to manage your cash flow, consider utilizing a business cash flow worksheet template.

Table of Images 👆

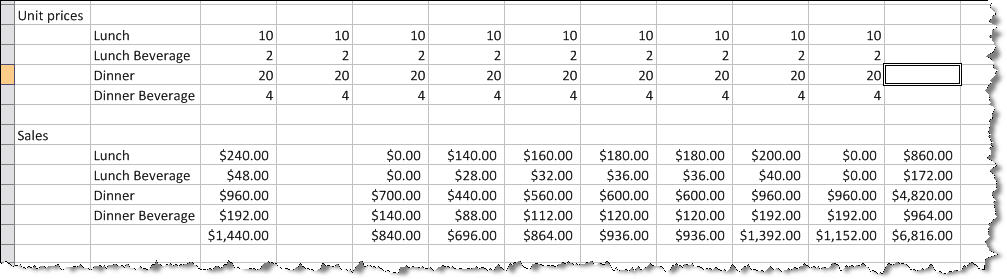

- Restaurant Sales Forecast Template

- Cash Flow Forecast Template

- Free Blank Spreadsheets

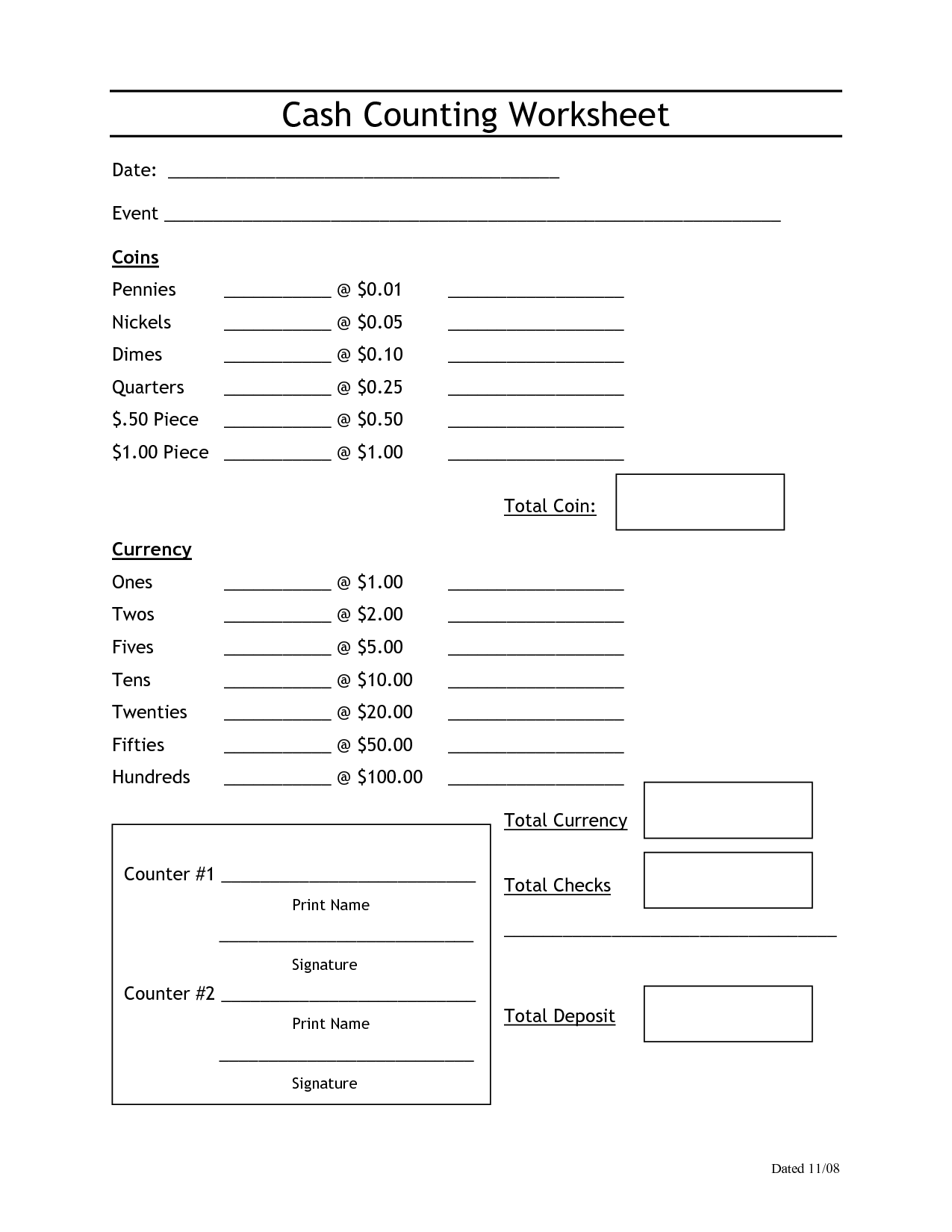

- Cash Register Count Sheet Template

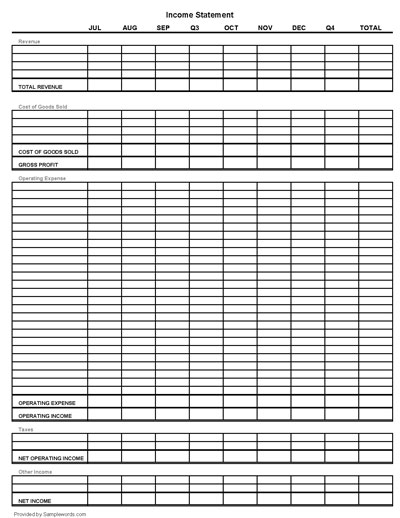

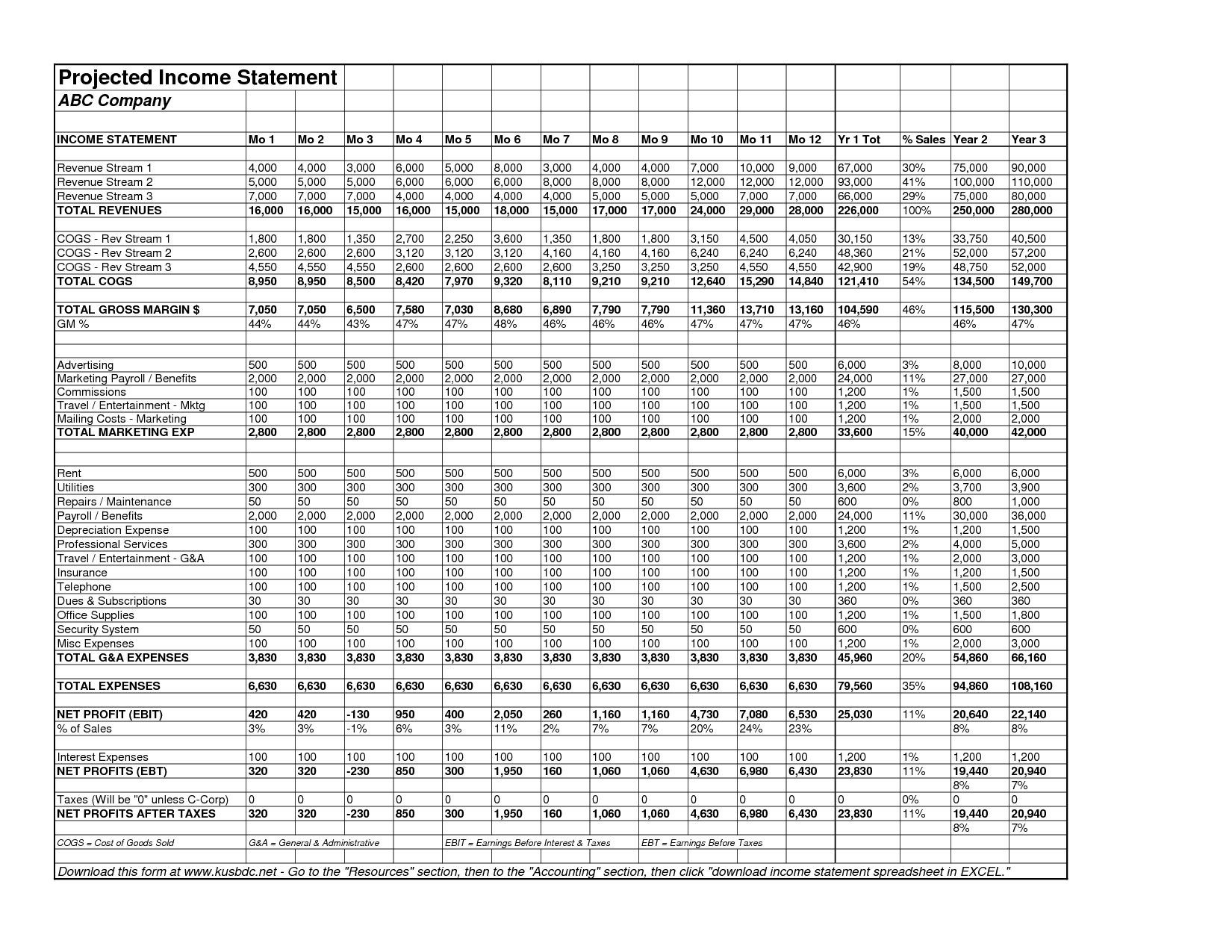

- Projected Income Statement Template

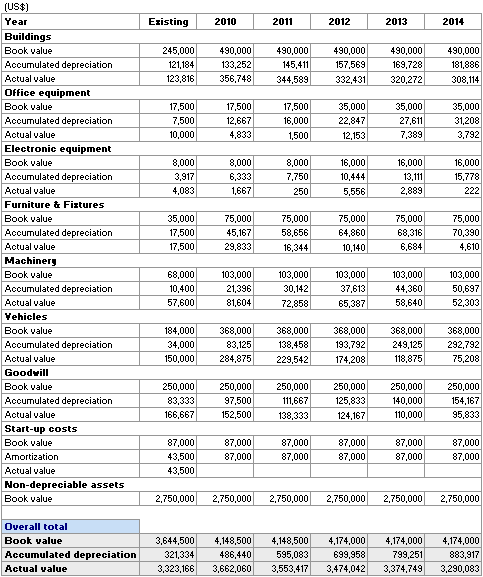

- Investment in Fixed Assets On Balance Sheet

- Beauty Salon Business Plan Template

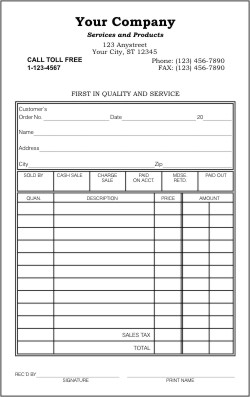

- Free Business Receipt Template

- Small Business Budget Worksheet Printable

- Monthly Profit and Loss Worksheet

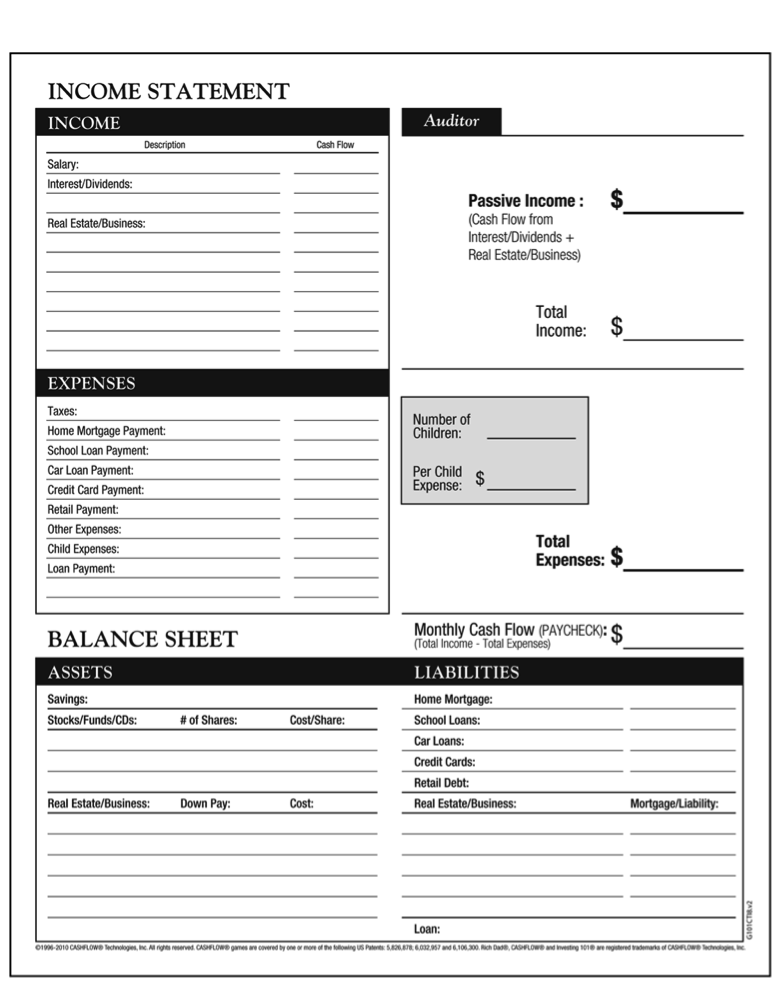

- Rich Dad Financial Statement

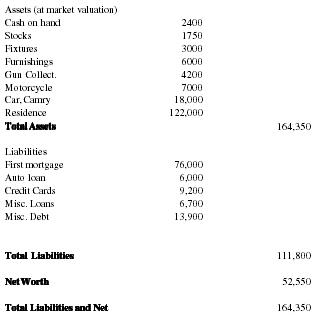

- Sample Balance Sheet for Service Company

- Petty Cash Audit Form

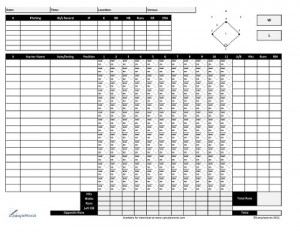

- Baseball Scorecard

- Committee Appointment Letter Sample

- Committee Appointment Letter Sample

- Committee Appointment Letter Sample

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a business cash flow worksheet template?

A business cash flow worksheet template is a tool used by businesses to track and manage their cash flow. It typically includes sections for recording income sources, expenses, and expected future cash flows. By using this template, businesses can analyze their cash flow patterns, identify potential issues, and make informed decisions to improve their financial health and stability.

How can a cash flow worksheet template help in managing finances?

A cash flow worksheet template provides a structured framework for tracking income and expenditures, allowing individuals to gain a clear understanding of their financial inflows and outflows over a specific period. By utilizing this tool, one can identify patterns in their cash flow, recognize areas of overspending or potential savings, and make informed decisions to effectively manage their finances. Additionally, a cash flow worksheet template enables individuals to forecast future cash flow, set budget goals, and ensure financial stability through proactive planning and monitoring.

What are the essential components of a cash flow worksheet template?

The essential components of a cash flow worksheet template include sections for listing all sources of cash inflows (such as sales revenue, investments, loans) and cash outflows (such as expenses, loan repayments, tax payments), calculations for net cash flow (inflows minus outflows), and opening and closing cash balances. It should also have sections for projecting future cash flows, tracking actual cash flows, analyzing variances, and highlighting areas of concern. Additionally, it should allow for easy updating and customization to suit the specific needs of the business or individual using it.

How can a business cash flow worksheet template assist in tracking monthly expenses?

A business cash flow worksheet template can assist in tracking monthly expenses by providing a structured format to record all income and expenses in one place. By inputting all financial transactions into the template, businesses can easily calculate their net cash flow for the month, track trends in spending, identify areas of overspending, and make informed decisions to improve cash flow management. Additionally, having a standardized format helps in creating consistency and accuracy in financial record-keeping, making it easier to analyze and make strategic financial decisions for the business.

What are the advantages of using a cash flow worksheet template for budgeting?

Using a cash flow worksheet template for budgeting offers several advantages, such as providing a structured format to organize income and expenses, helping to track and analyze spending patterns over time, enabling better decision-making based on clear financial data, and serving as a visual representation of financial goals and progress. Additionally, these templates often come with formulas and functions that simplify calculations and make budget management more efficient and effective.

How can a cash flow worksheet template help in identifying cash surplus or deficit?

A cash flow worksheet template can help in identifying cash surplus or deficit by organizing and tracking all sources of cash inflows and outflows within a specific period. By inputting accurate financial data, the template calculates the net cash flow, which is the difference between total inflows and outflows. A positive net cash flow indicates a cash surplus, implying that there is more cash coming in than going out. Conversely, a negative net cash flow suggests a cash deficit, indicating that more cash is going out than coming in. This visual representation allows for a clear understanding of the financial health of a business or individual and helps in making informed decisions to manage cash effectively.

What information should be entered in the income section of a cash flow worksheet template?

In the income section of a cash flow worksheet template, you should enter all sources of cash inflows for your business, including revenues from sales, interest earned, dividends received, and any other sources of income such as grants or loans. This section helps you track the money coming into your business over a specific period, providing a clear picture of your financial health and performance.

How can a cash flow worksheet template aid in predicting future cash flow patterns?

A cash flow worksheet template can aid in predicting future cash flow patterns by allowing the user to input and track all incoming and outgoing cash flows over a specified period. By organizing and categorizing cash inflows and outflows, users can identify trends, patterns, and potential risks that may impact future cash flows. This visibility enables better forecasting and planning, helping organizations anticipate cash flow fluctuations and make informed decisions to improve financial stability.

What are the common categories for expenses in a cash flow worksheet template?

Common categories for expenses in a cash flow worksheet template may include operational expenses (such as rent, utilities, and salaries), cost of goods sold (materials and labor costs directly tied to producing goods), marketing and advertising expenses, administrative expenses, taxes, loan payments, and any other miscellaneous expenses. These categories help businesses track and analyze their cash flow effectively to make informed financial decisions.

How can a business cash flow worksheet template be customized to suit specific needs?

A business cash flow worksheet template can be customized to suit specific needs by adjusting categories and line items to align with the business's revenue sources and expenses. This may involve adding or removing categories, modifying formulas to calculate specific items, adjusting time periods to reflect the business's financial cycle, and incorporating any unique factors relevant to the company's cash flow. Additionally, the template can be personalized by including specific goals, benchmarks, or forecasting elements to better track and manage the business's liquidity and financial health.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments