Business Budget Plan Worksheet

Are you a business owner or entrepreneur looking for a reliable tool to help you manage your finances? Look no further! Introducing the Business Budget Plan Worksheet, a powerful and user-friendly resource that will assist you in creating a comprehensive budget plan for your company. Whether you're just starting out or have been in business for years, this worksheet is designed to cater to your needs and simplify the process of tracking and analyzing your business's expenses and revenues.

Table of Images 👆

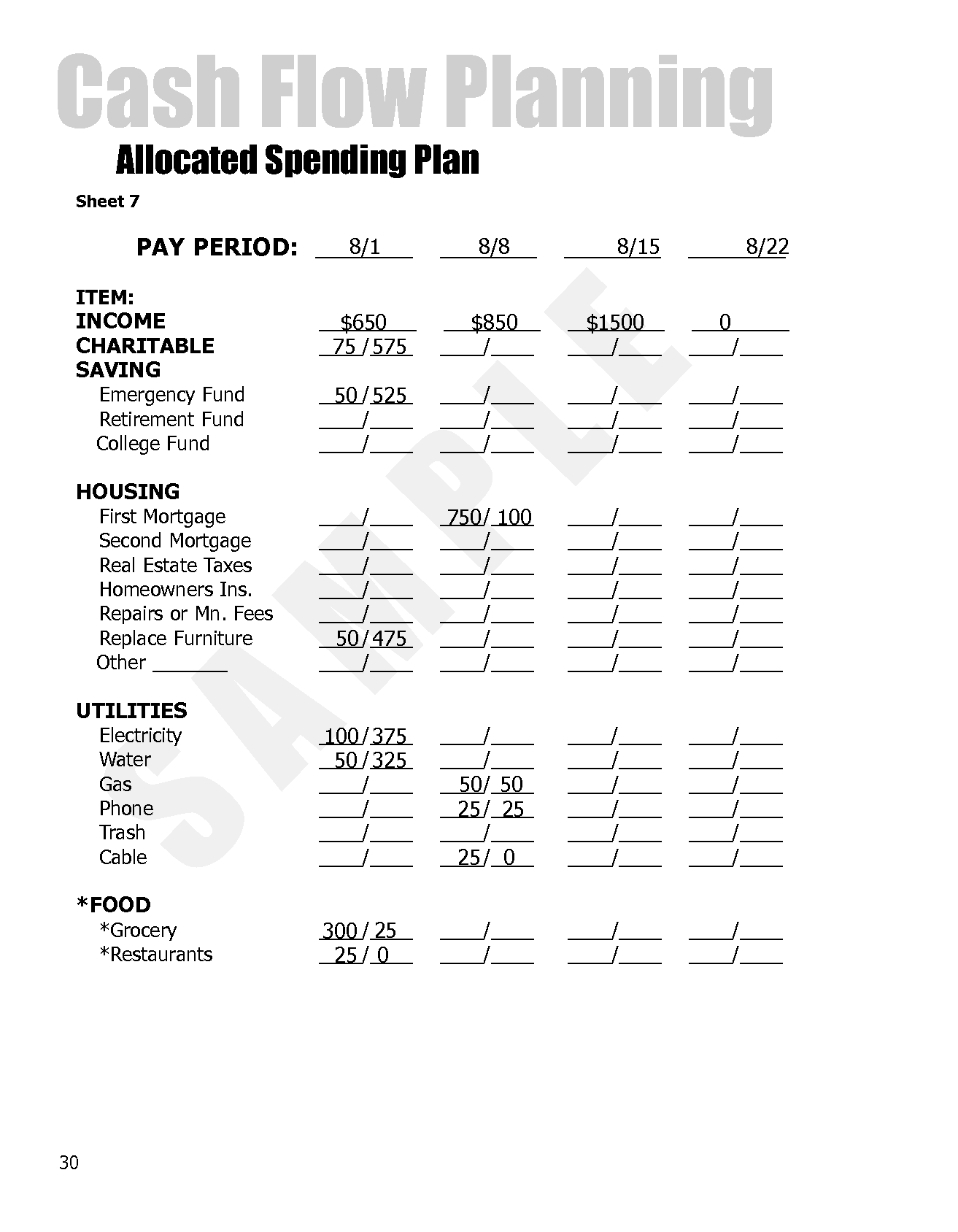

- Dave Ramsey Allocated Spending Plan Budget

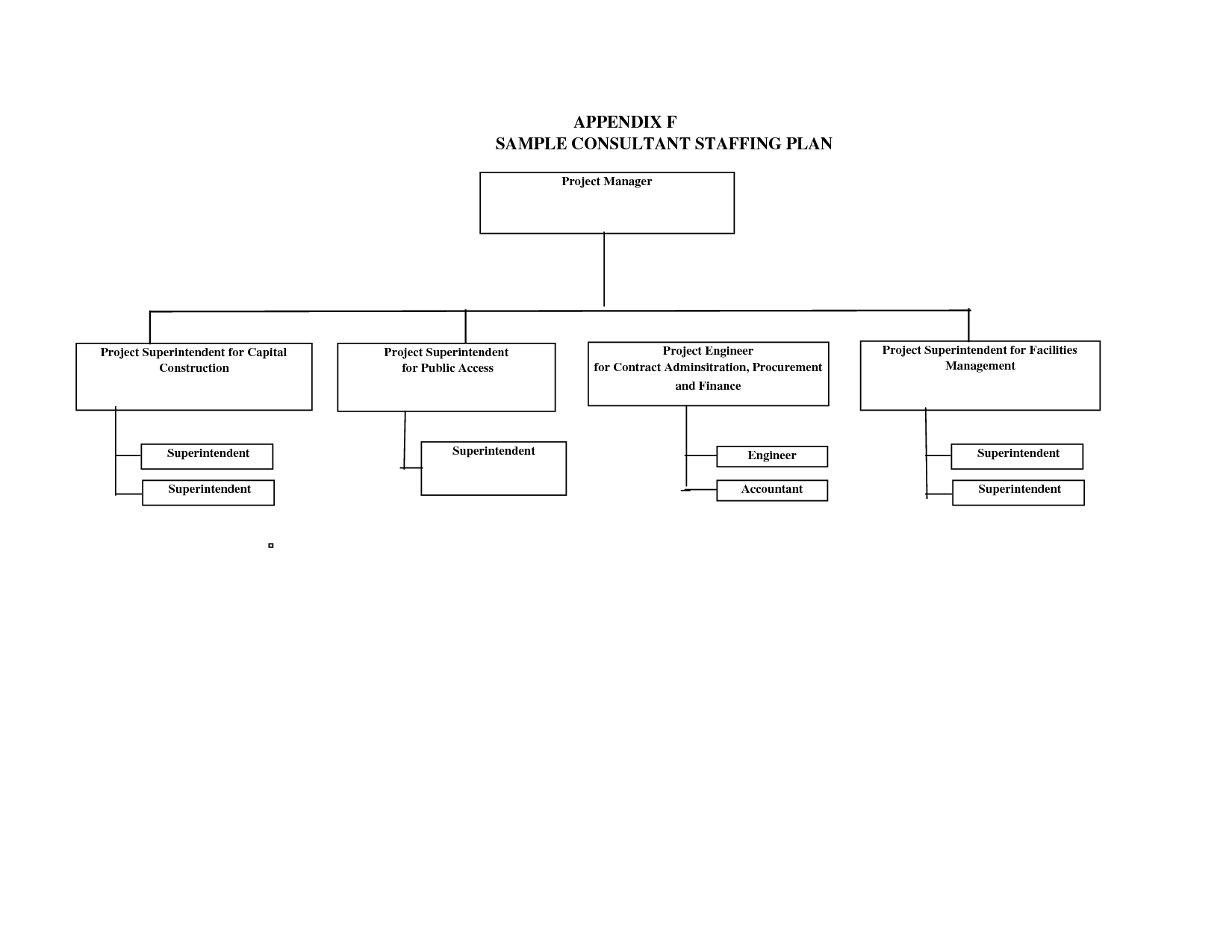

- Project Staffing Plan Template

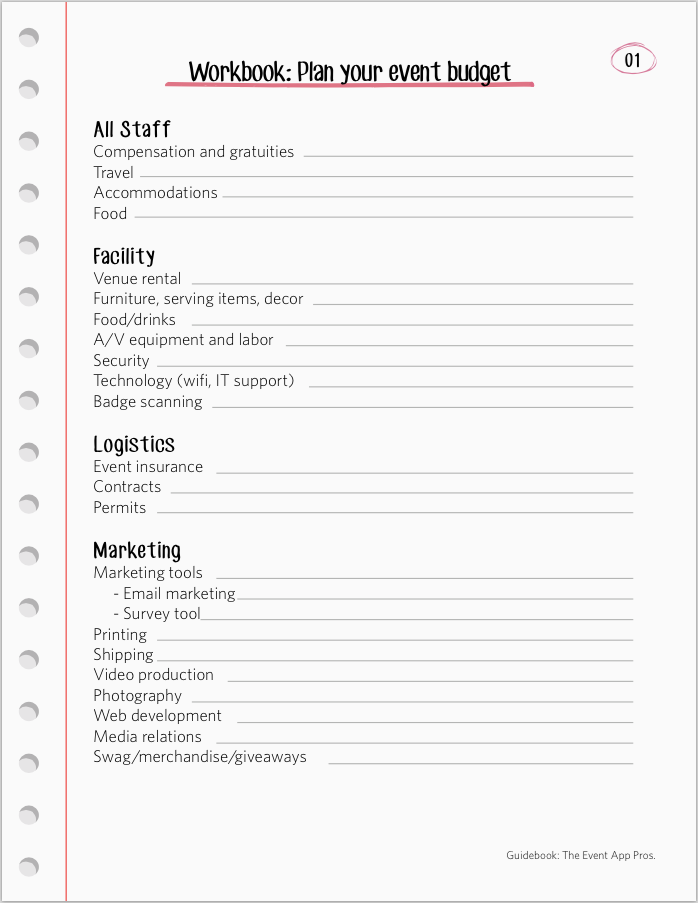

- Free Event Planning Budget Template

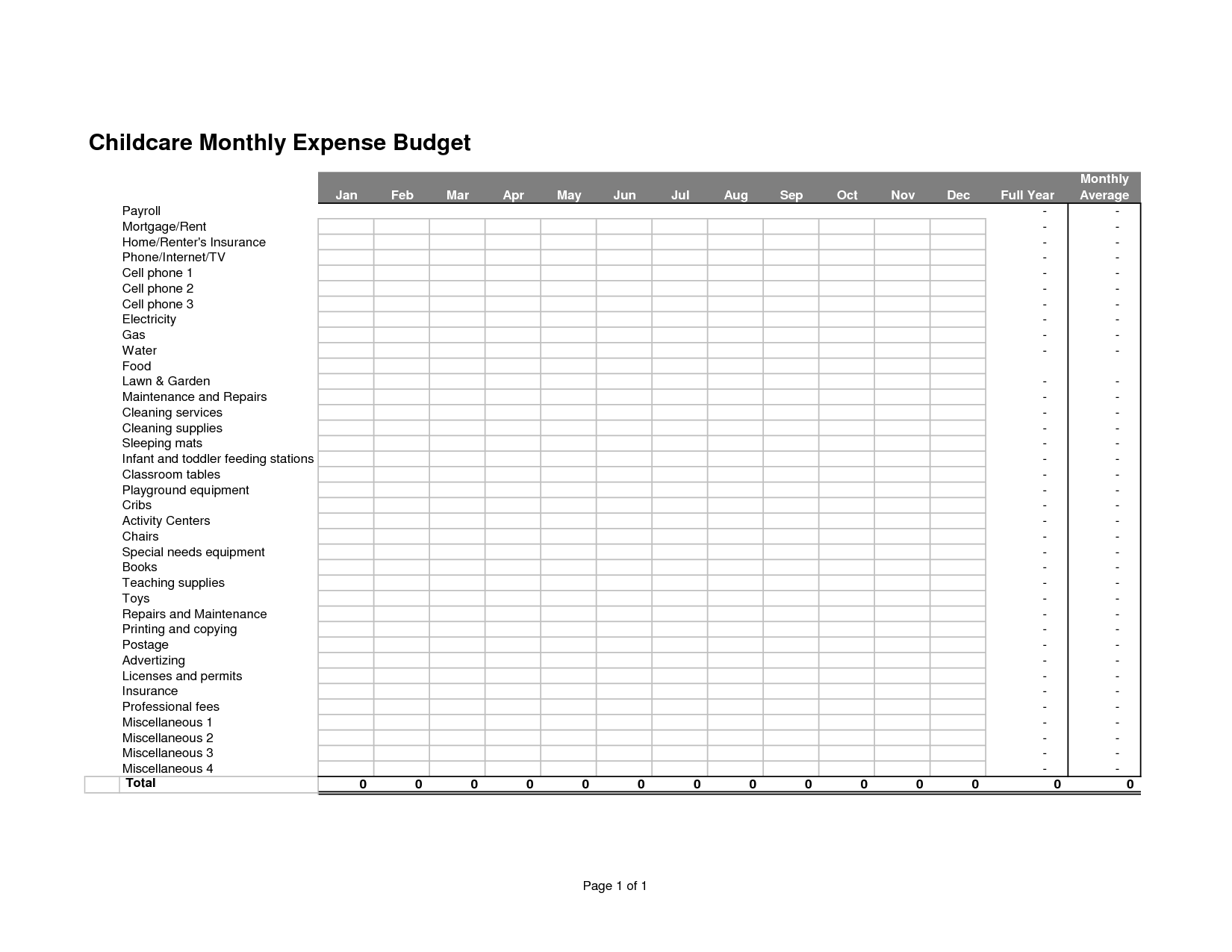

- Day Care Budget Form Expenses

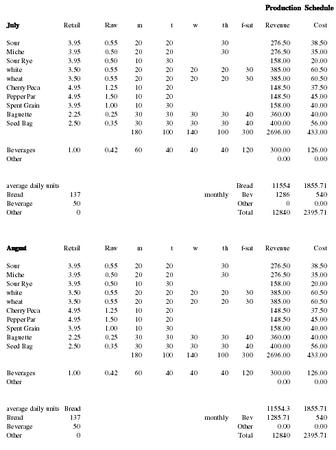

- Bakery Business Plan

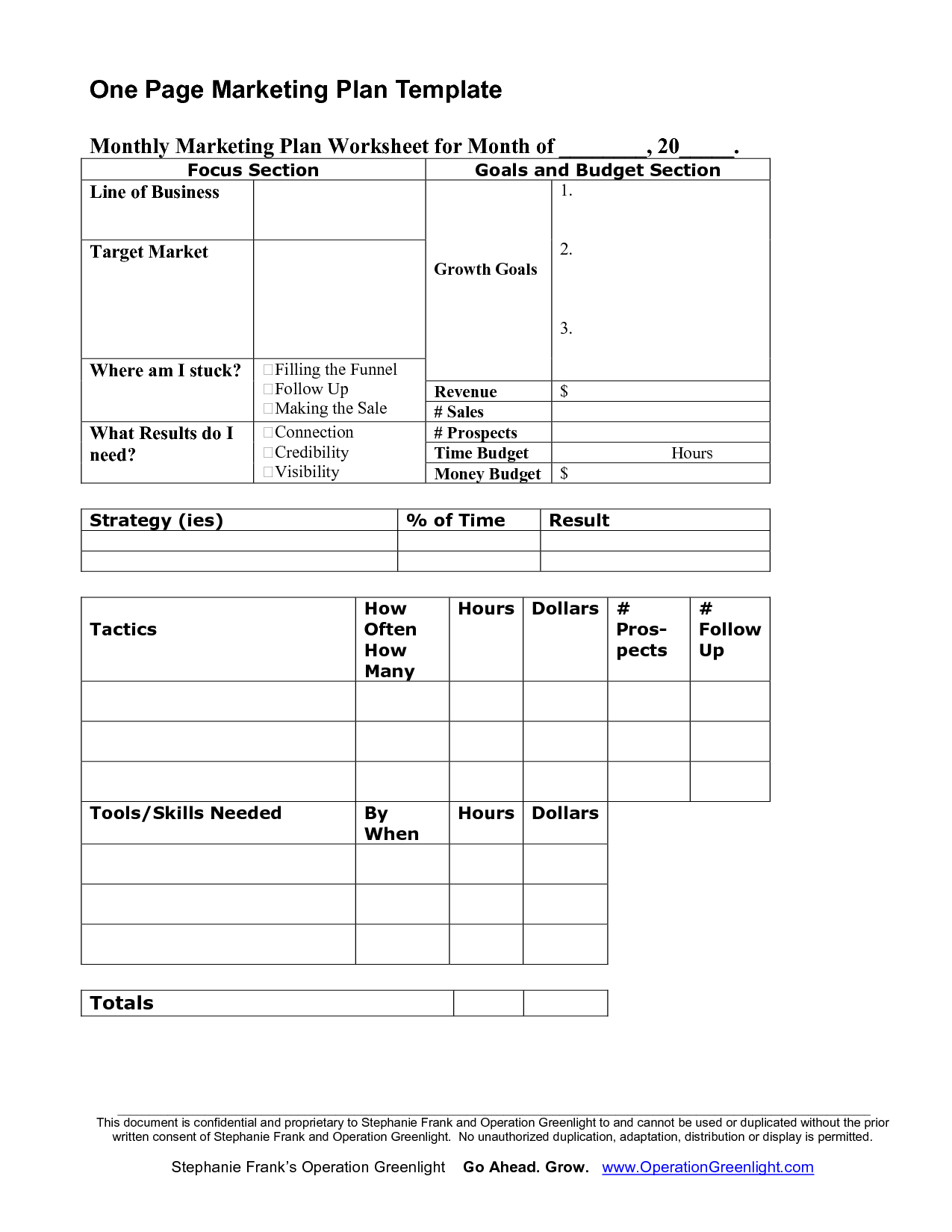

- One Page Marketing Plan Template

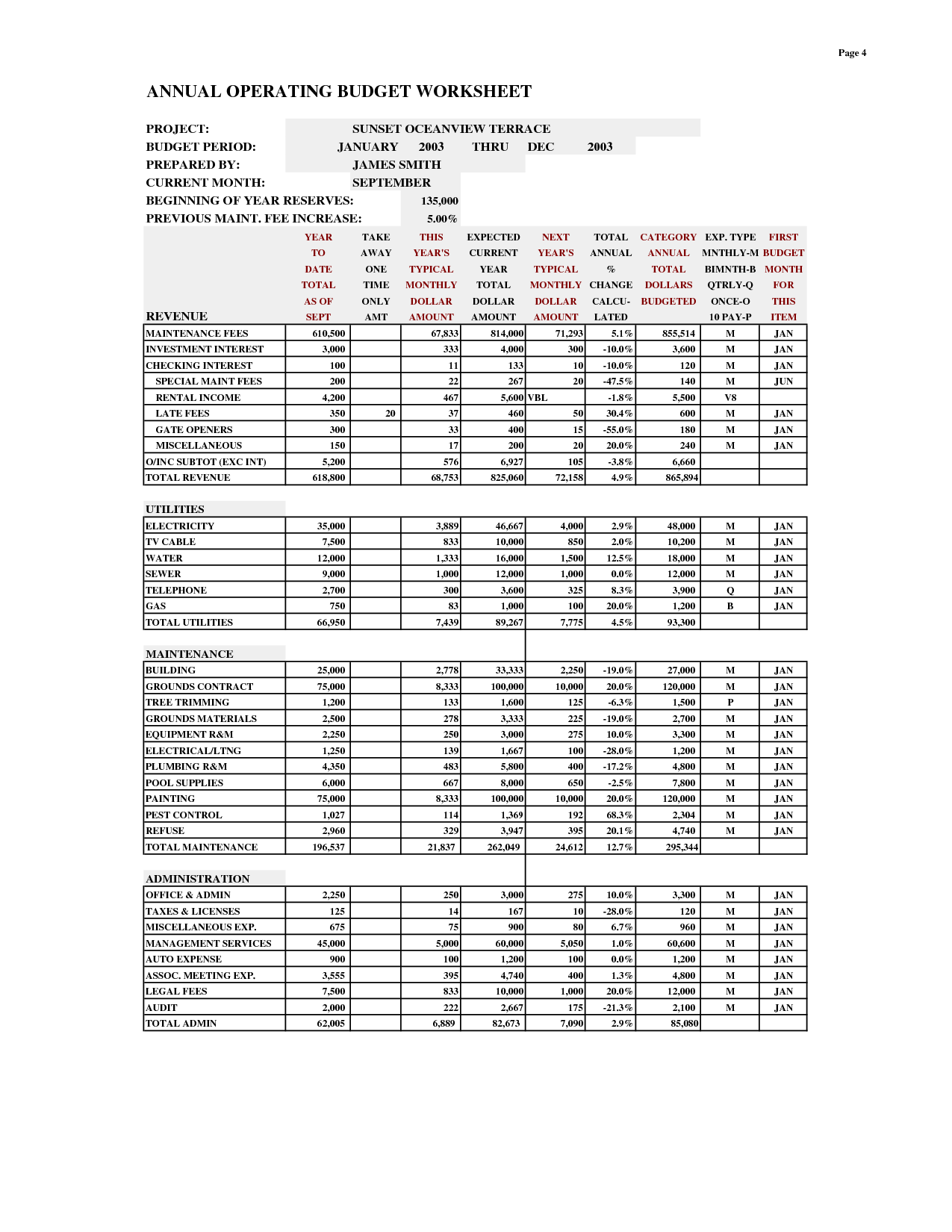

- Annual Operating Budget Template

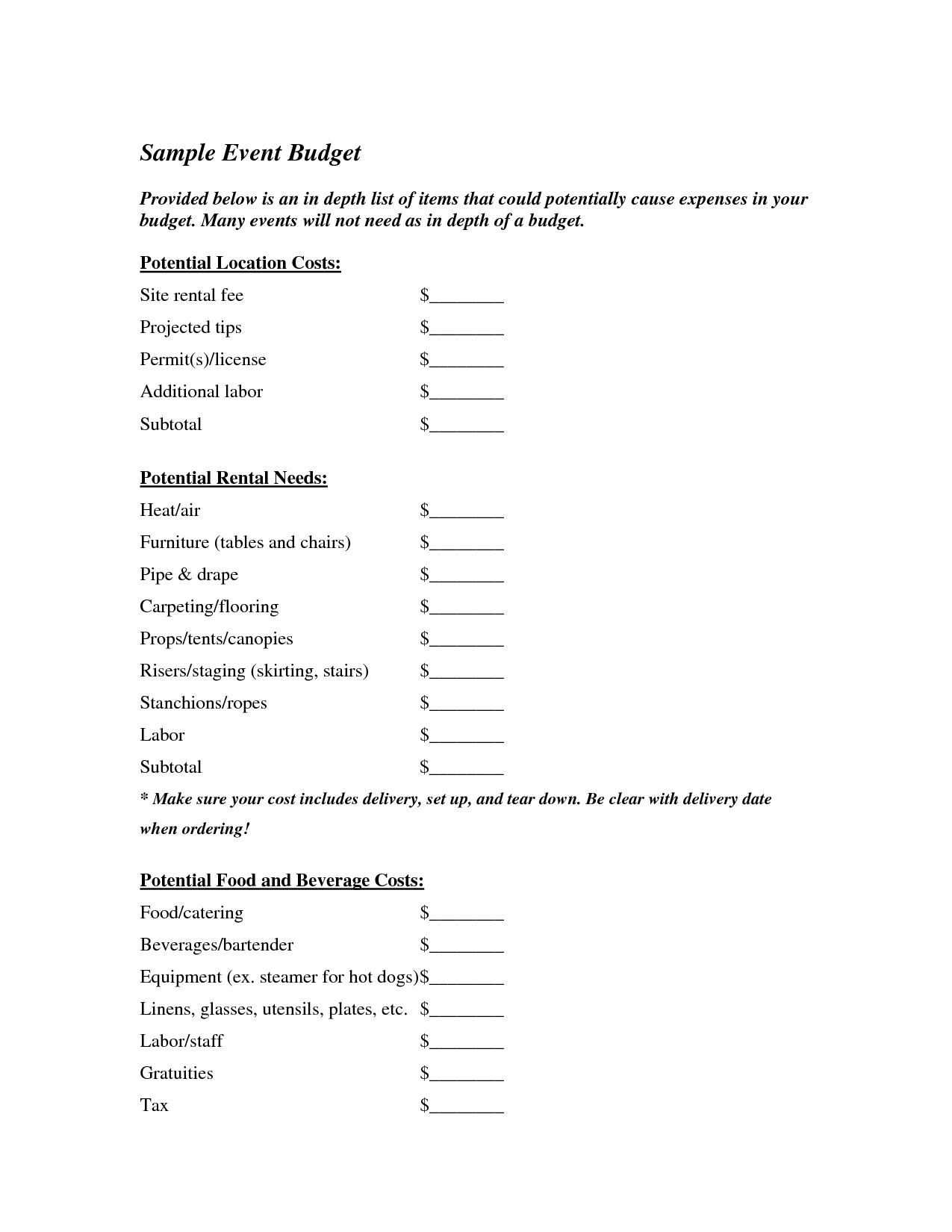

- Sample Event Budget Template

- Sign Out Sheet Template

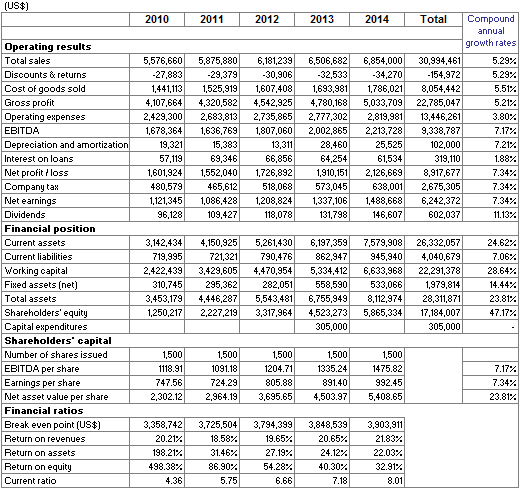

- Business Financial Plan Sample

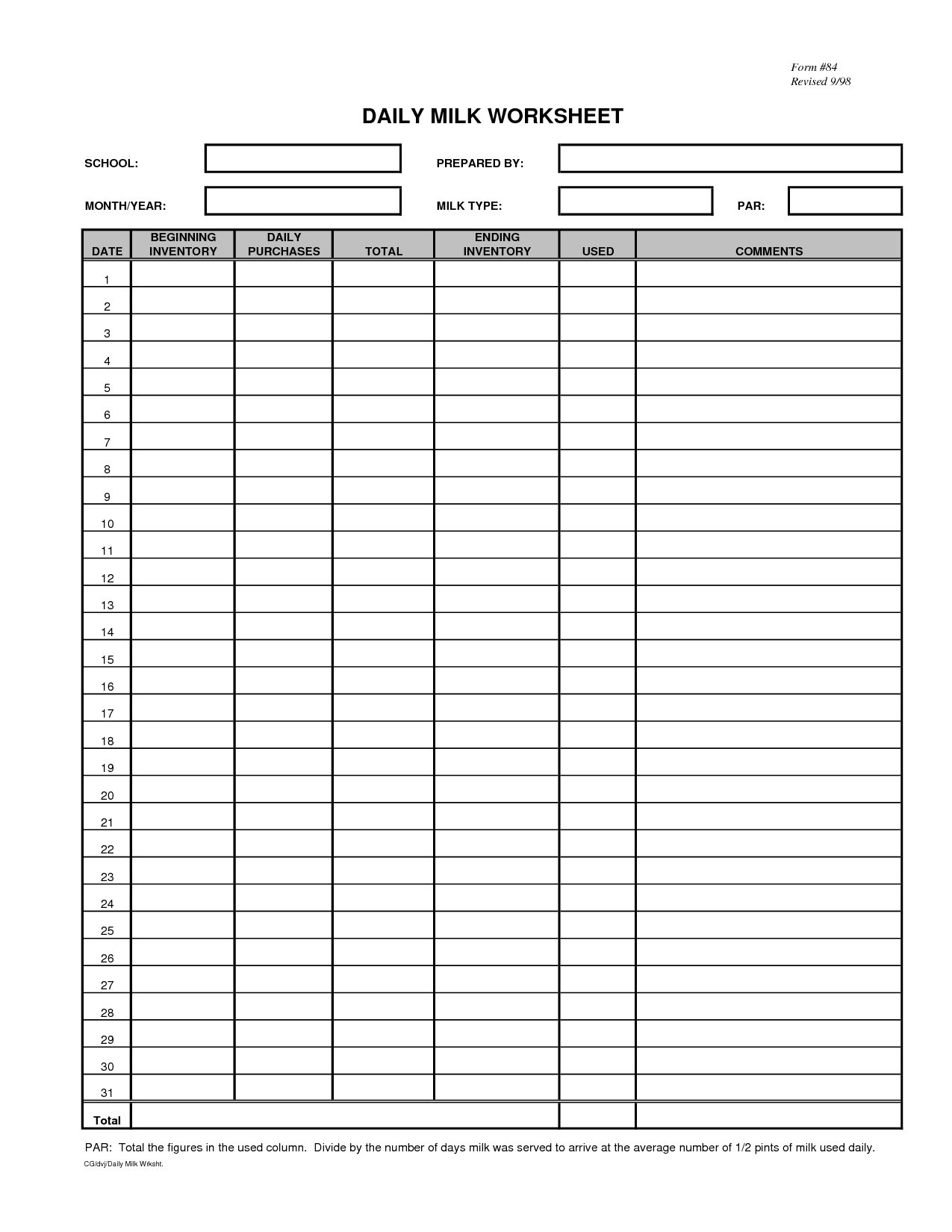

- Daily Inventory Worksheet

- Hair Stylist Commission Contract Agreement

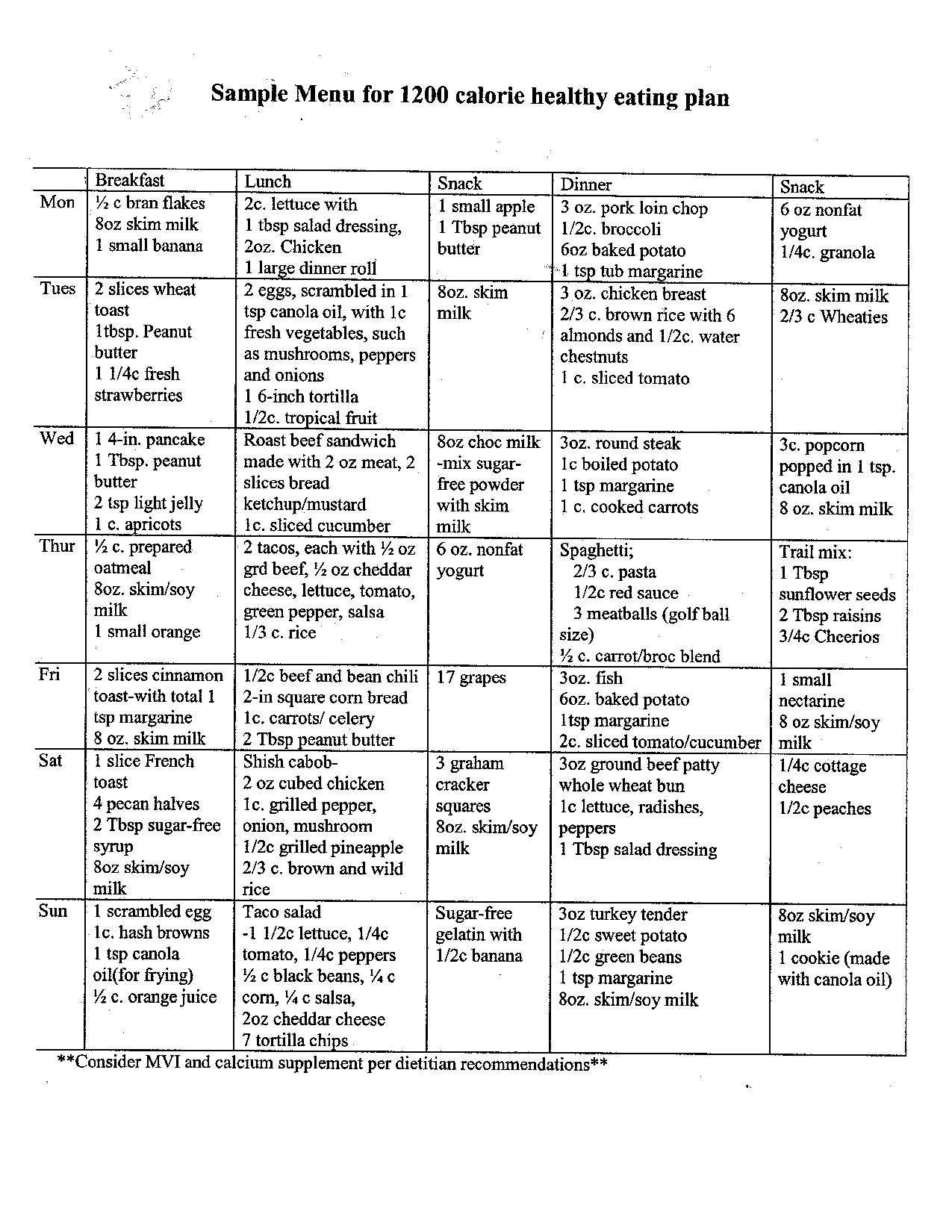

- Sample 1200 Calorie Diet Plan

- Kitchen Remodel Cost Calculator

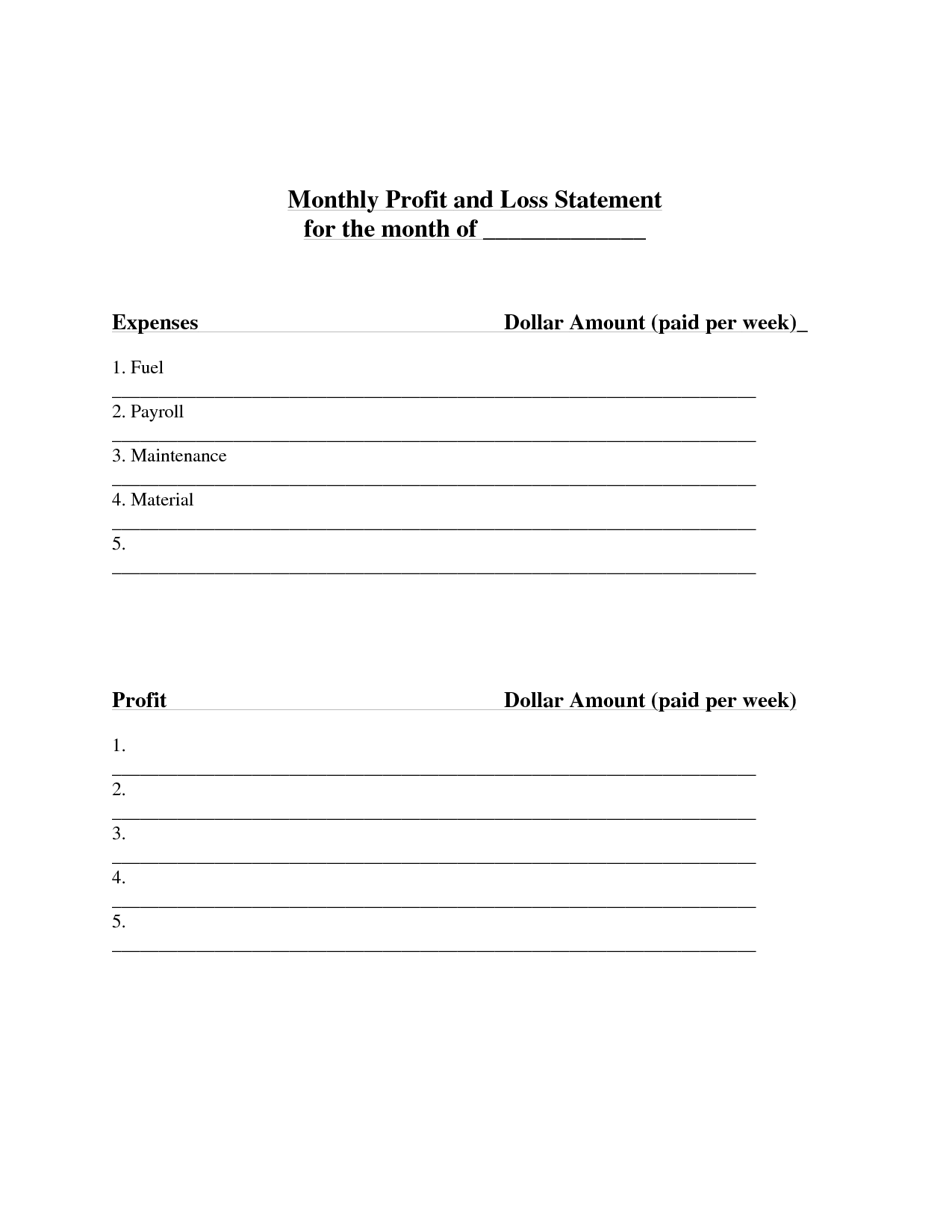

- Monthly Profit and Loss Statement

- Yearly Expense Form

- Medical Bill Tracker Template

- Medical Bill Tracker Template

- Medical Bill Tracker Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a business budget plan worksheet?

A business budget plan worksheet is a tool used to outline and track financial information for a business. It typically includes projected income, expenses, and expenditures over a specific period, helping to establish financial goals, monitor cash flow, and make informed decisions about resource allocation and cost management. It serves as a structured document that helps organizations to manage and control their finances effectively.

Why is it important for businesses to have a budget plan?

Having a budget plan is important for businesses because it helps them effectively manage their finances, set financial goals, and track performance. A budget plan allows businesses to allocate resources efficiently, identify areas of overspending or potential cost savings, make informed decisions on investments and expenses, and navigate through uncertain economic conditions. Additionally, having a budget plan provides a framework for monitoring cash flow, improving financial stability, and ensuring long-term sustainability and growth for the business.

What components are typically included in a budget plan worksheet?

A budget plan worksheet typically includes sections for income sources, such as wages and investments, as well as categories for expenses such as housing, transportation, groceries, utilities, and entertainment. It may also have areas for savings goals, debt payments, emergency funds, and a summary section that calculates total income, total expenses, and the difference between the two to evaluate if the budget is balanced.

How often should businesses review and update their budget plan worksheet?

Businesses should review and update their budget plan worksheet regularly, ideally on a monthly basis. This allows companies to assess their financial performance and make necessary adjustments to stay on track with their financial goals. Regular reviews also help businesses to identify any emerging trends or financial challenges that need to be addressed promptly.

How does a budget plan worksheet help businesses identify and control expenses?

A budget plan worksheet helps businesses identify and control expenses by outlining all anticipated costs and revenues, allowing a clear overview of financial health. By detailing expenses in categories, businesses can track spending, identify areas of overspending or unnecessary costs, and make informed decisions to reduce expenses or reallocate resources. Regularly updating and reviewing the budget plan worksheet enables businesses to set financial goals, monitor progress, and adjust spending to stay within budget, ultimately improving financial management and ensuring profitability.

What role does a budget plan worksheet play in setting financial goals and targets?

A budget plan worksheet plays a crucial role in setting financial goals and targets by providing a structured framework for organizing income, expenses, and savings. It helps individuals track their spending habits, identify areas where they can cut costs or save more, and ultimately allocate funds towards achieving specific financial goals. By outlining a detailed budget plan with clear targets, individuals can monitor their progress, make adjustments as needed, and stay on course towards reaching their financial objectives.

How can a budget plan worksheet assist businesses in forecasting revenue and cash flow?

A budget plan worksheet can assist businesses in forecasting revenue and cash flow by providing a structured framework to estimate anticipated income sources and expenses over a specific period. By detailing expenses such as salaries, overhead costs, and investments, businesses can project their cash flow and identify potential funding gaps or surpluses. Additionally, the budget plan worksheet allows for scenario planning, enabling businesses to make informed decisions based on different revenue projections or cost-cutting measures to optimize their financial performance.

In what ways can a budget plan worksheet help businesses make informed financial decisions?

A budget plan worksheet can help businesses make informed financial decisions by providing a clear overview of their income, expenses, and financial goals. By tracking and analyzing financial data on the worksheet, businesses can identify areas where costs can be minimized, opportunities for revenue growth, and potential risks that need to be addressed. This systematic approach enables businesses to prioritize their spending, allocate resources efficiently, and make strategic decisions based on accurate financial information, ultimately leading to better financial outcomes and long-term success.

How can a budget plan worksheet help businesses track and evaluate their financial performance?

A budget plan worksheet can help businesses track and evaluate their financial performance by providing a structured framework to allocate funds, set financial goals, and monitor actual expenses against projected costs. By regularly updating the worksheet with actual financial data, businesses can identify areas of overspending or underperformance, make necessary adjustments, and ensure they are staying on track towards achieving their financial objectives. This tool enables businesses to make informed decisions, prioritize investments, and improve overall financial management by having a clear overview of their financial health.

What are some common challenges faced by businesses when creating and maintaining a budget plan worksheet?

Some common challenges faced by businesses when creating and maintaining a budget plan worksheet include accurately forecasting revenue and expenses, tracking and controlling costs, aligning budget goals with overall business objectives, keeping the budget flexible to adapt to changes, obtaining buy-in and cooperation from all departments and employees, and ensuring accurate and timely financial data input. Additionally, unexpected events or market shifts can also create challenges in budget planning and monitoring. Liaising with various stakeholders and regularly reviewing and adjusting the budget plan are crucial to overcoming these challenges and ensuring financial success.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments