Budget Worksheet Monthly Bill

Tracking your monthly bills and expenses is essential for managing your budget effectively. A budget worksheet can help you stay organized and in control of your finances. With its clear and comprehensive layout, it provides a convenient way to list and monitor all your expenses. Whether you are a busy professional, a student trying to manage expenses, or a parent juggling household bills, a budget worksheet can be a valuable tool for keeping your finances on track.

Table of Images 👆

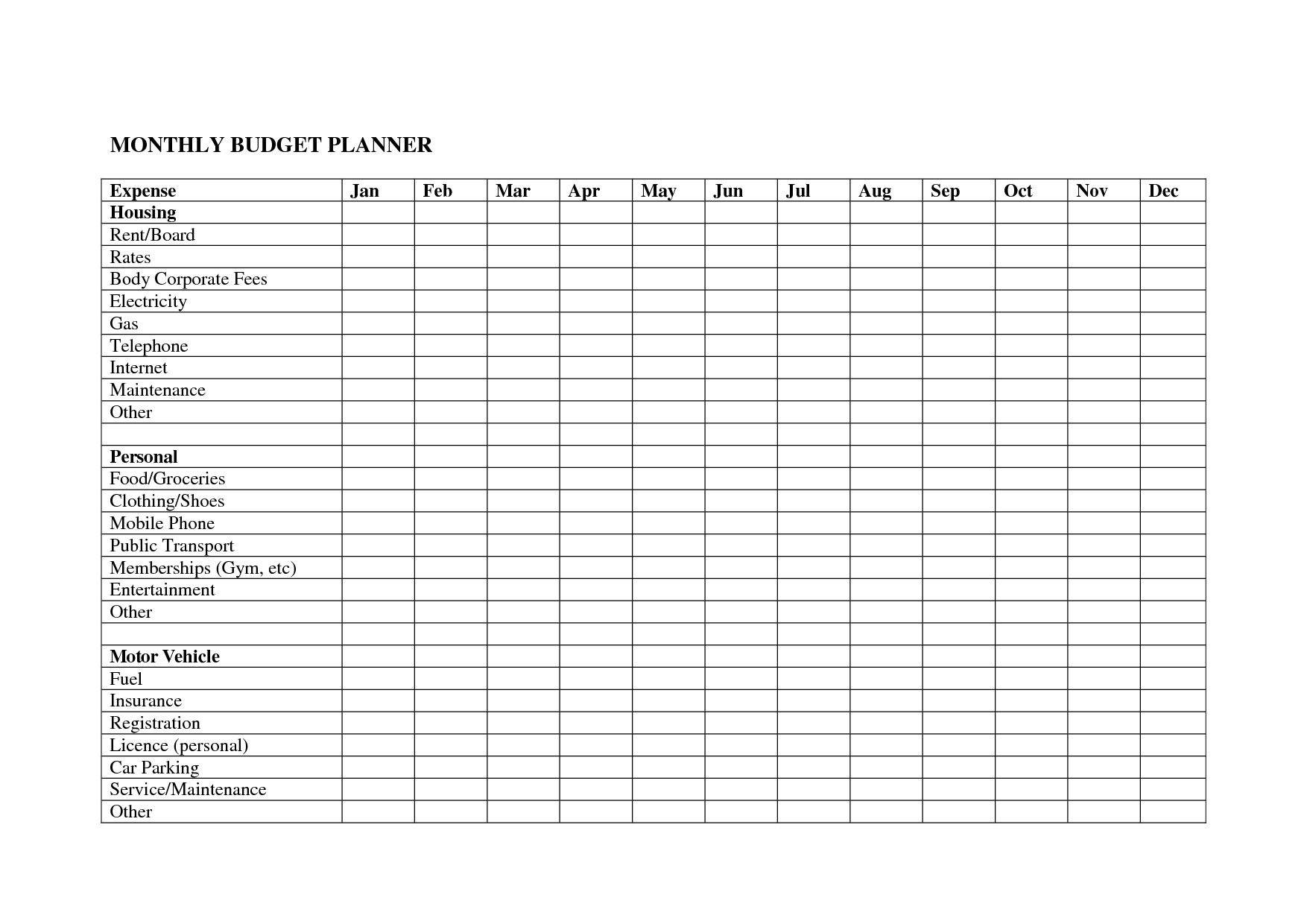

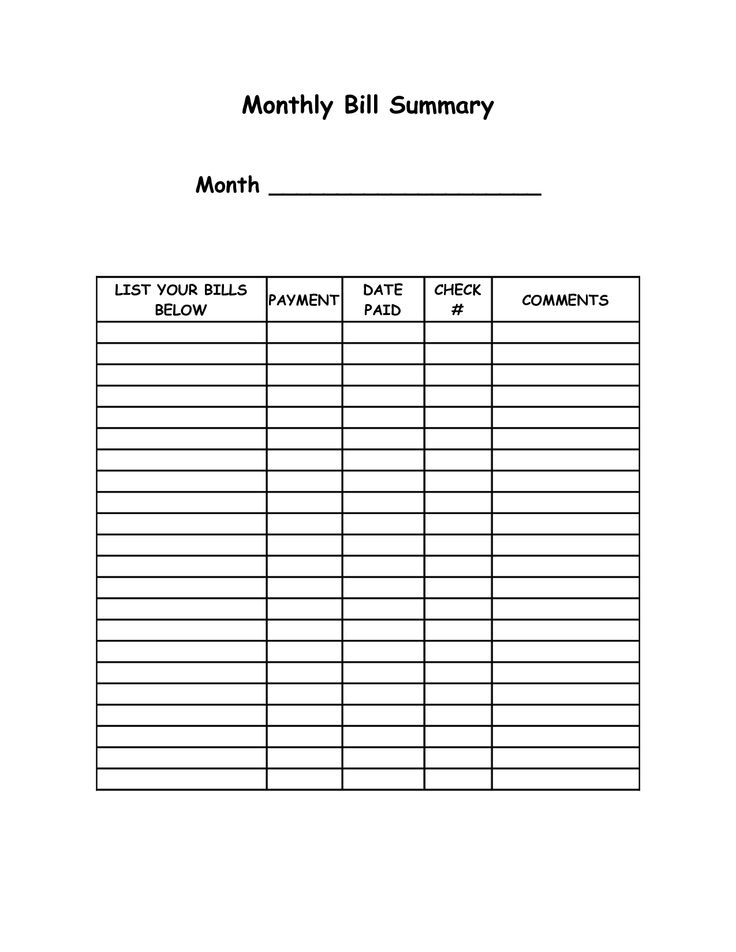

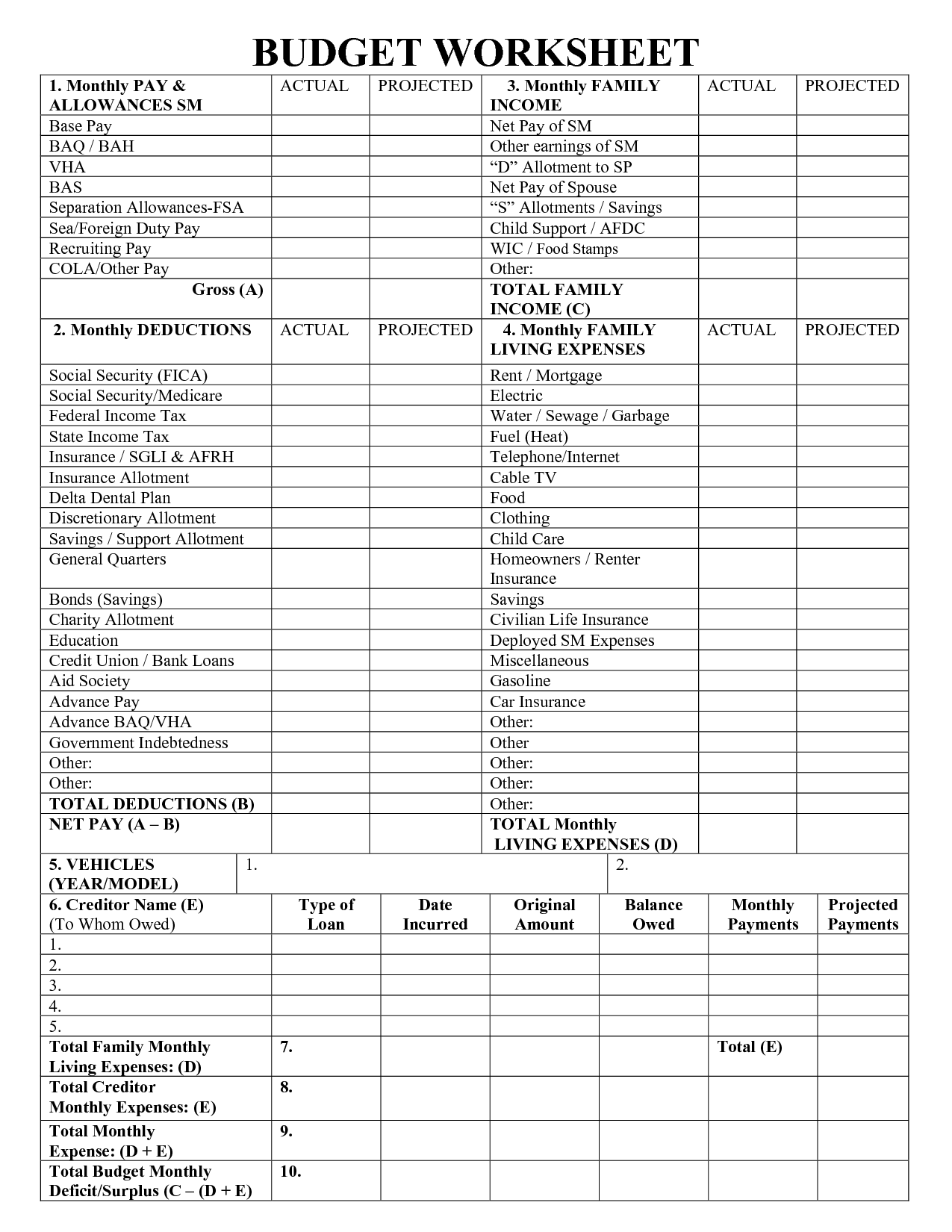

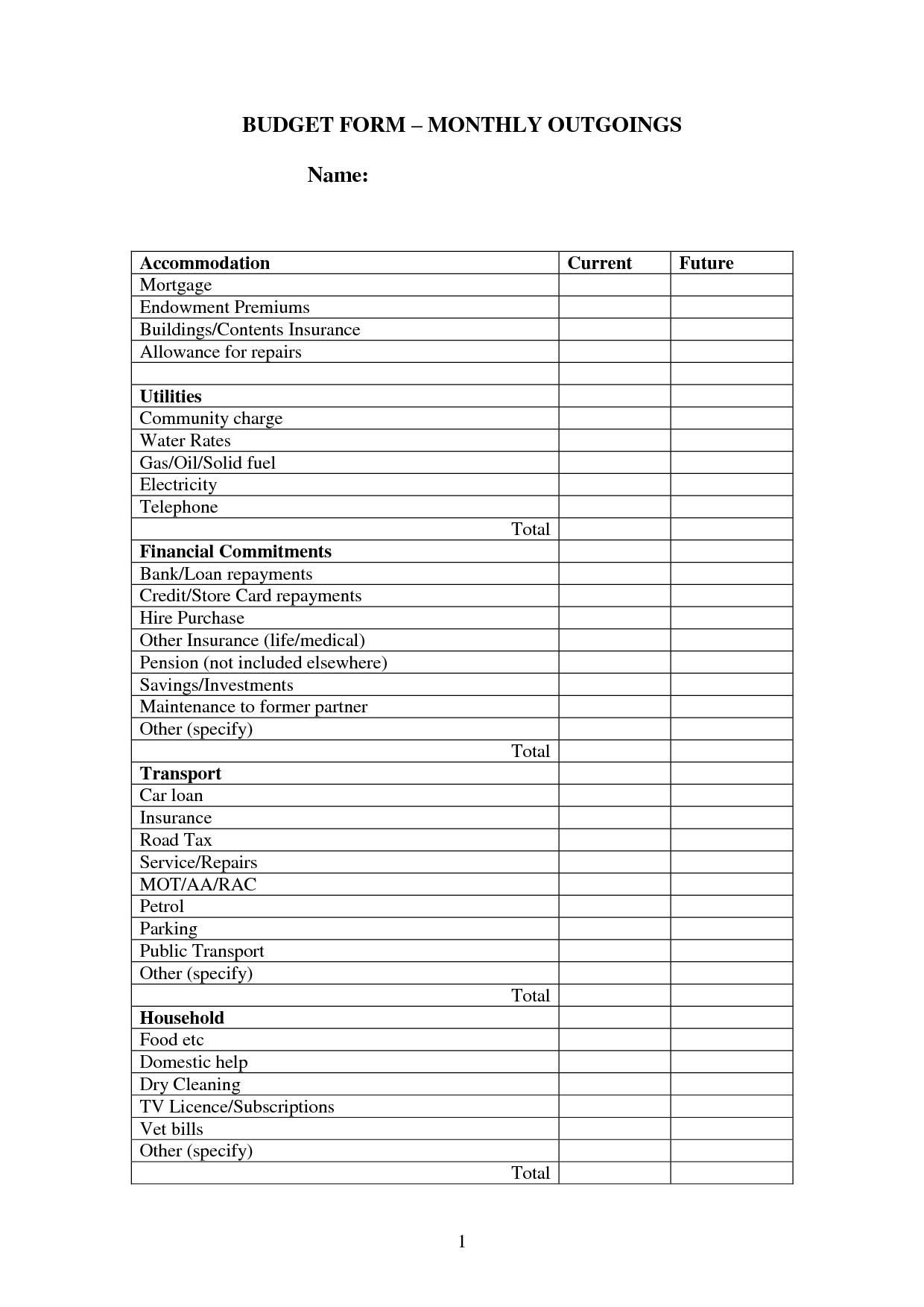

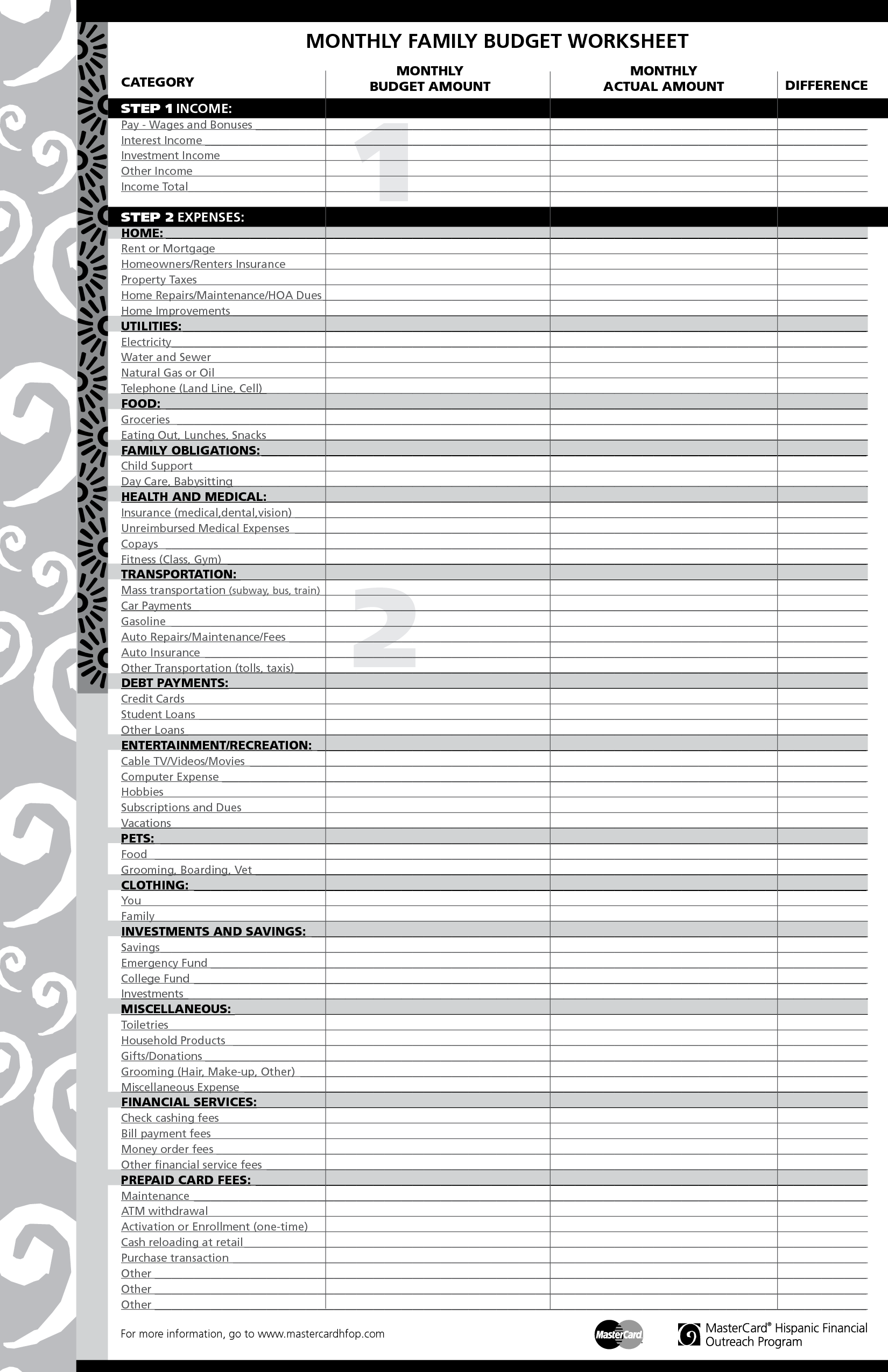

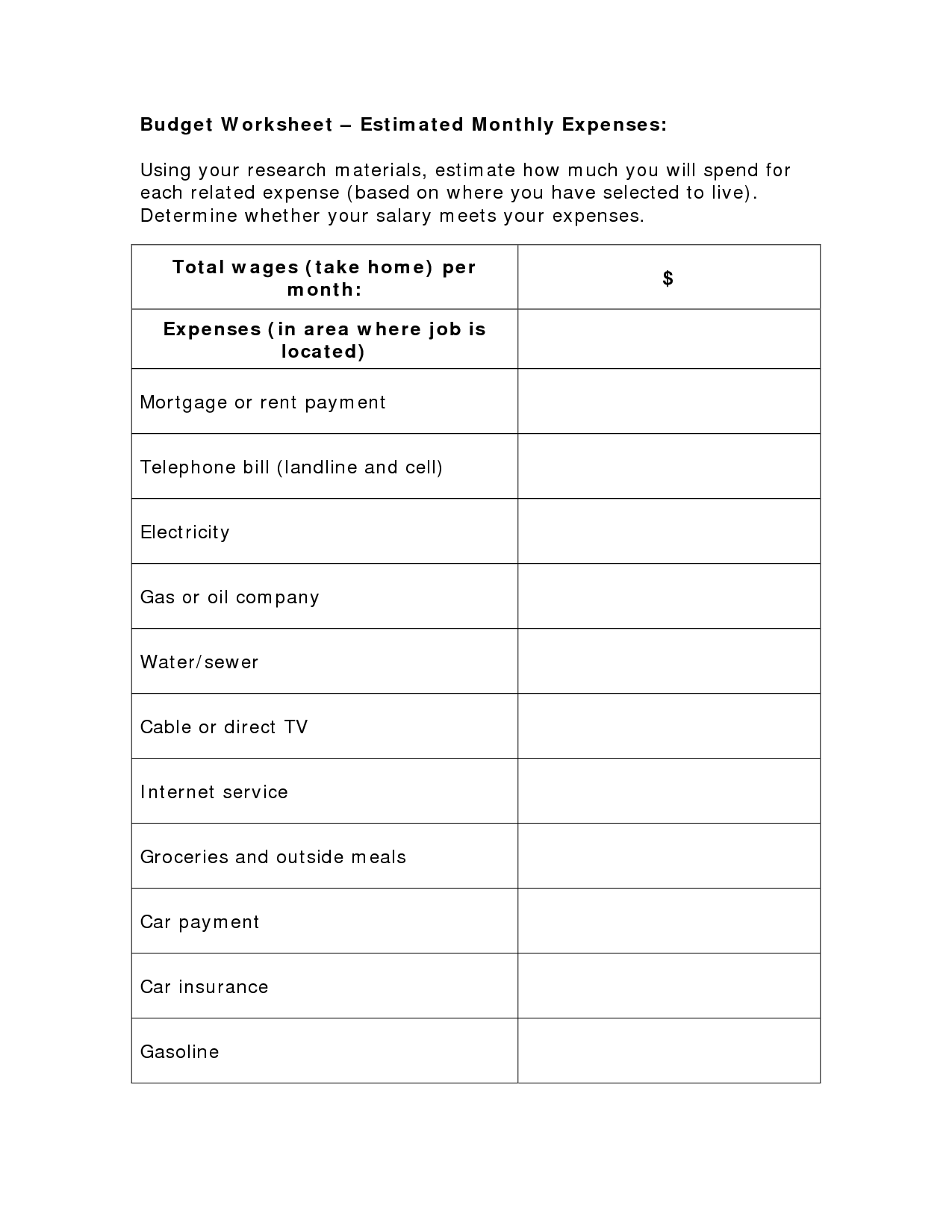

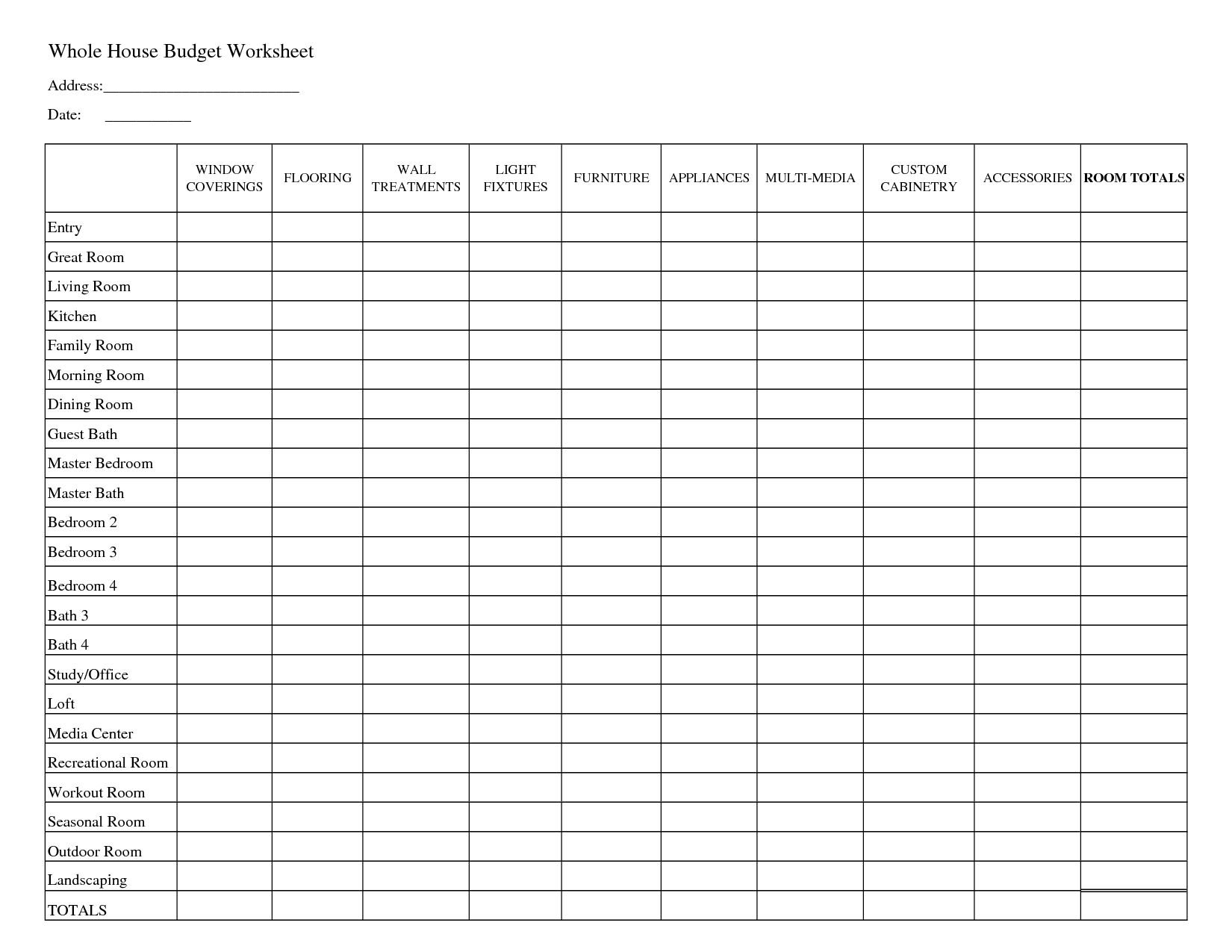

- Blank Monthly Budget Spreadsheet

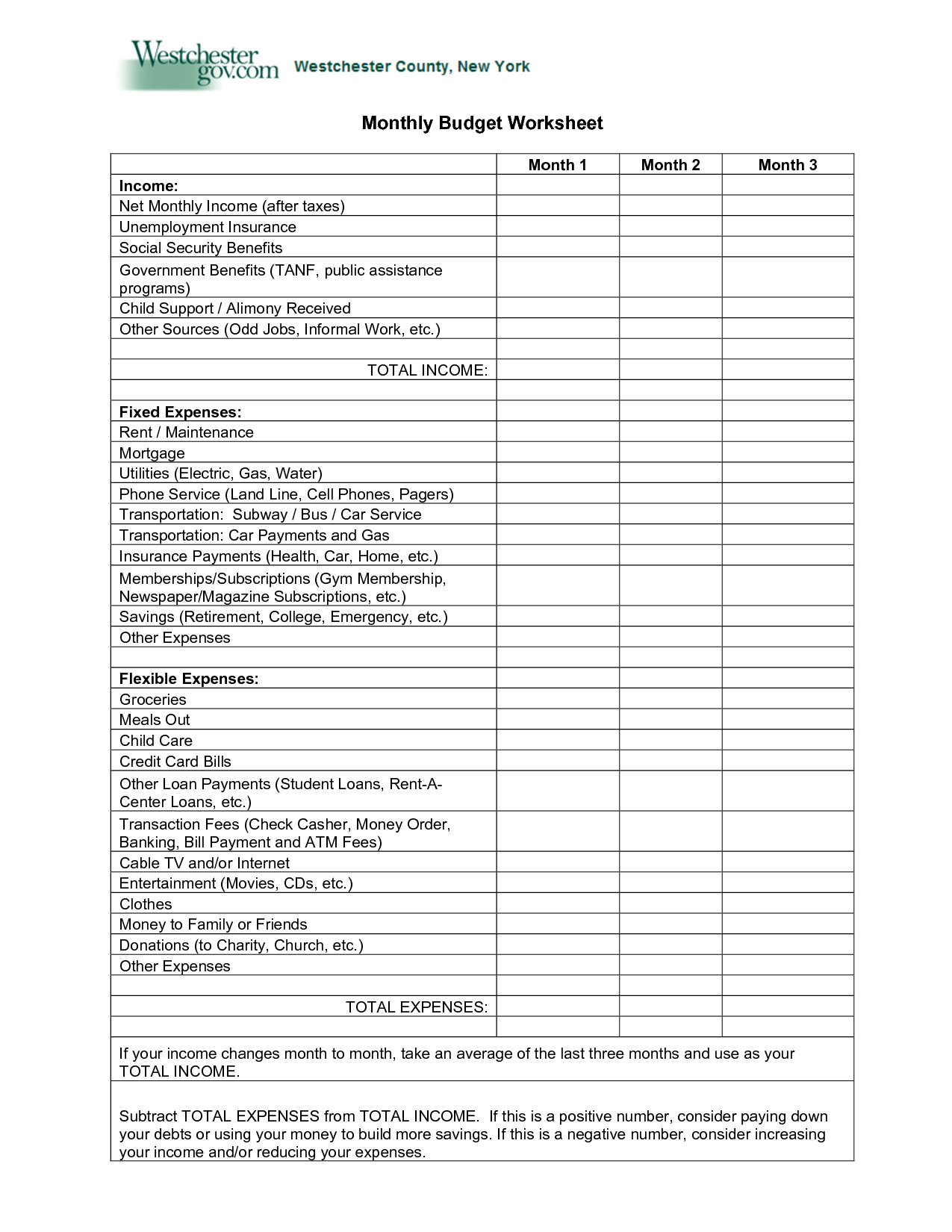

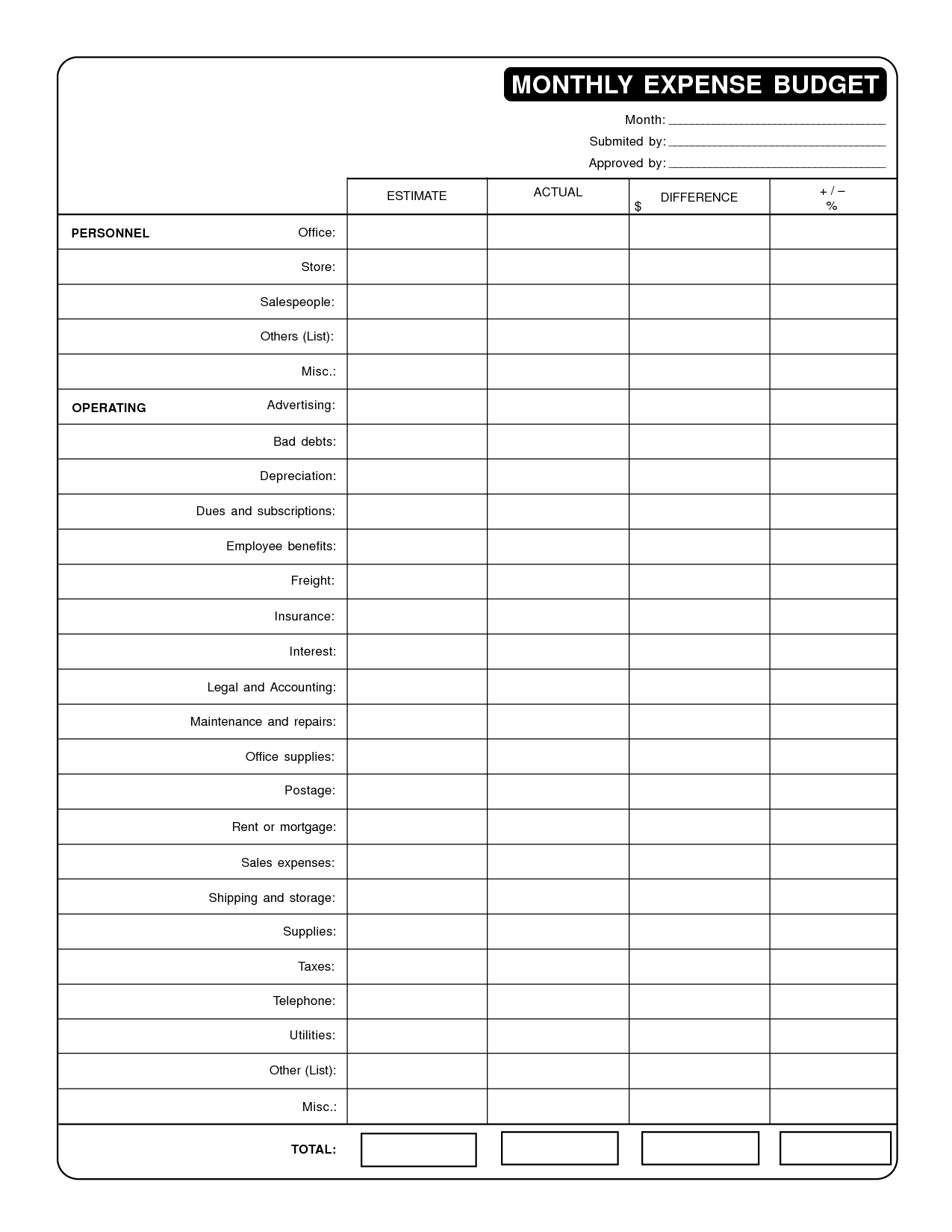

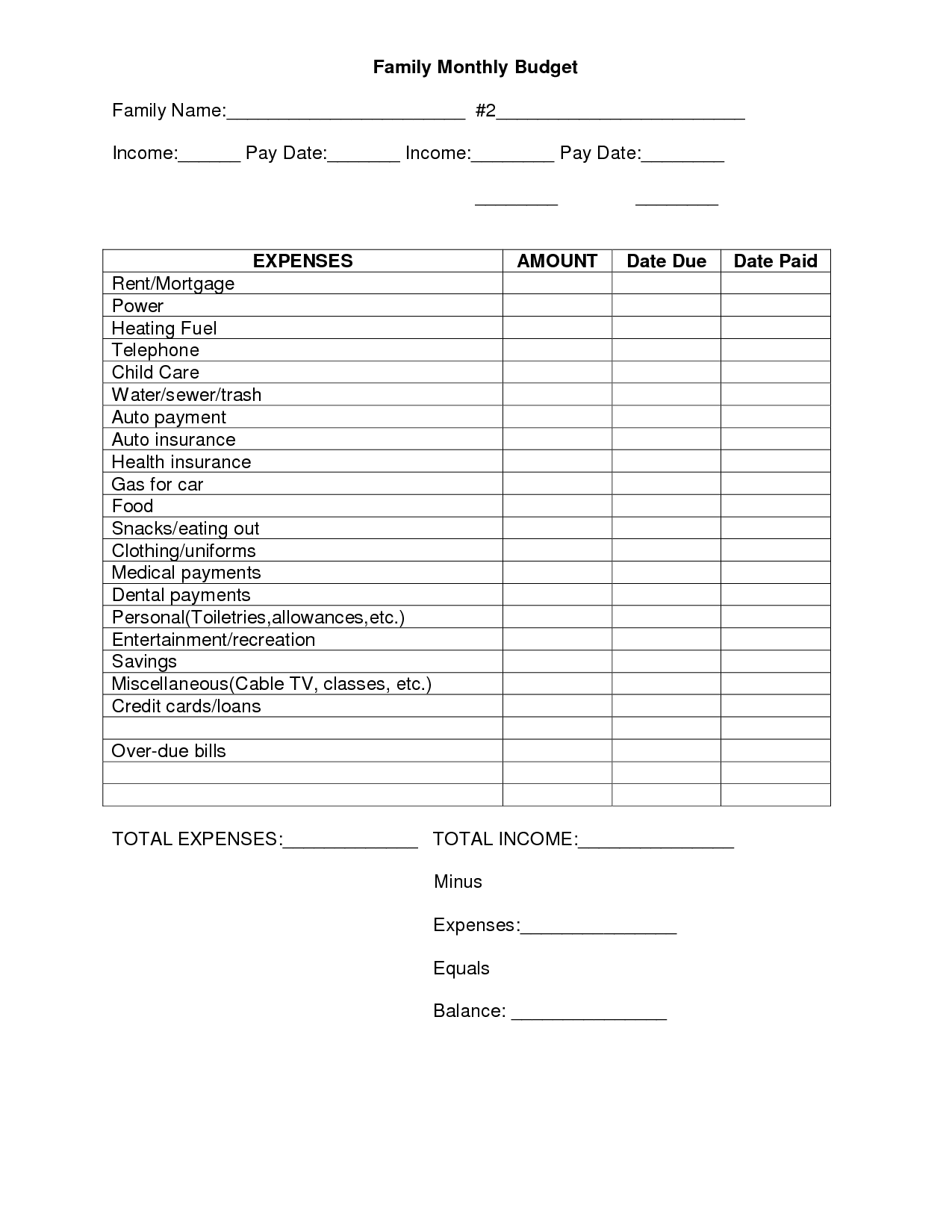

- Monthly Income Budget Worksheet Printable

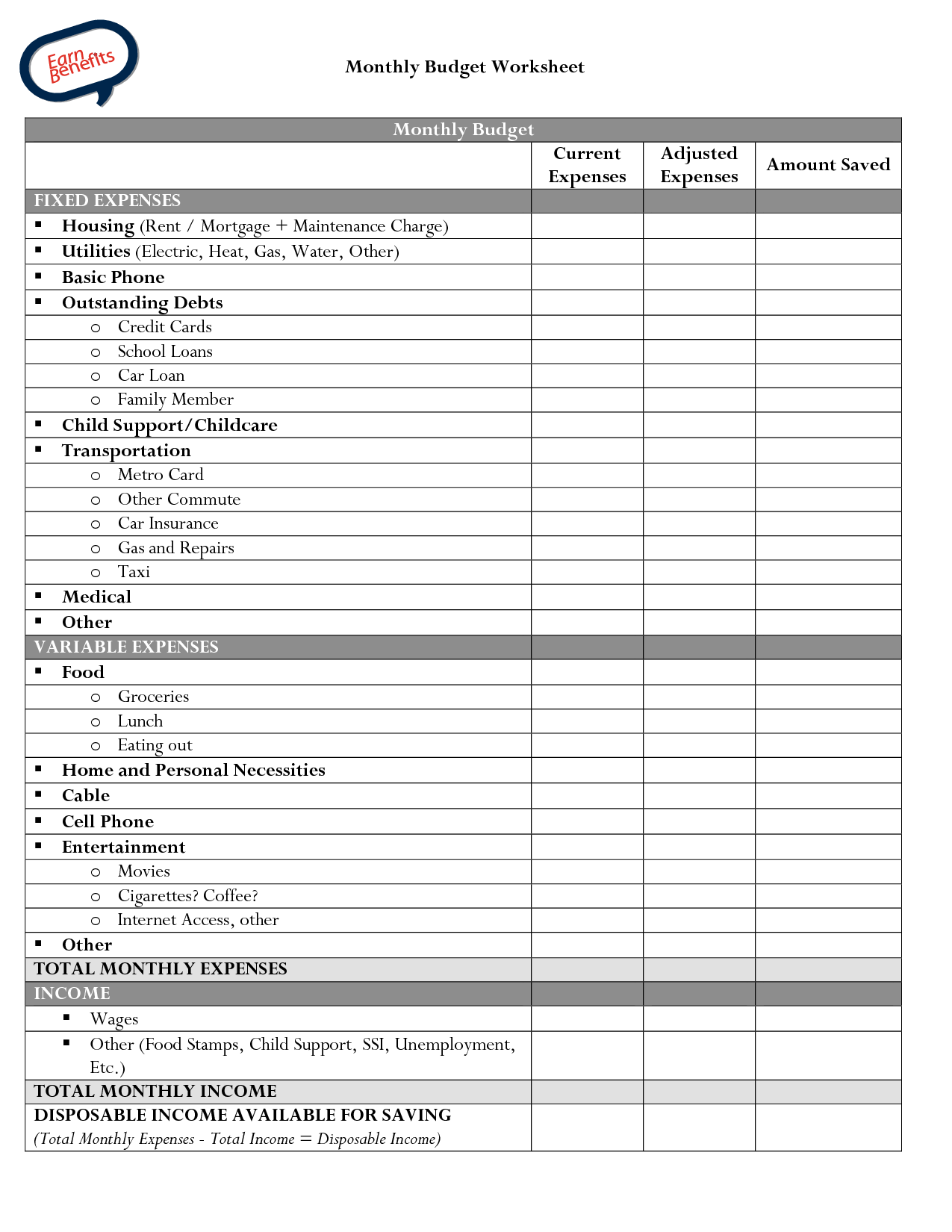

- Monthly Budget Expense Worksheet

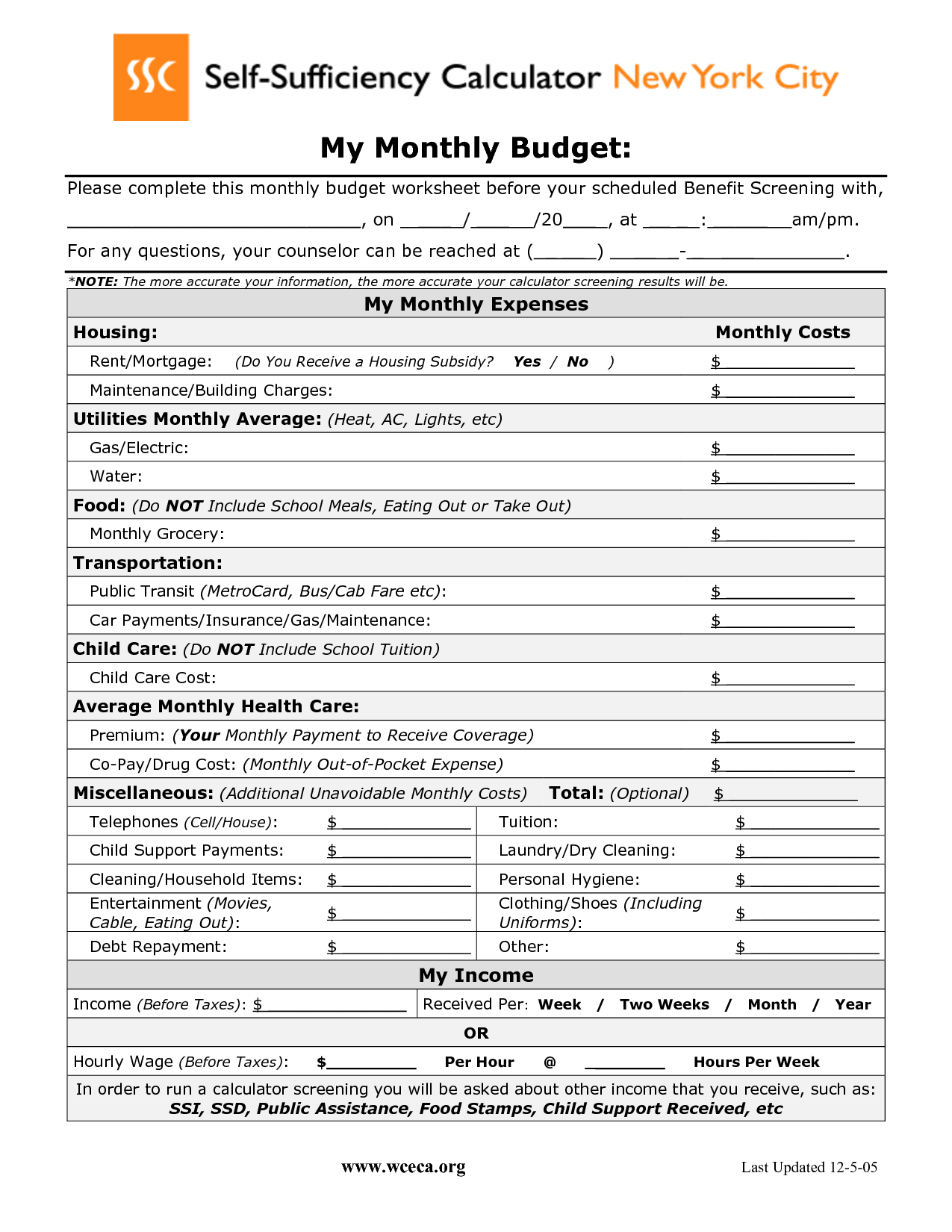

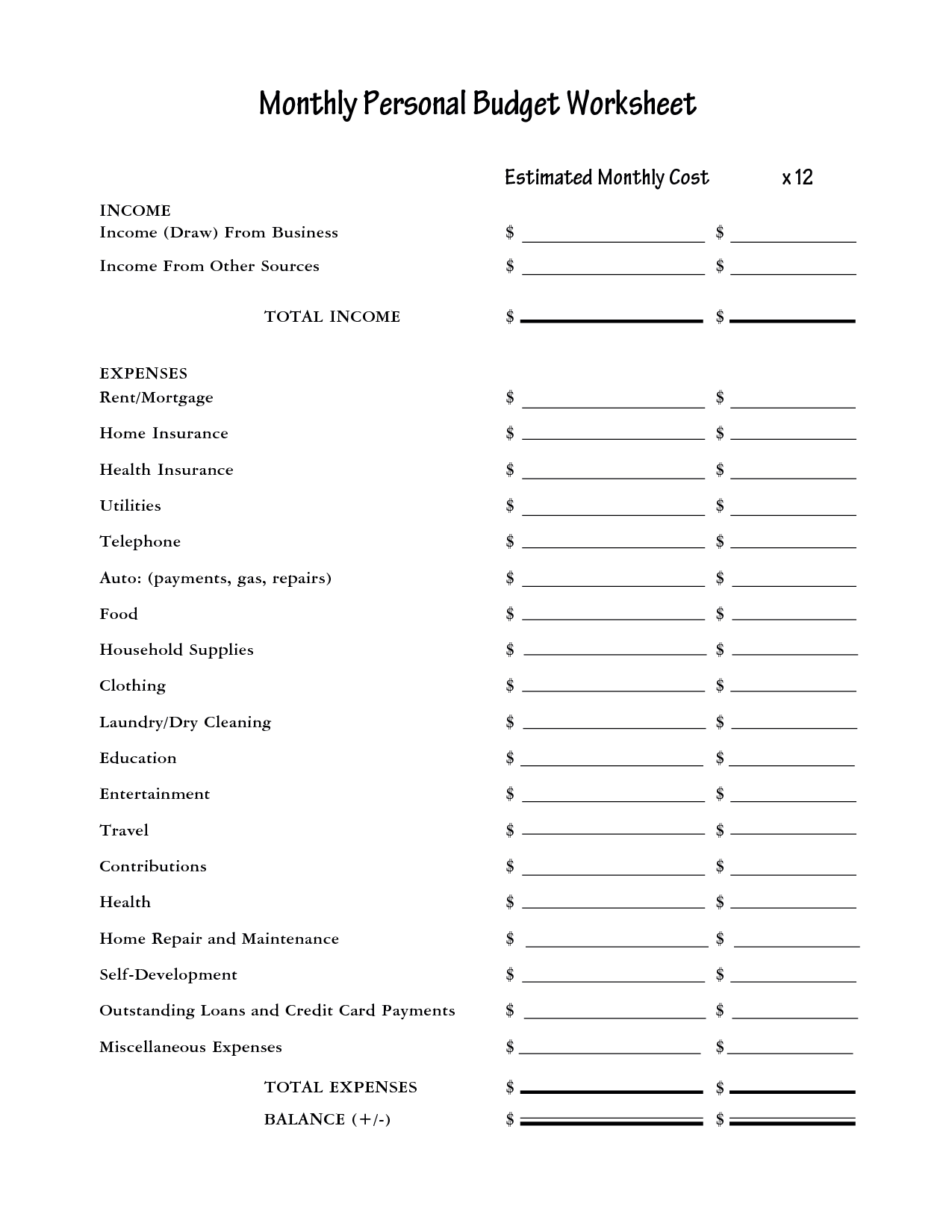

- My Monthly Budget Worksheet

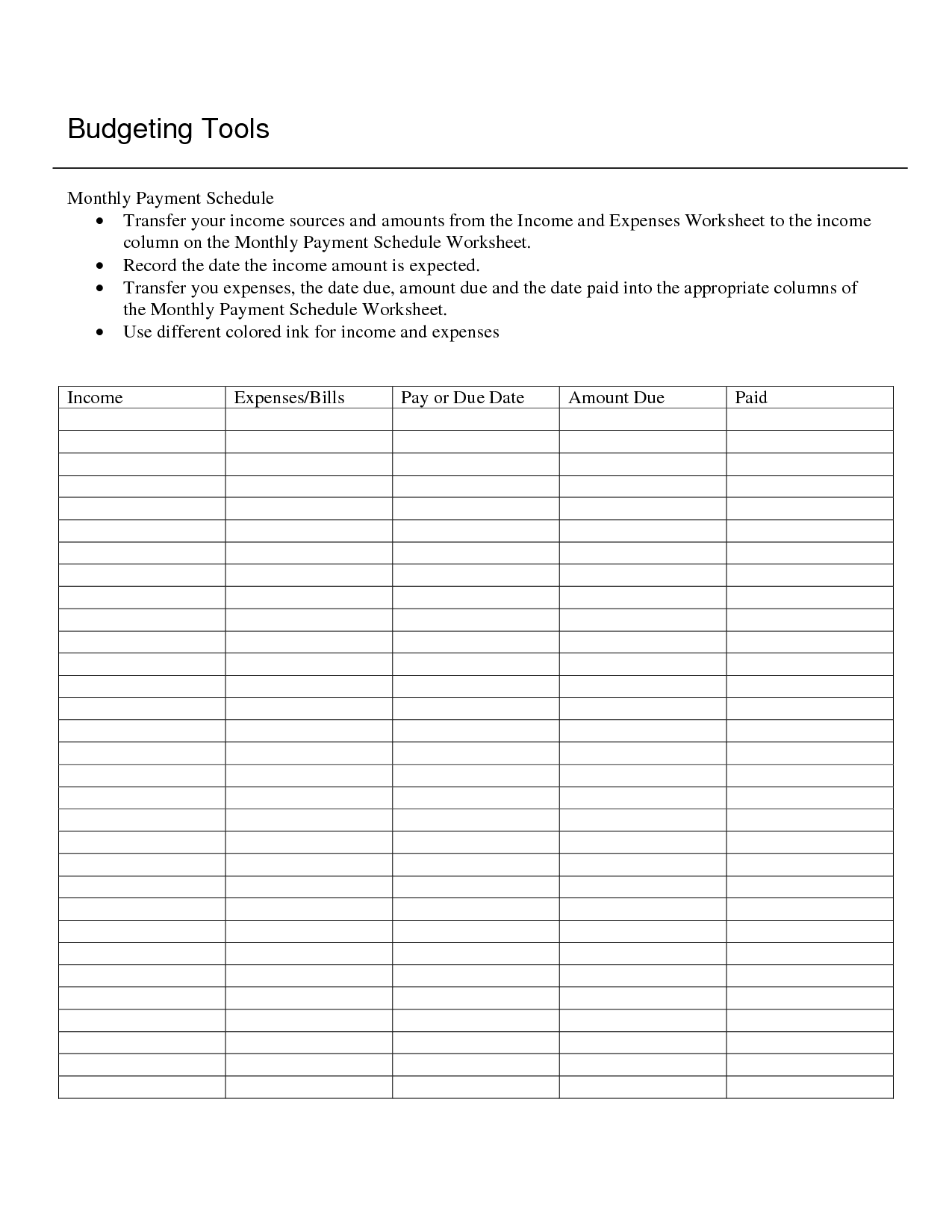

- Monthly Bill Organizer Template

- Monthly Budget Expense Worksheet

- Blank Personal Monthly Budget Worksheet

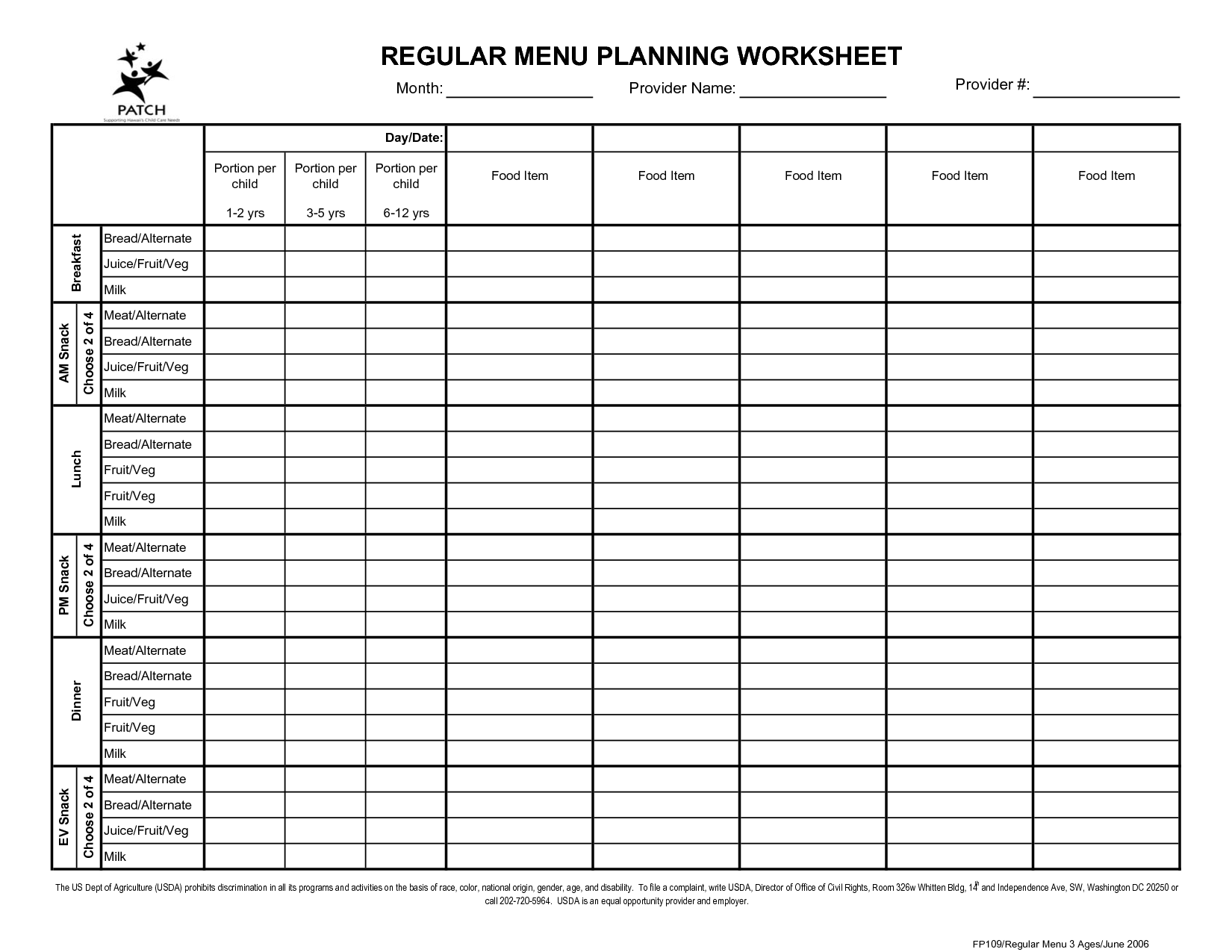

- Free Printable Monthly Menu Planning Worksheets

- Blank Monthly Budget Worksheet

- Personal Monthly Budget Form

- Family Monthly Budget Worksheet

- Monthly Household Budget Worksheet Printable

- Printable Household Budget Forms Templates

- Monthly Money Management Worksheet

- Monthly Bill Budget

- Monthly Bill Payment Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a budget worksheet?

A budget worksheet is a tool used to track income, expenses, and savings on a regular basis. It helps individuals or households manage their finances by providing a visual representation of their financial situation, making it easier to identify areas where spending can be reduced, increased, or reallocated to meet financial goals.

What are the benefits of using a budget worksheet?

Using a budget worksheet helps individuals and businesses to track and manage their finances effectively. It provides a clear overview of income, expenses, and savings goals, helping in identifying areas for saving money, making informed financial decisions, and avoiding overspending. With a budget worksheet, one can prioritize spending, set financial goals, and keep track of progress towards achieving them, leading to better financial management and stability in the long run.

What types of bills should be included on a monthly budget worksheet?

A monthly budget worksheet should include all recurring bills such as rent or mortgage payments, utilities, insurance premiums, debt payments (e.g., credit card bills, student loans), transportation costs, groceries, and any other necessary expenses like healthcare and childcare. It's important to also factor in irregular expenses, savings contributions, and discretionary spending to have a comprehensive overview of your financial situation.

How often should a budget worksheet be updated?

A budget worksheet should ideally be updated at least once a month to accurately track expenses, income, and any changes in financial goals. Regular updates can help evaluate spending habits, make adjustments to the budget, and ensure that financial objectives are being met effectively.

How can a budget worksheet help in tracking expenses?

A budget worksheet can help in tracking expenses by providing a visual representation of income sources and planned expenditures, allowing individuals to compare their actual spending against their budgeted amounts. It can help to identify areas of overspending, track spending patterns over time, and make adjustments to ensure financial goals are being met. By recording expenses on a budget worksheet, individuals can have a clear picture of their financial health and make informed decisions to improve their overall financial well-being.

What information should be included in the monthly bill section of a budget worksheet?

The monthly bill section of a budget worksheet should include all recurring expenses that occur each month such as rent or mortgage, utilities, internet and cable, car payments, insurance premiums, subscriptions, and any other fixed monthly bills. It is important to list the name of the bill, the amount due, the due date, and whether it is on auto-pay or needs to be manually paid. This section helps in tracking and planning for these regular expenses to ensure they are accounted for in the budget.

How can a budget worksheet help in prioritizing expenses?

A budget worksheet can help in prioritizing expenses by allowing individuals to track and categorize their income and expenses, identify necessary and discretionary spending, allocate funds to different categories based on importance, and compare actual spending to budgeted amounts to ensure that essential expenses are covered first before allocating funds to non-essential expenses. This exercise helps individuals prioritize their financial goals and make informed decisions on how to allocate their limited resources effectively.

What are some common categories to include in a budget worksheet?

Common categories to include in a budget worksheet are income, expenses (such as housing, transportation, groceries, utilities, entertainment, and savings), debt payments, and miscellaneous expenses. It is also important to incorporate a section for tracking actual expenses to compare against the budgeted amounts. This will help in evaluating financial health and making necessary adjustments to the budget.

How can a budget worksheet assist in setting financial goals?

A budget worksheet can assist in setting financial goals by providing a clear overview of current income, expenses, and saving habits. By analyzing these figures, individuals can identify areas where they can cut back on spending in order to allocate more funds toward their goals. The worksheet helps track progress towards these goals by monitoring spending and ensuring that money is being directed towards the predetermined financial objectives.

What are some tips for effectively using a budget worksheet?

To effectively use a budget worksheet, start by tracking all sources of income and expenses accurately. Make sure to review and update the budget regularly to reflect changes in financial situations. Be realistic and detailed in categorizing expenses to get a clear picture of where money is being spent. Set specific financial goals and prioritize them within the budget to allocate funds accordingly. Lastly, consider using budgeting tools or apps to automate the process and make tracking expenses easier.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments