Budget Planner Worksheet

Are you in search of a helpful tool to effectively manage your finances? Look no further, as we introduce the Budget Planner Worksheet. This simple yet powerful document provides individuals and households with the means to track their income and expenses, enabling them to plan and maintain a balanced budget. Whether you are a college student trying to manage your monthly expenses or a young family aiming to save for future goals, this worksheet can be a valuable entity to help you achieve your financial objectives.

Table of Images 👆

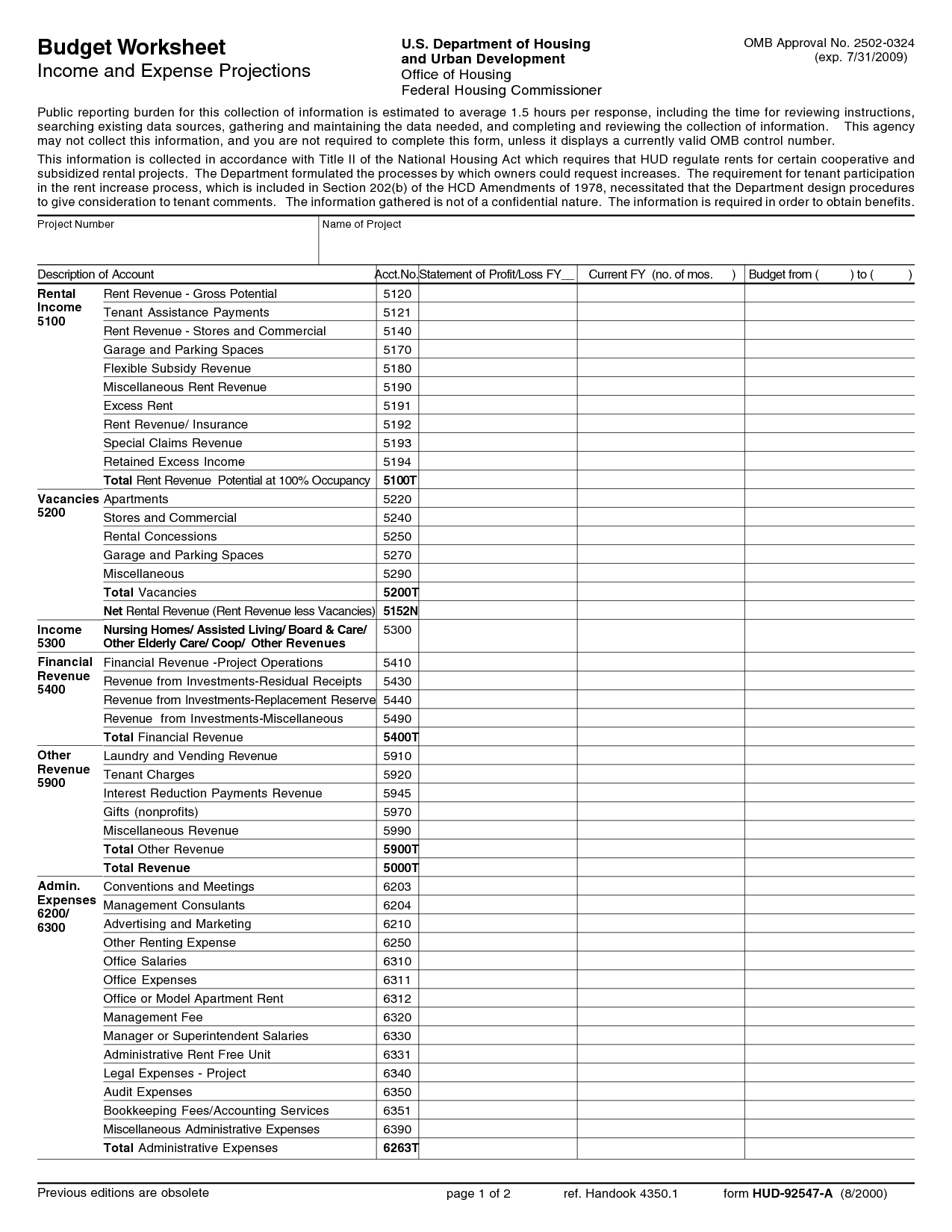

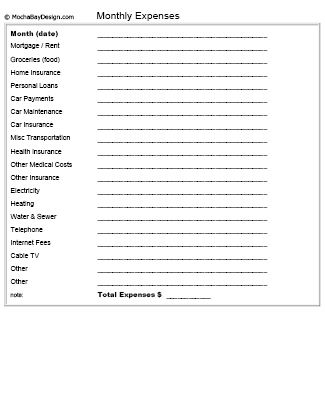

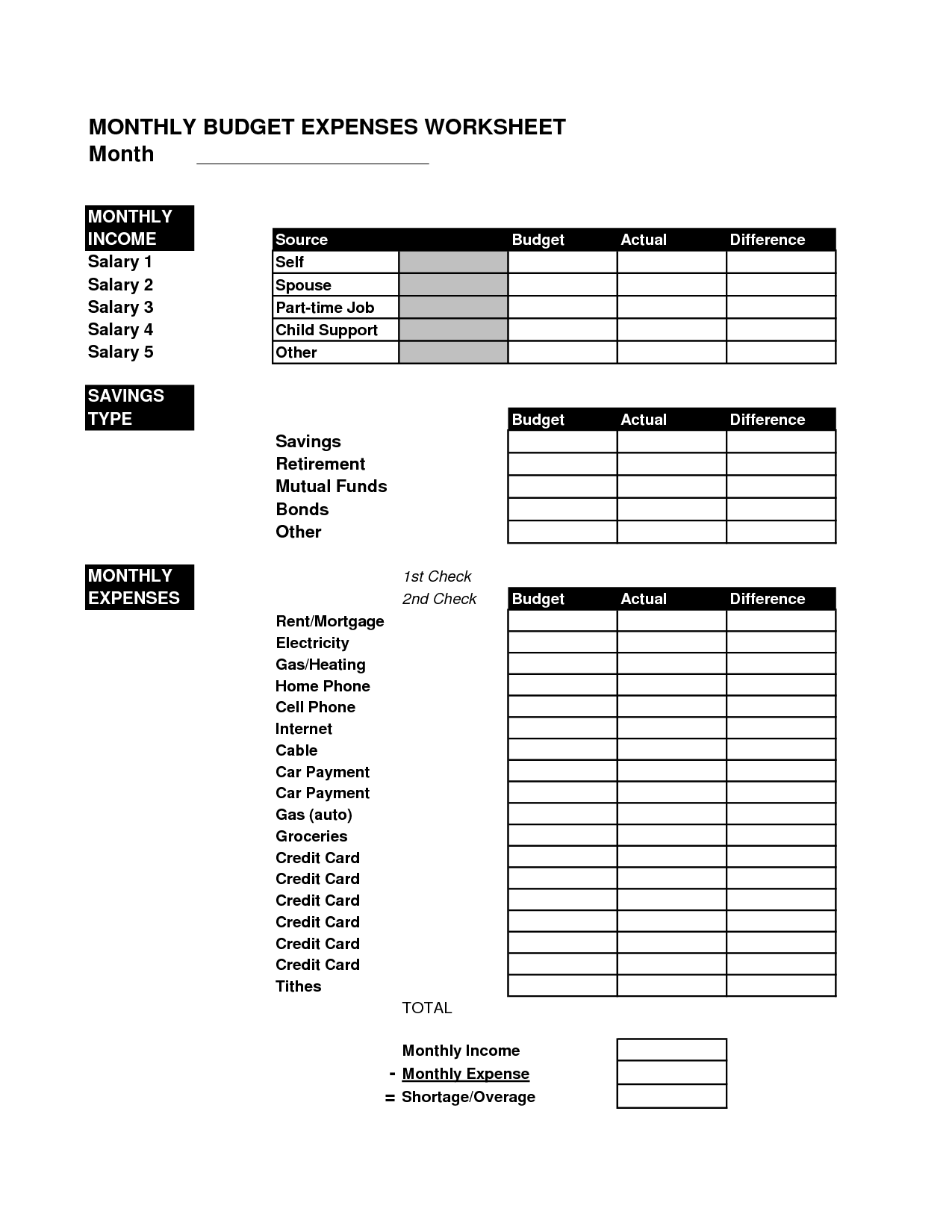

- Free Printable Budget Worksheets

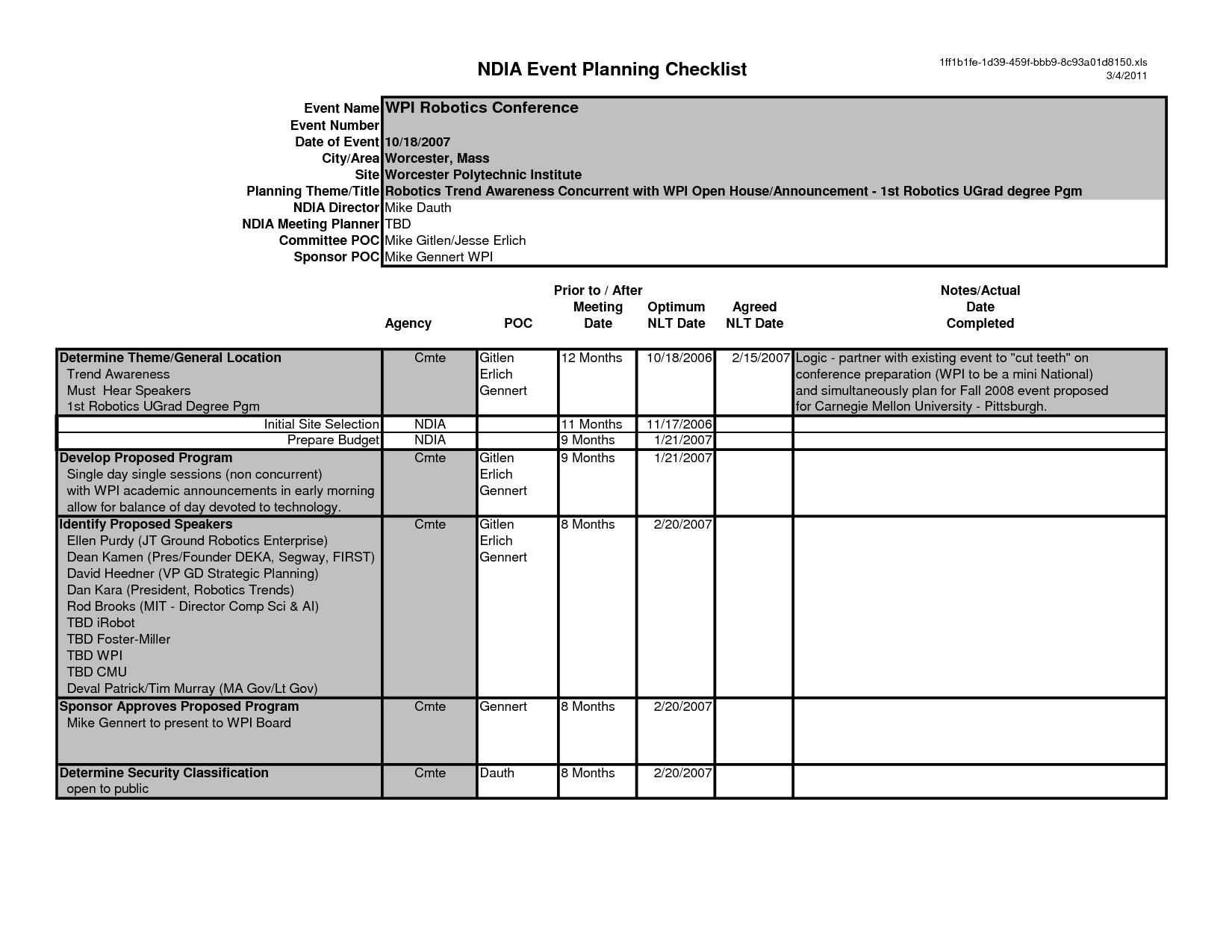

- Event Planning Budget Worksheet

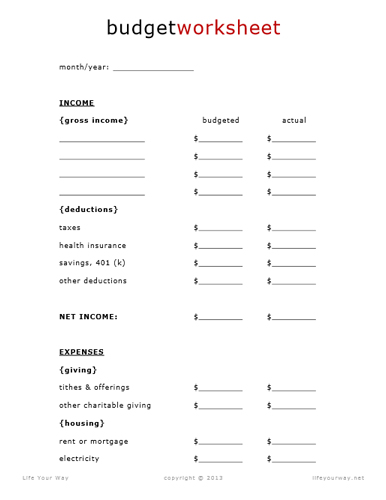

- Budget Worksheet Printable

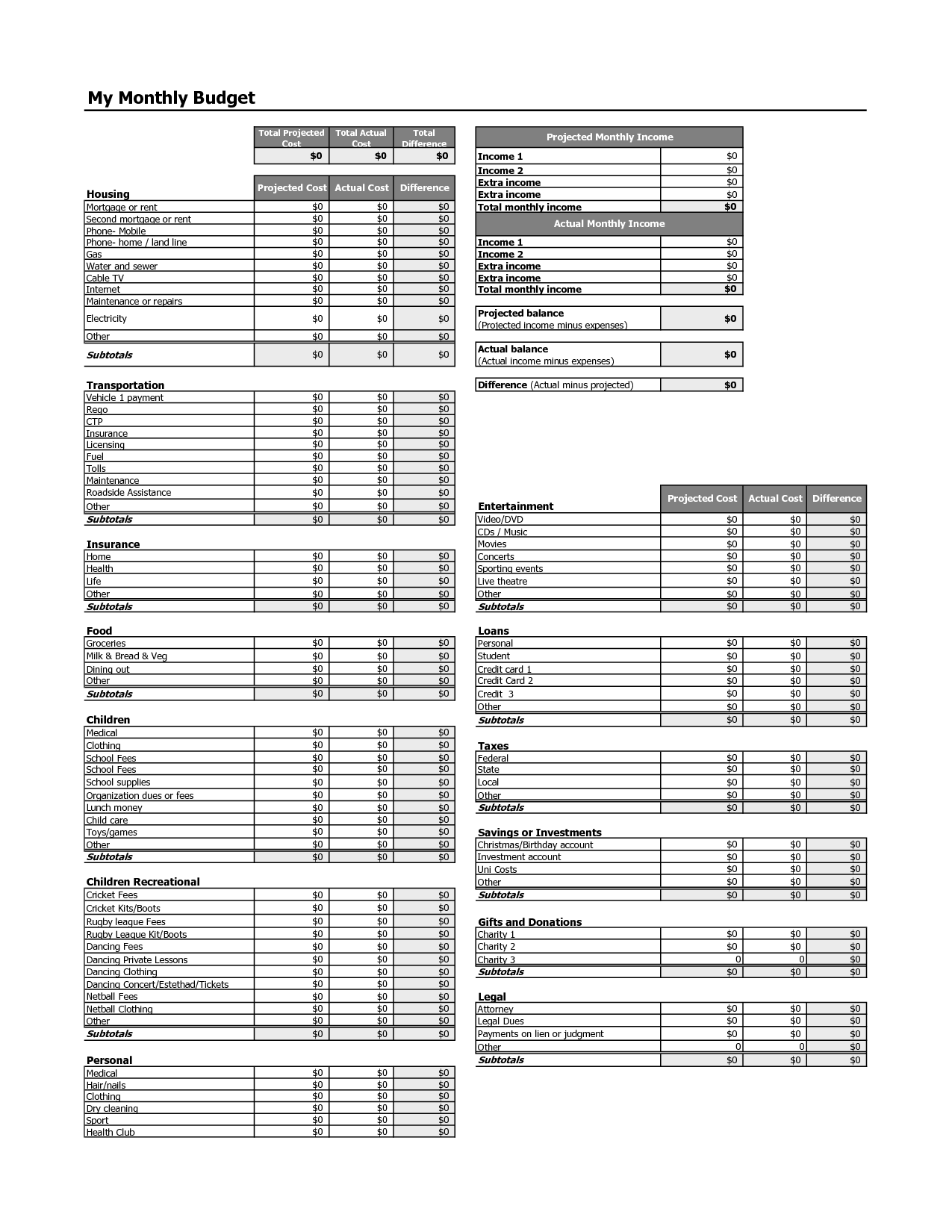

- Family Monthly Budget Planner Excel

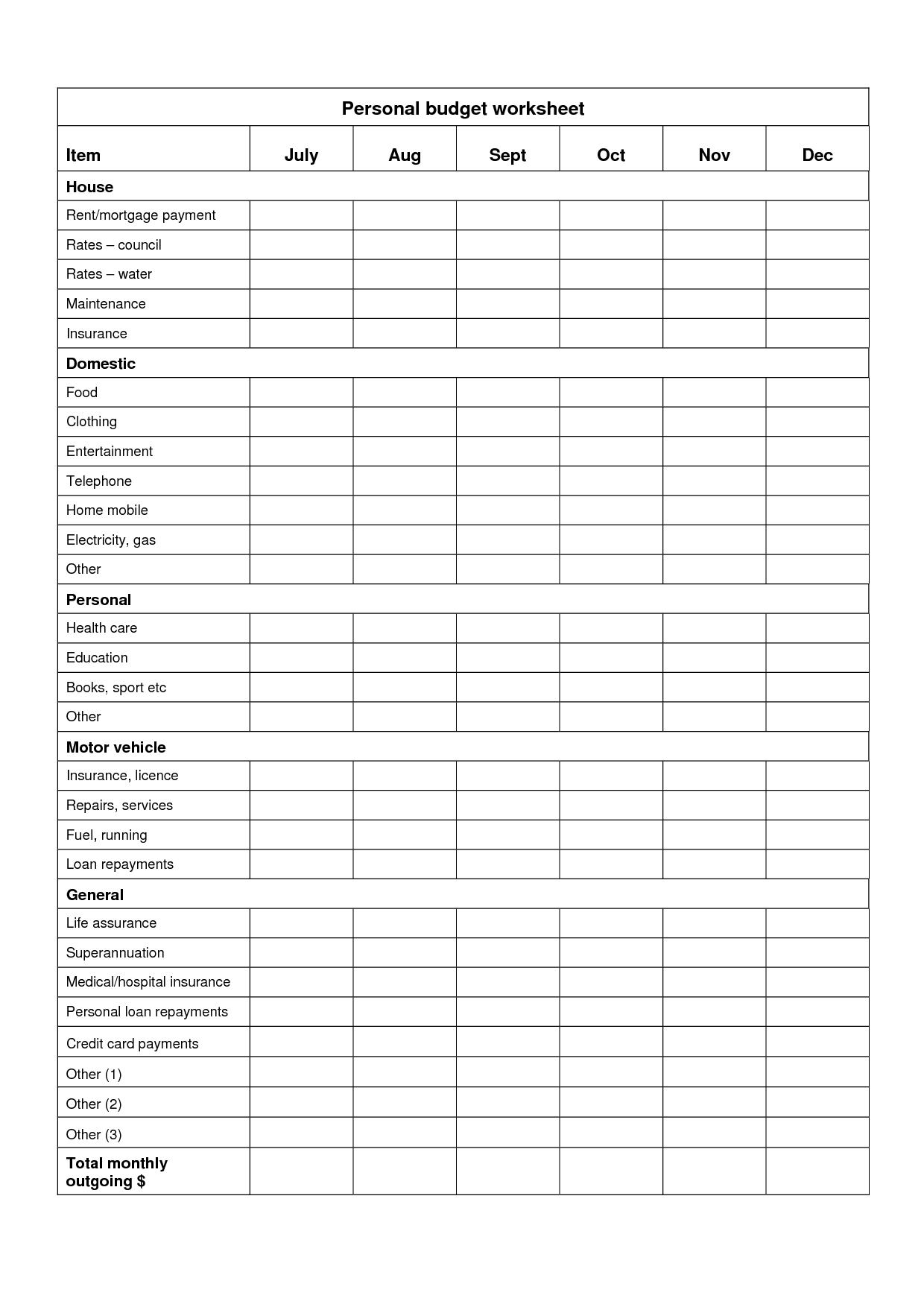

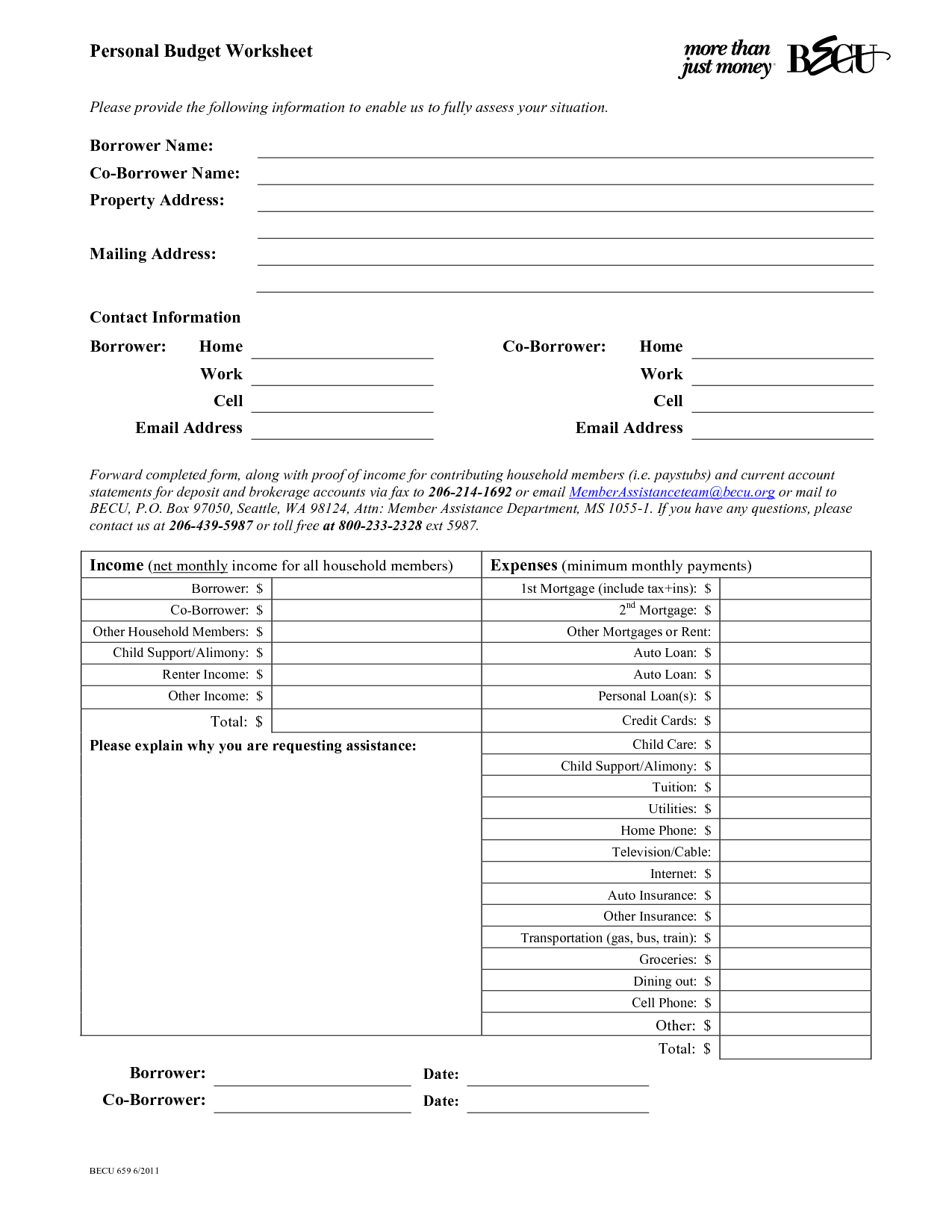

- Free Printable Personal Budget Worksheet

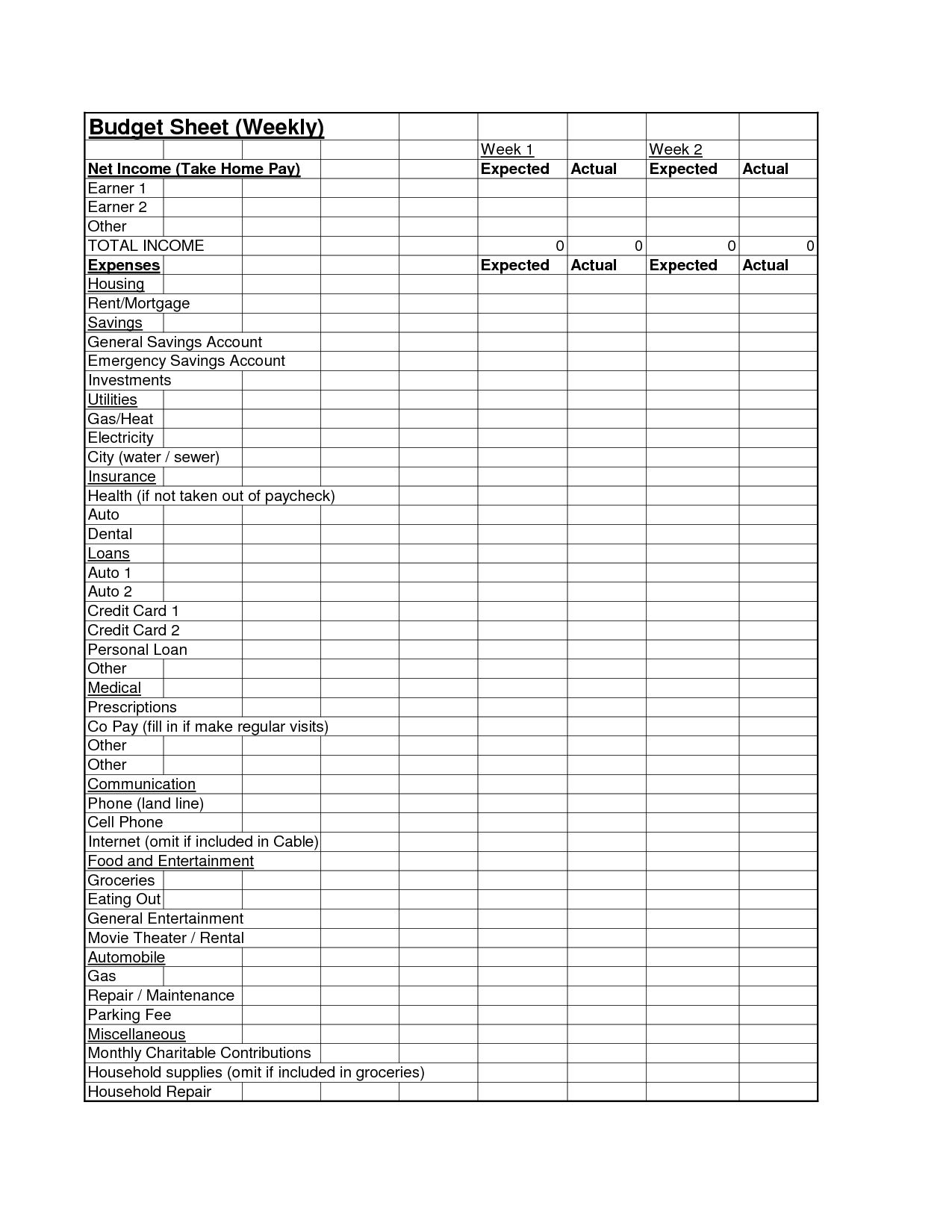

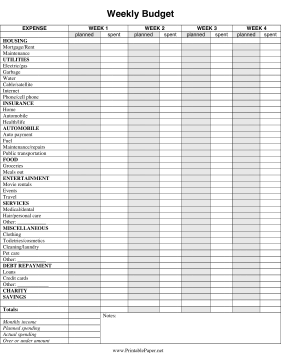

- Weekly Budget Planner

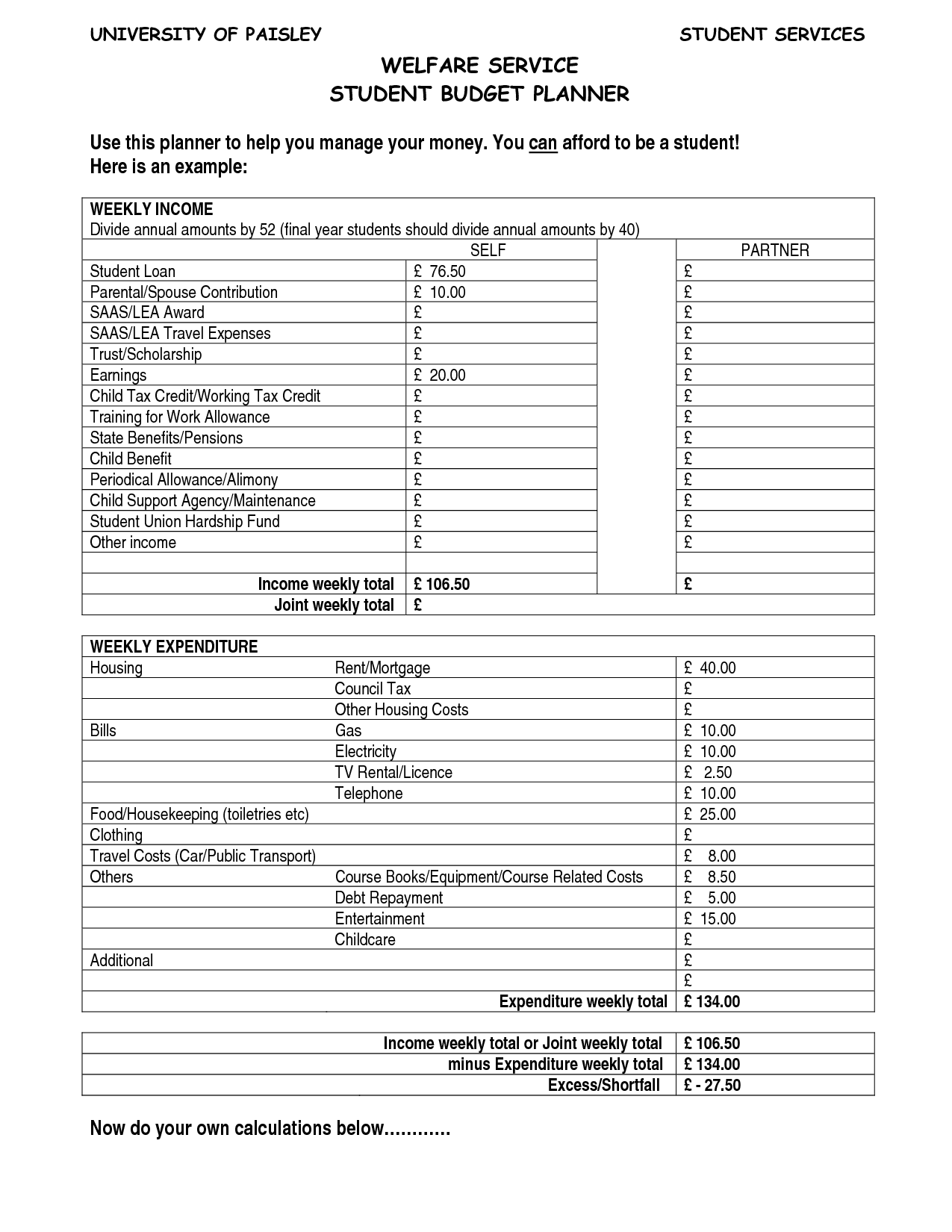

- Student Budget Planner

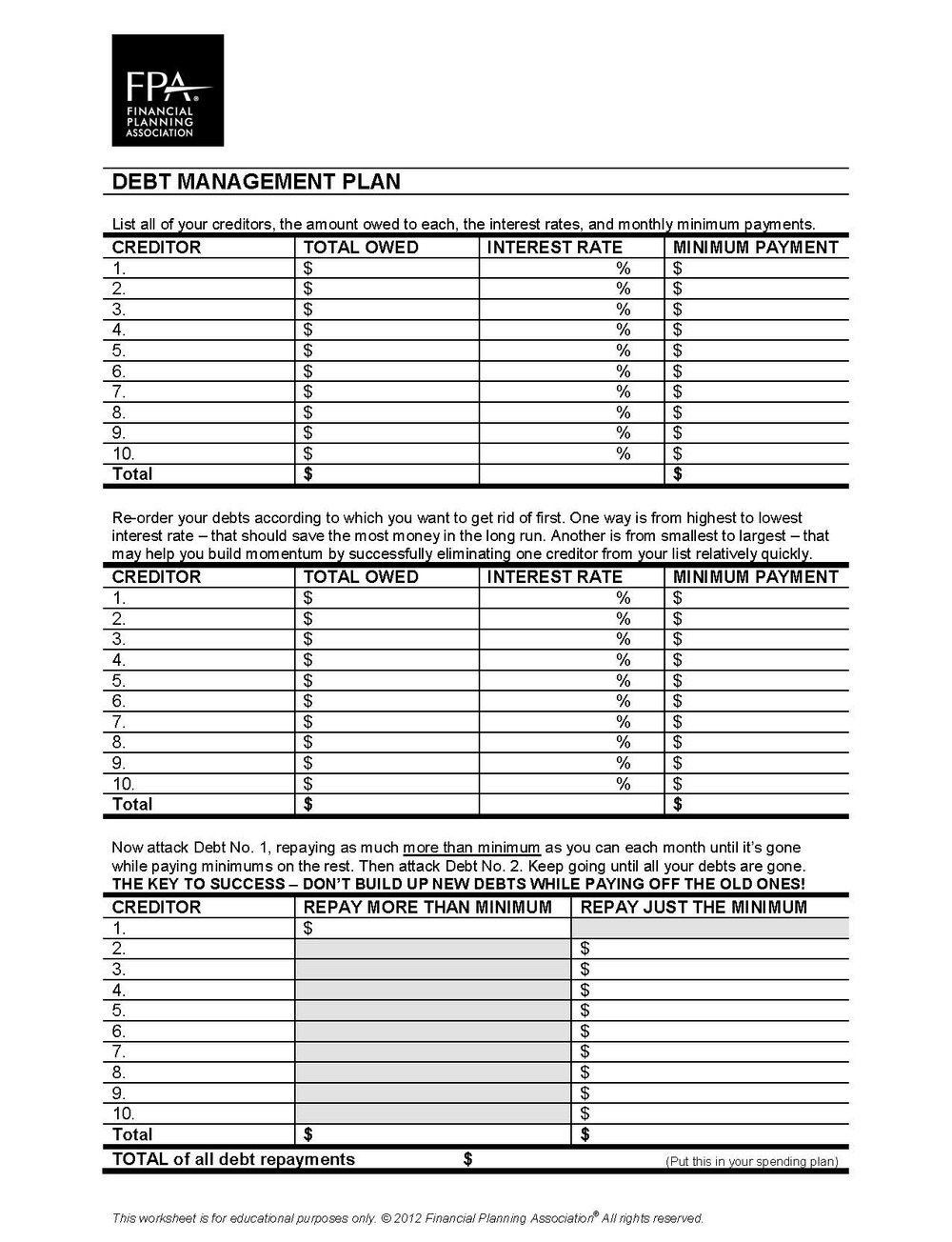

- Spending Plan Worksheet

- Free Printable Weekly Budget Template

- Simple Monthly Budget Worksheet Printable

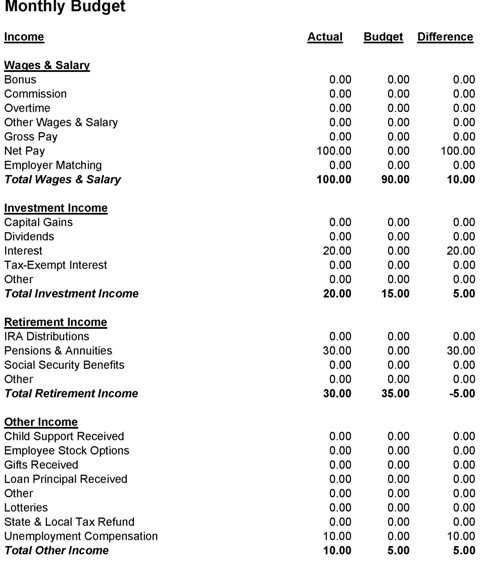

- Sample Personal Budget Worksheet

- Credit Card Budget Worksheet

- Monthly Home Budget Worksheet Excel

- Free Printable Weekly Budget Template

- Budget Calendar Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

What is a Budget Planner Worksheet?

A Budget Planner Worksheet is a tool used to track and manage personal or household finances. It typically includes sections for income, expenses, savings goals, and a summary of overall financial health. By detailing where money is earned and spent, individuals can create a budget to control expenses, prioritize savings, and make informed financial decisions.

How can a Budget Planner Worksheet help with financial management?

A Budget Planner Worksheet can help with financial management by providing a structured format to track income, expenses, and savings goals. It allows individuals to see a clear picture of their financial situation, identify areas where they can cut costs or increase savings, and make informed decisions on how to allocate their money. By regularly updating and reviewing the budget planner, individuals can stay on top of their finances, set priorities, and work towards achieving their financial goals effectively.

What are the main categories typically included in a Budget Planner Worksheet?

A budget planner worksheet typically includes categories such as income, expenses (e.g. housing, utilities, transportation, food, and entertainment), savings, and debt repayment. Additional categories may include miscellaneous expenses, emergency fund contributions, and specific financial goals such as retirement or vacation savings. It is important to customize the categories based on individual financial priorities and circumstances to effectively track and manage finances.

How do you track income in a Budget Planner Worksheet?

In a Budget Planner Worksheet, you can track income by listing all sources of income you expect to receive, such as salary, side hustle earnings, investment dividends, etc. Next to each income source, record the expected amount and frequency of payment (e.g., monthly, bi-weekly). As you receive income, update the actual amount in the worksheet. Make sure to differentiate between fixed and variable income to better understand your financial situation. Regularly review and adjust your income tracking to ensure accurate budgeting and financial planning.

What are some common expenses to include in a Budget Planner Worksheet?

Common expenses to include in a Budget Planner Worksheet are rent or mortgage payments, utilities, groceries, transportation costs, insurance premiums, debt payments, entertainment expenses, savings contributions, and miscellaneous expenses. It's important to capture all your regular and occasional expenses to create an accurate budget plan and track your financial health effectively.

How do you calculate the total income and expenses in a Budget Planner Worksheet?

To calculate the total income in a Budget Planner Worksheet, you would add up all sources of income such as salaries, bonuses, and any other money coming in. For expenses, you would total up all the spending categories like rent, utilities, groceries, entertainment, etc. Subtract the total expenses from the total income to determine whether you have a budget surplus or deficit.

How can a Budget Planner Worksheet help with setting financial goals?

A Budget Planner Worksheet can help with setting financial goals by providing a clear overview of an individual's income, expenses, and financial habits. By tracking spending patterns and identifying areas where money can be saved or invested, individuals can prioritize their financial goals more effectively. The worksheet can also help in creating a realistic budget that aligns with these goals, making it easier to monitor progress and stay accountable. Ultimately, using a Budget Planner Worksheet can empower individuals to take control of their finances, set achievable goals, and work towards building a strong financial foundation.

What are some tips for using a Budget Planner Worksheet effectively?

To use a Budget Planner Worksheet effectively, start by accurately tracking all sources of income and expenses. Set realistic financial goals and allocate funds accordingly. Review and update the worksheet regularly to stay on track with your budget. Prioritize essential expenses and consider cutting back on non-essential ones. Use categories to organize expenses and identify areas where you can potentially save money. Finally, consult the worksheet frequently to assess your progress and make adjustments as needed to meet your financial goals.

Are there any additional features or tools that can enhance a Budget Planner Worksheet?

Yes, there are several features and tools that can enhance a Budget Planner Worksheet. Some examples include: automatic calculations for income and expenses, color coding for categories, interactive charts and graphs to visualize data, alerts or reminders for upcoming bills or financial goals, linked cells to track progress in real-time, and the ability to set budget limits or goals. These features can make the budget planning process more efficient, organized, and effective.

How often should you review and update your Budget Planner Worksheet?

It is recommended to review and update your Budget Planner Worksheet at least once a month. This will allow you to track your expenses, identify any trends or changes in your spending habits, and make any necessary adjustments to stay on track with your financial goals. Regularly reviewing and updating your budget will help you stay organized, informed, and in control of your finances.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments