Blank Income Tax Worksheets

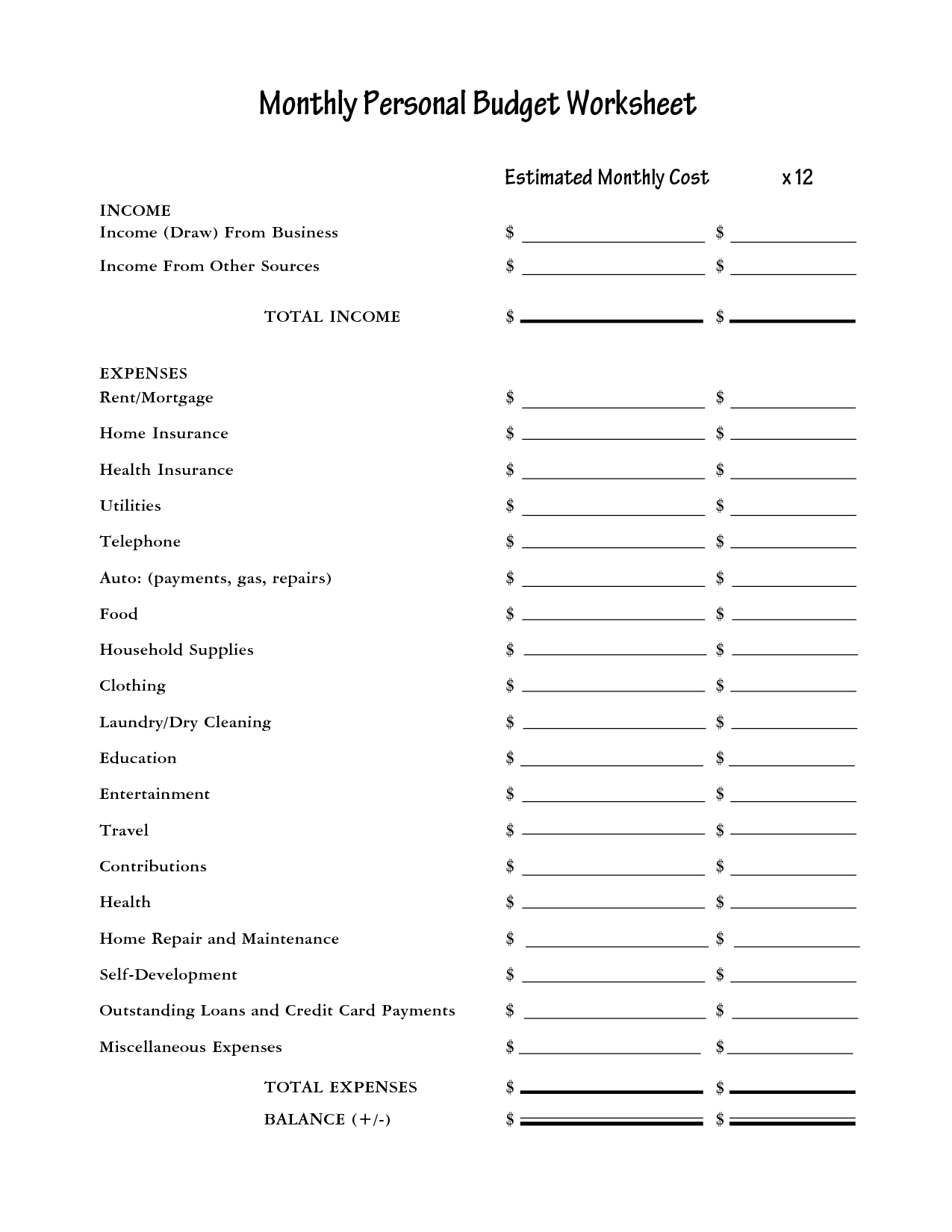

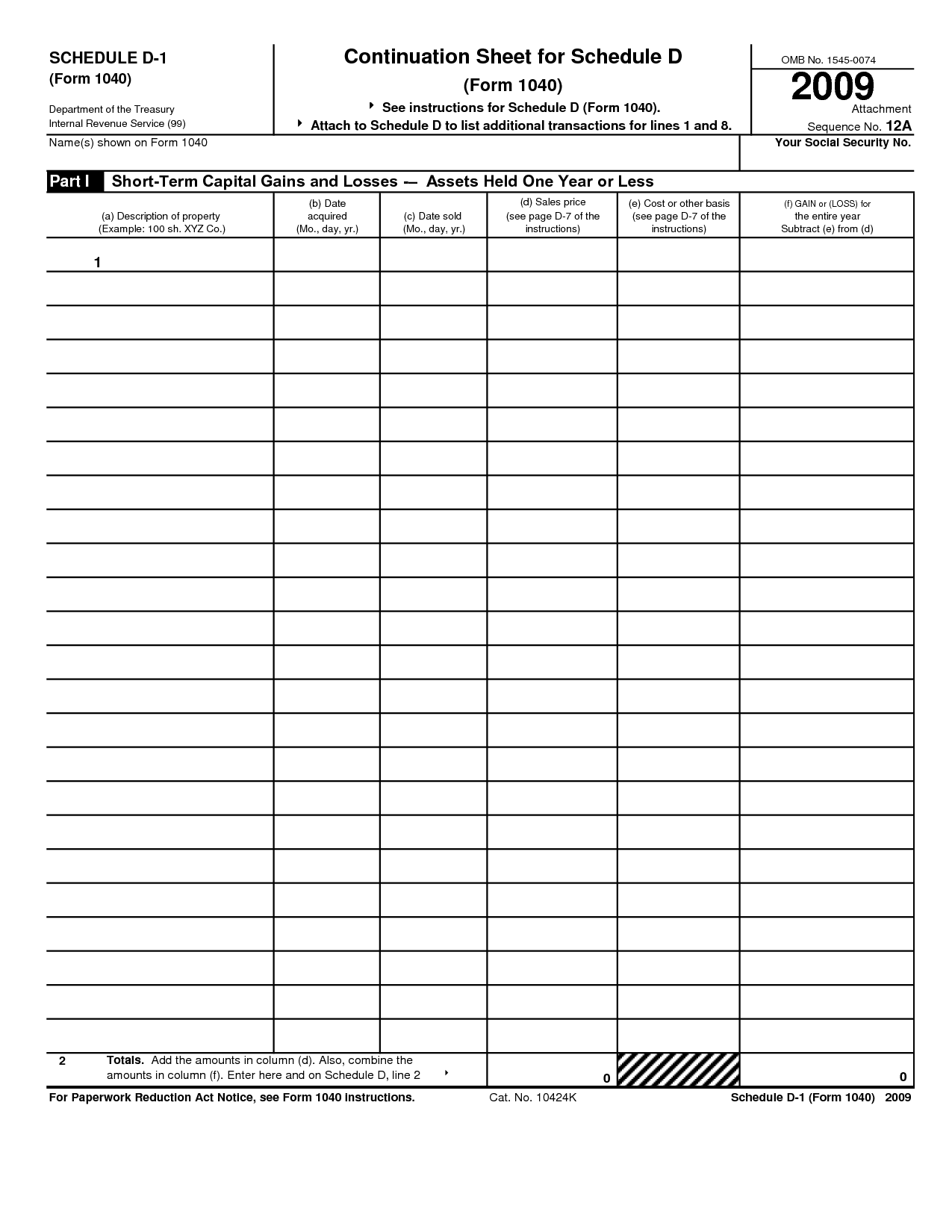

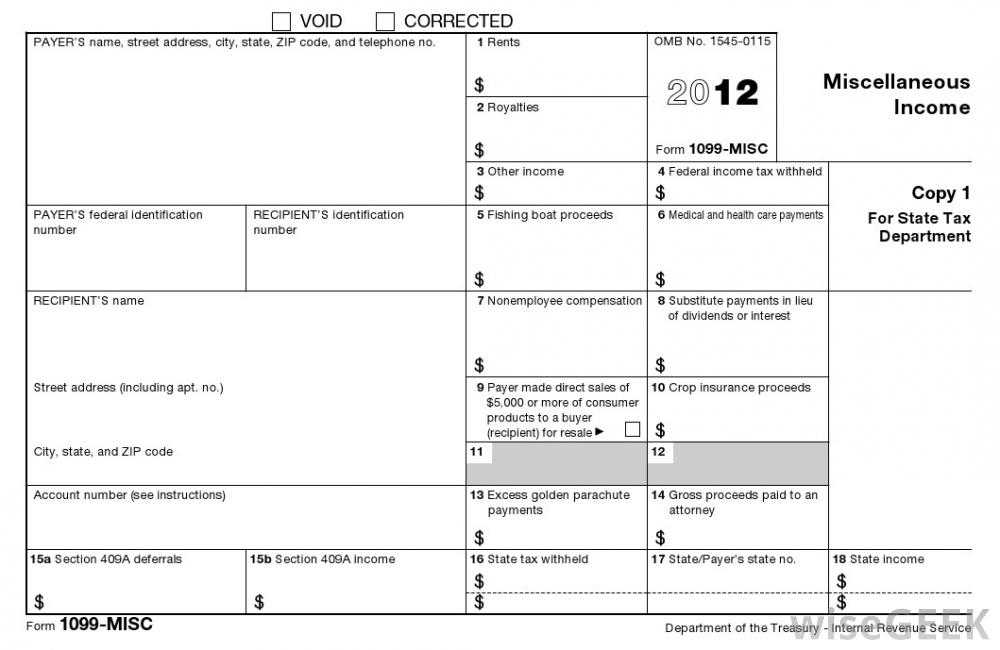

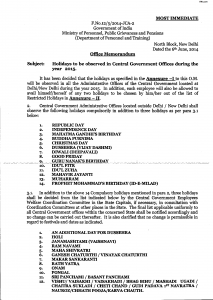

Income tax season can be a daunting time for many individuals, but with the help of worksheets, managing your finances becomes a much more manageable task. Designed to simplify the process, income tax worksheets provide a structured format to organize your financial information. Whether you are an individual, freelancer, or small business owner, these worksheets serve as a valuable tool to help you accurately report your income and deductions to the IRS or other tax authorities.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is the purpose of a blank income tax worksheet?

The purpose of a blank income tax worksheet is to help individuals organize their financial information, calculate their taxable income, deductions, credits, and determine how much tax they owe or are owed. It serves as a tool to facilitate the process of filing income tax returns accurately and efficiently by providing a structured format for collecting and documenting all necessary financial data.

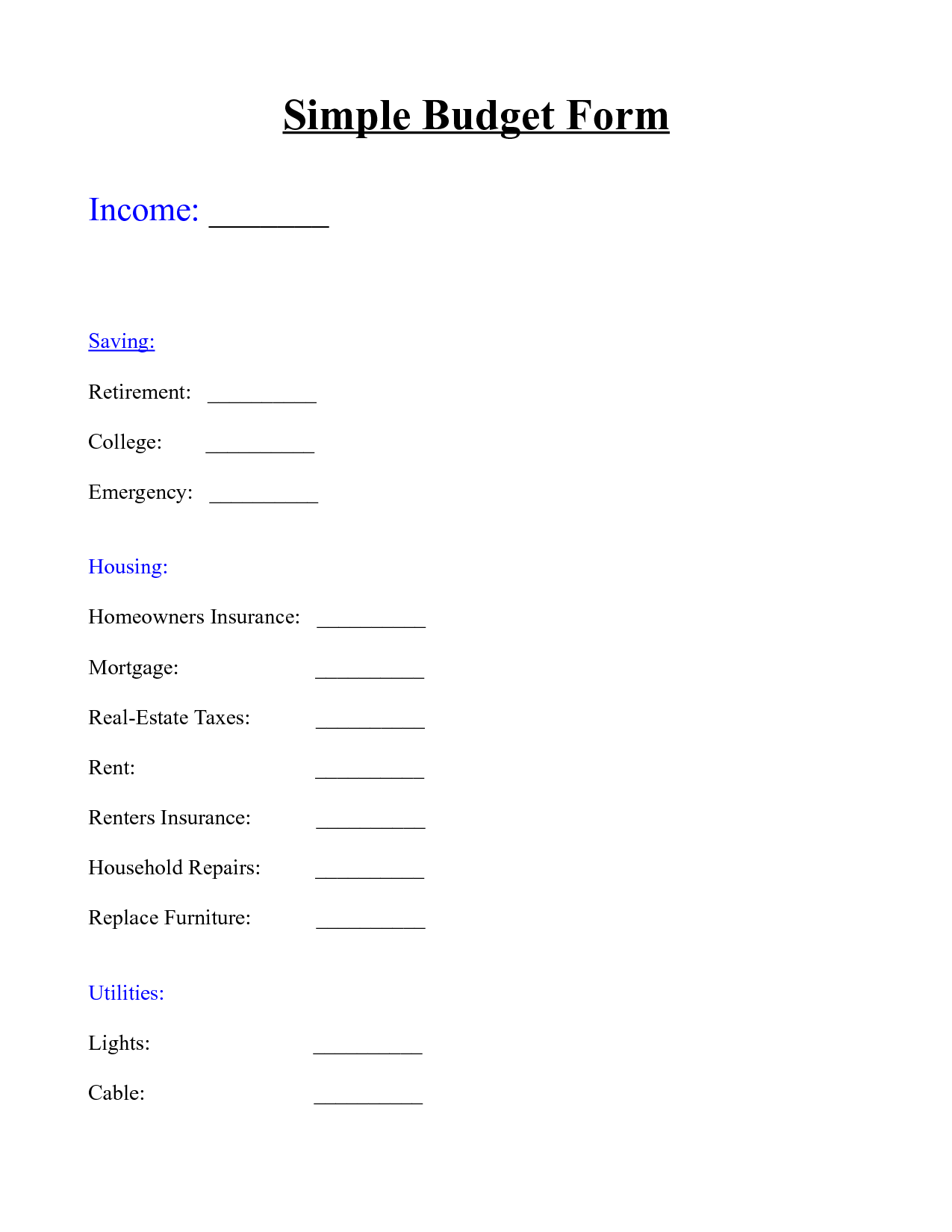

What information is typically included in a blank income tax worksheet?

A blank income tax worksheet typically includes sections for capturing various sources of income such as wages, self-employment earnings, dividends, and interest income. It may also include areas to list deductions such as student loan interest, medical expenses, and charitable contributions. Additionally, the worksheet may have sections for adjustments to income, credits, and calculations for taxable income and tax liability.

How do blank income tax worksheets help individuals prepare their tax returns?

Blank income tax worksheets help individuals prepare their tax returns by providing a structured format for organizing and calculating their income, deductions, and credits. By filling out the worksheets, individuals can ensure they don't miss any important details or overlook potential tax-saving opportunities. These worksheets serve as a guide to help taxpayers accurately report their financial information and determine their tax liabilities, ultimately streamlining the tax preparation process and potentially reducing the risk of errors on their tax returns.

Are there different types of blank income tax worksheets for different tax situations?

Yes, there are different types of blank income tax worksheets available for different tax situations. These worksheets are designed to help taxpayers calculate their income, deductions, and credits based on their specific circumstances and sources of income. Common types of income tax worksheets include ones for standard deductions, itemized deductions, self-employment income, investment income, and various tax credits. It's important to choose the appropriate worksheet that aligns with your individual tax situation to accurately report and calculate your taxes.

Are blank income tax worksheets specific to a certain country or jurisdiction?

Yes, blank income tax worksheets are specific to a certain country or jurisdiction because tax laws and regulations vary between countries. Each country has its own requirements and forms for filing income taxes, so the worksheets will be different depending on the tax laws in that particular jurisdiction.

Can blank income tax worksheets be downloaded and printed online?

Yes, blank income tax worksheets can be downloaded and printed online from various websites and government sources. These worksheets are typically available in PDF format and can be easily accessed and printed for personal use in organizing and calculating income tax information.

Are there any calculations or formulas included in blank income tax worksheets?

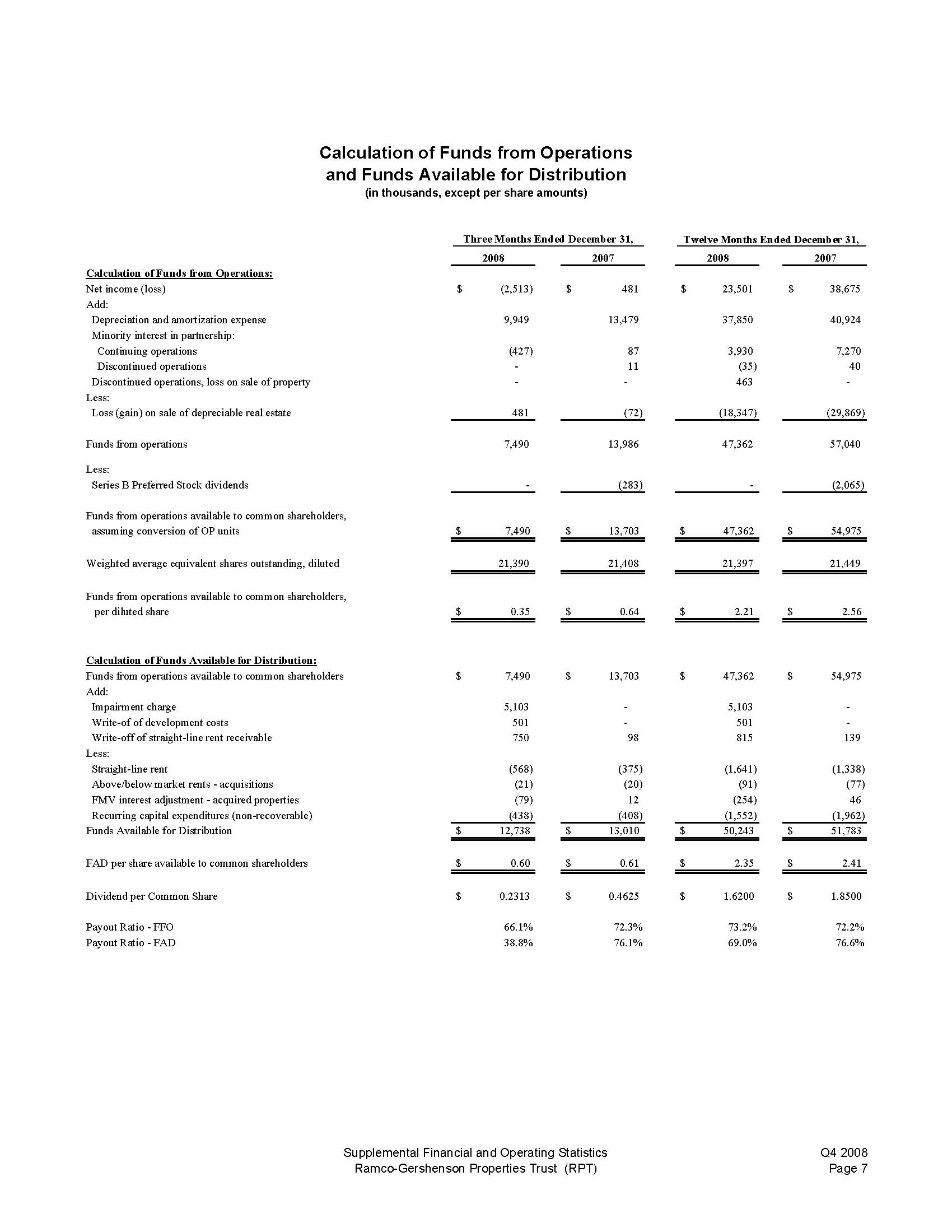

Yes, blank income tax worksheets often include various calculations and formulas to help taxpayers calculate their taxable income, deductions, credits, and ultimately determine their final tax liability. These worksheets typically guide taxpayers through the process of tallying their income sources, deductible expenses, and potential credits to arrive at an accurate tax amount owed or refund due.

Are there certain deductions or credits that can be accounted for in blank income tax worksheets?

Yes, there are several deductions and credits that can be accounted for in income tax worksheets, such as the standard deduction, itemized deductions for expenses like mortgage interest and charitable donations, and various tax credits like the Child Tax Credit or the Earned Income Tax Credit. These deductions and credits can help reduce your taxable income and ultimately lower the amount of taxes you owe.

Do blank income tax worksheets require documentation or receipts for income and expenses?

Income tax worksheets typically do not require documentation or receipts to be submitted along with the worksheet itself. However, it is important to keep all documentation and receipts organized and easily accessible in case the tax authority requests them as part of an audit or review. It is a good practice to maintain accurate records of income and expenses to support the information reported on the tax worksheet.

Can blank income tax worksheets be used to estimate a person's tax liability before filing their tax return?

No, blank income tax worksheets are typically used as part of the tax return preparation process to compute the actual tax liability based on the taxpayer's income and deductions. To estimate tax liability before filing a tax return, taxpayers can use tax calculators or online tax estimation tools provided by governmental agencies or reputable financial websites.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments