Bank Balance Worksheet

Keeping track of your bank balance is an essential aspect of managing your finances effectively. With the help of a bank balance worksheet, you can easily keep a record of your income and expenses, and maintain a clear overview of your financial situation. Whether you are a business owner, a student, or someone who simply wants to stay on top of their finances, a bank balance worksheet can be a valuable tool to help you stay organized and make informed financial decisions.

Table of Images 👆

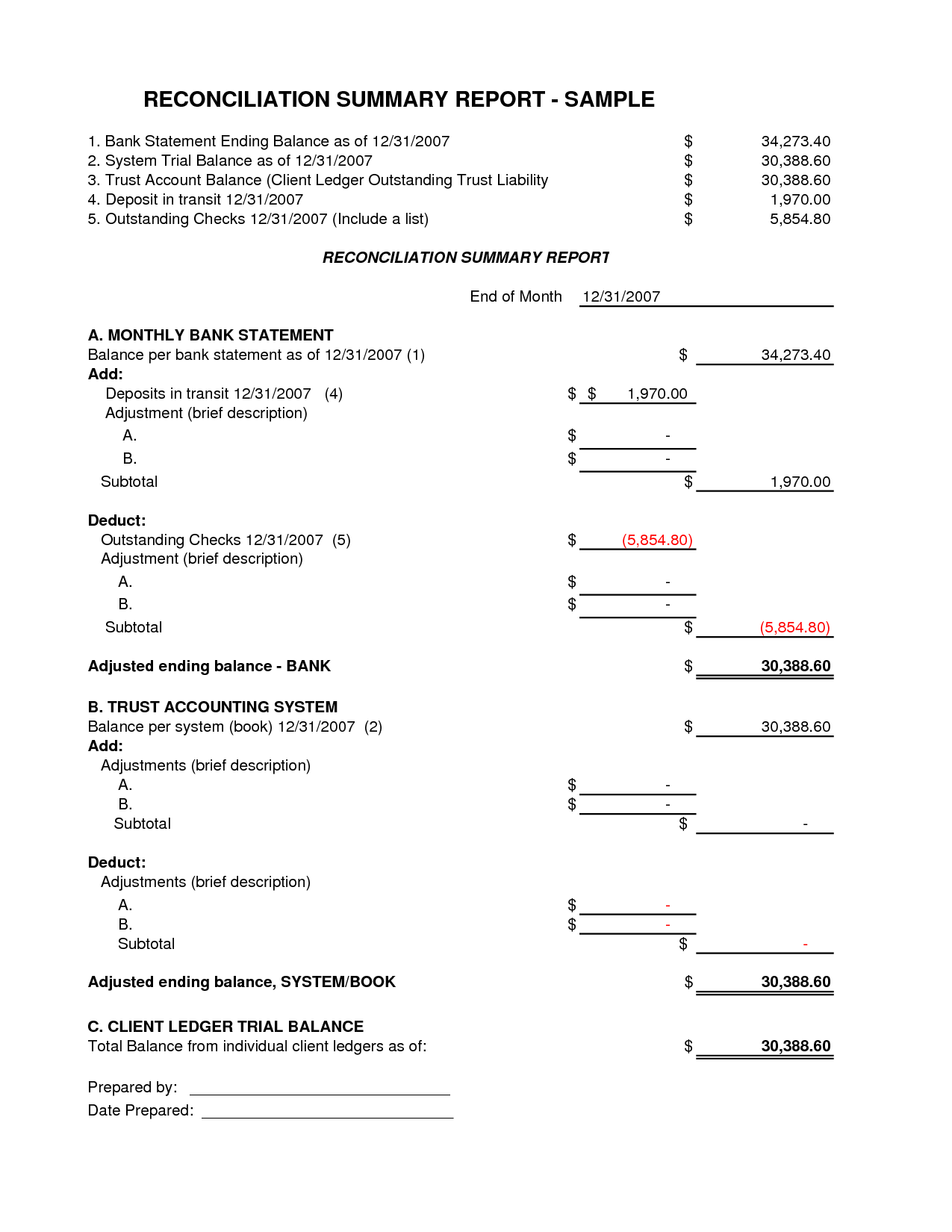

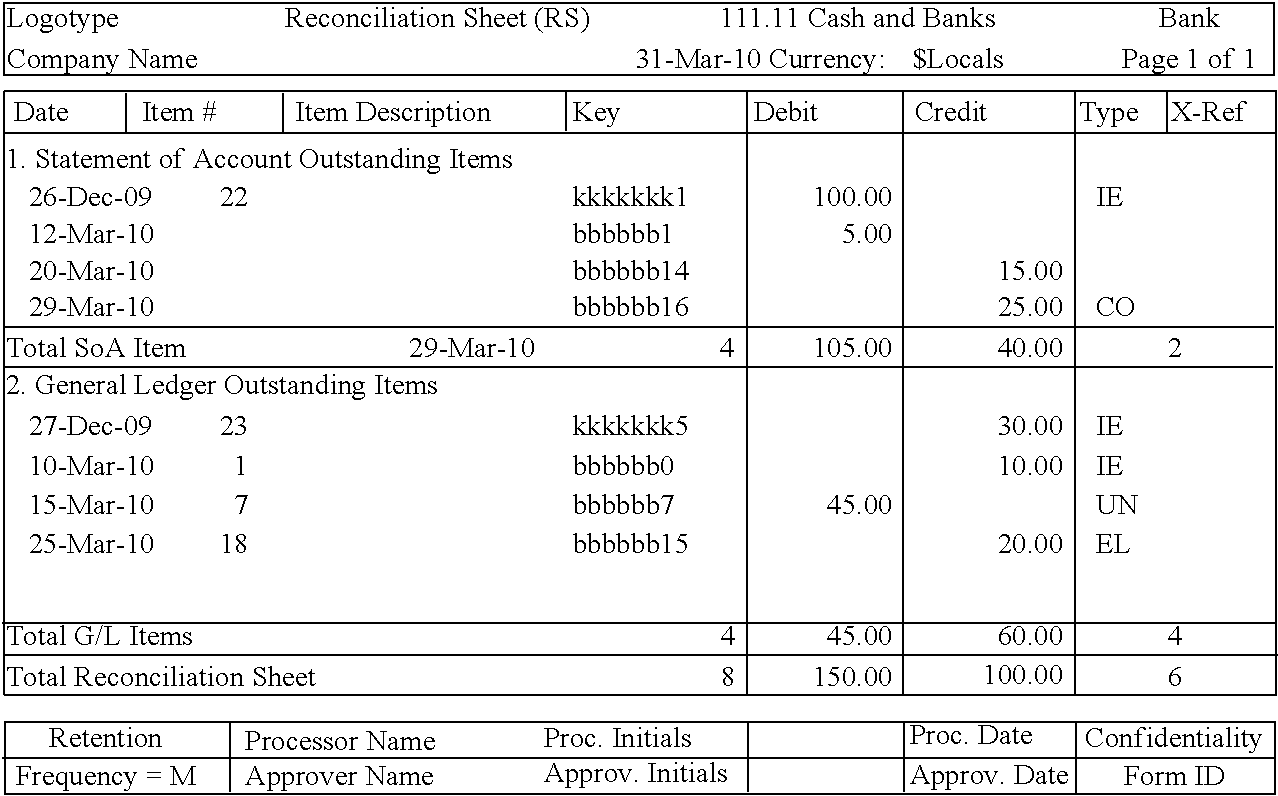

- Bank Reconciliation Statement Sample

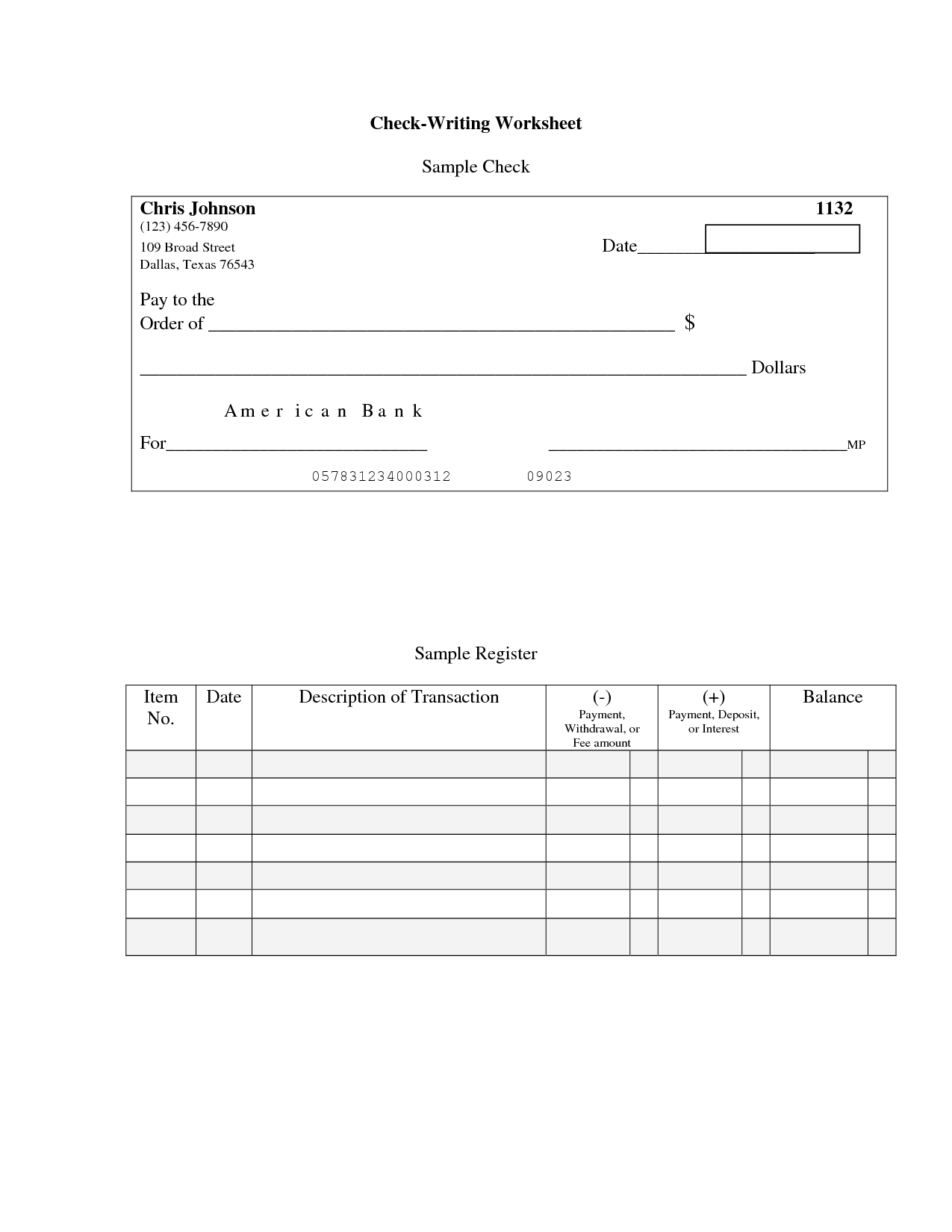

- Check Writing Practice Worksheets

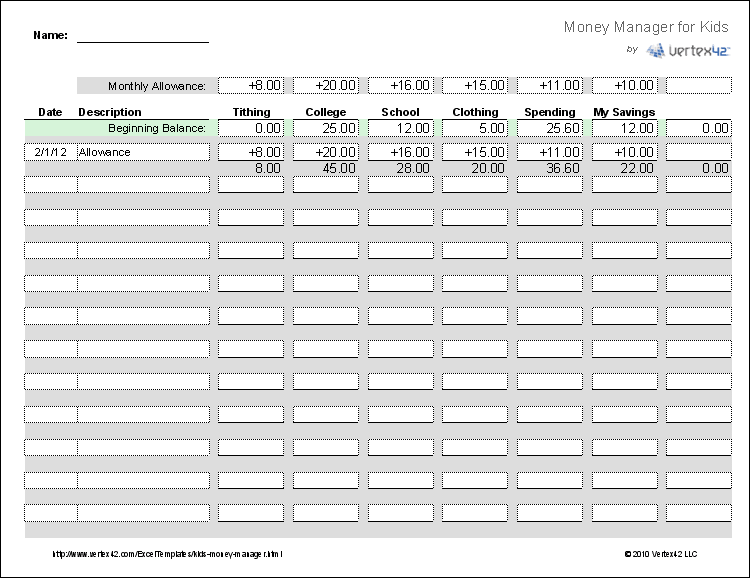

- Money Management Worksheets

- Sample Check Register Worksheet

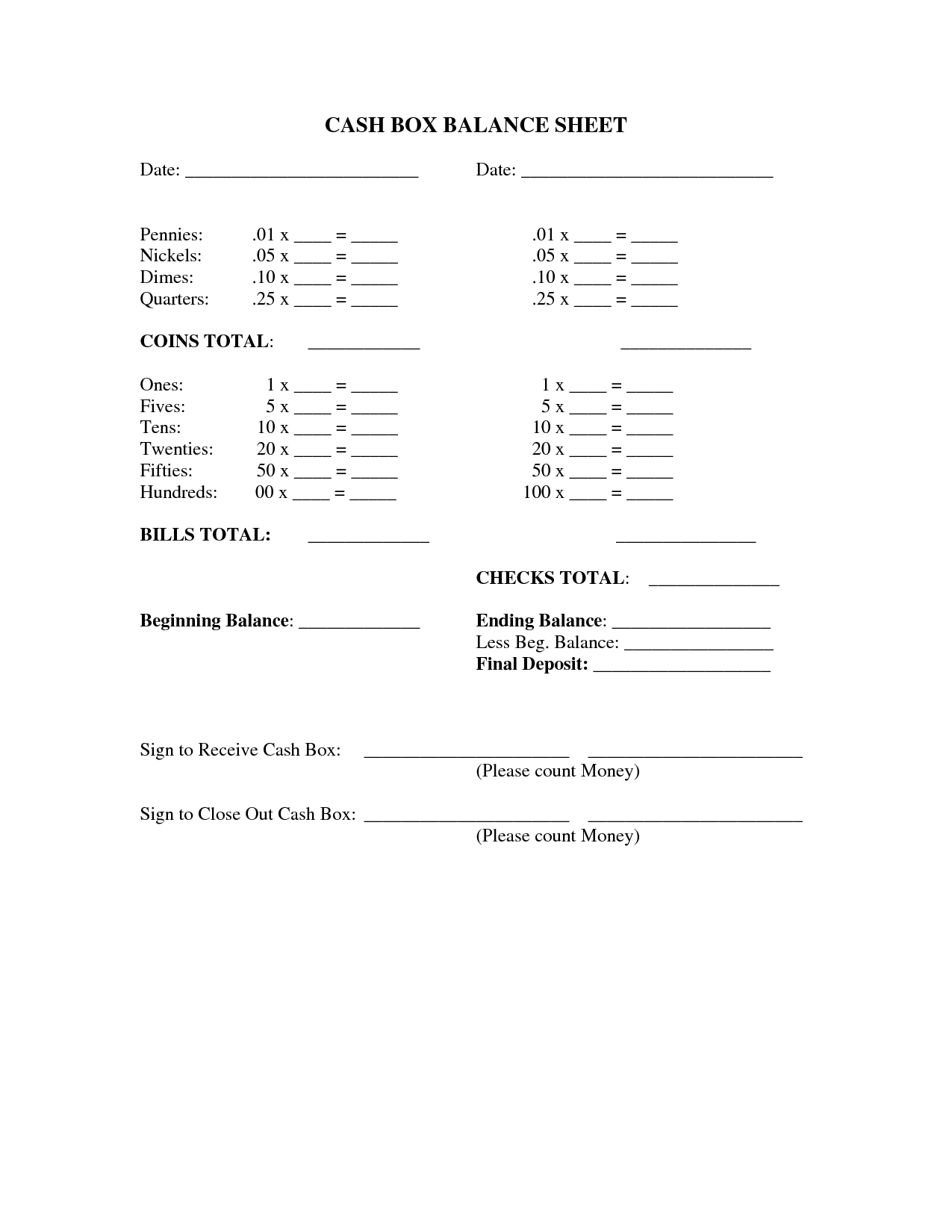

- Cash Box Balance Sheet

- Bank Reconciliation Template

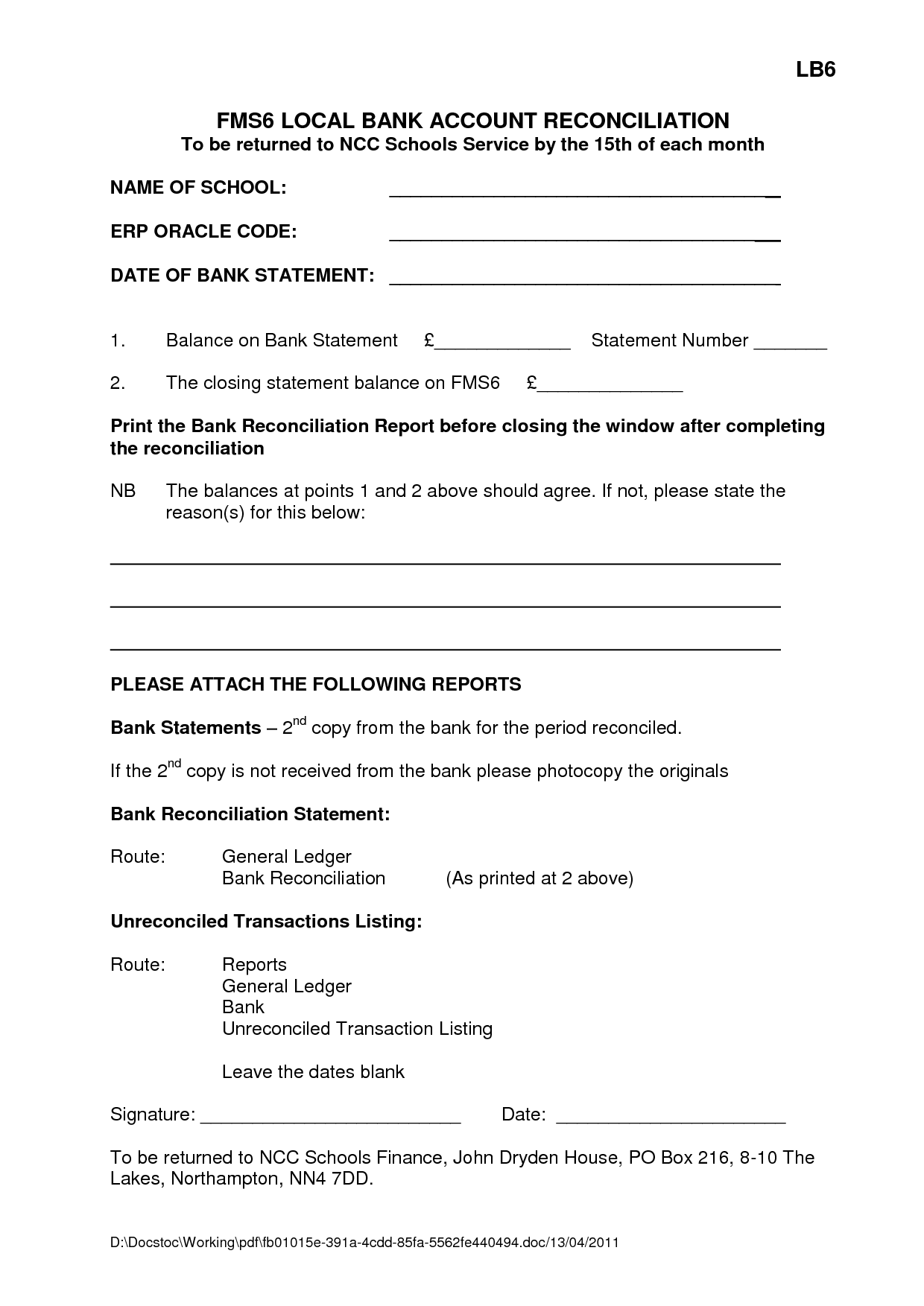

- Bank Statement Reconciliation Form

- Business Expenses Definition

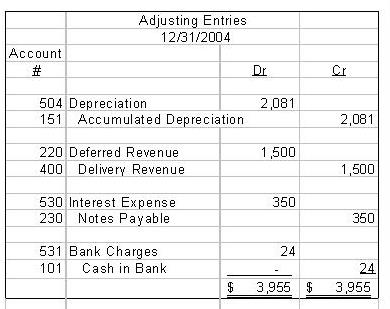

- Adjusting Journal Entries Examples

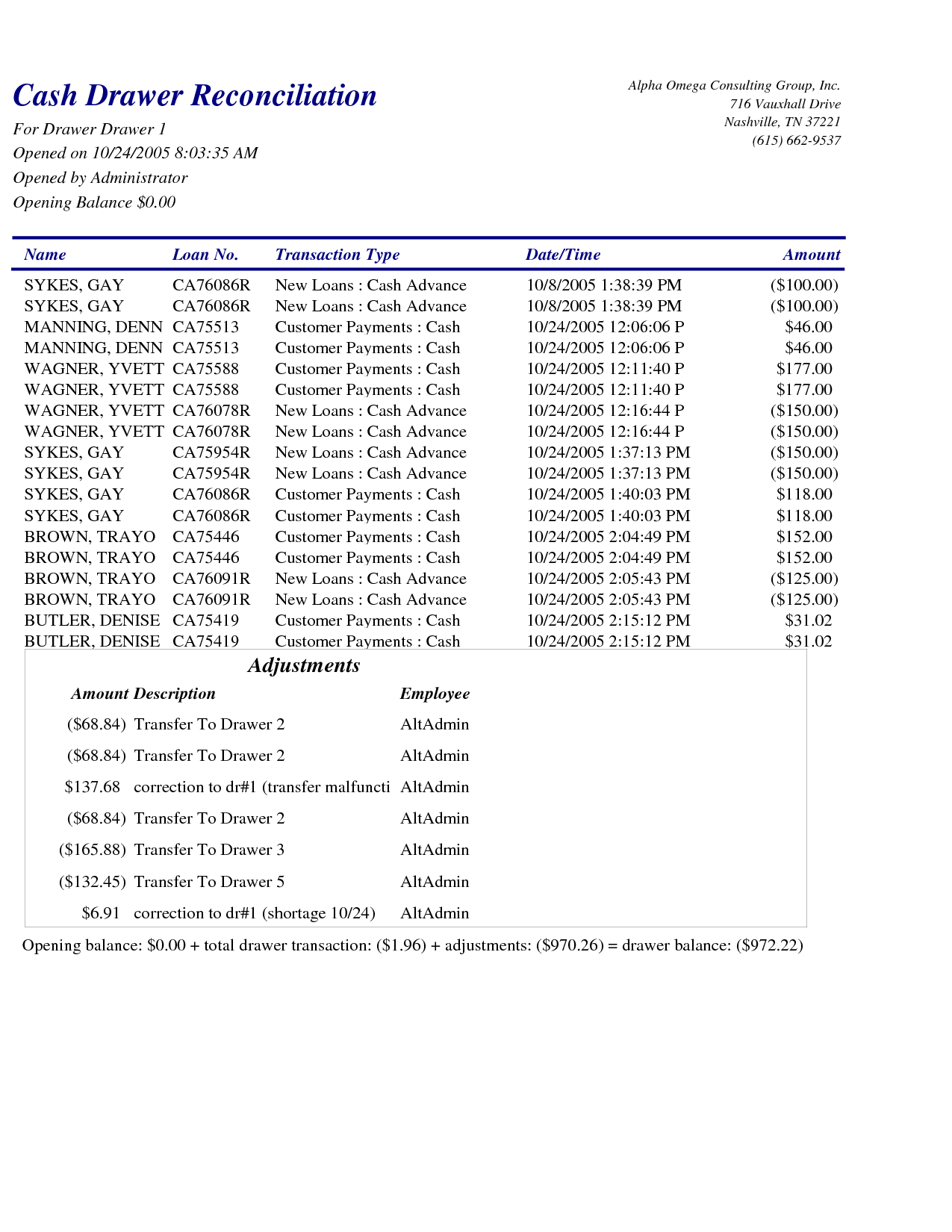

- Cash Drawer Reconciliation Form

- Free Promissory Note Template PDF

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a bank balance worksheet?

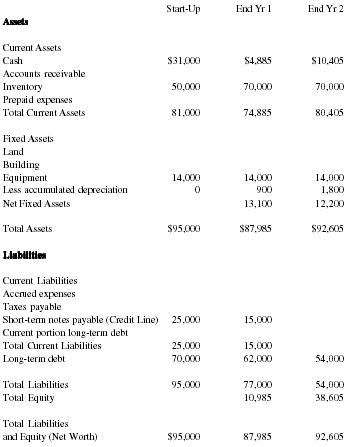

A bank balance worksheet is a financial tool used by individuals or businesses to monitor and reconcile their bank account balances. It typically lists the beginning balance, transactions such as deposits and withdrawals, any fees or charges, and the ending balance for a specific period. This worksheet helps track and compare the bank's records with the account holder's records to identify any discrepancies or errors that need to be resolved.

How is a bank balance worksheet different from a bank statement?

A bank balance worksheet is an internal document maintained by an individual or organization to track all the deposits, withdrawals, and other transactions made to the bank account. It is used to reconcile the account with the bank statement to ensure accuracy. On the other hand, a bank statement is an official document issued by the bank to an account holder, showing all the transactions that have occurred in the account over a specific period, including deposits, withdrawals, fees, and interest earned. The key difference is that the bank balance worksheet is a tool for the account holder to track and reconcile their account, whereas the bank statement is an official record provided by the bank.

What information does a bank balance worksheet typically include?

A bank balance worksheet typically includes details about the bank account holder, such as account number, account holder's name, address, and contact information. It also includes information about the bank, such as the bank's name, branch address, and contact details. Additionally, the worksheet will list all the transactions that have occurred in the account, including deposits, withdrawals, transfers, and any fees charged. The worksheet will also show the opening and closing balances for the designated accounting period.

Why is it important to maintain a bank balance worksheet?

Maintaining a bank balance worksheet is important because it helps individuals or businesses track their financial transactions accurately, monitor their cash flow, identify potential errors or unauthorized charges, and prevent overdrafts or insufficient funds. By reconciling the bank statement with their own records regularly, they can ensure that their financial information is up to date and make informed decisions about their spending and saving habits. Additionally, it provides a clear overview of their financial health and helps in budgeting effectively.

How often should a bank balance worksheet be updated or reviewed?

A bank balance worksheet should ideally be updated and reviewed on a regular basis, such as daily or weekly, depending on the frequency of transactions in the account. This ensures that the information is accurate and up to date, helping to monitor cash flow, detect errors or discrepancies, and make informed financial decisions.

What are some common sources of errors when preparing a bank balance worksheet?

Some common sources of errors when preparing a bank balance worksheet include incorrect recording of transactions, missing or duplicated entries, reconciling against the wrong ending statement balance, not accounting for outstanding checks or deposits, and errors in mathematical calculations. It is important to carefully review all transactions and reconciliations to ensure accuracy and avoid discrepancies in the bank balance worksheet.

How can a bank balance worksheet help in detecting fraudulent activities?

A bank balance worksheet can help in detecting fraudulent activities by providing a clear overview of all transactions, making it easier to spot irregularities or discrepancies. By comparing the transactions listed on the worksheet with the bank statement, any unauthorized charges, unusual patterns, or missing funds can be easily identified. This can alert the bank to potential fraud and prompt further investigation to protect the account holder and prevent further fraudulent activity.

How does reconciling a bank balance worksheet with a bank statement help in ensuring accuracy?

Reconciling a bank balance worksheet with a bank statement helps ensure accuracy by verifying all recorded transactions, identifying any discrepancies or errors, and making necessary adjustments to account for any differences between the two. This process helps to detect potential fraud, prevent overdrafts, and maintain accurate financial records, ultimately ensuring the reliability of the financial information being reported.

What are some advantages of using electronic or online bank balance worksheets?

Some advantages of using electronic or online bank balance worksheets include the ability to easily access and update financial information in real-time, efficient organization of transactions for greater clarity and analysis, automatic calculations to minimize errors, customizable features to tailor to individual needs, and the convenience of being able to track finances on-the-go from any device with internet access.

How can a bank balance worksheet be used in personal financial management?

A bank balance worksheet can be used in personal financial management by helping individuals keep track of their bank account transactions, reconcile the balances, and monitor their financial health. By recording all deposits, withdrawals, and other transactions on the worksheet, individuals can easily compare the bank's balance with their own records to identify any discrepancies or errors. This tool can also assist in budgeting, cash flow management, and identifying any fraudulent activities on the account, ultimately promoting better financial organization and decision-making.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments