2014 Tax Preparation Worksheet

Tax season is upon us, and for those who want to stay organized and ensure a smooth filing process, a tax preparation worksheet can be an invaluable tool. Designed to help individuals and businesses keep track of all necessary financial information, this worksheet is essential for those who want to tackle their taxes with confidence and accuracy. Whether you are a self-employed professional, a small business owner, or simply an individual looking to simplify the filing process, having a comprehensive tax preparation worksheet can make all the difference in staying organized and maximizing your deductions.

Table of Images 👆

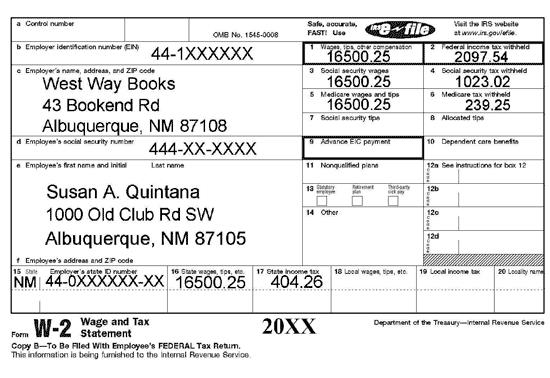

- Sample W2 Completed Form

- Federal 941 Form Example

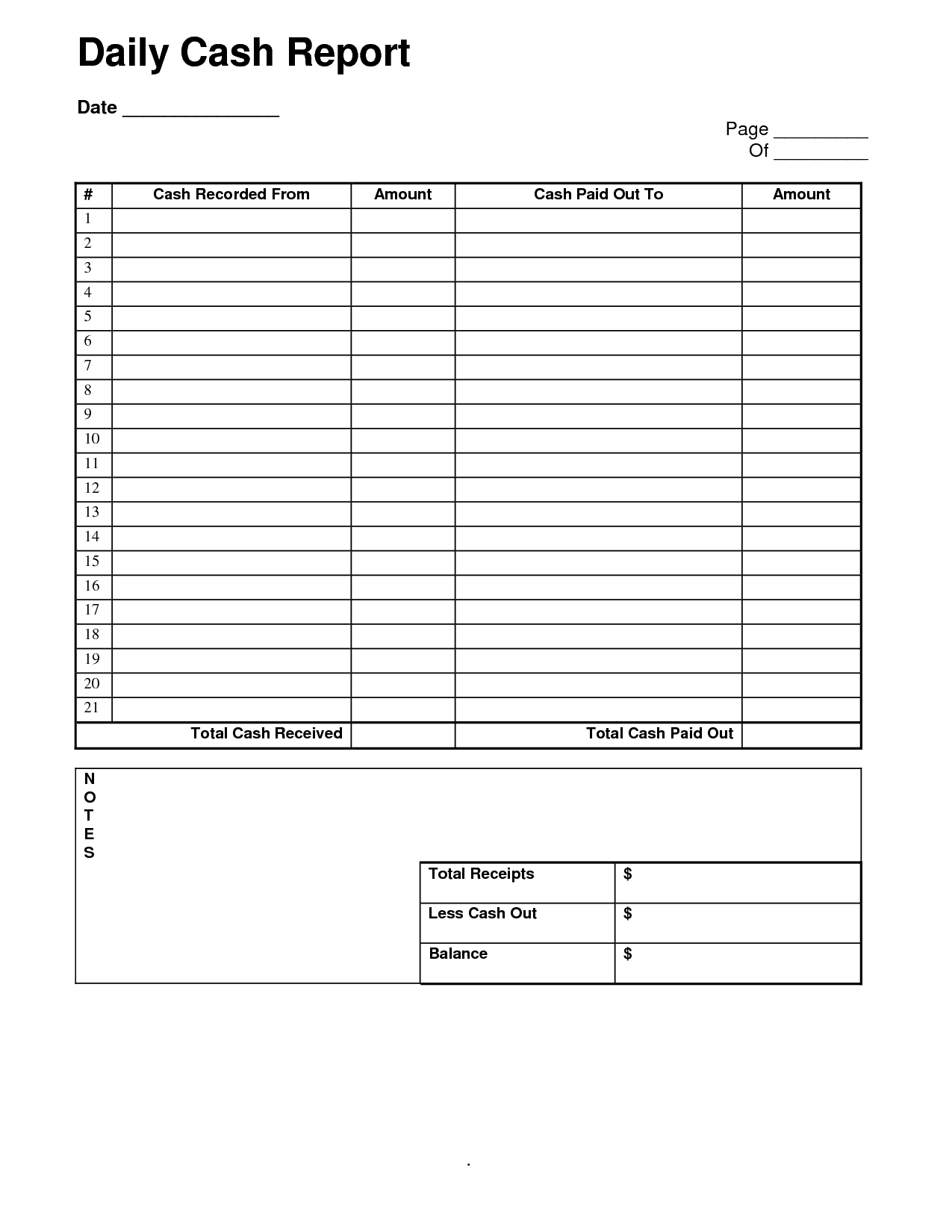

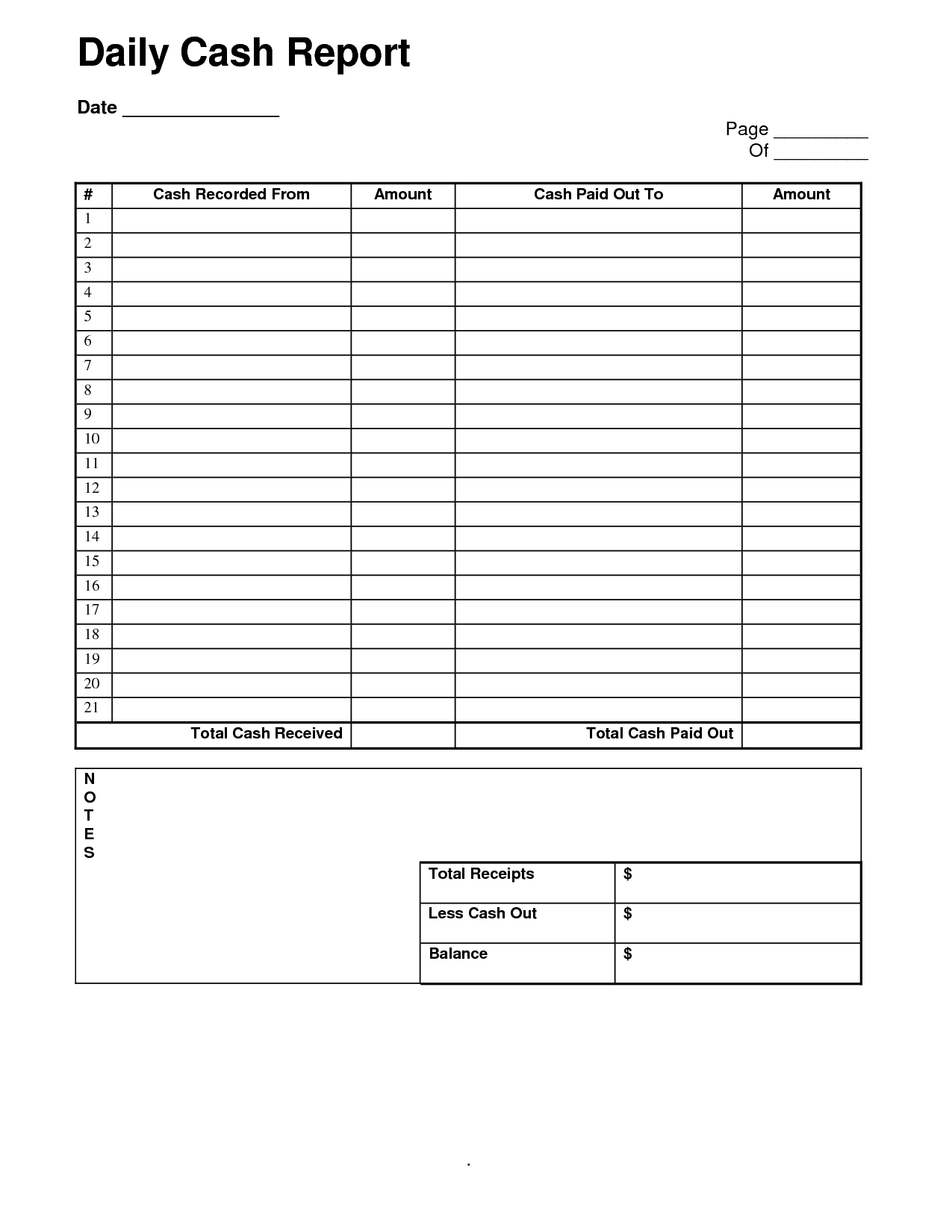

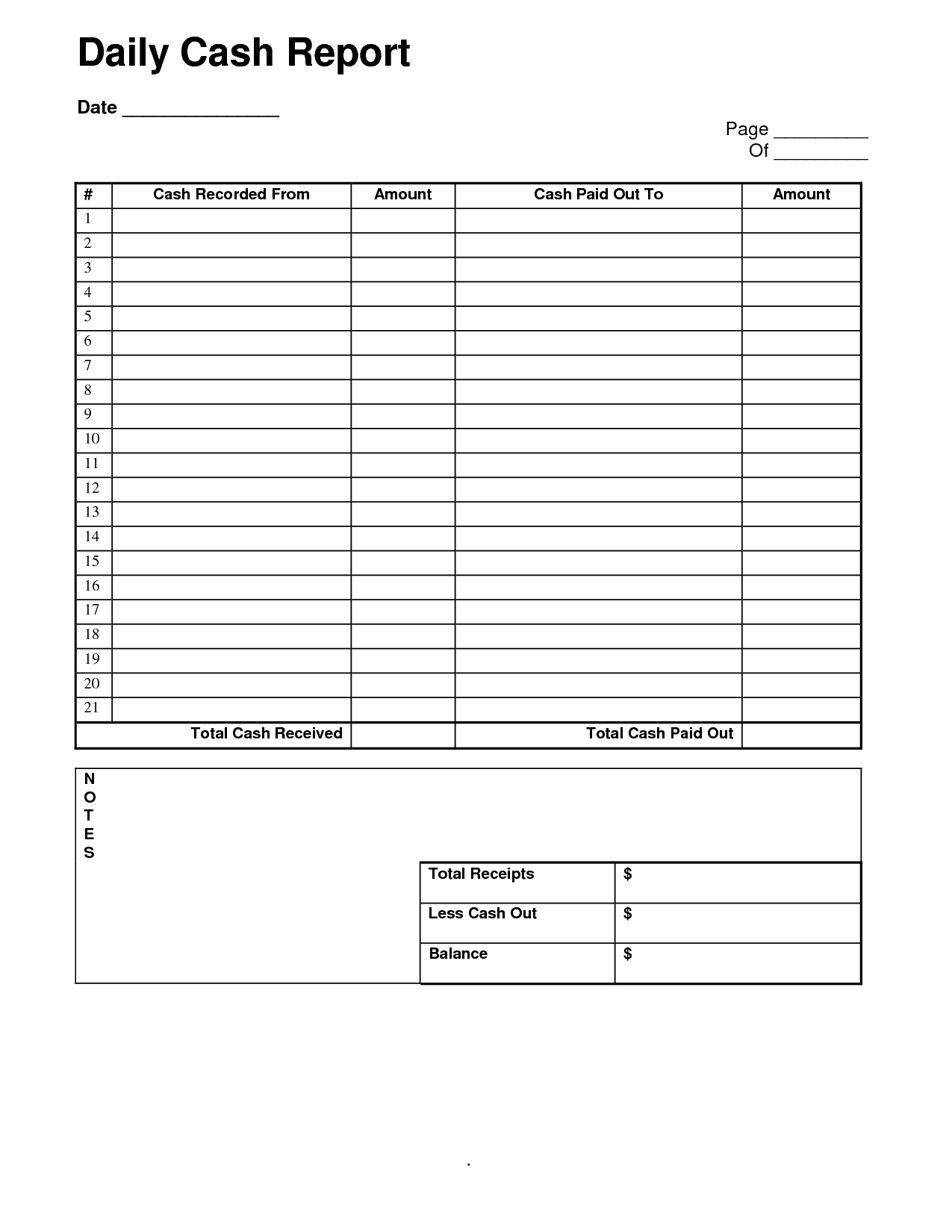

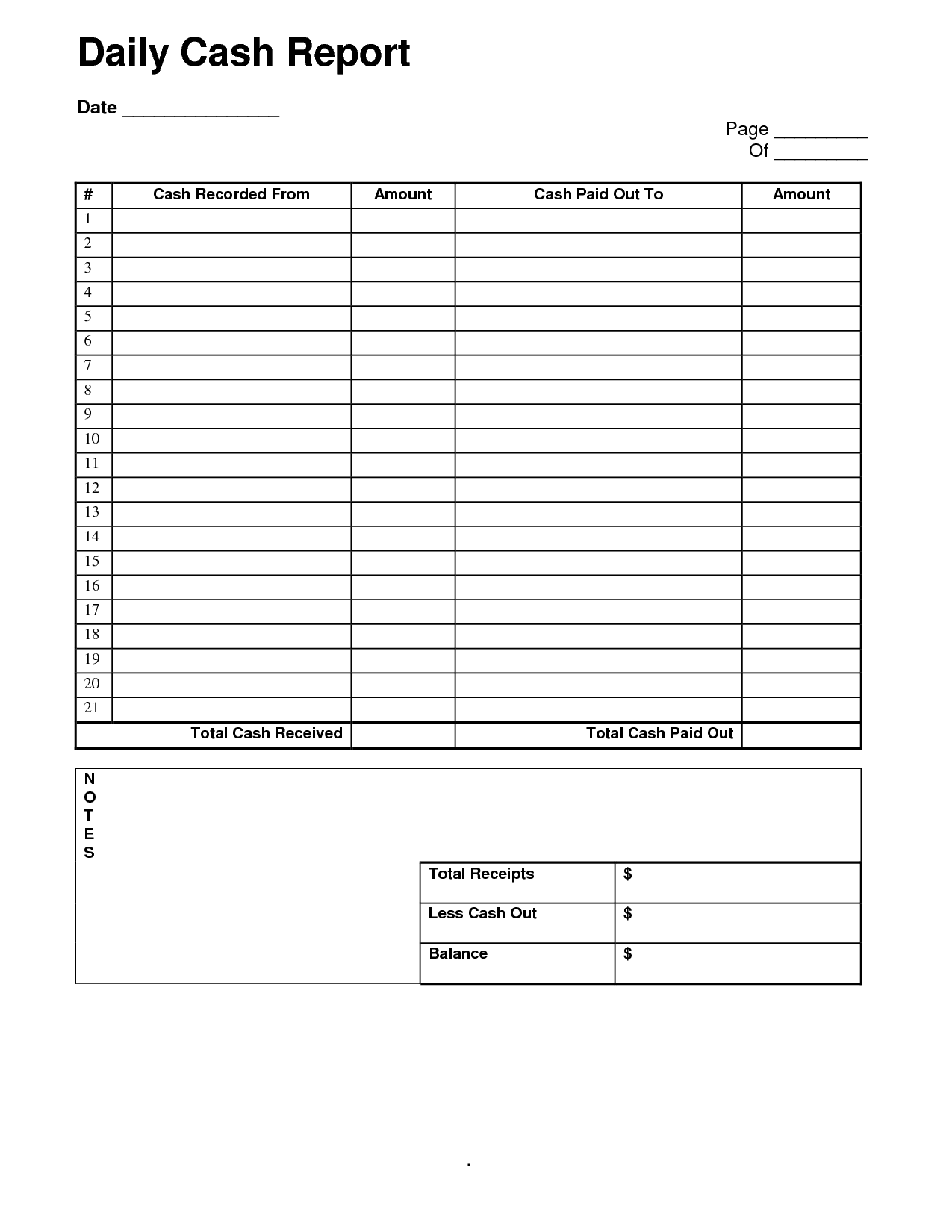

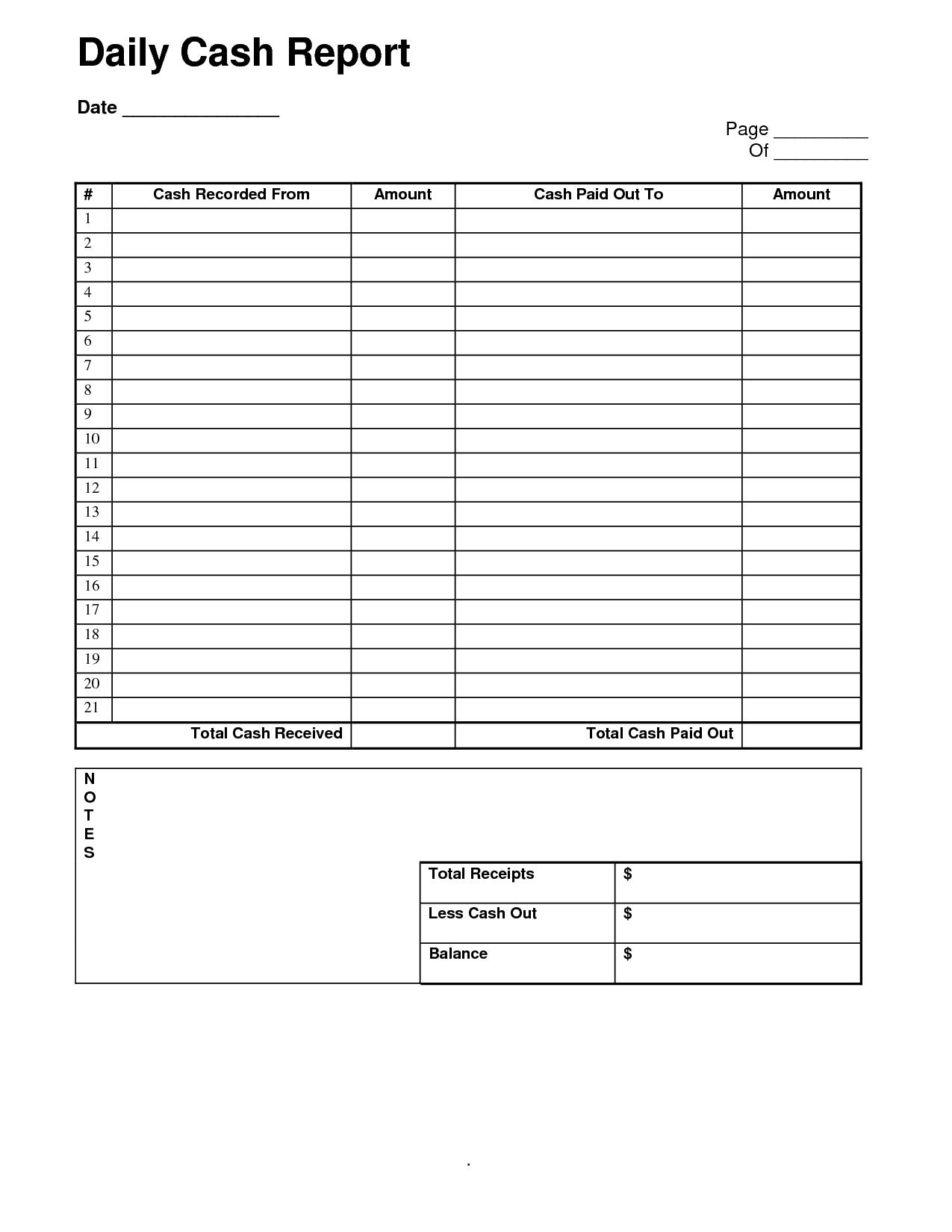

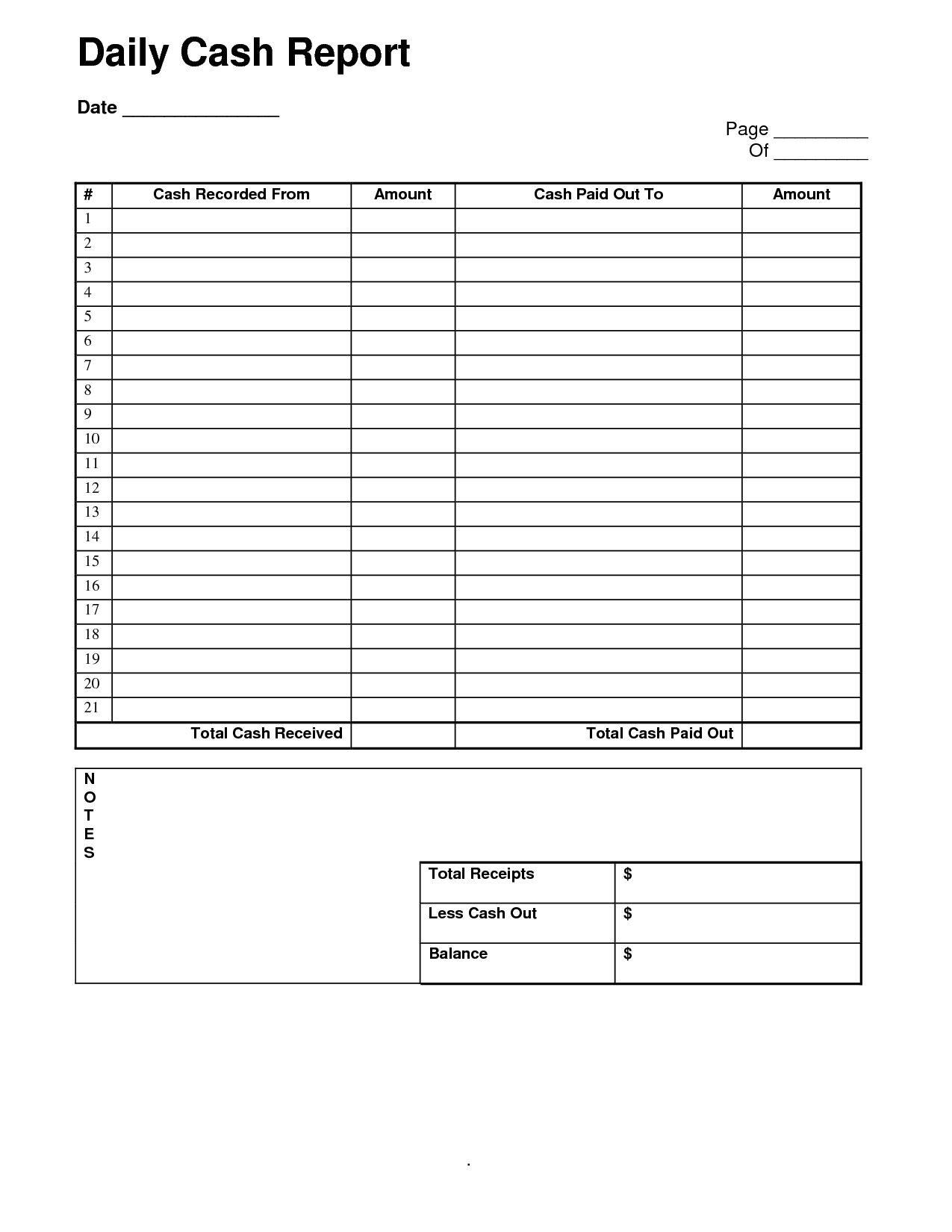

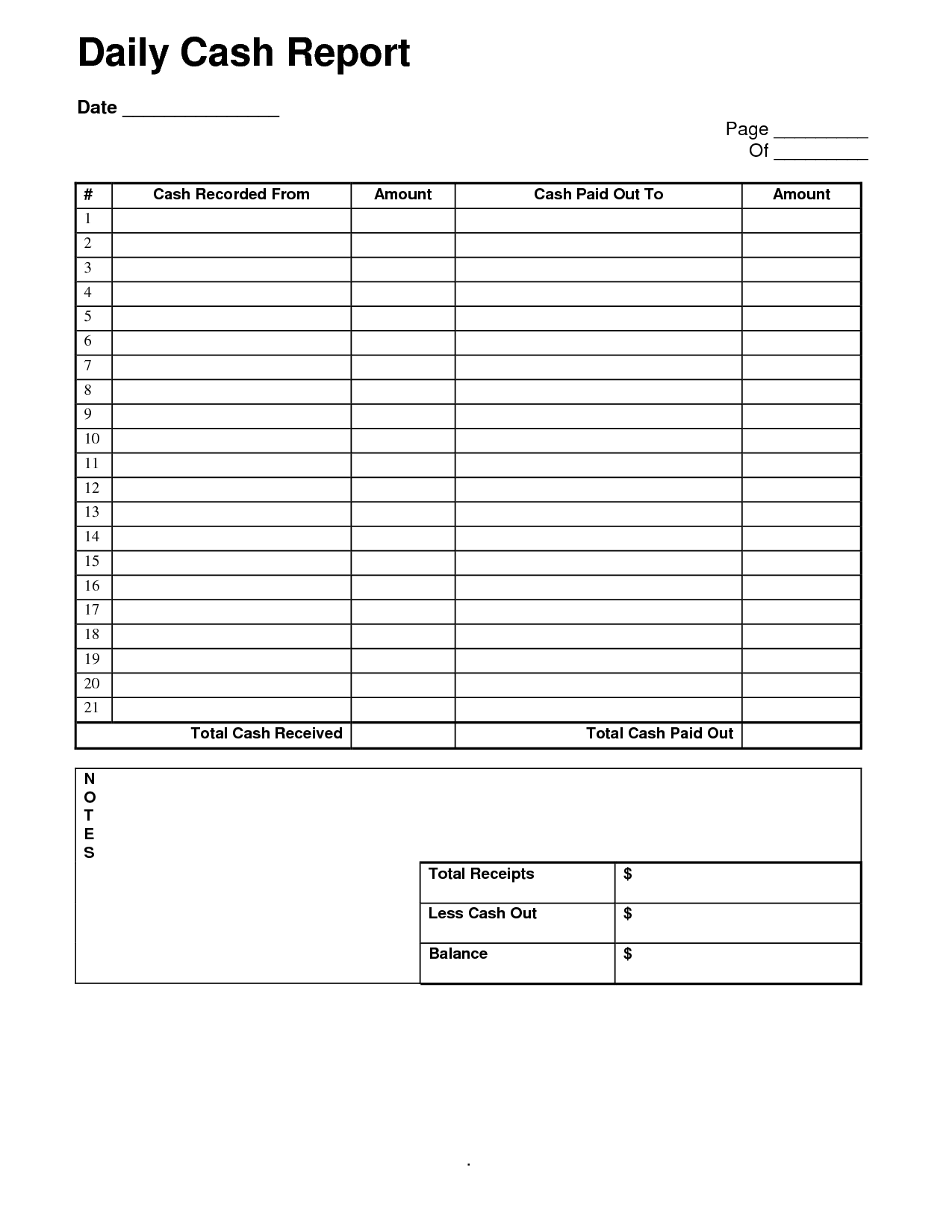

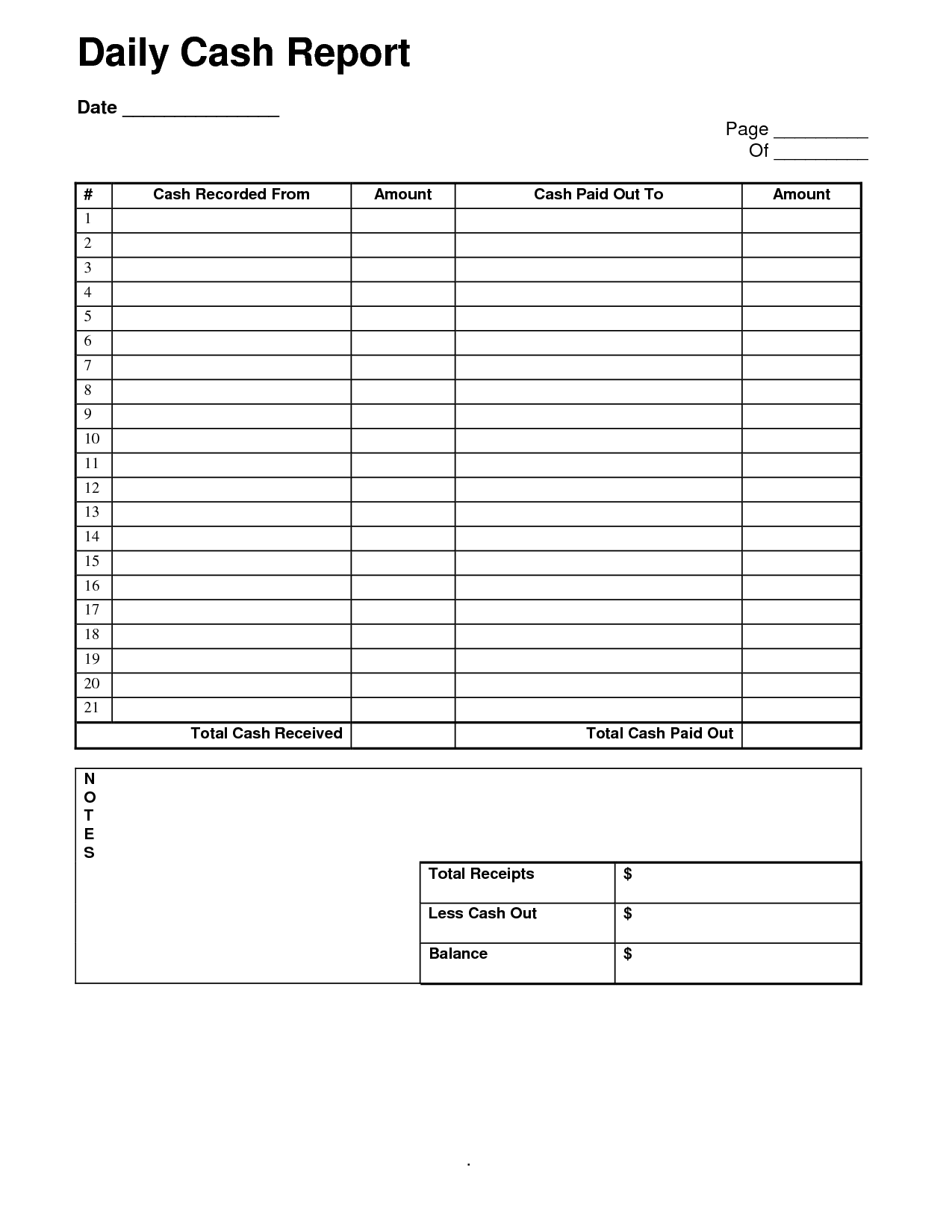

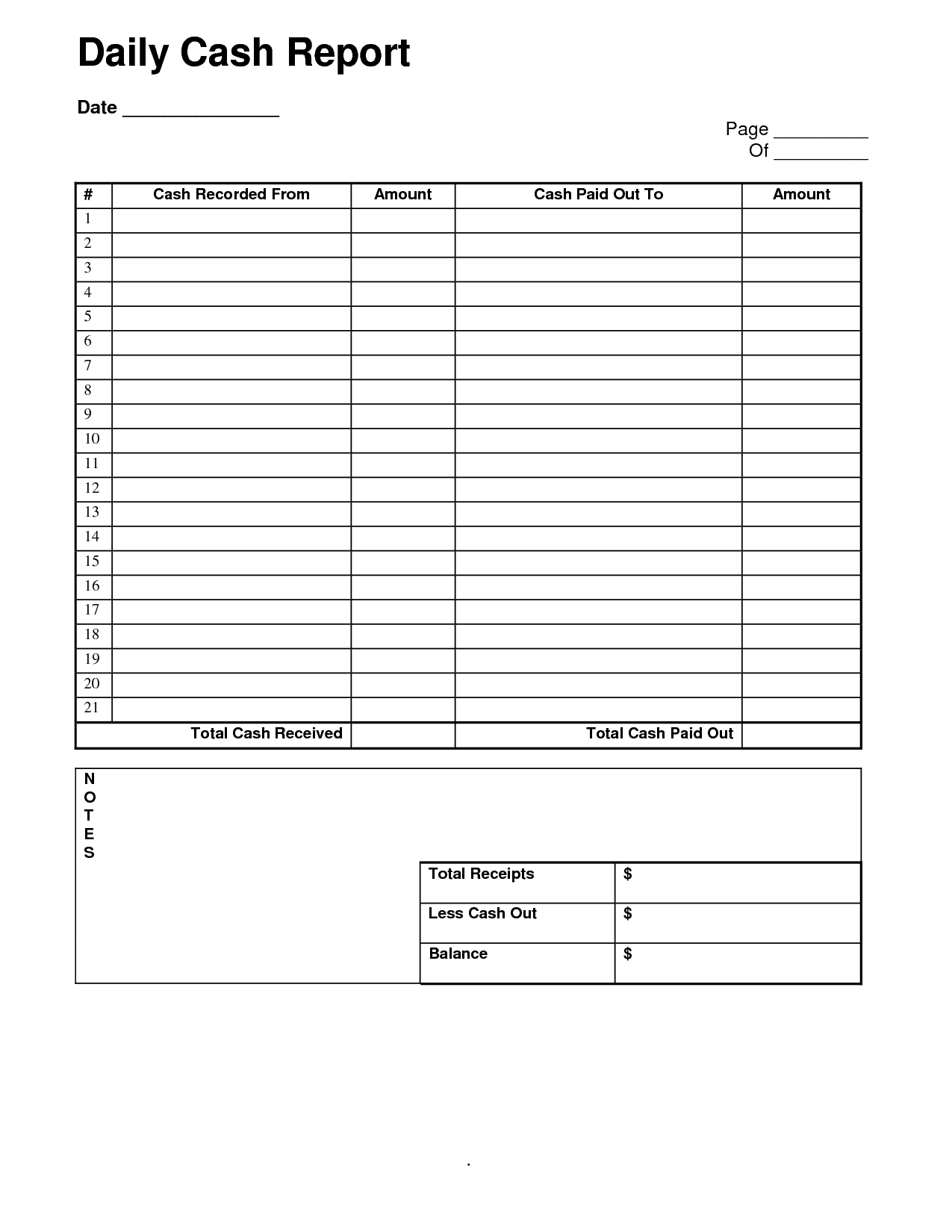

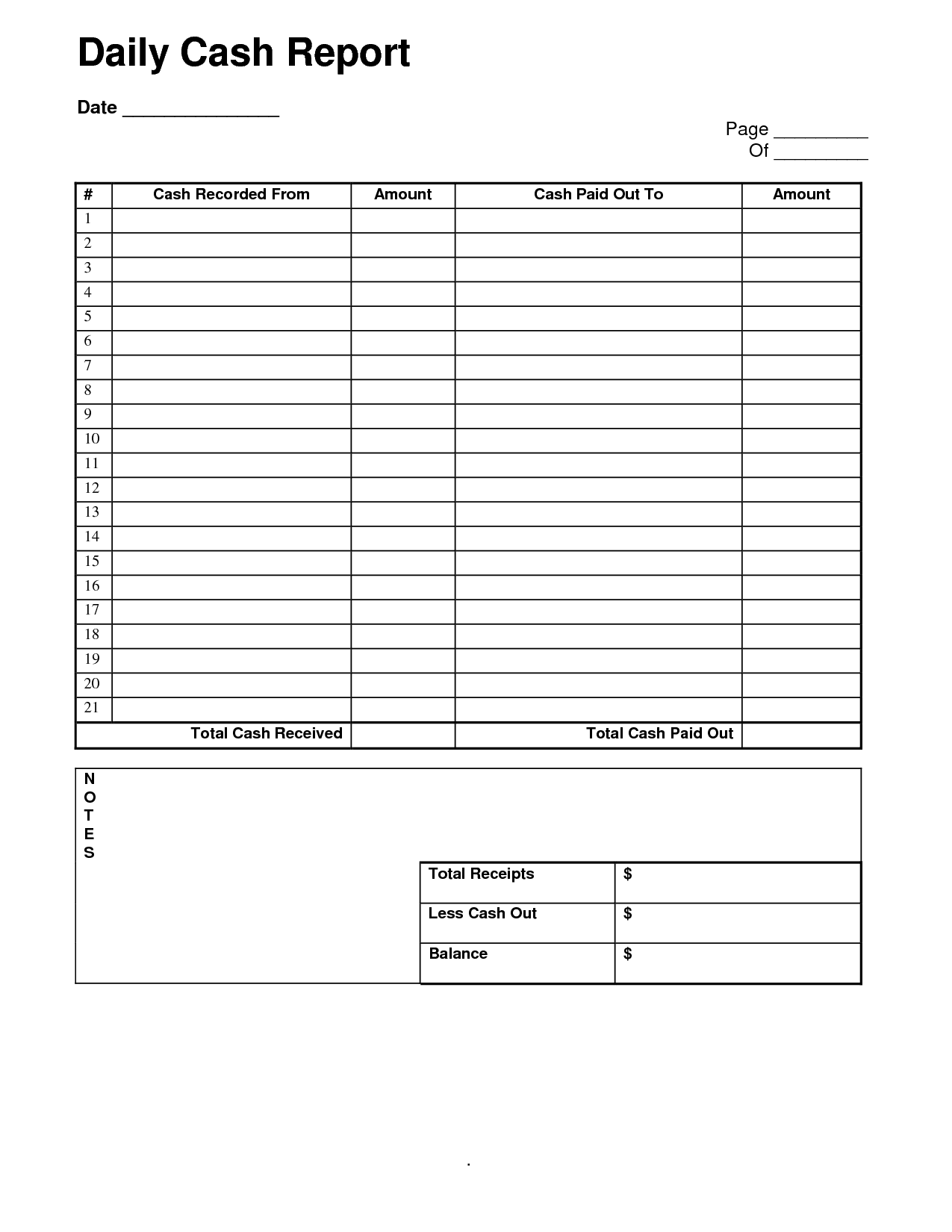

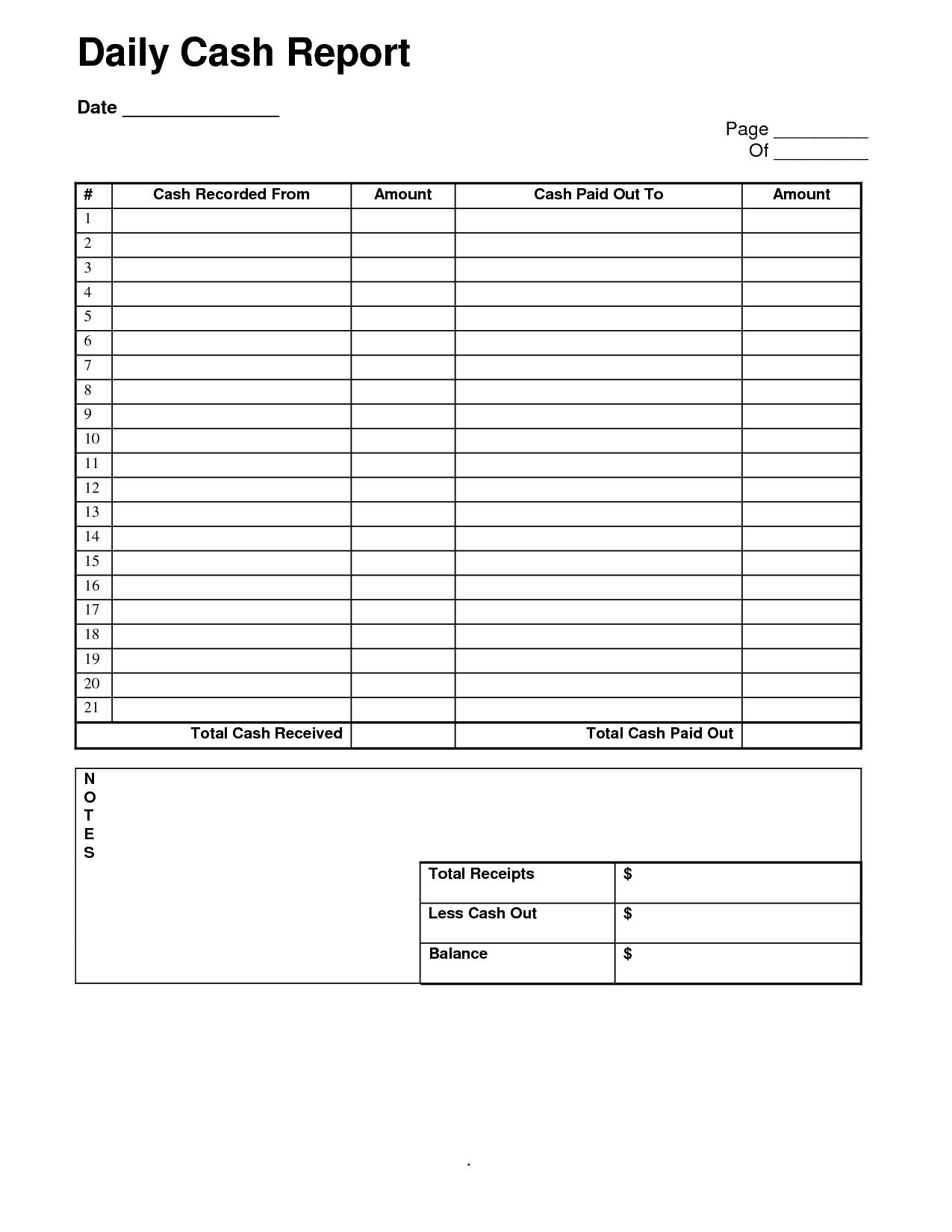

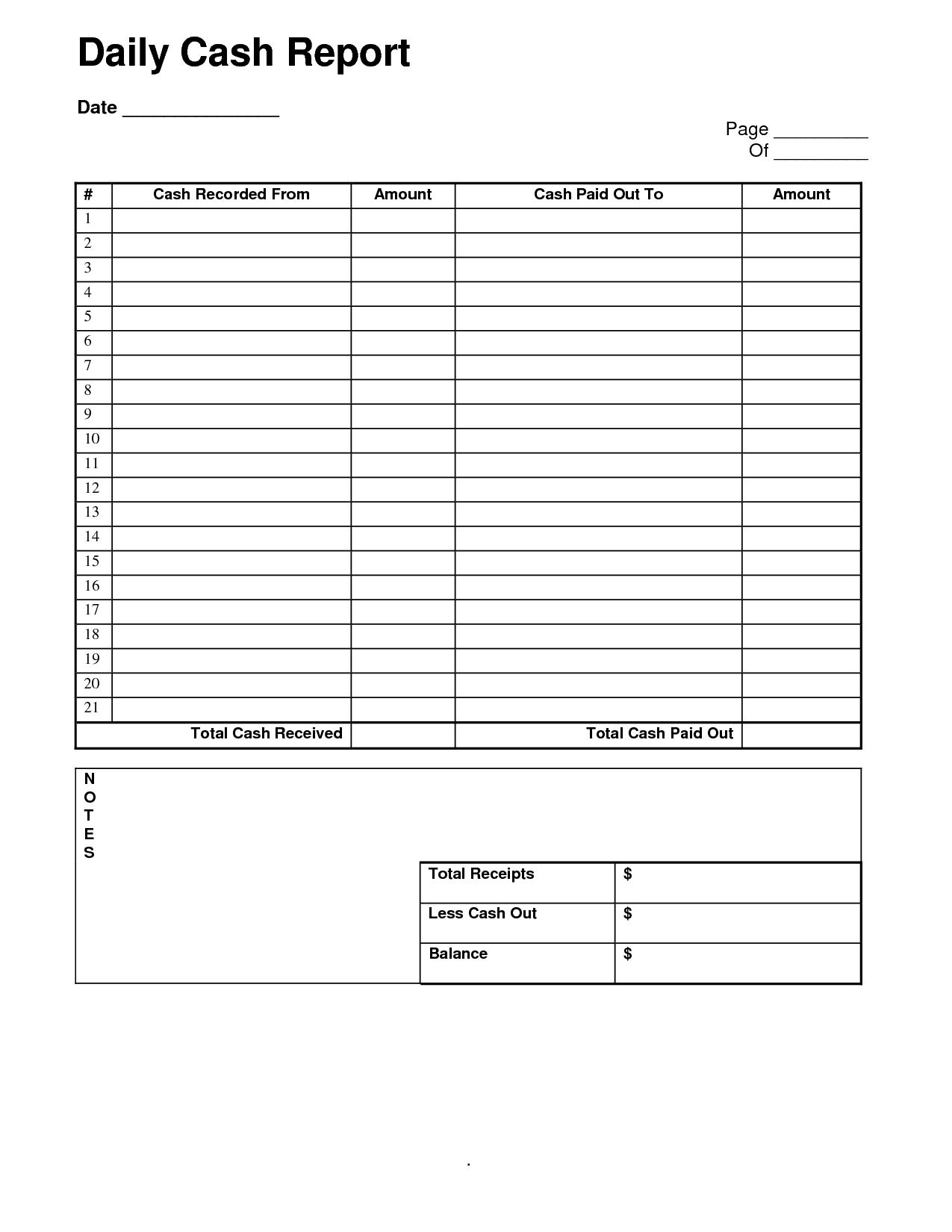

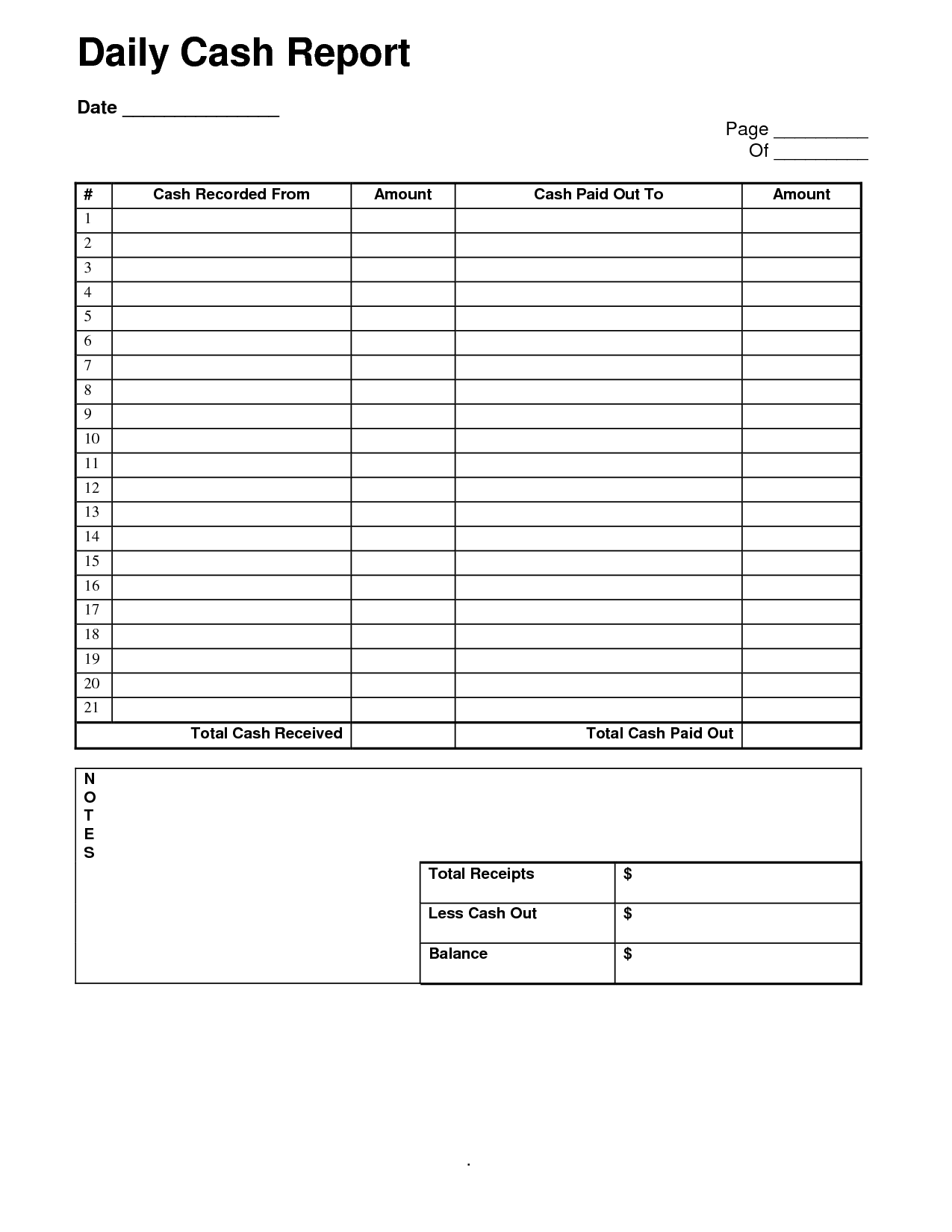

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

- Daily Sales Cash Report Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a 2014 Tax Preparation Worksheet?

A 2014 Tax Preparation Worksheet is a document used by taxpayers to gather and organize necessary information for preparing their 2014 tax return. It typically includes sections for personal information, income sources, deductions, credits, and other relevant tax-related details to ensure accurate and efficient filing of taxes for the 2014 tax year.

Why is a 2014 Tax Preparation Worksheet important for tax filing?

A 2014 Tax Preparation Worksheet is important for tax filing because it helps individuals organize and summarize their financial information from the previous tax year in a structured manner. This worksheet can assist in identifying potential deductions, credits, and other tax benefits that may apply, ultimately helping to ensure accurate and efficient completion of tax filings for that year.

What information is typically included in a 2014 Tax Preparation Worksheet?

A 2014 Tax Preparation Worksheet typically includes personal information such as name, address, Social Security number, and filing status. It also includes details of income sources, deductions, credits, and taxes paid during the tax year 2014. Additionally, it may require information on any dependents claimed, investments, retirement accounts, and details of any other relevant financial transactions.

How can a 2014 Tax Preparation Worksheet help with organizing tax documents?

A 2014 Tax Preparation Worksheet can help with organizing tax documents by providing a structured outline of the information and documents required for filing taxes in that specific year. This worksheet typically includes sections for income sources, deductions, credits, and other relevant details, making it easier to gather and compile the necessary paperwork. By following the worksheet's guidance and filling in the required information, individuals can ensure that they have all the necessary documents in one place and are better prepared for filing their taxes accurately and on time.

Are there specific sections or categories in a 2014 Tax Preparation Worksheet?

Yes, a 2014 Tax Preparation Worksheet typically includes sections or categories such as personal information (name, address, social security number), income (wages, interest, dividends), deductions (such as mortgage interest, medical expenses), credits (such as child tax credit, education credits), and any other additional information relevant to calculating and preparing your taxes for the year 2014.

How can a 2014 Tax Preparation Worksheet help identify tax deductions or credits?

A 2014 Tax Preparation Worksheet can help identify tax deductions or credits by systematically capturing all relevant income, expenses, and contributions throughout the year. By organizing this information in one place, the worksheet can highlight potential deductions or credits based on eligibility criteria outlined in the tax laws. It allows for a comprehensive review of financial transactions, ensuring nothing is overlooked, and enabling taxpayers to claim all eligible tax benefits, thereby reducing their tax liability.

What are some common mistakes to avoid when using a 2014 Tax Preparation Worksheet?

Some common mistakes to avoid when using a 2014 Tax Preparation Worksheet include inputting incorrect data such as wrong social security numbers or income amounts, overlooking deductions or credits that could reduce your tax liability, not updating the worksheet with any changes in tax laws or regulations for that year, and not reviewing the final calculations for accuracy. Make sure to carefully fill out the worksheet, double-check all entries, and seek assistance from a tax professional if needed to avoid any costly errors or penalties.

Can a 2014 Tax Preparation Worksheet be used for both personal and business taxes?

No, a 2014 Tax Preparation Worksheet is typically designed for personal tax preparation and may not contain the necessary sections or information needed for business taxes. It is recommended to use a separate worksheet or software specifically tailored for business taxes to ensure accurate and thorough preparation of both personal and business tax returns.

Are there any resources or tools available online for accessing a 2014 Tax Preparation Worksheet?

Yes, there are several resources and tools available online for accessing a 2014 Tax Preparation Worksheet. You can try searching for IRS forms and publications on the official Internal Revenue Service (IRS) website, or utilize tax preparation software such as TurboTax or H&R Block, which may have archived versions of tax forms and worksheets from previous years like 2014. Additionally, you can consider reaching out to a tax professional or accountant for assistance in locating and completing the necessary worksheet for your taxes.

How can a 2014 Tax Preparation Worksheet help streamline the overall tax filing process?

A 2014 Tax Preparation Worksheet can help streamline the overall tax filing process by providing a structured format for organizing all relevant financial information required for preparing and filing taxes. By having a clear breakdown of income, deductions, credits, and other tax-related details in one document, individuals can easily ensure they have all necessary documentation and can accurately calculate their tax liability. This can help save time and reduce the likelihood of overlooking important information when filing taxes for the tax year.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments