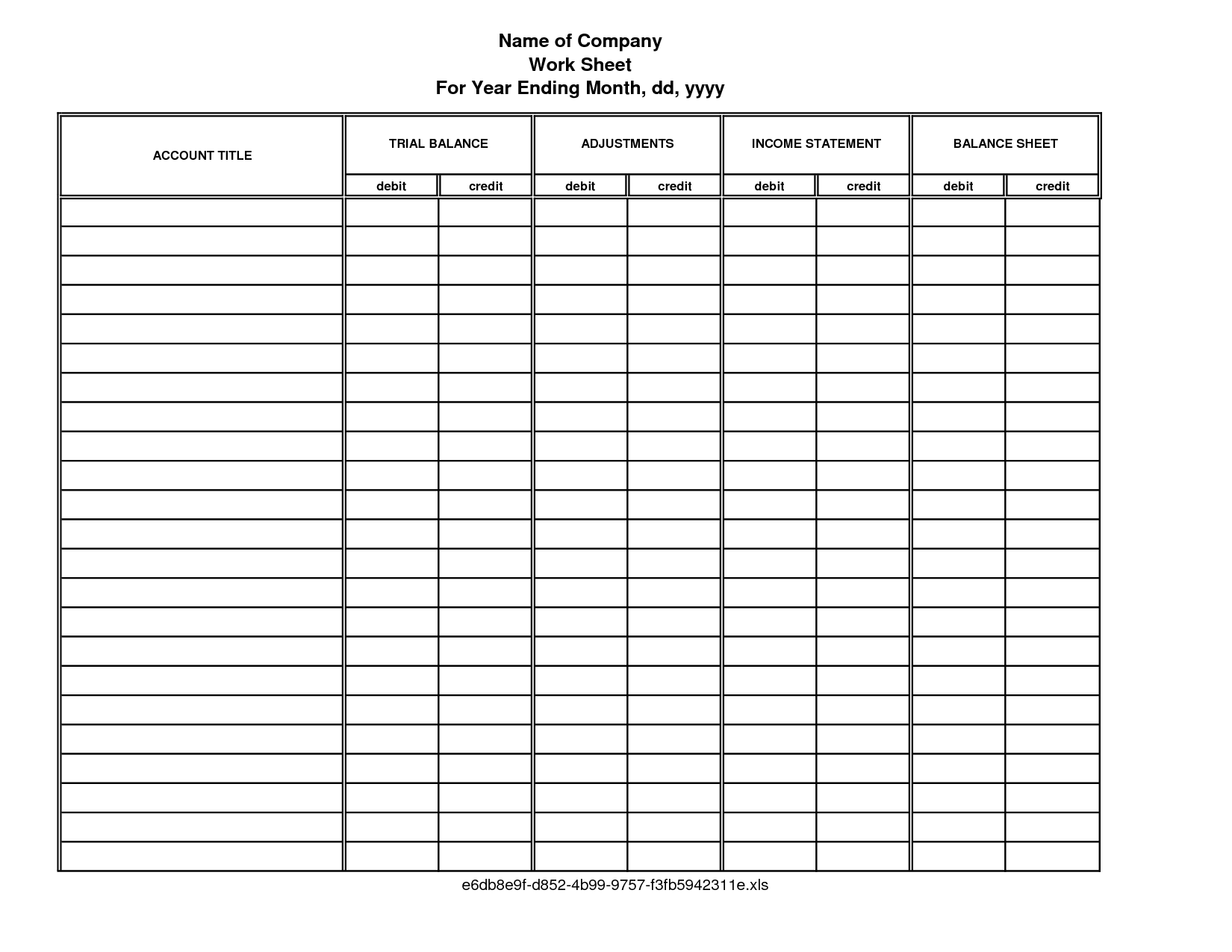

10 Column Accounting Worksheet

An accounting worksheet is a useful tool for organizing financial data and calculations in a systematic and structured manner. Whether you're a student studying accounting or a small business owner managing your own books, a 10-column accounting worksheet can be a valuable resource. It provides a clear framework for recording and summarizing financial transactions, allowing you to easily track and analyze your income, expenses, and overall financial health. With its structured layout and clearly defined columns, this type of worksheet simplifies the process of financial management, making it ideal for students and small business owners alike.

Table of Images 👆

- Free Printable Accounting Ledger Sheets

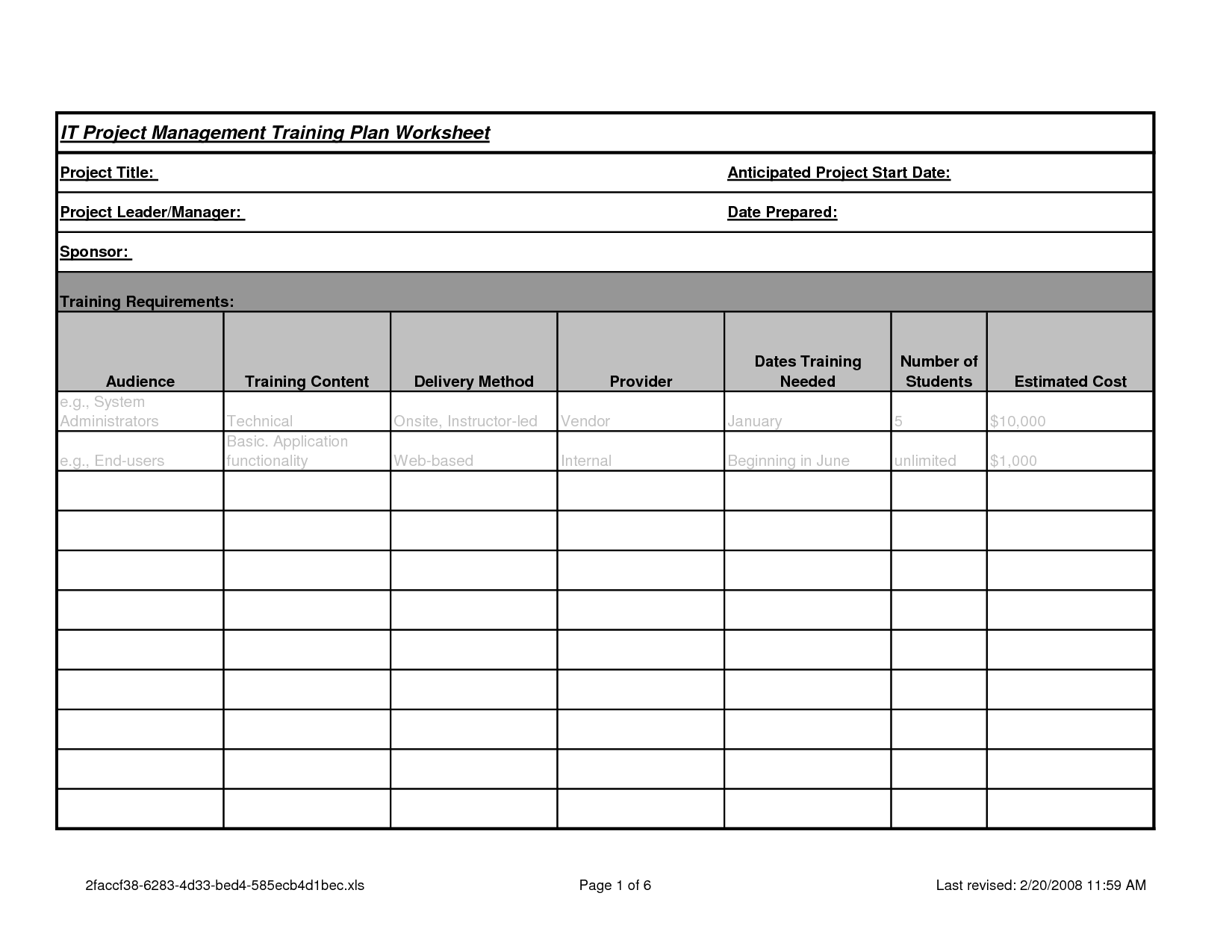

- Project Management Worksheet Template

- Blank 4 Column Spreadsheet Template

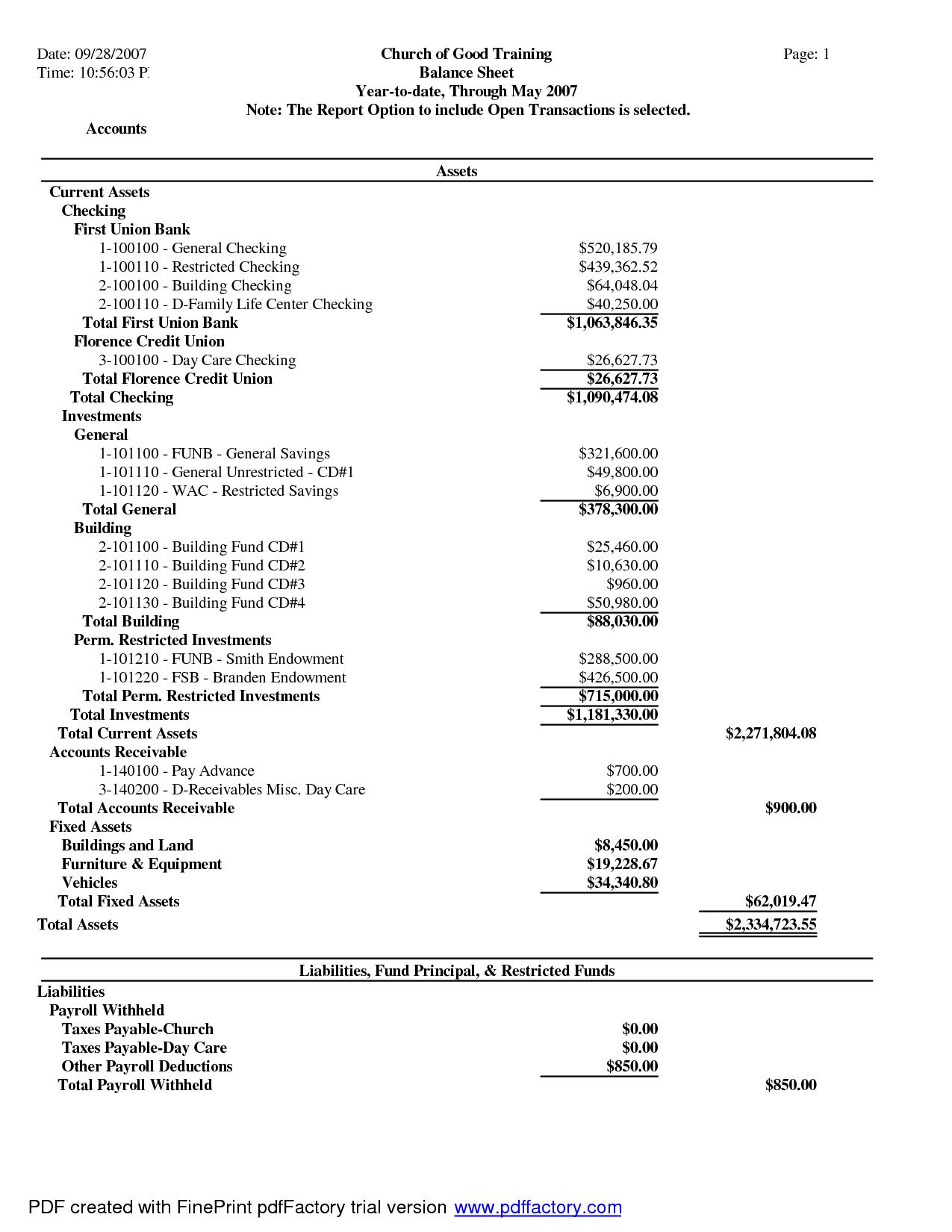

- Sample Church Balance Sheet Template

- Trial Balance Template Excel

- 3-Digit Addition and Subtraction Worksheets

- Insurance Complaint Letter Sample

- General Ledger Account Reconciliation Template

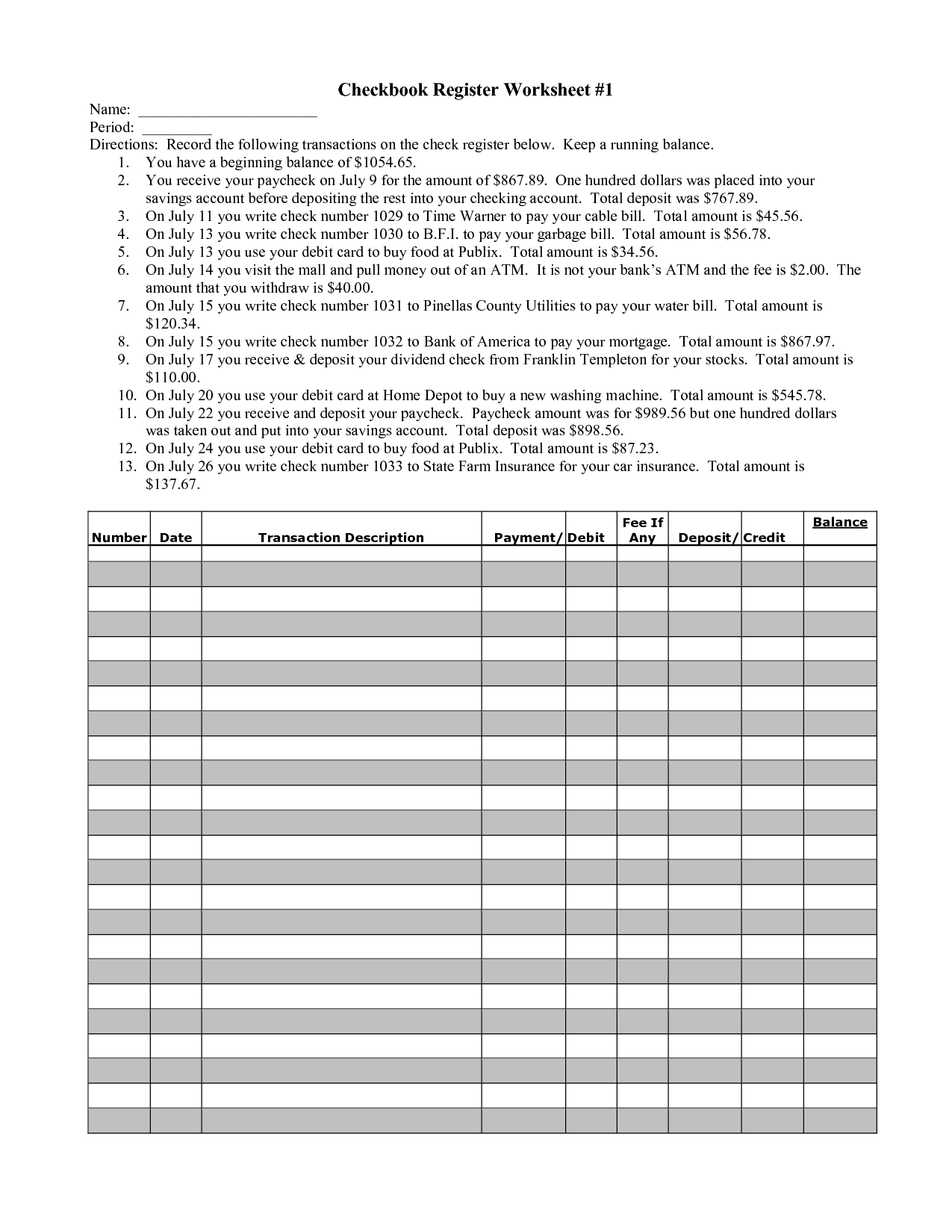

- Balance Checkbook Worksheet

- Two-Column Notes Template Printable

- Two-Column Notes Template Printable

- Two-Column Notes Template Printable

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Rosa Parks Worksheet Grade 1

What is a 10-column accounting worksheet?

A 10-column accounting worksheet is a tool used in accounting to summarize the trial balance, adjustments, and financial statements preparation. It typically consists of 10 columns: Trial Balance, Adjustments, Adjusted Trial Balance, Income Statement, Statement of Retained Earnings, Balance Sheet, and five additional columns for adding account balances and calculations. The worksheet helps accountants organize and analyze financial information before finalizing the financial statements.

What are the 10 columns present in a 10-column accounting worksheet?

The 10 columns present in a 10-column accounting worksheet typically include columns for Account Titles, Trial Balance, Adjustments, Adjusted Trial Balance, Income Statement, Balance Sheet, Income Statement Difference, Balance Sheet Difference, Income Statement Totals, and Balance Sheet Totals.

How is a 10-column accounting worksheet used in the accounting process?

A 10-column accounting worksheet is used in the accounting process to prepare financial statements, ensure accuracy, and adjust entries before finalizing the financial reports. It typically includes columns for adjusting entries, income statement, balance sheet, and other relevant data. This worksheet helps accountants organize and summarize financial information, making it easier to identify errors, analyze trends, and prepare accurate financial statements for decision-making and reporting purposes.

What is the purpose of the Trial Balance column in a 10-column accounting worksheet?

The purpose of the Trial Balance column in a 10-column accounting worksheet is to help verify the accuracy of the entries made in the other columns. It allows for the total debits and credits to be compared, ensuring that they are equal and that the worksheet is in balance. This step helps to identify any errors in the recording process before preparing financial statements.

What information is recorded in the Adjustments column of a 10-column accounting worksheet?

The Adjustments column of a 10-column accounting worksheet records all adjusting entries that are necessary for ensuring that the financial statements reflect the accurate and up-to-date financial position of a company at the end of a specific accounting period. These adjustments typically include accruals, deferrals, depreciation, and other corrections that have not yet been accounted for in the general ledger.

What is the role of the Income Statement column in a 10-column accounting worksheet?

The Income Statement column in a 10-column accounting worksheet is used to calculate and display the revenues, expenses, and resulting net income for a specific period. This column helps in analyzing the financial performance of a company by showing how much money was earned and spent during the period, ultimately providing insight into the profitability of the business.

How is the Balance Sheet column used in a 10-column accounting worksheet?

The Balance Sheet column in a 10-column accounting worksheet is used to calculate the ending balances of assets, liabilities, and owner's equity accounts to prepare the balance sheet. This column shows the adjusted balances of these accounts after considering adjustments and closing entries. The information in the Balance Sheet column is crucial for accurately reporting the financial position of a company at a specific point in time, which is essential for stakeholders and decision-making.

What is the purpose of the Income Statement Total column in a 10-column accounting worksheet?

The purpose of the Income Statement Total column in a 10-column accounting worksheet is to show the total of all revenue and expense accounts. This column helps in calculating the net income or loss by subtracting the total expenses from total revenues, providing a snapshot of the company's financial performance over a specific period.

How does the Statement of Retained Earnings column contribute to a 10-column accounting worksheet?

The Statement of Retained Earnings column in a 10-column accounting worksheet helps track changes in a company's retained earnings over a specific period. It shows the beginning balance of retained earnings, adjustments such as net income or dividends, and the ending balance, which is then carried over to the balance sheet. This column ensures that the retained earnings account is accurately updated with all relevant information and facilitates the preparation of financial statements for the period covered by the worksheet.

What is the significance of the Closing Entries column in a 10-column accounting worksheet?

The Closing Entries column in a 10-column accounting worksheet is used to record the adjustment entries needed to close temporary accounts such as revenues, expenses, and dividends at the end of an accounting period. These entries transfer the balances from these temporary accounts to the retained earnings account to prepare the financial statements for the next accounting period. This step ensures that the income and expenditure accounts start with a zero balance in the new period, allowing for accurate tracking and reporting of financial performance.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments